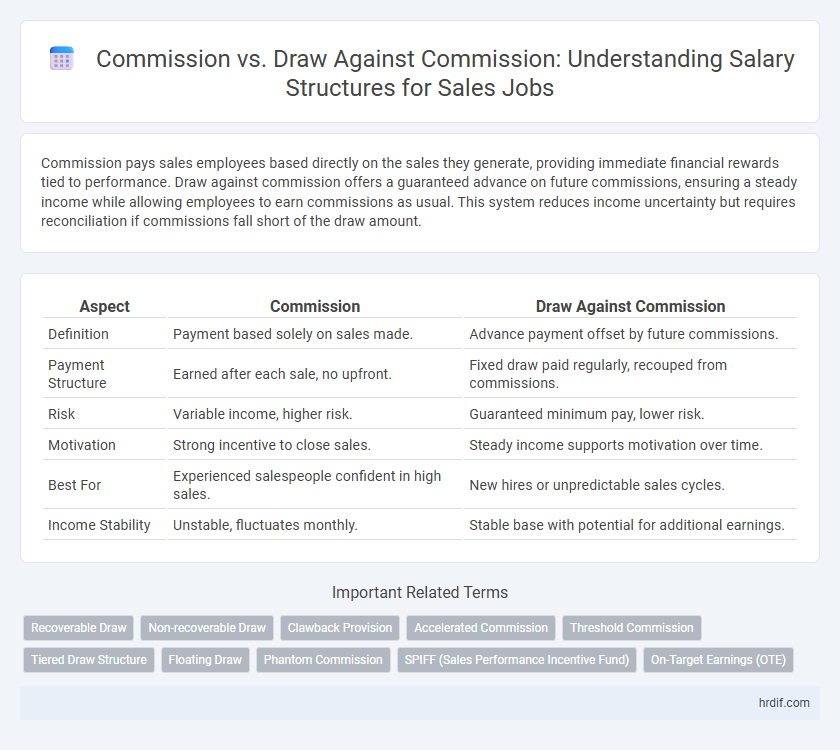

Commission pays sales employees based directly on the sales they generate, providing immediate financial rewards tied to performance. Draw against commission offers a guaranteed advance on future commissions, ensuring a steady income while allowing employees to earn commissions as usual. This system reduces income uncertainty but requires reconciliation if commissions fall short of the draw amount.

Table of Comparison

| Aspect | Commission | Draw Against Commission |

|---|---|---|

| Definition | Payment based solely on sales made. | Advance payment offset by future commissions. |

| Payment Structure | Earned after each sale, no upfront. | Fixed draw paid regularly, recouped from commissions. |

| Risk | Variable income, higher risk. | Guaranteed minimum pay, lower risk. |

| Motivation | Strong incentive to close sales. | Steady income supports motivation over time. |

| Best For | Experienced salespeople confident in high sales. | New hires or unpredictable sales cycles. |

| Income Stability | Unstable, fluctuates monthly. | Stable base with potential for additional earnings. |

Understanding Commission-Only Pay Structures

Commission-only pay structures rely entirely on sales-generated revenue, offering no base salary and incentivizing high performance. Commission payments are calculated as a percentage of sales, directly rewarding sales volume and profitability. Draw against commission provides a guaranteed advance on expected commissions, reducing income volatility while maintaining strong motivational ties to sales results.

What Is a Draw Against Commission?

A draw against commission is an advance payment provided to sales employees, allowing them to receive a guaranteed minimum income before their earned commissions are calculated. This arrangement helps stabilize cash flow by offsetting future commissions with the draw amount; if commissions exceed the draw, the salesperson receives the difference, but if commissions fall short, the draw must be repaid or deducted from future earnings. Employers use draws against commission to balance risk and incentive, motivating sales performance while offering financial security during slower sales periods.

Key Differences Between Commission and Draw Structures

Commission structures reward salespeople with a percentage of their sales revenue, directly linking income to performance and encouraging higher sales productivity. Draw against commission provides a guaranteed advance payment, which is later recovered from earned commissions, offering income stability while maintaining sales incentives. The key difference lies in risk and cash flow timing: commission-only pays after sales, increasing income variability, whereas draw offers upfront earnings with reconciliation based on actual commissions earned.

Pros and Cons of Commission-Only Compensation

Commission-only compensation offers significant earning potential, motivating sales professionals to maximize performance and close more deals without salary limitations. However, this payment structure creates financial uncertainty, as income depends solely on sales results, leading to inconsistent cash flow and potential economic hardship during slow periods. It may also increase stress and risk for employees lacking a financial safety net, impacting job satisfaction and long-term retention.

Advantages and Disadvantages of Draw Against Commission

Draw against commission provides sales employees with a steady income by advancing payments before commissions are earned, offering financial stability during slower sales periods. The disadvantage lies in the risk of debt accumulation if sales do not meet expectations, as unpaid draws must be repaid, potentially creating financial strain. Employers benefit from incentivizing performance while managing cash flow, but the complexity of accounting and potential for disputes over draw reconciliation can be challenging.

