Salary provides immediate and predictable income essential for covering living expenses, while equity compensation offers potential long-term financial gains through stock ownership in a growing company. Tech jobs often balance these components to attract talent by combining stable pay with incentives aligned to company success. Evaluating salary versus equity compensation depends on personal financial needs, risk tolerance, and belief in the company's future growth.

Table of Comparison

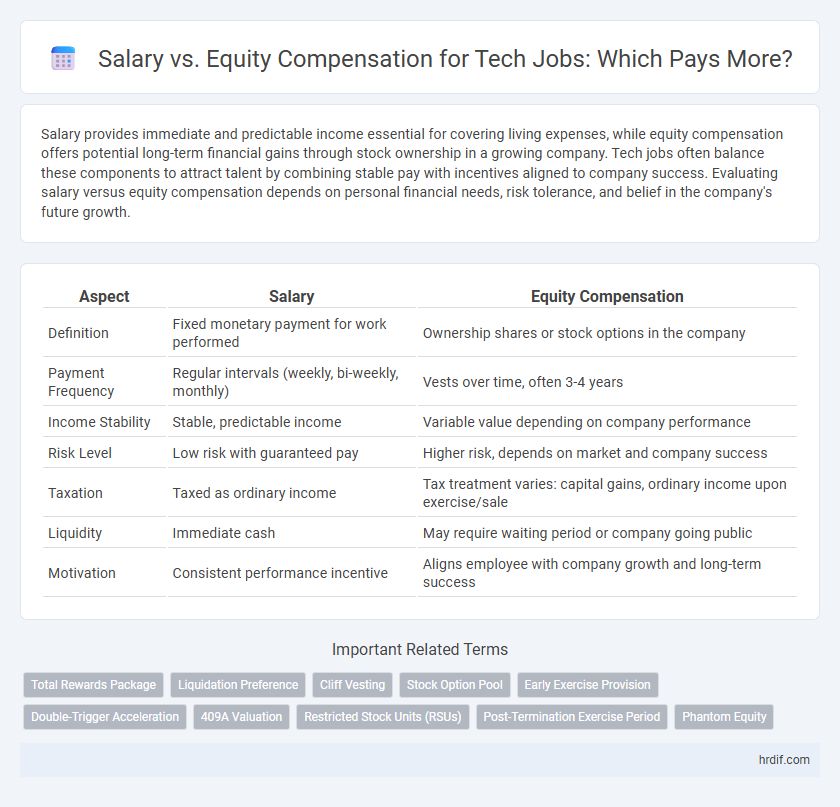

| Aspect | Salary | Equity Compensation |

|---|---|---|

| Definition | Fixed monetary payment for work performed | Ownership shares or stock options in the company |

| Payment Frequency | Regular intervals (weekly, bi-weekly, monthly) | Vests over time, often 3-4 years |

| Income Stability | Stable, predictable income | Variable value depending on company performance |

| Risk Level | Low risk with guaranteed pay | Higher risk, depends on market and company success |

| Taxation | Taxed as ordinary income | Tax treatment varies: capital gains, ordinary income upon exercise/sale |

| Liquidity | Immediate cash | May require waiting period or company going public |

| Motivation | Consistent performance incentive | Aligns employee with company growth and long-term success |

Understanding Salary and Equity Compensation

Salary in tech jobs provides consistent, predictable income that covers living expenses and financial obligations, while equity compensation offers potential future value tied to company performance and growth. Understanding the balance between fixed salary and stock options, restricted stock units (RSUs), or stock grants is crucial for evaluating total compensation packages. Tech professionals should assess their risk tolerance, company stage, and financial goals when comparing immediate salary benefits to long-term equity incentives.

Key Differences Between Salary and Equity

Salary in tech jobs provides fixed, predictable income, typically paid biweekly or monthly, reflecting immediate compensation for work performed. Equity compensation, such as stock options or restricted stock units (RSUs), offers potential for long-term wealth tied to company performance, aligning employees' interests with shareholder value. Key differences include liquidity, risk exposure, and tax implications, where salary is stable and taxable as ordinary income, while equity's value fluctuates and may benefit from capital gains tax advantages upon sale.

Pros and Cons of Salary in Tech Roles

Salary in tech roles offers consistent, predictable income with fixed intervals, providing financial stability and ease of budgeting. It guarantees immediate compensation regardless of company performance, reducing financial risk compared to equity compensation. However, salary lacks the potential for significant upside that equity might offer during company growth or successful exits.

Advantages and Risks of Equity Compensation

Equity compensation in tech jobs offers significant upside potential by aligning employee incentives with company growth and providing opportunities for substantial financial gains if the company's valuation increases. However, it carries risks such as illiquidity, market volatility, and potential dilution of shares, making it less predictable than fixed salaries. Understanding vesting schedules and company performance is crucial before accepting equity to balance immediate financial needs with long-term investment benefits.

How to Evaluate Equity Offers in Job Negotiations

Evaluating equity offers in tech job negotiations requires analyzing the company's valuation, vesting schedule, and potential exit opportunities to determine the true value of stock options or shares. Consider factors like the percentage of ownership, dilution risks, and the liquidity timeline, as equity can significantly impact long-term financial gains compared to base salary. Understanding the tax implications and comparing the total compensation package, including salary, bonuses, and benefits, ensures a balanced decision between immediate income and future wealth growth.

