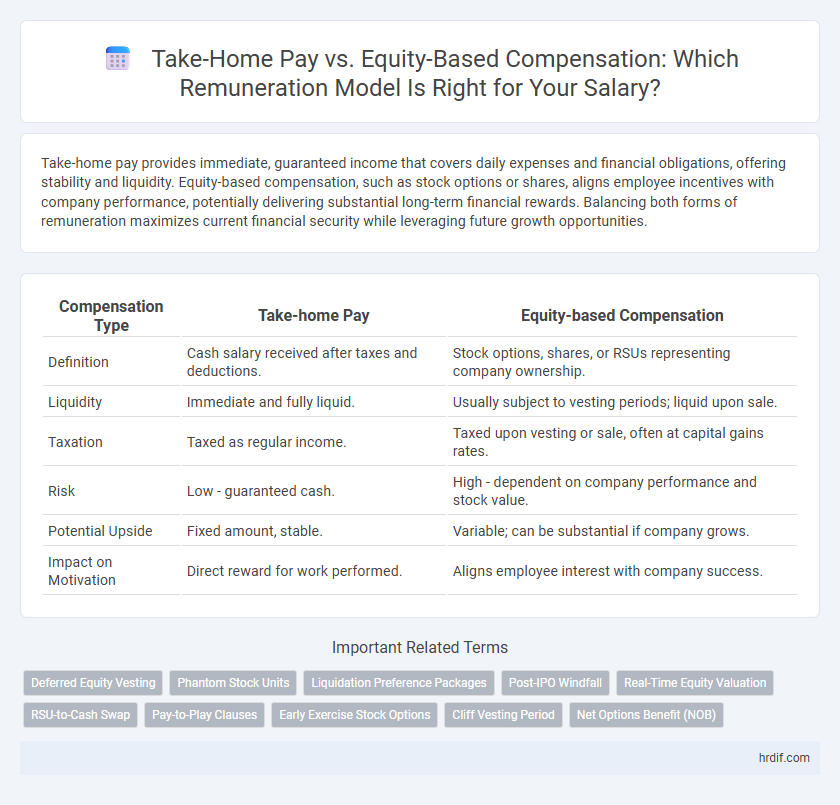

Take-home pay provides immediate, guaranteed income that covers daily expenses and financial obligations, offering stability and liquidity. Equity-based compensation, such as stock options or shares, aligns employee incentives with company performance, potentially delivering substantial long-term financial rewards. Balancing both forms of remuneration maximizes current financial security while leveraging future growth opportunities.

Table of Comparison

| Compensation Type | Take-home Pay | Equity-based Compensation |

|---|---|---|

| Definition | Cash salary received after taxes and deductions. | Stock options, shares, or RSUs representing company ownership. |

| Liquidity | Immediate and fully liquid. | Usually subject to vesting periods; liquid upon sale. |

| Taxation | Taxed as regular income. | Taxed upon vesting or sale, often at capital gains rates. |

| Risk | Low - guaranteed cash. | High - dependent on company performance and stock value. |

| Potential Upside | Fixed amount, stable. | Variable; can be substantial if company grows. |

| Impact on Motivation | Direct reward for work performed. | Aligns employee interest with company success. |

Understanding Take-home Pay: What It Really Means

Take-home pay represents the net salary an employee receives after all deductions such as taxes, social security, and retirement contributions are subtracted from the gross income. It reflects the actual amount available for personal expenses and savings, contrasting with equity-based compensation which may have future value but lacks immediate liquidity. Understanding take-home pay is essential for accurately assessing financial stability and making informed decisions about total remuneration.

Equity-Based Compensation: An Overview

Equity-based compensation offers employees ownership stakes in the company, often through stock options or restricted stock units, aligning their interests with long-term corporate growth and shareholder value. This form of remuneration can significantly enhance total earnings, particularly in high-growth startups or publicly traded companies, though it typically involves vesting periods and market risk. Understanding equity-based pay requirements, tax implications, and potential liquidity events is critical for maximizing the benefits of this compensation strategy.

Key Differences Between Salary and Equity Compensation

Salary provides a fixed, predictable cash flow paid regularly, ensuring financial stability and covering immediate expenses. Equity-based compensation offers potential long-term growth by granting shares or stock options, aligning employee incentives with company performance but carrying market risk and vesting conditions. Key differences include liquidity, risk exposure, tax implications, and timing of value realization, with salary being immediate and certain, while equity rewards depend on future company valuation and stock market dynamics.

Pros and Cons of Take-home Pay

Take-home pay provides immediate, guaranteed income, ensuring financial stability and liquid assets for everyday expenses and savings. However, it lacks the potential for substantial long-term gains that equity-based compensation offers through company growth and stock appreciation. Relying solely on take-home pay may limit wealth-building opportunities compared to equity incentives tied to performance and company valuation.

Pros and Cons of Equity-Based Compensation

Equity-based compensation offers the potential for significant financial gains through company growth and stock appreciation but carries the risk of market volatility and lack of liquidity. Unlike take-home pay, equity compensation may align employee incentives with company performance, promoting long-term commitment and motivation. However, it can lead to unpredictable income and potential dilution of ownership value, making it less reliable for covering daily expenses.

