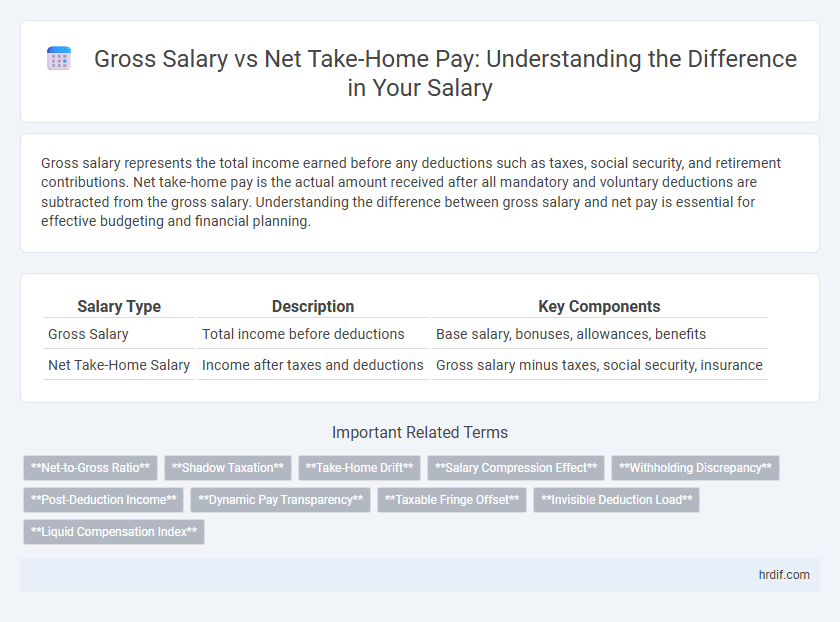

Gross salary represents the total income earned before any deductions such as taxes, social security, and retirement contributions. Net take-home pay is the actual amount received after all mandatory and voluntary deductions are subtracted from the gross salary. Understanding the difference between gross salary and net pay is essential for effective budgeting and financial planning.

Table of Comparison

| Salary Type | Description | Key Components |

|---|---|---|

| Gross Salary | Total income before deductions | Base salary, bonuses, allowances, benefits |

| Net Take-Home Salary | Income after taxes and deductions | Gross salary minus taxes, social security, insurance |

Understanding Gross Salary: What It Really Means

Gross salary represents the total amount an employee earns before any deductions such as taxes, social security, and retirement contributions are applied. It includes base pay, bonuses, and allowances, forming the basis for calculating payroll taxes and benefits. Understanding gross salary is essential for accurately assessing income, budgeting, and negotiating compensation packages.

Net Take-Home Pay: Breaking Down the Concept

Net take-home pay represents the amount employees actually receive after mandatory deductions such as taxes, social security contributions, and retirement fund payments are subtracted from the gross salary. Understanding net take-home pay is crucial for accurate personal budgeting and financial planning, as it reflects the real income available for living expenses and savings. Employers often provide detailed pay stubs breaking down these deductions to enhance transparency and help workers comprehend their actual earnings.

Key Differences Between Gross Salary and Net Salary

Gross salary represents the total earnings before any deductions, including taxes, social security, and other withholdings, while net salary is the actual amount received by an employee after all deductions are made. Key differences include gross salary reflecting the contractual pay agreed upon, whereas net salary indicates the disposable income available for personal use. Understanding these distinctions is vital for accurate financial planning and assessing real income.

Common Deductions from Gross Salary Explained

Common deductions from gross salary include income tax, social security contributions, and health insurance premiums, which reduce the gross amount to arrive at the net take-home pay. Retirement fund contributions and union dues may also be subtracted, impacting the final paycheck. Understanding these deductions helps employees accurately estimate their actual income and manage personal finances effectively.

Taxes and Contributions: Impact on Net Income

Gross salary represents the total earnings before deductions, while net take-home pay reflects the amount received after taxes and contributions. Income tax rates, social security premiums, health insurance, and pension contributions significantly reduce net income from the gross amount. Understanding these deductions is crucial for accurate budgeting and financial planning based on actual disposable income.

Why Your Net Take-Home Pay Varies Each Month

Net take-home pay varies each month due to fluctuations in tax withholdings, social security contributions, and other deductions like health insurance or retirement fund payments that are often calculated based on gross salary. Variable components such as bonuses, overtime, or unpaid leave further impact the final amount received. Understanding the difference between gross salary--which represents total earnings before deductions--and net salary, or take-home pay, highlights how mandatory and voluntary deductions affect monthly income consistency.

