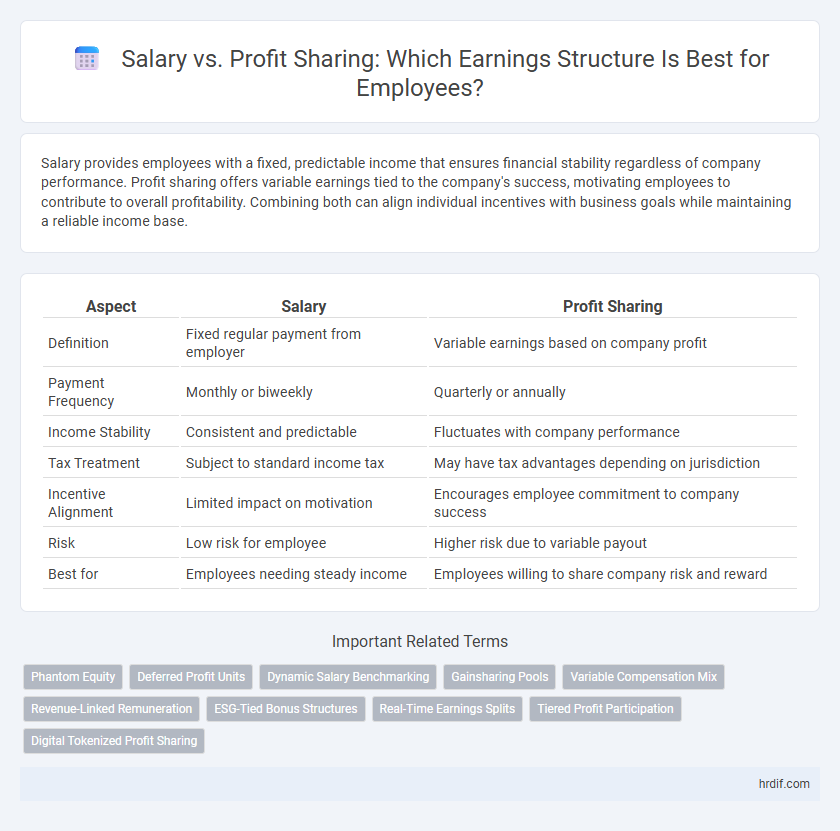

Salary provides employees with a fixed, predictable income that ensures financial stability regardless of company performance. Profit sharing offers variable earnings tied to the company's success, motivating employees to contribute to overall profitability. Combining both can align individual incentives with business goals while maintaining a reliable income base.

Table of Comparison

| Aspect | Salary | Profit Sharing |

|---|---|---|

| Definition | Fixed regular payment from employer | Variable earnings based on company profit |

| Payment Frequency | Monthly or biweekly | Quarterly or annually |

| Income Stability | Consistent and predictable | Fluctuates with company performance |

| Tax Treatment | Subject to standard income tax | May have tax advantages depending on jurisdiction |

| Incentive Alignment | Limited impact on motivation | Encourages employee commitment to company success |

| Risk | Low risk for employee | Higher risk due to variable payout |

| Best for | Employees needing steady income | Employees willing to share company risk and reward |

Understanding Salary and Profit Sharing: Key Differences

Salary provides employees with a fixed, predictable income based on their role and experience, ensuring financial stability regardless of company performance. Profit sharing links employee earnings directly to the company's profitability, incentivizing productivity and aligning interests between staff and management. Understanding these differences helps employees and employers design compensation packages that balance risk, motivation, and security.

Advantages of a Salary-Based Earnings Structure

A salary-based earnings structure offers consistent and predictable income, providing financial stability for employees regardless of company performance fluctuations. It simplifies budgeting and financial planning for both the employee and employer by establishing fixed payment terms. This approach enhances employee retention and satisfaction by reducing income uncertainty and fostering a sense of security.

Benefits of Profit Sharing for Employees

Profit sharing enhances employee motivation by directly linking compensation to company performance, fostering a sense of ownership and commitment. It can lead to higher overall earnings during profitable periods, providing financial rewards beyond a fixed salary. This system encourages teamwork and productivity, aligning employees' goals with organizational success.

Salary Stability vs. Profit Sharing Flexibility

Salary offers consistent and predictable income, ensuring financial stability regardless of company performance, which is crucial for budgeting and long-term planning. Profit sharing provides flexibility by aligning employee earnings with business success, potentially increasing income during profitable periods but introducing variability and uncertainty. The choice between salary stability and profit-sharing flexibility depends on individual risk tolerance and financial priorities.

Motivational Impacts: Salary vs. Profit Sharing

Salary provides consistent financial security that supports employee stability and focus, while profit sharing directly aligns individual motivation with company success by offering variable rewards based on performance outcomes. Profit sharing fosters a sense of ownership and teamwork, encouraging employees to contribute more actively to profitability, which can enhance long-term engagement and productivity. However, combining fixed salary with profit sharing often yields the most balanced motivational impact by ensuring basic financial needs are met while incentivizing exceptional performance.

