Traditional paychecks often involve paper checks that require physical handling and manual deposit processes, leading to potential delays and inconvenience. Digital wallets enable instant salary delivery directly to employees' devices, offering faster access to funds and enhanced security through encryption. Embracing digital wallets for salary payments streamlines payroll management and supports financial inclusion by providing seamless, real-time transactions.

Table of Comparison

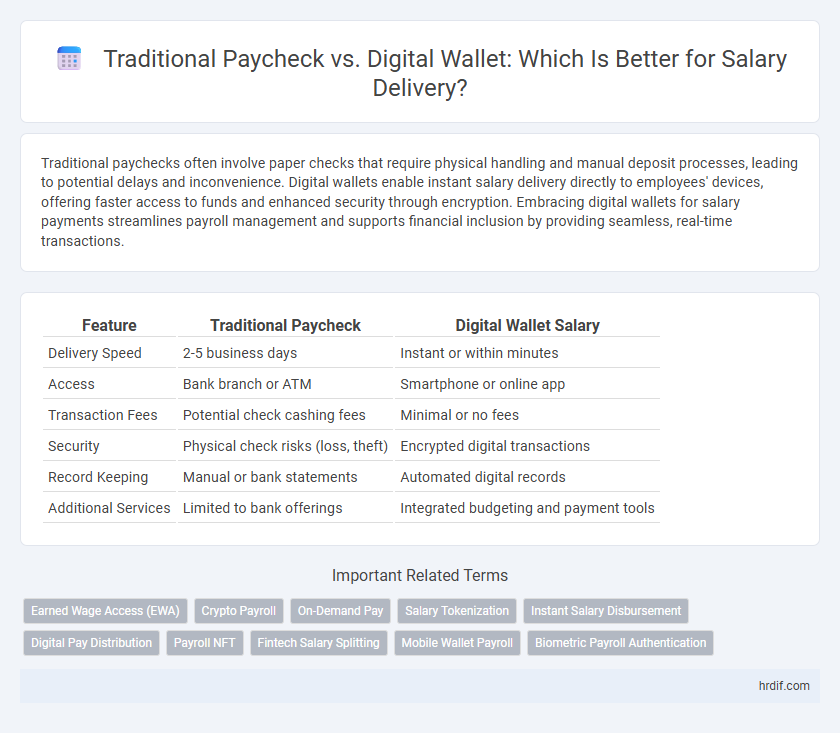

| Feature | Traditional Paycheck | Digital Wallet Salary |

|---|---|---|

| Delivery Speed | 2-5 business days | Instant or within minutes |

| Access | Bank branch or ATM | Smartphone or online app |

| Transaction Fees | Potential check cashing fees | Minimal or no fees |

| Security | Physical check risks (loss, theft) | Encrypted digital transactions |

| Record Keeping | Manual or bank statements | Automated digital records |

| Additional Services | Limited to bank offerings | Integrated budgeting and payment tools |

Understanding Traditional Paycheck Methods

Traditional paycheck methods rely on physical paper checks issued by employers, requiring employees to visit banks for deposit or cashing, which can cause delays and additional fees. This process involves manual handling, increasing the risk of lost or stolen checks, and limits immediate access to funds. Despite its widespread use, the traditional method lacks the convenience and speed offered by digital wallet salary delivery systems.

The Rise of Digital Wallets in Salary Payment

Digital wallets have revolutionized salary payment by offering faster, more secure transactions compared to traditional paychecks, reducing processing times from days to mere seconds. Employers benefit from decreased administrative costs and enhanced payroll accuracy, while employees enjoy immediate access to funds and seamless integration with budgeting apps. The increasing adoption of blockchain technology further ensures transparency and tamper-proof salary disbursements, driving the rise of digital wallets in modern payroll systems.

Speed and Convenience: Digital vs. Paper Salary Delivery

Digital wallets enable instant salary transfers, eliminating the delays associated with traditional paycheck processing and bank clearing times. Employees gain immediate access to funds, enhancing cash flow management and reducing dependency on physical visits to banks or check cashing services. This convenience supports seamless transactions, especially for remote or mobile workers who benefit from on-the-go access to their earnings.

Security Concerns: Paychecks vs. Digital Wallets

Traditional paychecks pose risks such as theft, loss, and forgery, making physical security a major concern for employees. Digital wallets enhance security by utilizing encryption, multi-factor authentication, and real-time transaction monitoring to protect salary payments from fraud and unauthorized access. Despite cyber threats, digital wallet platforms continuously update security protocols, offering a more secure and efficient salary delivery method compared to paper paychecks.

Cost Implications for Employers and Employees

Traditional paychecks incur higher costs for employers due to printing, mailing, and processing fees, while employees face delays and potential bank fees when cashing checks. Digital wallet salary delivery reduces these expenses by enabling instant, secure transfers, lowering administrative overhead and minimizing transaction fees for both parties. Enhanced transparency and faster access to funds improve overall financial efficiency for employers and employees alike.

