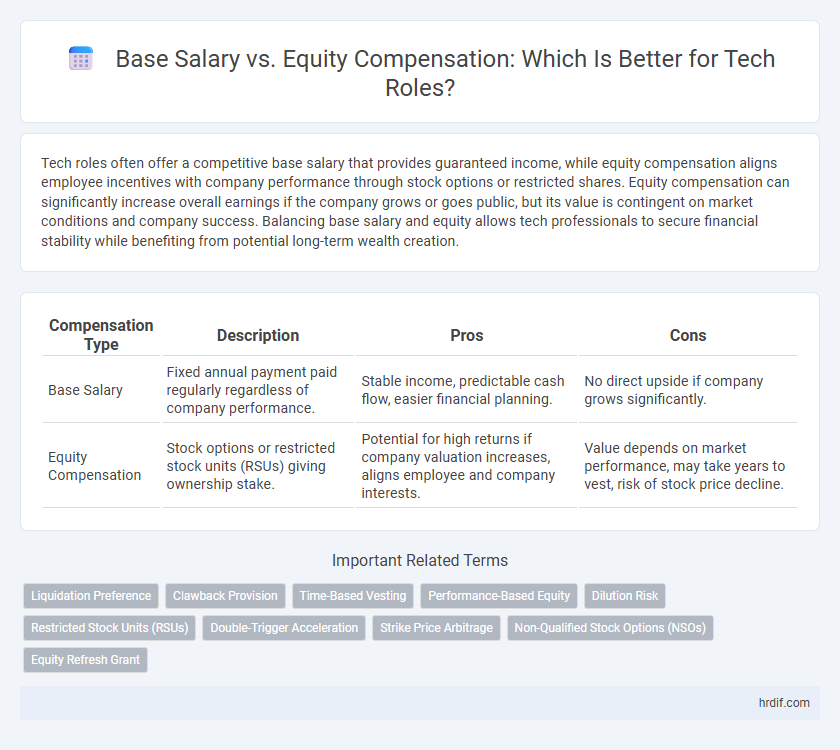

Tech roles often offer a competitive base salary that provides guaranteed income, while equity compensation aligns employee incentives with company performance through stock options or restricted shares. Equity compensation can significantly increase overall earnings if the company grows or goes public, but its value is contingent on market conditions and company success. Balancing base salary and equity allows tech professionals to secure financial stability while benefiting from potential long-term wealth creation.

Table of Comparison

| Compensation Type | Description | Pros | Cons |

|---|---|---|---|

| Base Salary | Fixed annual payment paid regularly regardless of company performance. | Stable income, predictable cash flow, easier financial planning. | No direct upside if company grows significantly. |

| Equity Compensation | Stock options or restricted stock units (RSUs) giving ownership stake. | Potential for high returns if company valuation increases, aligns employee and company interests. | Value depends on market performance, may take years to vest, risk of stock price decline. |

Understanding Base Salary and Equity Compensation

Base salary represents the fixed annual income paid to tech employees, providing predictable financial stability and covering essential living expenses. Equity compensation involves stock options or shares, offering potential for significant long-term financial gain aligned with the company's growth and success. Balancing base salary with equity compensation is crucial for tech professionals seeking both immediate income and future wealth accumulation.

Key Differences Between Base Salary and Equity

Base salary provides a fixed, predictable income paid regularly, offering immediate financial stability for tech professionals. Equity compensation, such as stock options or restricted stock units (RSUs), aligns employee incentives with company performance, potentially delivering substantial long-term wealth if the company grows. The key differences lie in liquidity and risk: base salary is guaranteed cash, while equity value fluctuates with market conditions and company success.

Pros and Cons of Base Salary in Tech Jobs

Base salary in tech roles provides stable, predictable income crucial for financial planning and meeting immediate expenses. It lacks the potential upside found in equity compensation, which can significantly increase total earnings if the company performs well. However, reliance solely on base salary may limit long-term wealth accumulation opportunities compared to stock options or shares.

Advantages and Risks of Equity Compensation

Equity compensation in tech roles offers potential for significant financial gain through stock appreciation, aligning employees' interests with company success and fostering long-term commitment. However, it carries risks such as stock price volatility, lack of liquidity, and possible dilution of shares, which can diminish actual value received. Unlike base salary, equity's uncertain value requires careful consideration of company performance, vesting schedules, and market conditions before reliance as primary income.

How Equity Compensation Works in Tech Companies

Equity compensation in tech companies typically involves granting stock options or restricted stock units (RSUs) to employees as part of their total remuneration, aligning their financial interests with company performance and long-term growth. Vesting schedules determine when employees can exercise or sell their equity, encouraging retention and sustained contribution to the company's success. This form of compensation complements base salary by offering potential for significant financial upside as the company's valuation increases.

Evaluating Total Compensation Packages

Evaluating total compensation packages for tech roles requires balancing base salary with equity compensation, such as stock options or RSUs, to assess overall financial value. Base salary provides guaranteed, predictable income, while equity offers potential upside tied to company growth, appealing to candidates seeking long-term wealth creation. Understanding vesting schedules, market volatility, and tax implications is essential for accurately comparing these components and making informed career decisions.