Tax Implications of Salary and Profit Sharing

Salary income is subject to federal income tax, Social Security, and Medicare taxes, resulting in consistent payroll tax obligations for employees and employers. Profit sharing distributions are typically taxed as ordinary income but may offer tax deferral advantages if contributed to qualified retirement plans, reducing immediate tax liability. Understanding these distinctions allows businesses to optimize compensation structures for tax efficiency, balancing taxable income and potential tax-deferred growth.

Employer Perspectives: Choosing the Right Compensation Model

Employers weigh salary and profit sharing by considering predictability and motivation in compensation models. Salary offers consistent labor cost management and straightforward budgeting, supporting stable financial planning. Profit sharing aligns employee incentives with company performance, fostering collaborative growth but introduces variability in payroll expenses.

Employee Financial Security: Salary Compared to Profit Sharing

Salary provides employees with predictable and stable income, ensuring consistent financial security regardless of company performance. Profit sharing can lead to variable earnings tied directly to the company's profitability, introducing potential fluctuations in an employee's total compensation. A fixed salary mitigates financial risk, supporting long-term planning and stability for employees.

Industry Trends: Salary Dominance or Rise of Profit Sharing?

Industry trends reveal salary continues to dominate earnings structures across sectors, offering predictable income and financial stability for employees. However, profit sharing is gaining traction in startups and tech companies, promoting employee engagement and aligning compensation with company performance. Data shows firms integrating profit sharing report higher retention rates and enhanced motivation, signaling a gradual shift toward hybrid models combining fixed salary with performance-based incentives.

Making the Right Choice: Factors to Consider in Compensation Structure

Evaluating salary versus profit sharing requires analyzing factors such as financial stability, employee motivation, and company growth potential to structure effective compensation. Fixed salaries provide predictable income and financial security, while profit sharing aligns employee incentives with company performance, fostering a sense of ownership and driving productivity. Companies must consider cash flow variability, talent retention goals, and employee risk tolerance to determine the optimal earnings structure that maximizes motivation and organizational success.

Related Important Terms

Phantom Equity

Phantom Equity provides employees with profit-sharing benefits by simulating stock ownership without actual equity dilution, aligning compensation with company performance more effectively than fixed salary alone. This structure enhances motivation and retention by offering potential financial upside linked to company profits while maintaining predictable cash flow for employers.

Deferred Profit Units

Deferred Profit Units offer employees a performance-linked earnings structure that aligns personal incentives with company profitability, fostering long-term commitment and wealth accumulation. Unlike fixed salaries, Deferred Profit Units provide the potential for higher financial rewards contingent on the company's success, promoting shared risk and reward among stakeholders.

Dynamic Salary Benchmarking

Dynamic salary benchmarking leverages real-time market data to adjust fixed salaries competitively while integrating profit-sharing elements that align employee incentives with company performance. This flexible earnings structure enables organizations to attract and retain top talent by balancing guaranteed income with performance-driven rewards, enhancing overall compensation strategy effectiveness.

Gainsharing Pools

Gainsharing pools create a direct link between employee performance and company profitability, offering a variable earnings structure that supplements fixed salary with profit-based incentives. This approach enhances employee motivation and aligns individual goals with organizational financial success, often resulting in higher overall compensation compared to traditional salary-only models.

Variable Compensation Mix

Variable compensation mix often balances fixed salary and profit sharing to align employee incentives with company performance. Profit sharing increases variable pay potential, fostering motivation and reward for achieving financial targets within the earnings structure.

Revenue-Linked Remuneration

Revenue-linked remuneration models integrate both fixed salary and profit sharing to align employee incentives with company performance, enhancing motivation and financial outcomes. This hybrid structure balances predictable income with variable earnings tied directly to revenue growth, optimizing compensation effectiveness.

ESG-Tied Bonus Structures

Salary provides a fixed, predictable income ensuring financial stability, while profit sharing aligns employee rewards with company performance, promoting shared success. ESG-tied bonus structures enhance motivation by linking earnings to environmental, social, and governance goals, driving sustainable business practices and long-term value creation.

Real-Time Earnings Splits

Real-time earnings splits enable employees to instantly receive a portion of company profits alongside their base salary, enhancing transparency and motivation. This dynamic compensation structure aligns individual performance with business success, optimizing financial rewards and employee engagement.

Tiered Profit Participation

Tiered profit participation structures align employee incentives with company performance by distributing a percentage of profits based on predefined tiers, often resulting in higher earnings potential compared to fixed salaries alone. This model enhances motivation and retention by directly linking compensation to business success, surpassing the predictability but limited upside of traditional salary frameworks.

Digital Tokenized Profit Sharing

Digital tokenized profit sharing offers a transparent and flexible alternative to traditional salary models by distributing earnings based on company performance using blockchain technology. This approach aligns employee incentives with business success, enabling participants to earn variable income tied directly to profit generation rather than fixed wages.

Salary vs Profit Sharing for earnings structure. Infographic

hrdif.com

hrdif.com