Impact on Taxes: Salary vs Equity

Salary income is subject to regular income tax and payroll taxes, with immediate tax withholding on each paycheck. Equity compensation, such as stock options or restricted stock units (RSUs), often involves capital gains tax upon vesting or sale, which can result in tax deferral and potentially lower tax rates. Understanding the timing and type of equity awards is essential for optimizing tax liability and maximizing after-tax compensation in tech jobs.

Long-Term Career Implications of Equity

Equity compensation in tech jobs offers significant long-term wealth-building potential compared to immediate salary, as stock options and RSUs can appreciate substantially with company growth. Professionals benefiting from equity may accumulate considerable financial resources and align their interests closely with the company's success, enhancing motivation and job satisfaction. However, reliance on equity requires careful evaluation of company stability and market conditions to mitigate risks associated with stock volatility and liquidity constraints.

Startups vs Established Companies: Compensation Trends

Tech jobs at startups often emphasize equity compensation to attract talent despite offering lower base salaries compared to established companies. Equity stakes in startups can lead to significant financial gains if the company succeeds, whereas established firms provide higher base salaries and comprehensive benefits with less equity risk. Current compensation trends reveal a growing preference for blended packages, balancing stable cash flow with potential equity upside to meet diverse employee priorities.

Negotiating the Right Mix: Salary and Equity

Negotiating the right mix of salary and equity compensation in tech jobs requires understanding the value and risks associated with each component. Salary offers reliable, immediate income, while equity provides potential long-term upside tied to company performance and growth. Balancing these factors involves assessing personal financial stability, company stage, and growth prospects to achieve optimal total compensation.

Making an Informed Decision: What’s Best for Tech Professionals

Tech professionals must evaluate salary and equity compensation by considering factors such as company valuation, stock vesting schedules, and personal financial goals. Cash salary offers stability and immediate liquidity, while equity compensation provides potential for significant long-term gains tied to the company's performance. Assessing risk tolerance, market trends, and career stage helps optimize total compensation packages for maximum value and security.

Related Important Terms

Total Rewards Package

Tech professionals often evaluate the total rewards package by balancing base salary with equity compensation, such as stock options or RSUs, which can significantly enhance long-term financial gains. Equity grants align employee incentives with company performance, making the overall compensation more competitive and attractive in high-growth tech firms.

Liquidation Preference

Equity compensation in tech jobs often includes liquidation preferences that prioritize investors during exit events, potentially limiting employee gains despite equity ownership. Salary provides immediate, guaranteed income, while equity's value depends on company performance and exit liquidity, making liquidation preference a critical factor in compensation decisions.

Cliff Vesting

Cliff vesting in equity compensation for tech jobs means employees must work a set period, typically one year, before earning any stock options, impacting overall compensation value compared to immediate salary. This structure aligns employee incentives with long-term company performance while initially limiting liquidity compared to fixed salary payments.

Stock Option Pool

Tech employees often weigh salary against equity compensation, particularly stock options from the option pool, which can offer significant upside if the company's valuation grows. The size and vesting schedule of stock option pools directly impact long-term wealth accumulation, making it critical to understand dilution effects and exit scenarios.

Early Exercise Provision

Early exercise provisions in equity compensation enable tech employees to purchase stock options before they vest, often reducing tax liabilities and allowing for longer capital gains treatment. Salary offers immediate, guaranteed cash flow, while early exercise can enhance total compensation through potential company growth, making it a strategic choice for startup employees seeking wealth accumulation.

Double-Trigger Acceleration

Double-trigger acceleration in equity compensation ensures that employees receive immediate vesting of stock options or shares upon a change in company control followed by termination without cause, providing financial security beyond base salary. This mechanism balances the risk between salary and equity, making tech job offers with equity more attractive by mitigating potential losses during mergers or acquisitions.

409A Valuation

Salary provides immediate, guaranteed income, while equity compensation offers potential long-term gains tied to company performance and valuation milestones. Accurate 409A valuation is crucial for setting fair strike prices on stock options, ensuring compliance with IRS regulations and optimizing tax benefits in tech job compensation packages.

Restricted Stock Units (RSUs)

Restricted Stock Units (RSUs) offer tech employees potential long-term value through stock equity that can appreciate over time, often complementing base salary by aligning employee incentives with company performance. RSUs vest over a set period, providing a balance between immediate cash compensation and future wealth accumulation, which can be especially attractive in high-growth tech companies.

Post-Termination Exercise Period

Post-Termination Exercise (PTE) period in equity compensation for tech jobs determines how long an employee can exercise stock options after leaving the company, impacting financial outcomes significantly. A shorter PTE period often pressures former employees to buy shares quickly, while a longer PTE offers more flexibility compared to fixed salary benefits, influencing total compensation value.

Phantom Equity

Phantom equity offers tech employees a cash bonus tied to company valuation growth without diluting ownership, providing a tax-efficient alternative to traditional salary or stock options. This form of equity compensation aligns employee incentives with company performance while preserving cash flow, making it especially attractive for startups and private tech firms.

Salary vs Equity Compensation for tech jobs Infographic

hrdif.com

hrdif.com