Impact on Earnings Stability: Commission vs Draw

Commission-only compensation offers variable earnings based solely on sales performance, leading to fluctuating income and less predictability. A draw against commission provides a guaranteed advance salary that offsets future commissions, enhancing earnings stability and reducing financial uncertainty. While commission alone incentivizes higher sales, a draw ensures consistent cash flow, particularly valuable in volatile markets or for new employees.

How to Choose Between Commission and Draw

Choosing between commission and draw against commission depends on your cash flow needs and risk tolerance. Commission-only pay offers higher earning potential but less financial stability, while draw against commission provides a steady income with a risk of repayment if sales targets aren't met. Evaluate your sales cycle length, consistency of leads, and personal financial situation to make an informed decision that aligns with your career goals.

Legal Considerations in Commission and Draw Agreements

Legal considerations in commission and draw agreements for sales jobs include clear contract terms outlining payment structures, responsibilities, and conditions for repayment of draws. Compliance with labor laws, such as the Fair Labor Standards Act (FLSA), ensures minimum wage and overtime protections are met even when earnings include commissions and draws. Proper documentation helps prevent disputes and protects both employers and employees from legal liabilities related to compensation.

Industry Trends: Commission vs Draw in Sales Roles

Industry trends reveal a growing preference for draw against commission structures in sales roles, providing sales professionals with steady income while still incentivizing performance. Commission-only models remain prevalent in high-risk, high-reward sectors such as real estate and luxury sales, where earnings potential is directly tied to deal closures. Hybrid compensation plans combining base salary, draw, and commission are increasingly adopted to balance income stability and motivation, reflecting evolving demands in competitive sales environments.

Negotiating Your Sales Compensation Package

When negotiating your sales compensation package, understanding the difference between commission and draw against commission is crucial for maximizing earnings potential. Commission provides direct pay based on sales performance, whereas a draw against commission offers an advance that must be repaid through future commissions, impacting cash flow and risk management. Clarifying these terms and their implications with your employer ensures alignment on payout structure and financial expectations in your sales role.

Related Important Terms

Recoverable Draw

A recoverable draw in sales jobs acts as an advance against future commissions, requiring sales employees to pay back the draw if their earned commissions exceed the draw amount. This arrangement provides financial stability during slower sales periods while ensuring employers recoup advances once sales performance improves.

Non-recoverable Draw

A non-recoverable draw in sales compensation provides a guaranteed minimum income regardless of future commissions earned, ensuring stability for sales professionals during low-sales periods. Unlike recoverable draws, the non-recoverable draw is not deducted from earned commissions, offering a financial cushion without repayment obligations.

Clawback Provision

A clawback provision in draw against commission agreements requires sales employees to repay any advanced draws that exceed their earned commissions if sales targets are not met, protecting employers from overpayments. Commission-only structures typically avoid clawbacks, tying income strictly to actual sales performance without repayment obligations.

Accelerated Commission

Accelerated commission structures reward sales professionals by increasing commission rates once sales targets surpass a predetermined threshold, driving motivation for high performance. In contrast, draw against commission provides a prepayment or advance on future earnings, which is later reconciled with actual commissions earned, offering financial stability but less direct incentive to exceed quotas.

Threshold Commission

Threshold commission sets a minimum sales target that must be reached before earning commission, ensuring sales representatives only receive additional pay after surpassing this benchmark. In contrast, draw against commission provides an advance payment deducted from future commissions, helping stabilize income but requiring sales to exceed the draw amount for true profit.

Tiered Draw Structure

A tiered draw structure in sales jobs provides a progressive advance against future commissions, allowing representatives to access increasing amounts as they hit specified sales targets, reducing financial risk while incentivizing higher performance. This approach balances immediate income needs with long-term earning potential by ensuring draws are recouped only when commissions exceed each tier threshold, optimizing cash flow management for both employer and employee.

Floating Draw

A floating draw in sales compensation offers a temporary advance on expected commissions, adjusted against actual sales performance, allowing sales representatives financial stability without fixed salary guarantees. This flexible draw system incentivizes higher sales by recouping advances only after commission thresholds are met, balancing risk between employer and employee.

Phantom Commission

Phantom commission occurs when sales representatives receive advances against future commissions, often leading to debt if sales targets are not met, contrasting with standard commission where earnings directly reflect actual sales. Draw against commission structures can impact cash flow and motivation, as reps may owe money back if their commission does not exceed the advance.

SPIFF (Sales Performance Incentive Fund)

SPIFFs (Sales Performance Incentive Funds) enhance motivation by providing immediate, targeted bonuses separate from base salary or commissions, driving sales reps to prioritize specific products or promotions. Unlike draw against commission, which functions as an advance on future earnings, SPIFFs incentivize short-term performance spikes without financial risk to the employee.

On-Target Earnings (OTE)

Commission-based pay structures offer sales professionals a percentage of sales revenue, directly aligning earnings with performance, while Draw Against Commission provides a guaranteed upfront payment that is later deducted from earned commission. On-Target Earnings (OTE) combines base salary and expected commissions, serving as a key metric to evaluate total compensation potential under both models.

Commission vs Draw Against Commission for sales jobs. Infographic

hrdif.com

hrdif.com