Gross salary provides a transparent and regulated income amount before taxes and deductions, ensuring clarity in financial planning and legal compliance. Crypto wage offers faster transactions and lower fees, appealing to those valuing decentralization and borderless payments. Choosing between traditional gross salary and crypto wage depends on preferences for stability versus innovation in compensation methods.

Table of Comparison

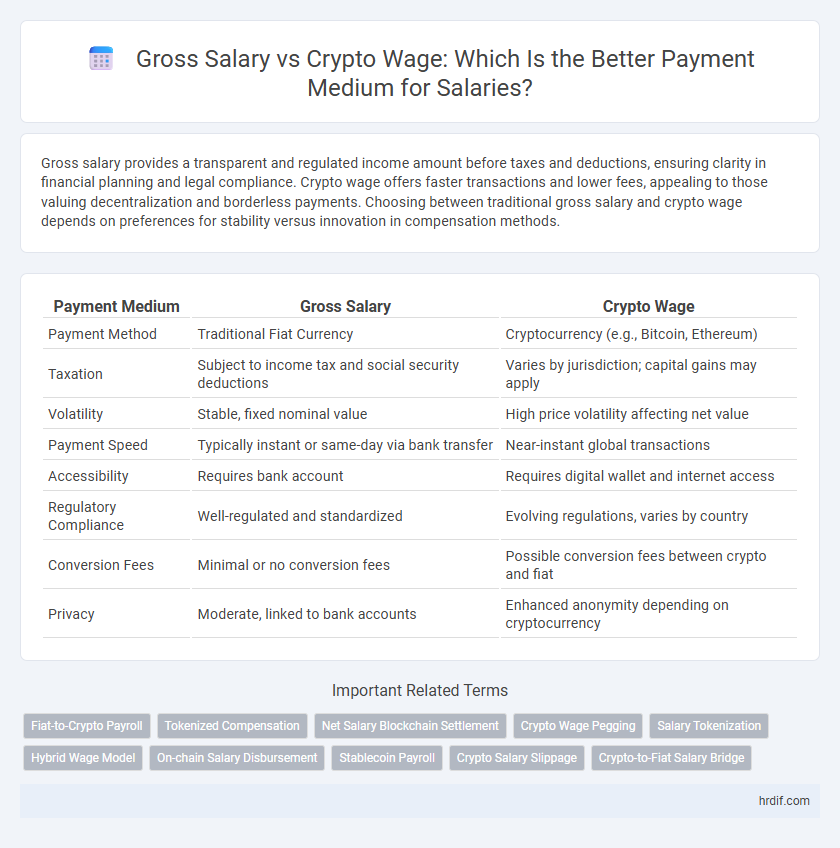

| Payment Medium | Gross Salary | Crypto Wage |

|---|---|---|

| Payment Method | Traditional Fiat Currency | Cryptocurrency (e.g., Bitcoin, Ethereum) |

| Taxation | Subject to income tax and social security deductions | Varies by jurisdiction; capital gains may apply |

| Volatility | Stable, fixed nominal value | High price volatility affecting net value |

| Payment Speed | Typically instant or same-day via bank transfer | Near-instant global transactions |

| Accessibility | Requires bank account | Requires digital wallet and internet access |

| Regulatory Compliance | Well-regulated and standardized | Evolving regulations, varies by country |

| Conversion Fees | Minimal or no conversion fees | Possible conversion fees between crypto and fiat |

| Privacy | Moderate, linked to bank accounts | Enhanced anonymity depending on cryptocurrency |

Understanding Gross Salary vs Crypto Wage

Gross salary represents the total earnings before taxes and deductions, providing a clear measurement of an employee's income in traditional currency. Crypto wage refers to payment made in cryptocurrencies like Bitcoin or Ethereum, introducing volatility and regulatory considerations absent in conventional salaries. Understanding the differences helps employees evaluate stability, tax implications, and potential growth opportunities tied to digital assets compared to fixed fiat compensation.

Key Differences between Traditional Salary and Crypto Payments

Gross salary is a fixed monetary amount paid by employers, subject to taxes and regulations, providing predictable income and financial security. In contrast, crypto wages are digital asset payments that offer faster transactions and borderless transfers but face volatility and regulatory uncertainty. Traditional salary payments rely on established banking systems, while crypto wages utilize blockchain technology, affecting transparency and payroll processing methods.

Pros and Cons of Receiving Crypto Wages

Receiving crypto wages offers increased transaction speed and reduced cross-border fees compared to traditional gross salary payments, enhancing liquidity and financial control for remote workers. However, the volatility of cryptocurrencies can lead to unpredictable income values, posing risks in financial planning and tax reporting complexities. Employers must also consider regulatory uncertainties and the integration of crypto payroll systems into existing financial infrastructures.

Legal and Tax Implications of Crypto Salaries

Gross salary represents the total income before deductions, typically paid in fiat currency, whereas crypto wage involves payment using cryptocurrencies like Bitcoin or Ethereum. Legal frameworks differ by jurisdiction, with many countries lacking clear regulations on crypto salaries, potentially complicating tax reporting and compliance. Employees receiving crypto wages must navigate tax liabilities such as income tax, capital gains, and anti-money laundering regulations, requiring careful documentation and adherence to evolving legal standards.

