Salary represents the fixed annual amount an employee earns, while total compensation includes salary plus additional benefits such as bonuses, stock options, health insurance, and retirement contributions. Evaluating total compensation provides a more comprehensive view of an employee's overall financial package and can significantly impact job satisfaction and retention. Beyond base pay, total compensation reflects the true value of employment, influencing long-term financial security and career decisions.

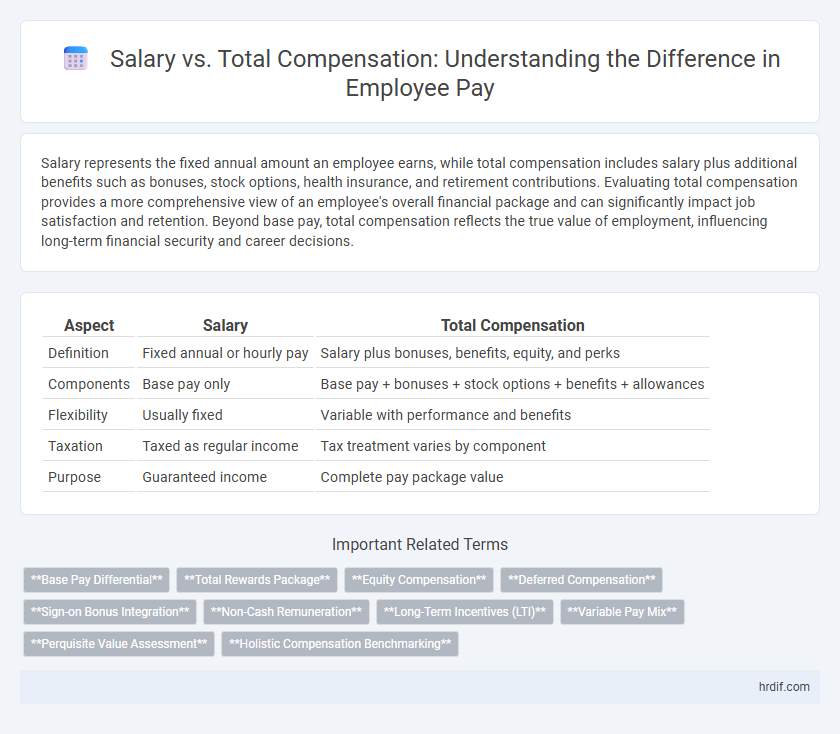

Table of Comparison

| Aspect | Salary | Total Compensation |

|---|---|---|

| Definition | Fixed annual or hourly pay | Salary plus bonuses, benefits, equity, and perks |

| Components | Base pay only | Base pay + bonuses + stock options + benefits + allowances |

| Flexibility | Usually fixed | Variable with performance and benefits |

| Taxation | Taxed as regular income | Tax treatment varies by component |

| Purpose | Guaranteed income | Complete pay package value |

Understanding Salary vs Total Compensation

Understanding salary versus total compensation is crucial for accurate job offer evaluation, as salary refers to the fixed base pay while total compensation includes bonuses, stock options, benefits, and other perks. Total compensation provides a comprehensive view of an employee's financial rewards and better reflects the overall value of a job package. Comparing total compensation across offers ensures informed decisions beyond just the salary figure.

Key Differences Between Salary and Total Compensation

Salary represents the fixed annual amount an employee receives before taxes, typically expressed as a consistent paycheck. Total compensation encompasses salary plus additional financial benefits such as bonuses, stock options, health insurance, retirement contributions, and other perks. Understanding the key differences between salary and total compensation is crucial for assessing an employee's full earning potential and comparing job offers accurately.

Why Total Compensation Matters More Than You Think

Total compensation encompasses base salary, bonuses, stock options, benefits, and other perks, providing a comprehensive view of an employee's true earnings. Evaluating only salary overlooks critical elements like health insurance, retirement contributions, and performance incentives that significantly affect overall financial well-being. Understanding total compensation empowers employees to make informed career decisions and negotiate more effectively for rewards that align with their long-term goals.

Components of Total Compensation Packages

Salary represents the fixed base pay employees receive for their work, excluding additional financial benefits. Total compensation packages encompass salary plus diverse components such as bonuses, stock options, health insurance, retirement contributions, and other perks. Understanding these elements is crucial for accurately evaluating an employee's overall earnings and benefits beyond just the salary figure.

Negotiating Beyond Base Salary

Negotiating beyond base salary involves considering total compensation, which includes bonuses, stock options, benefits, and retirement plans that significantly impact overall earnings. Understanding the full value of total compensation enables employees to leverage elements like signing bonuses, performance incentives, and healthcare coverage during salary discussions. Focusing solely on base salary may overlook opportunities for enhanced financial security and long-term wealth growth through comprehensive package negotiations.

Evaluating Job Offers: Salary or Total Compensation?

