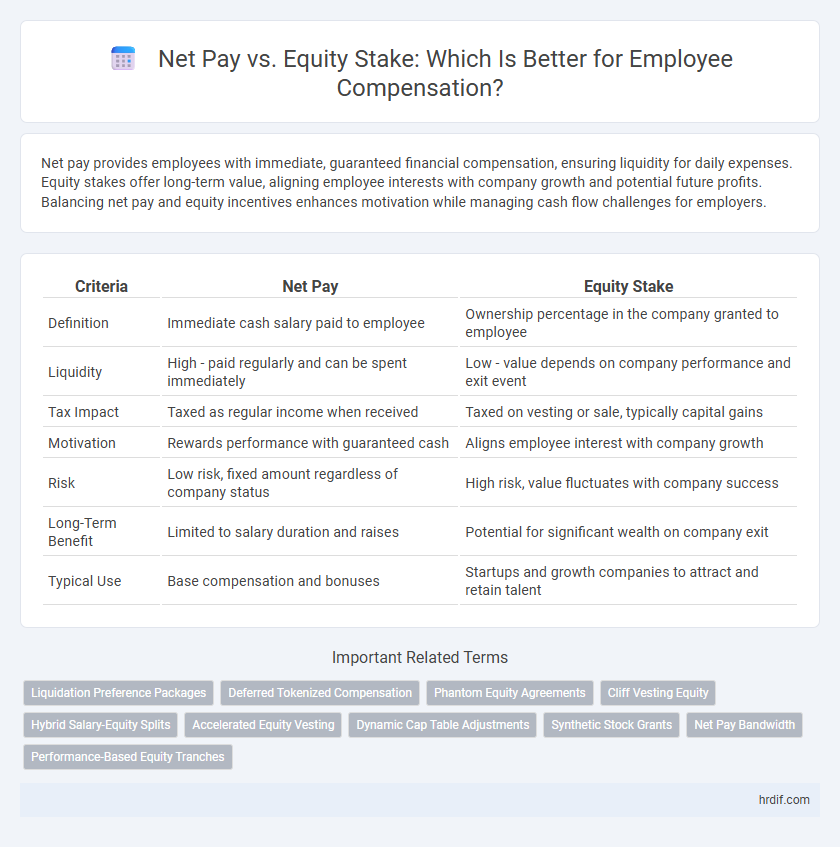

Net pay provides employees with immediate, guaranteed financial compensation, ensuring liquidity for daily expenses. Equity stakes offer long-term value, aligning employee interests with company growth and potential future profits. Balancing net pay and equity incentives enhances motivation while managing cash flow challenges for employers.

Table of Comparison

| Criteria | Net Pay | Equity Stake |

|---|---|---|

| Definition | Immediate cash salary paid to employee | Ownership percentage in the company granted to employee |

| Liquidity | High - paid regularly and can be spent immediately | Low - value depends on company performance and exit event |

| Tax Impact | Taxed as regular income when received | Taxed on vesting or sale, typically capital gains |

| Motivation | Rewards performance with guaranteed cash | Aligns employee interest with company growth |

| Risk | Low risk, fixed amount regardless of company status | High risk, value fluctuates with company success |

| Long-Term Benefit | Limited to salary duration and raises | Potential for significant wealth on company exit |

| Typical Use | Base compensation and bonuses | Startups and growth companies to attract and retain talent |

Understanding Net Pay: Immediate Financial Rewards

Net pay represents the immediate financial reward employees receive after all deductions such as taxes, social security, and retirement contributions are made from their gross salary. It directly affects daily living expenses and personal savings, providing tangible monetary value without delay. Understanding net pay's impact is crucial for employees when weighing the benefits of immediate cash compensation versus long-term equity stakes.

Equity Stake Explained: Long-term Wealth Potential

Equity stake provides employees with ownership in the company, aligning their interests with long-term business growth and potentially resulting in significant financial gains beyond regular salary. Unlike net pay, which is fixed and subject to immediate taxation, equity rewards can appreciate in value over time, offering wealth accumulation through stock price increases and dividends. This compensation strategy motivates employees to contribute to the company's success while building substantial net worth tied to the firm's future performance.

Key Differences Between Net Pay and Equity Compensation

Net pay represents the actual cash salary an employee receives after taxes and deductions, providing immediate financial liquidity and spending power. Equity compensation, such as stock options or shares, offers potential long-term value aligned with company growth but carries market risk and delayed realization. Key differences include liquidity timing, risk exposure, and the direct control employees have over their financial rewards.

Advantages of Receiving Net Pay as an Employee

Receiving net pay as an employee provides immediate and predictable financial security, enabling effective personal budgeting and stability without the risk associated with fluctuating equity values. Net pay ensures liquidity, allowing employees to cover daily expenses, savings, and investments without delay or dependency on company performance. This guaranteed income stream enhances financial planning and reduces anxiety linked to market volatility that often affects equity stakes.

Benefits of Employee Equity Participation

Employee equity participation offers long-term wealth creation through company stock ownership, aligning employees' interests with corporate growth and profitability. Unlike net pay, which provides immediate cash compensation, equity stakes incentivize commitment and performance by granting potential value appreciation over time. This approach fosters a sense of ownership, enhances retention, and can significantly boost total employee rewards beyond traditional salary packages.

