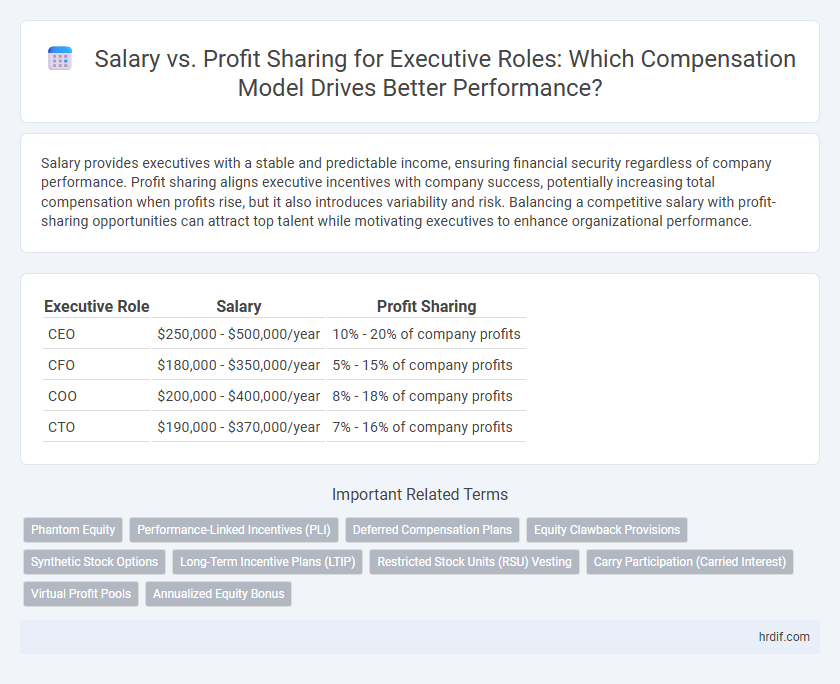

Salary provides executives with a stable and predictable income, ensuring financial security regardless of company performance. Profit sharing aligns executive incentives with company success, potentially increasing total compensation when profits rise, but it also introduces variability and risk. Balancing a competitive salary with profit-sharing opportunities can attract top talent while motivating executives to enhance organizational performance.

Table of Comparison

| Executive Role | Salary | Profit Sharing |

|---|---|---|

| CEO | $250,000 - $500,000/year | 10% - 20% of company profits |

| CFO | $180,000 - $350,000/year | 5% - 15% of company profits |

| COO | $200,000 - $400,000/year | 8% - 18% of company profits |

| CTO | $190,000 - $370,000/year | 7% - 16% of company profits |

Understanding Salary and Profit Sharing in Executive Compensation

Executive compensation often includes a fixed salary and a variable profit-sharing component that aligns leadership incentives with company performance. Salary provides financial stability and reflects the executive's responsibilities, while profit sharing offers potential for increased earnings linked directly to the profitability of the organization. Balancing these elements ensures competitive remuneration and motivates executives to drive long-term shareholder value.

Key Differences Between Salary and Profit Sharing

Salary provides executives with a fixed, predictable income regardless of company performance, ensuring financial stability and regular cash flow. Profit sharing ties compensation to the company's profitability, aligning executives' incentives with business success and potentially yielding higher earnings during profitable periods. The key difference lies in salary offering guaranteed remuneration, while profit sharing introduces variability tied directly to the organization's financial results.

Pros and Cons of Salary-Based Compensation

Salary-based compensation for executive roles offers predictable and stable income, ensuring financial security regardless of company performance. It fosters focus on strategic decision-making without direct pressure from short-term profit fluctuations but may reduce motivation linked to company success. However, it lacks the incentivizing potential of profit sharing, which can align executives' interests more closely with shareholder value creation.

Advantages of Profit Sharing for Executives

Profit sharing aligns executives' interests with company performance, motivating them to drive profitability and long-term growth. It provides potential for higher earnings beyond fixed salaries by rewarding successful business outcomes. This compensation approach enhances retention and attracts top talent by offering financial participation in the company's success.

Impact on Motivation: Salary vs Profit Sharing

Fixed salary provides executives with financial stability, reducing stress and allowing them to focus on long-term strategic goals, while profit sharing aligns their interests with company performance by directly linking rewards to profitability. Profit sharing can significantly boost motivation by creating a sense of ownership and incentivizing executives to drive revenue growth and cost efficiency. However, inconsistent payouts in profit sharing schemes may cause fluctuations in executive motivation compared to the reliability of a steady salary.

Aligning Executive Goals with Organizational Performance

Salary provides executives with a fixed, predictable income that ensures financial stability regardless of company performance. Profit sharing links executive compensation directly to organizational success, motivating leaders to improve profitability and align their decisions with shareholder interests. Combining a competitive salary with profit sharing creates a balanced approach that incentivizes long-term value creation while maintaining executive commitment and retention.

