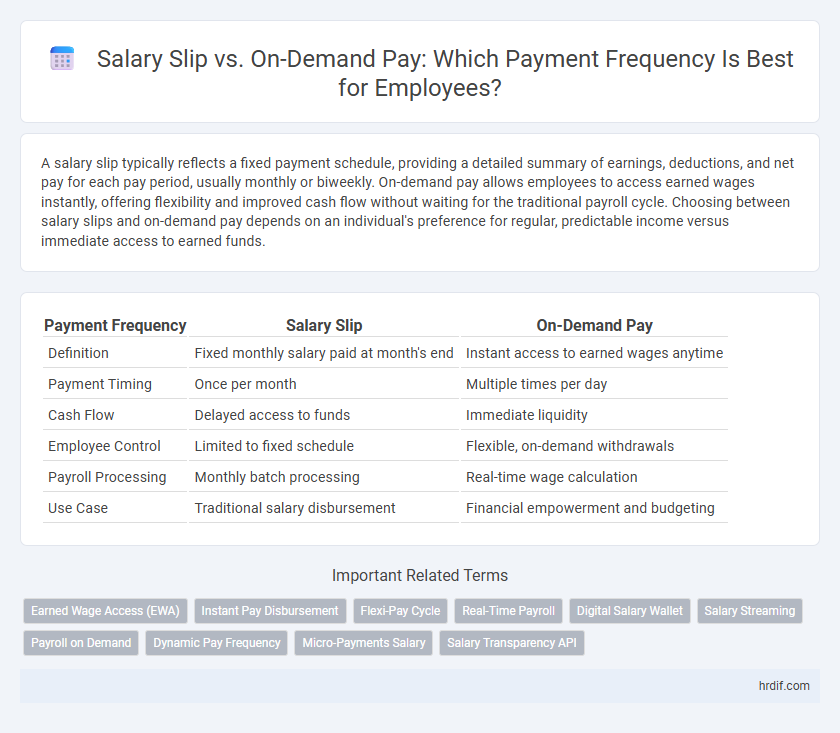

A salary slip typically reflects a fixed payment schedule, providing a detailed summary of earnings, deductions, and net pay for each pay period, usually monthly or biweekly. On-demand pay allows employees to access earned wages instantly, offering flexibility and improved cash flow without waiting for the traditional payroll cycle. Choosing between salary slips and on-demand pay depends on an individual's preference for regular, predictable income versus immediate access to earned funds.

Table of Comparison

| Payment Frequency | Salary Slip | On-Demand Pay |

|---|---|---|

| Definition | Fixed monthly salary paid at month's end | Instant access to earned wages anytime |

| Payment Timing | Once per month | Multiple times per day |

| Cash Flow | Delayed access to funds | Immediate liquidity |

| Employee Control | Limited to fixed schedule | Flexible, on-demand withdrawals |

| Payroll Processing | Monthly batch processing | Real-time wage calculation |

| Use Case | Traditional salary disbursement | Financial empowerment and budgeting |

Understanding Salary Slip: Traditional Payment Frequency

A salary slip provides a detailed record of monthly earnings, deductions, and tax withholdings, reflecting the traditional payment frequency where employees receive wages on a fixed date each month. This predictable schedule ensures consistent cash flow management and aligns with statutory requirements for payroll processing. Understanding salary slips helps employees verify accuracy in their compensation and benefits, reinforcing transparency in the employer-employee financial relationship.

What Is On-Demand Pay? A Modern Payment Approach

On-demand pay allows employees to access earned wages instantly, eliminating the traditional wait for a salary slip or fixed pay schedule. This flexible payment method enhances financial wellbeing by providing real-time access to earnings, reducing the need for payday loans or credit. By integrating on-demand pay systems, companies improve employee satisfaction and adapt to modern workforce expectations.

Key Differences Between Salary Slip and On-Demand Pay

Salary slips provide a detailed, monthly breakdown of earnings, deductions, and taxes, ensuring transparency and compliance with labor laws, while on-demand pay offers employees flexible access to earned wages before the regular payday, enhancing cash flow management. Unlike salary slips, which are standardized documents issued monthly, on-demand pay transactions occur as needed, allowing for immediate financial flexibility without altering the formal payroll cycle. Employers benefit from on-demand pay by boosting employee satisfaction and retention, whereas salary slips serve as official records for income verification and tax filings.

Benefits of Fixed Salary Slip Payment Schedules

Fixed salary slip payment schedules provide employees with predictable and consistent income, enabling better financial planning and budgeting. Regular pay cycles simplify tax calculations and compliance for employers, ensuring accurate and timely salary documentation. This structured approach enhances employee trust and stability by eliminating uncertainties associated with variable payment timing.