Risks Associated with Equity Stakes

Equity stakes in employee rewards hold potential for significant financial gain but carry inherent risks such as market volatility, lack of liquidity, and company performance dependency. Unlike net pay, which provides immediate and guaranteed compensation, equity value can fluctuate widely, impacting an employee's overall financial stability. Employees must carefully evaluate dilution risks, vesting schedules, and the long-term viability of the issuing company before relying heavily on equity as part of their total compensation.

Tax Implications: Net Pay vs Equity Compensation

Net pay offers employees immediate, fully taxable income subject to payroll and income taxes, reducing take-home earnings but providing liquidity. Equity compensation, such as stock options or RSUs, often benefits from favorable tax treatment, including deferral of taxation until vesting or sale, potentially lowering overall tax burden. Understanding the tax implications of net pay versus equity stake is crucial for optimizing employee rewards and maximizing after-tax income.

Net Pay vs Equity: Which Suits Your Career Goals?

Net pay provides immediate, reliable income crucial for meeting daily expenses, while equity stake offers potential long-term wealth through company growth and stock value appreciation. Employees prioritizing financial stability and predictable cash flow may prefer net pay, whereas those aiming for significant future gains and alignment with company success often opt for equity. Evaluating personal financial needs, risk tolerance, and career timeline helps determine whether net pay or equity better suits individual career goals.

How Startups Structure Salaries and Equity Offers

Startups often structure employee compensation with a lower base salary complemented by an equity stake to align incentives and attract talent with growth potential. Net pay provides immediate financial liquidity, while equity stakes offer long-term wealth through potential company appreciation and exit events. This balance helps startups conserve cash flow while motivating employees to contribute to the company's success.

Decision Factors: Choosing Between Net Pay and Equity

Choosing between net pay and equity stake as employee rewards depends on factors like immediate financial needs, risk tolerance, and long-term growth potential. Employees prioritizing stable income often prefer higher net pay, while those valuing company growth and potential wealth accumulation lean toward equity stakes. Consideration of tax implications, vesting schedules, and market volatility also influences the optimal compensation mix.

Related Important Terms

Liquidation Preference Packages

Net pay provides immediate financial benefit to employees, but equity stakes with liquidation preference packages offer long-term upside by prioritizing payout during company liquidation events. Liquidation preference ensures that employees holding preferred shares receive their equity value before common shareholders, maximizing returns in exit scenarios.

Deferred Tokenized Compensation

Deferred tokenized compensation enhances employee rewards by converting equity stakes into liquid digital assets that vest over time, aligning incentives with long-term company performance. This approach contrasts with net pay by offering potential value appreciation and increased ownership transparency while managing tax and liquidity considerations for employees.

Phantom Equity Agreements

Phantom Equity Agreements provide employees with benefits similar to ownership through cash bonuses tied to company valuation increases without issuing actual shares, optimizing net pay by avoiding immediate tax liabilities and dilution of equity. This structure aligns employee rewards with company performance, enhancing motivation while preserving shareholder equity and improving cash flow management.

Cliff Vesting Equity

Cliff vesting equity offers employees a substantial ownership stake that fully vests after a set period, aligning long-term incentives with company performance and promoting retention. While net pay provides immediate liquid income, cliff vesting equity balances short-term compensation with significant future financial upside tied to company growth.

Hybrid Salary-Equity Splits

Hybrid salary-equity splits balance immediate financial needs with long-term wealth creation, offering employees a fixed net pay alongside a variable equity stake in the company. This approach aligns employee incentives with company growth, enhancing retention and motivation while managing cash flow for employers.

Accelerated Equity Vesting

Accelerated equity vesting enables employees to access a larger portion of their equity stake sooner, enhancing their total compensation beyond net pay. This mechanism aligns employee incentives with company performance while mitigating the risk of forfeiture upon events like acquisitions or departures.

Dynamic Cap Table Adjustments

Net pay provides immediate financial compensation, while equity stakes offer long-term value tied to company performance; dynamic cap table adjustments enable real-time recalibration of ownership percentages to maintain fair equity distribution amid new investments, stock option exercises, or employee grants. This approach ensures employees' rewards reflect both their contributions and evolving company valuation, optimizing total compensation strategies.

Synthetic Stock Grants

Synthetic stock grants offer employees a form of equity-based compensation that mimics stock ownership without actual shares, providing potential financial upside aligned with company performance. Compared to net pay, synthetic stock grants can enhance total rewards by delivering long-term value and tax-efficient benefits, fostering employee retention and motivation.

Net Pay Bandwidth

Net pay bandwidth defines the range of take-home salary an employee receives after deductions, directly impacting financial stability and spending power. Balancing net pay with equity stake allows companies to offer immediate monetary compensation alongside potential long-term wealth through stock ownership.

Performance-Based Equity Tranches

Performance-based equity tranches align employee incentives with company growth by granting stock options or shares contingent on achieving specific milestones, enhancing long-term net pay potential beyond fixed salary components. These equity stakes complement base compensation by offering significant financial upside linked to individual and corporate performance, driving sustained employee engagement and retention.

Net Pay vs Equity Stake for employee rewards. Infographic

hrdif.com

hrdif.com