Evaluating job offers requires understanding the difference between salary and total compensation, where salary refers to the fixed annual or hourly wage, while total compensation includes bonuses, stock options, benefits, and other perks. Focusing solely on salary overlooks elements such as health insurance, retirement contributions, and performance incentives that significantly impact overall financial value. Considering total compensation provides a comprehensive view of an offer's true worth and helps make informed career decisions.

The Hidden Value in Total Compensation

Total compensation includes base salary, bonuses, stock options, benefits, and retirement contributions, revealing a more comprehensive view of employee earnings. Understanding the hidden value in benefits such as health insurance, paid time off, and professional development opportunities often surpasses the apparent base salary. Evaluating total compensation uncovers long-term financial and personal advantages critical for accurate pay comparisons and career decisions.

Common Misconceptions About Salary and Total Compensation

Many employees mistakenly equate salary with total compensation, overlooking benefits like bonuses, health insurance, retirement contributions, and stock options that significantly enhance overall pay value. Salary represents only the fixed payment, while total compensation encompasses all monetary and non-monetary rewards provided by employers. Recognizing the full scope of total compensation helps in making better-informed career decisions and negotiations.

How Employers Structure Total Compensation

Employers structure total compensation by combining base salary with additional components such as bonuses, benefits, stock options, and retirement plans to create a competitive remuneration package. This holistic approach ensures employees receive both fixed income and variable incentives, reflecting company performance and individual contributions. Understanding total compensation helps employees evaluate the full value beyond the base salary, influencing job satisfaction and retention.

Salary vs Total Compensation: Making an Informed Decision

Salary represents the fixed annual amount paid to an employee, while total compensation includes salary plus bonuses, benefits, stock options, and other perks. Evaluating total compensation provides a comprehensive understanding of the true value of a job offer beyond the base salary alone. This approach enables professionals to make informed career decisions by comparing overall financial and non-financial rewards.

Related Important Terms

Base Pay Differential

Base pay differential significantly impacts overall salary comparisons, as it represents the fixed portion of compensation before bonuses, benefits, or stock options are included. Evaluating total compensation requires factoring in this base pay variance alongside performance incentives to understand true earning potential.

Total Rewards Package

Total compensation surpasses base salary by incorporating elements such as bonuses, stock options, healthcare benefits, retirement plans, and paid time off, collectively forming the Total Rewards Package. This holistic approach ensures employees understand the full value of their employment beyond just the paycheck.

Equity Compensation

Salary represents the fixed cash amount paid regularly, while total compensation includes salary, bonuses, benefits, and equity compensation such as stock options or restricted stock units (RSUs). Equity compensation aligns employee incentives with company performance, offering potential long-term financial gain beyond the base salary by granting ownership stakes.

Deferred Compensation

Deferred compensation is a key component of total compensation that allows employees to earn income now but receive payment at a later date, often for tax advantages and long-term financial planning. Unlike base salary, deferred compensation includes pension plans, stock options, and other benefits that accrue value over time, significantly impacting the overall financial package.

Sign-on Bonus Integration

Sign-on bonus integration significantly enhances total compensation by providing an immediate financial incentive that supplements base salary and other benefits. Employers use sign-on bonuses to attract top talent and bridge gaps in overall pay packages, making total compensation a more competitive figure than salary alone.

Non-Cash Remuneration

Non-cash remuneration, including benefits such as stock options, health insurance, retirement contributions, and performance bonuses, significantly enhances total compensation beyond base salary. These perks often provide substantial financial value, reflecting a comprehensive approach to employee pay and long-term wealth accumulation.

Long-Term Incentives (LTI)

Long-Term Incentives (LTI) significantly enhance total compensation by offering stock options, performance shares, or other equity-based rewards that align employees' interests with company growth and shareholder value. Unlike base salary, LTIs provide potential for substantial financial gain tied to long-term corporate performance, making them a critical component of executive pay and retention strategies.

Variable Pay Mix

Variable pay mix significantly influences total compensation by combining base salary with performance-based incentives such as bonuses, commissions, and profit-sharing. This structure rewards employee productivity and aligns individual goals with company performance, resulting in a more dynamic and motivating pay package.

Perquisite Value Assessment

Perquisite value assessment plays a crucial role in differentiating salary from total compensation by quantifying non-cash benefits such as company cars, housing allowances, and stock options that enhance overall employee remuneration. Accurately evaluating perquisite values ensures a comprehensive understanding of total compensation, enabling better pay comparisons and informed financial planning.

Holistic Compensation Benchmarking

Salary represents the fixed monetary payment employees receive, while total compensation includes base salary plus bonuses, benefits, stock options, and other perks. Holistic compensation benchmarking combines these elements to provide a comprehensive comparison of an organization's pay competitiveness and employee value proposition.

Salary vs Total Compensation for pay. Infographic

hrdif.com

hrdif.com