Accessibility and Inclusivity in Payroll Solutions

Digital wallets enhance salary delivery by providing immediate, secure access to funds without the need for bank accounts, making payroll more inclusive for unbanked and underbanked employees. Traditional paychecks often require physical transportation and bank deposits, which can delay access and exclude workers in remote or underserved areas. Integrating digital payment solutions in payroll systems promotes financial inclusivity and streamlines salary distribution, improving accessibility for a diverse workforce.

Employee Preferences: Cash, Check, or Digital Wallet?

Employee preferences for salary delivery vary widely, with traditional paychecks still favored for their tangible security and record-keeping benefits, while digital wallets appeal due to instant access and convenience. Cash remains preferred among employees without bank accounts or those seeking immediate liquidity, particularly in hourly or gig economy roles. Studies indicate a growing shift toward digital wallets, driven by younger workers valuing seamless mobile payments and integrated financial management features.

Digital Wallet Adoption: Challenges and Opportunities

Digital wallet adoption for salary delivery faces challenges including cybersecurity risks, limited digital literacy among employees, and inconsistent regulatory frameworks across regions. Opportunities arise from faster, transparent transactions, reduced payroll processing costs, and enhanced financial inclusion for unbanked workers. Employers benefit from streamlined payroll operations, while employees gain convenient access to funds and real-time transaction tracking.

Legal and Compliance Factors in Salary Disbursement

Legal and compliance factors in salary disbursement require strict adherence to labor laws and tax regulations, which vary by jurisdiction and impact both traditional paychecks and digital wallet payments. Traditional paychecks often provide clear audit trails and compliance with withholding requirements, while digital wallets must integrate secure, compliant processes for tax reporting and employee consent. Employers must ensure digital payment platforms comply with data privacy laws and anti-money laundering regulations to avoid penalties and ensure lawful salary delivery.

Future Trends: The Evolution of Salary Delivery Methods

Emerging salary delivery methods increasingly prioritize digital wallets over traditional paychecks, driven by faster transactions and enhanced financial accessibility. Employers adopting digital wallets benefit from reduced processing costs and seamless integration with payroll software, supporting real-time payments. The future of salary distribution emphasizes secure, contactless, and instant payment solutions aligning with global trends in digital finance and workforce expectations.

Related Important Terms

Earned Wage Access (EWA)

Traditional paychecks often delay employee access to earned funds until the scheduled payday, whereas digital wallets integrated with Earned Wage Access (EWA) enable real-time salary delivery, enhancing financial flexibility. EWA solutions reduce reliance on high-interest loans and improve cash flow management by allowing workers to access a portion of their earned wages instantly through secure digital platforms.

Crypto Payroll

Crypto payroll streamlines salary delivery by using digital wallets, enabling instant, secure, and borderless payments compared to traditional paycheck methods that involve bulky paperwork and delayed bank processing. Employers adopting crypto payroll benefit from reduced transaction fees and enhanced transparency through blockchain technology, optimizing payroll efficiency in the digital economy.

On-Demand Pay

On-demand pay delivered through digital wallets provides employees instant access to earned wages, eliminating the wait for traditional paycheck cycles and enhancing financial flexibility. This method reduces reliance on cash advances and high-interest loans, promoting improved financial wellness and employee satisfaction.

Salary Tokenization

Salary tokenization transforms traditional paychecks into digital assets secured on blockchain, enabling instant, transparent, and tamper-proof salary delivery via digital wallets. This decentralized approach reduces payroll processing time, lowers transaction fees, and facilitates seamless cross-border payments with real-time salary access for employees.

Instant Salary Disbursement

Instant salary disbursement via digital wallets enables employees to receive wages immediately after payroll processing, eliminating delays common with traditional paychecks. This method enhances cash flow management and reduces dependency on physical banking hours, providing faster access to funds and increased financial flexibility.

Digital Pay Distribution

Digital pay distribution via digital wallets enhances salary delivery by offering instant access, reduced transaction fees, and improved financial inclusion for employees globally. This method ensures secure, transparent payments and enables real-time tracking, surpassing the limitations of traditional paper paychecks.

Payroll NFT

Payroll NFTs revolutionize salary delivery by enabling instant, secure payments directly to digital wallets, eliminating delays and reducing transaction fees associated with traditional paychecks. This blockchain-based approach ensures transparent, tamper-proof payroll records, enhancing both employer efficiency and employee trust.

Fintech Salary Splitting

Fintech Salary Splitting enables employees to allocate their salaries instantly across multiple accounts or digital wallets, offering greater financial flexibility compared to traditional paycheck methods that typically deposit funds into a single bank account. This innovation enhances real-time fund management, reduces reliance on physical paychecks, and supports seamless integration with budgeting and savings tools.

Mobile Wallet Payroll

Mobile wallet payroll offers faster, secure, and more convenient salary delivery compared to traditional paychecks, enabling instant access and real-time transaction tracking. This digital method reduces processing costs and minimizes errors associated with manual handling, enhancing overall payroll efficiency for employers and employees.

Biometric Payroll Authentication

Biometric payroll authentication enhances digital wallet salary delivery by providing secure, fingerprint or facial recognition verification, reducing fraud and ensuring timely access to funds. Traditional paychecks lack such biometric security features, making them more vulnerable to theft, loss, and delayed payments.

traditional paycheck vs digital wallet for salary delivery Infographic

hrdif.com

hrdif.com