Negotiation Strategies: Salary vs Equity

Negotiating base salary versus equity compensation requires a clear understanding of your immediate financial needs and long-term wealth goals, especially in tech roles where stock options or RSUs can significantly impact total compensation. Prioritize securing a competitive base salary to cover living expenses and minimize financial risk, while strategically negotiating equity to benefit from potential company growth and upside. Use market data on salary benchmarks and company valuation to justify your requests, balancing guaranteed income with equity's variable future value.

Tax Implications of Equity Compensation

Equity compensation, such as stock options or restricted stock units (RSUs), often results in complex tax implications that differ significantly from base salary taxation. Unlike base salary taxed as ordinary income at the time of payment, equity compensation may trigger taxable events upon vesting or exercising shares, potentially subjecting recipients to capital gains tax rates on appreciation after holding periods. Understanding the timing and type of equity awards is crucial for tech professionals to optimize tax liabilities and plan financial strategies effectively.

Which is Better for Tech Professionals: Salary or Equity?

Tech professionals often weigh base salary against equity compensation to determine overall financial benefits, with base salary providing immediate, predictable income and equity offering potential for substantial long-term wealth through stock appreciation. Equity compensation, such as stock options or restricted stock units (RSUs), aligns employee incentives with company performance but carries risks tied to market volatility and company success. Choosing between salary and equity depends on individual risk tolerance, career stage, and confidence in the company's growth trajectory.

Future Growth: Long-Term Impact of Equity vs Base Salary

Equity compensation in tech roles offers significant potential for future wealth accumulation, aligning employee incentives with company growth and market success. Unlike base salary, which provides stable, immediate income, equity's value can exponentially increase as the startup or company scales, creating long-term financial benefits. Evaluating total compensation requires understanding equity dilution, vesting schedules, and exit events that determine actual future returns compared to consistent base salary earnings.

Related Important Terms

Liquidation Preference

Base salary provides immediate, stable income for tech professionals, while equity compensation ties financial rewards to company performance and potential future value. Liquidation preference in equity agreements ensures investors are paid before employees during exits, impacting the actual realization of equity gains for tech employees.

Clawback Provision

In tech roles, base salary provides guaranteed income while equity compensation offers potential long-term financial gains, but clawback provisions can require repayment of equity under specific conditions like misconduct or departure. Understanding clawback clauses is crucial for employees to evaluate the true value and risk associated with their overall compensation package.

Time-Based Vesting

Time-based vesting structures in tech roles typically span four years with a one-year cliff, aligning employees' equity compensation incentives with long-term company performance and retention goals. While base salary provides immediate, stable income, equity vesting rewards sustained contribution and can significantly enhance total compensation when the company's valuation grows.

Performance-Based Equity

Performance-based equity in tech roles aligns employee incentives with company success by granting stock options or restricted stock units contingent on achieving specific milestones, often resulting in higher long-term financial rewards compared to a fixed base salary. While base salary provides guaranteed income stability, performance-based equity maximizes potential earnings by directly linking compensation to individual and organizational performance metrics.

Dilution Risk

Base salary offers stable, predictable income for tech professionals, while equity compensation presents potential high rewards but carries significant dilution risk as the company issues more shares. Evaluating the long-term value of stock options requires understanding how future financing rounds can reduce individual ownership percentage and impact overall compensation.

Restricted Stock Units (RSUs)

Base salary provides consistent, predictable income, while equity compensation through Restricted Stock Units (RSUs) offers potential for significant financial gains aligned with company performance. RSUs grant employees shares that vest over time, incentivizing long-term commitment and can substantially increase total compensation in high-growth tech companies.

Double-Trigger Acceleration

Double-trigger acceleration in equity compensation ensures that employees receive vested stock options promptly upon a change of control combined with termination without cause, providing financial security beyond base salary. This mechanism aligns employee incentives with company performance during mergers or acquisitions, complementing the stability of a fixed base salary.

Strike Price Arbitrage

Strike price arbitrage in tech roles enables employees to capitalize on low exercise prices of stock options relative to current market value, effectively boosting total compensation beyond the base salary. This strategy maximizes equity compensation returns by exercising options at discounted strike prices and selling shares at higher market prices, often outpacing typical salary increments.

Non-Qualified Stock Options (NSOs)

Base salary provides consistent, guaranteed income, while Non-Qualified Stock Options (NSOs) offer potential equity upside but come with tax implications upon exercise, including ordinary income tax on the spread between the exercise price and the fair market value. NSOs enhance total compensation in tech roles by aligning employee incentives with company growth, though they carry the risk of stock price volatility and lack the favorable tax treatment of Incentive Stock Options (ISOs).

Equity Refresh Grant

Equity refresh grants in tech roles provide ongoing stock options or restricted stock units (RSUs) that supplement initial equity awards, aligning employee incentives with long-term company performance. These refreshers often enhance total compensation packages beyond base salary by offering potential upside through company growth and market valuation increases.

Base Salary vs Equity Compensation for tech roles. Infographic

hrdif.com

hrdif.com