Tax Implications of Salary and Profit Sharing

Salary earned by executives is subject to standard income tax rates and payroll taxes, including Social Security and Medicare, which can reduce net compensation. Profit sharing distributions may benefit from more favorable tax treatment, often taxed as capital gains or deferred income, depending on plan structure and jurisdiction. Executives should carefully evaluate the tax implications of both compensation methods to optimize after-tax earnings and comply with relevant tax regulations.

Retention and Recruitment: Which Model Works Best?

Executive retention and recruitment often benefit more from profit sharing models, as these align leadership incentives with company performance, fostering long-term commitment. Salary offers stability and predictability, appealing to candidates requiring guaranteed compensation, but may lack motivational impact compared to profit-sharing schemes. Companies aiming to attract dynamic executives typically leverage profit sharing to enhance engagement, while balancing fixed salary to ensure financial security.

Industry Trends in Executive Compensation Structures

Executive compensation structures increasingly integrate profit sharing alongside base salary to align leadership incentives with company performance. Industry data reveals a rising adoption of profit-sharing models in sectors like technology and finance, where variable pay accounts for up to 40% of total executive earnings. This trend reflects a strategic shift towards performance-based rewards that drive long-term value creation and executive accountability.

Making the Right Choice: Salary or Profit Sharing for Executives

Choosing between salary and profit sharing for executive roles requires analyzing financial stability and motivation alignment with company goals. Salary offers predictable income and budget control, while profit sharing ties compensation to company performance, fostering ownership and incentivizing growth. Evaluating risk tolerance, cash flow, and long-term retention objectives ensures executives are rewarded optimally to drive business success.

Related Important Terms

Phantom Equity

Phantom equity offers executives a profit-sharing alternative that aligns their incentives with company performance without diluting ownership or requiring immediate cash payouts. Unlike fixed salaries, phantom equity grants typically vest based on company valuation milestones, providing potential for substantial long-term financial rewards tied directly to business success.

Performance-Linked Incentives (PLI)

Performance-Linked Incentives (PLI) in executive roles align compensation with company profitability, providing a dynamic alternative to fixed salary structures. Profit sharing enhances motivation by directly tying executive earnings to measurable financial outcomes, optimizing leadership performance and shareholder value.

Deferred Compensation Plans

Deferred compensation plans provide executives with a strategic vehicle to defer a portion of their salary or bonus, enabling tax efficiency and alignment with long-term company performance. Profit sharing complements this by distributing company earnings based on profitability, enhancing executive incentives tied directly to organizational success.

Equity Clawback Provisions

Salary provides a guaranteed income stream for executives, whereas profit sharing can fluctuate based on company performance, potentially affecting long-term financial stability. Equity clawback provisions impose risks on profit sharing by allowing companies to reclaim awarded shares or bonuses if certain conditions, such as misconduct or financial restatements, are met, thereby influencing executive compensation strategy.

Synthetic Stock Options

Synthetic Stock Options provide executives with performance-based compensation that aligns long-term incentives with company profitability, often resulting in greater earnings potential than fixed salary components. This equity-like reward structure enhances retention and motivation by offering exposure to stock value appreciation without actual equity dilution, contrasting with traditional profit sharing schemes that may offer more variable but less directly tied payouts.

Long-Term Incentive Plans (LTIP)

Long-Term Incentive Plans (LTIP) in executive compensation often balance fixed salary and profit sharing to align leadership goals with company performance over multiple years. LTIPs typically include stock options, restricted shares, or performance units designed to incentivize executives to drive sustained profitability and shareholder value growth.

Restricted Stock Units (RSU) Vesting

Restricted Stock Units (RSUs) vesting schedules directly impact executive compensation by aligning salary with long-term company performance through profit sharing mechanisms. Executives often receive a base salary complemented by RSU grants that vest over multiple years, incentivizing sustained value creation and enhancing retention.

Carry Participation (Carried Interest)

Executive compensation often balances salary with profit sharing through carried interest participation, aligning leadership incentives with company performance and long-term value creation. Carried interest allows executives to earn a percentage of investment profits, typically 20% in private equity, providing substantial upside beyond fixed salaries and driving strategic decision-making.

Virtual Profit Pools

Virtual Profit Pools enable executives to align compensation with company performance by granting profit-sharing benefits without immediate cash outflow, optimizing cash flow management while incentivizing leadership. Salary structures combined with Virtual Profit Pools create a balanced remuneration strategy, ensuring stable income alongside potential variable rewards tied to organizational profitability.

Annualized Equity Bonus

Annualized equity bonuses in executive roles provide a performance-driven alternative to fixed salary, aligning leadership incentives with long-term company profitability and shareholder value. Unlike traditional salary, profit sharing through equity grants offers potential upside tied directly to the company's market performance and sustained growth.

Salary vs Profit Sharing for executive roles Infographic

hrdif.com

hrdif.com