Volatility Risks: Crypto Wage Stability Compared to Gross Salary

Gross salary provides consistent and predictable income, insulated from market fluctuations, ensuring financial stability for budgeting and expenses. Crypto wages expose employees to volatility risks, as cryptocurrency values can dramatically fluctuate within short periods, impacting actual earnings. This instability complicates financial planning and may require frequent conversions to stable currencies to mitigate potential losses.

Security and Privacy in Crypto Wage Payments

Cryptocurrency wage payments enhance security by leveraging blockchain's decentralized ledger, reducing risks of fraud and unauthorized access common in traditional gross salary transactions. Crypto payments ensure greater privacy through pseudonymous digital wallets, protecting employee identity and financial details from exposure. This secure and private transaction method offers a modern alternative to conventional payroll systems reliant on centralized banking infrastructure.

Employer Considerations for Crypto-Based Payroll

Employers considering crypto-based payroll must evaluate the volatility of cryptocurrency prices, which can impact the actual value of gross salary disbursed to employees. Compliance with tax regulations and reporting requirements presents a critical challenge, as the legal landscape for crypto wages varies across jurisdictions. Integrating blockchain payment systems demands investment in secure technology and employee education to ensure smooth and transparent salary transactions.

Employee Perspectives: Gross Salary or Crypto Wage?

Employees evaluating gross salary versus crypto wage consider stability and regulatory clarity as key factors, with gross salary offering predictable income and legal protections. Crypto wages provide potential for high returns and borderless transactions but carry volatility risks and uncertain tax implications. Preference depends on individual risk tolerance, financial goals, and trust in emerging digital payment ecosystems.

Future Trends: The Evolution of Crypto Wages in the Job Market

The rising adoption of blockchain technology is driving a shift toward crypto wages as an alternative to traditional gross salary payments. Companies leveraging digital currencies offer faster, borderless transactions and increased transparency, appealing particularly to remote and international workers. Future trends indicate expanding acceptance of crypto wages, with regulatory frameworks evolving to support seamless integration into mainstream payroll systems.

Making the Choice: Which Payment Medium Suits You?

Gross salary provides a clear, fixed income with transparent tax deductions and benefits, ideal for employees seeking financial stability and traditional banking convenience. Crypto wages offer flexibility, faster cross-border transactions, and potential value appreciation but come with volatility risks and regulatory uncertainties. Evaluating personal risk tolerance, liquidity needs, and tax implications helps determine the most suitable payment medium for your financial goals.

Related Important Terms

Fiat-to-Crypto Payroll

Fiat-to-crypto payroll enables seamless conversion of gross salary from traditional currency into cryptocurrencies, offering employees flexible payment options while maintaining compliance with tax regulations. This payment medium enhances payroll efficiency by reducing transaction costs and providing fast, transparent salary disbursements on blockchain networks.

Tokenized Compensation

Tokenized compensation, delivered as crypto wages, offers increased transparency and instant transactions compared to traditional gross salary payments, reducing intermediaries and transaction fees. Employers and employees benefit from blockchain's immutable records and global accessibility, enhancing payroll efficiency and financial inclusivity.

Net Salary Blockchain Settlement

Net salary received through blockchain settlement provides transparent, instantaneous payments with reduced transaction fees compared to traditional gross salary disbursements. This crypto wage mechanism enhances financial privacy and eliminates delays from intermediaries, ensuring employees access their earned income faster and with greater security.

Crypto Wage Pegging

Crypto wage pegging offers a stable alternative to gross salary by linking digital payments to real-world currency values, mitigating cryptocurrency volatility risks. This method ensures consistent purchasing power, making crypto wages a reliable medium for employee compensation in fluctuating markets.

Salary Tokenization

Salary tokenization transforms gross salary into digital assets, enabling secure, instant payments through cryptocurrency while reducing traditional banking fees and enhancing transparency. This approach leverages blockchain technology to convert fixed salaries into tokenized wages, offering flexibility and global accessibility for employees.

Hybrid Wage Model

The hybrid wage model combines traditional gross salary with cryptocurrency payments, offering flexibility and diversification in employee compensation. This approach leverages the stability of fiat income alongside the potential growth and innovation benefits of crypto assets, optimizing overall remuneration strategies.

On-chain Salary Disbursement

On-chain salary disbursement enables transparent and instantaneous gross salary payments via blockchain, reducing intermediaries and transaction fees compared to traditional fiat methods. This method ensures secure, immutable records of wage distribution, facilitating seamless cross-border salary access and enhanced financial privacy for employees receiving crypto wages.

Stablecoin Payroll

Employers opting for stablecoin payroll can offer gross salary payments with faster settlement times and reduced transaction fees compared to traditional fiat systems. Stablecoins provide a transparent, borderless medium that maintains consistent value, minimizing volatility risk while ensuring employees receive reliable compensation.

Crypto Salary Slippage

Crypto salary slippage refers to the difference between the expected gross salary and the actual amount received when paid in cryptocurrency, caused by market volatility and transaction fees. Unlike fixed gross salary payments, crypto wages can fluctuate significantly in value upon conversion, impacting the effective income received by employees.

Crypto-to-Fiat Salary Bridge

The crypto-to-fiat salary bridge facilitates seamless conversion between gross salary payments denominated in cryptocurrencies and traditional fiat currencies, enabling employees to benefit from blockchain's transparency while maintaining stable spending power. This hybrid payment medium reduces currency volatility risks and enhances liquidity, offering flexible compensation tailored to modern, globalized workforces.

Gross Salary vs Crypto Wage for payment medium. Infographic

hrdif.com

hrdif.com