The Importance of Knowing Your Net Salary

Understanding your net salary is essential for accurate financial planning and budgeting, as it reflects the actual amount you take home after taxes, social contributions, and other deductions are applied to your gross salary. Unlike gross salary, which represents your total earnings before deductions, the net salary determines your real purchasing power and ability to meet monthly expenses. Being aware of your net income helps prevent overspending and ensures better management of personal finances.

Calculating Your Net Take-Home from Gross Salary

Calculating your net take-home pay from your gross salary involves deducting taxes, social security contributions, and other mandatory withholdings from the total earnings before deductions. Factors such as income tax brackets, retirement fund contributions, health insurance premiums, and local tax regulations significantly impact the final amount received. Understanding these components helps employees accurately determine their disposable income for budgeting and financial planning.

Negotiating Salary: Focus on Net or Gross?

When negotiating salary, prioritizing the net take-home pay offers a clearer understanding of your actual income after taxes and deductions, essential for budgeting and financial planning. Gross salary figures can be misleading as they do not reflect mandatory withholdings such as income tax, social security, and health insurance contributions. Focusing discussions on net salary ensures negotiations address the disposable income that impacts your standard of living directly.

Tools and Resources for Gross-to-Net Salary Calculation

Effective gross-to-net salary calculators integrate tax brackets, social security contributions, and benefit deductions to provide accurate take-home pay estimates. Online tools like ADP's Salary Calculator and PaycheckCity incorporate up-to-date federal and state tax codes, ensuring precise net salary computations. Utilizing these resources helps employees and employers forecast actual income and optimize financial planning by accounting for mandatory deductions and tax withholdings.

Related Important Terms

Net-to-Gross Ratio

The Net-to-Gross ratio indicates the percentage of gross salary an employee actually receives after deductions such as taxes, social security, and other contributions. Understanding this ratio helps employees estimate their effective take-home pay and compare job offers more accurately.

Shadow Taxation

Shadow taxation refers to indirect taxes and mandatory deductions that reduce an employee's gross salary before reaching their net take-home pay, often including social security contributions, healthcare premiums, and employer-mandated funds. Understanding shadow taxation is crucial for accurately assessing true disposable income, as it highlights the hidden financial burdens beyond visible tax rates.

Take-Home Drift

Take-home drift represents the difference between gross salary and net income after taxes, deductions, and benefits, significantly impacting employees' actual earnings. Understanding this gap is crucial for accurate financial planning and assessing disposable income.

Salary Compression Effect

Salary compression effect occurs when the gap between the gross salary of new hires and long-tenured employees narrows, often causing experienced staff to feel undervalued despite their higher qualifications. This issue impacts net take-home pay perception, as compressed gross salaries reduce the incentive for retention and can distort the true value of income after deductions like taxes and benefits.

Withholding Discrepancy

Withholding discrepancy occurs when the amount of tax withheld from gross salary does not accurately reflect the employee's actual tax liability, leading to differences between expected net take-home pay and the final amount received. This mismatch often results from errors in withholding allowances, incorrect tax bracket application, or changes in income that are not updated in withholding calculations.

Post-Deduction Income

Post-deduction income, or net take-home pay, represents the actual amount an employee receives after mandatory taxes, social security contributions, and other deductions are subtracted from the gross salary. Understanding the distinction between gross salary and net income is essential for accurate financial planning and budgeting.

Dynamic Pay Transparency

Dynamic pay transparency ensures employees understand the distinction between gross salary, which includes total earnings before deductions, and net take-home pay, reflecting actual income after taxes and benefits. This clarity fosters trust and informed financial planning by providing real-time access to detailed compensation breakdowns.

Taxable Fringe Offset

Taxable fringe offset reduces the gross salary by accounting for non-cash benefits that are subject to taxation, effectively lowering the net take-home income. Understanding this offset is crucial for accurate salary calculations and financial planning, as it impacts the taxable income and subsequent tax liabilities.

Invisible Deduction Load

Gross salary represents the total income earned before taxes and mandatory deductions, while net take-home pay reflects the actual amount received after these unseen deductions such as income tax, social security contributions, and healthcare premiums reduce the overall earnings. Understanding the invisible deduction load is crucial for accurately budgeting and financial planning, as these hidden costs can significantly lower the effective income beyond the stated gross amount.

Liquid Compensation Index

Gross salary represents the total earnings before deductions, while net take-home pay reflects the amount received after taxes and contributions, directly impacting the Liquid Compensation Index--an essential metric measuring an employee's real income liquidity. Understanding this index helps businesses and employees evaluate true earning capacity and financial wellness beyond nominal salary figures.

Gross Salary vs Net Take-Home for income. Infographic

hrdif.com

hrdif.com