Impact on Long-term Financial Growth

Take-home pay provides immediate liquidity and financial stability, essential for managing daily expenses and short-term goals. Equity-based compensation, such as stock options or restricted stock units, offers potential for substantial long-term financial growth by aligning employee interests with company performance and market valuation. Over time, the appreciation of equity can significantly enhance net worth, but its value depends on company success and market conditions, making it a higher-risk yet potentially higher-reward component of total remuneration.

Tax Implications: Salary Versus Equity

Take-home pay from a salary is subject to immediate income tax and payroll deductions, resulting in predictable net earnings each pay period. Equity-based compensation, such as stock options or RSUs, often benefits from favorable tax treatment, including capital gains rates upon sale, but can trigger complex tax events at vesting or exercise. Understanding the timing and tax rates applicable to each form of remuneration is crucial for optimizing overall compensation and minimizing tax liability.

Evaluating Risk: Guaranteed Income vs. Potential Upside

Take-home pay provides guaranteed income that ensures financial stability and predictable cash flow for employees, mitigating risk from market fluctuations. Equity-based compensation offers potential upside through stock appreciation, aligning employee incentives with company performance but carries inherent risk due to market volatility and uncertain liquidity events. Evaluating risk involves balancing immediate, secure earnings against the possible long-term gains from equity, depending on individual financial goals and risk tolerance.

Which Compensation Model Fits Your Career Goals?

Take-home pay offers immediate financial stability with consistent cash flow, making it ideal for professionals prioritizing short-term financial needs or risk aversion. Equity-based compensation aligns with long-term growth potential, providing significant upside through stock options or shares, and suits individuals aiming for wealth accumulation or involvement in a company's future success. Evaluating personal risk tolerance, career timeline, and financial goals helps determine whether steady salary or equity incentives better support your career aspirations.

Making an Informed Decision: Questions to Ask Before Accepting an Offer

Evaluate the stability and growth potential of equity-based compensation versus the guaranteed nature of take-home pay by asking about the company's valuation history, vesting schedules, and liquidity events. Inquire how fluctuations in stock price may affect your overall remuneration and whether the equity aligns with your financial goals and risk tolerance. Clarify tax implications for both cash salary and equity, ensuring a comprehensive understanding of your net income post-offer acceptance.

Related Important Terms

Deferred Equity Vesting

Deferred equity vesting structures align employee incentives with long-term company growth by locking in equity compensation that matures over multiple years. This approach contrasts with higher immediate take-home pay, offering potential future financial gains tied directly to company valuation and performance milestones.

Phantom Stock Units

Phantom Stock Units offer employees potential financial gains linked to company equity without actual stock ownership, which can supplement take-home pay through future cash payouts based on company valuation. Unlike direct salary, these equity-based compensations align employee incentives with company performance but may lack liquidity until specific vesting or payout events occur.

Liquidation Preference Packages

Take-home pay offers immediate, guaranteed income while equity-based compensation with liquidation preference packages provides prioritized payout during company liquidation events, ensuring investors or employees with such equity receive returns before common shareholders. Understanding the trade-off between steady cash flow and potential high-value equity returns is crucial for effective remuneration planning in startups and high-growth companies.

Post-IPO Windfall

Post-IPO windfall significantly boosts take-home pay when equity-based compensation converts into liquid assets, offering substantial financial liquidity beyond regular salary. Employees benefit from the ability to diversify wealth and mitigate risk by selling shares after the lock-up period, enhancing overall remuneration stability and potential growth.

Real-Time Equity Valuation

Real-time equity valuation enables employees to accurately assess the current worth of their equity-based compensation, providing a dynamic alternative to fixed take-home pay by reflecting market fluctuations instantly. This live valuation tool enhances decision-making by offering transparency and immediate insight into total remuneration beyond static salary figures.

RSU-to-Cash Swap

RSU-to-Cash swaps convert restricted stock units into immediate cash payments, providing employees with liquidity instead of delayed stock vesting, which can reduce exposure to market volatility and improve financial planning. This option often impacts take-home pay by offering upfront compensation that is fully taxable as ordinary income, contrasting with equity-based compensation, which may offer long-term capital gains benefits but lacks immediate cash flow.

Pay-to-Play Clauses

Pay-to-play clauses in equity-based compensation require employees to invest additional capital to maintain their ownership stake, directly impacting overall take-home pay by potentially reducing liquid cash income. These clauses align employee and company interests but may decrease immediate remuneration, making the balance between fixed salary and equity critical in total compensation planning.

Early Exercise Stock Options

Early exercise stock options allow employees to purchase shares before they fully vest, potentially increasing take-home pay by converting future equity into current taxable income with favorable capital gains treatment. This strategy balances immediate liquidity against long-term value appreciation, optimizing overall remuneration beyond traditional salary and direct equity-based compensation.

Cliff Vesting Period

Cliff vesting periods in equity-based compensation create a fixed timeframe before employees gain ownership of stock options, impacting the timing and certainty of their total remuneration compared to immediate take-home pay. Understanding the length and conditions of the cliff vesting period is crucial for accurately assessing the true value of equity incentives versus guaranteed salary components.

Net Options Benefit (NOB)

Net Options Benefit (NOB) quantifies the after-tax value employees gain from equity-based compensation, offering a clearer comparison to take-home pay by accounting for capital gains taxes and vesting schedules. Understanding NOB helps optimize remuneration strategies by balancing immediate salary with long-term wealth accumulation from stock options.

Take-home Pay vs Equity-based Compensation for remuneration. Infographic

hrdif.com

hrdif.com