Advantages of On-Demand Pay for Employees

On-demand pay offers employees immediate access to earned wages, improving financial flexibility and reducing reliance on high-interest loans. Unlike traditional salary slips issued monthly, on-demand pay supports timely expense management and helps alleviate cash flow challenges. This payment frequency enhances employee satisfaction and reduces financial stress by aligning pay with actual work hours.

Impact on Financial Planning: Salary Slip vs On-Demand Pay

Salary slips provide a fixed, predictable payment schedule that facilitates long-term financial planning and budgeting by allowing employees to anticipate their income clearly each month. On-demand pay offers greater flexibility by enabling access to earned wages before the traditional payday, which can help manage unexpected expenses but may complicate consistent budgeting. The choice between these payment frequencies significantly impacts financial stability, with salary slips promoting structured savings and on-demand pay providing agility for immediate cash flow needs.

Employer Perspectives: Payroll Management Challenges

Salary slips provide a structured record of wages, making payroll management more straightforward for employers by ensuring compliance and easing audit processes. On-demand pay introduces complexities in tracking and reconciling frequent, smaller payments, increasing administrative workload. Employers face challenges integrating on-demand pay into existing payroll systems while maintaining accurate tax withholding and benefits calculations.

Employee Satisfaction: Payment Frequency Preferences

Employees often prefer on-demand pay over traditional salary slips due to immediate access to earned wages, enhancing financial flexibility and reducing stress. Frequent payment options correlate with higher employee satisfaction, as workers can better manage cash flow and unforeseen expenses. Salary slips issued monthly may not meet the evolving preferences for timely compensation, impacting overall morale and retention.

Compliance and Legal Considerations for Payment Methods

Salary slips provide a comprehensive legal record of fixed payment schedules, ensuring compliance with labor laws and tax regulations. On-demand pay, while offering flexibility, requires robust verification processes to maintain compliance with wage and hour laws and avoid predatory lending concerns. Employers must balance legal obligations and employee rights when choosing between salary slips and on-demand pay to ensure accurate reporting and regulatory adherence.

Future Trends: Is On-Demand Pay Replacing Salary Slips?

On-demand pay is gaining traction as a flexible alternative to traditional salary slips, allowing employees to access earned wages instantly rather than waiting for monthly payroll cycles. Emerging financial technology platforms and mobile payment apps facilitate this shift, boosting employee satisfaction and financial wellness by reducing payday-related stress. Despite this growth, salary slips remain essential for official documentation, tax compliance, and transparent record-keeping, indicating that on-demand pay is complementing rather than fully replacing traditional salary disbursement methods.

Related Important Terms

Earned Wage Access (EWA)

Salary slips provide a detailed monthly breakdown of earnings and deductions, while On-Demand Pay, facilitated by Earned Wage Access (EWA), allows employees to access a portion of their earned wages before the traditional payday, enhancing financial flexibility. EWA platforms reduce reliance on payday loans by offering instant access to earned income, improving cash flow management and employee satisfaction.

Instant Pay Disbursement

Salary slips provide detailed monthly payment records, while on-demand pay enables instant pay disbursement, allowing employees to access earned wages immediately rather than waiting for the scheduled payroll date. Instant pay disbursement enhances cash flow flexibility and reduces financial stress by offering real-time access to earned income.

Flexi-Pay Cycle

Salary slips provide detailed monthly payment records aligned with traditional pay schedules, while On-Demand Pay offers employees flexible access to earned wages anytime, supporting a flexi-pay cycle that enhances cash flow management and reduces financial stress. This modern approach to payment frequency allows workers to withdraw portions of their salary as needed, promoting financial wellness compared to the fixed monthly payouts documented in standard salary slips.

Real-Time Payroll

Salary slips provide a detailed monthly breakdown of earnings and deductions, while on-demand pay offers employees instant access to earned wages before the official payday, enhancing financial flexibility. Real-time payroll systems integrate these methods by enabling continuous salary tracking and immediate payments, ensuring accuracy and timely fund disbursement.

Digital Salary Wallet

Digital Salary Wallets provide instant access to earned wages unlike traditional salary slips that only detail monthly earnings, enabling employees to receive on-demand pay anytime. This shift enhances financial flexibility by allowing workers to manage funds digitally and reduce reliance on fixed payment schedules.

Salary Streaming

Salary streaming offers employees the flexibility to access earned wages instantly instead of waiting for the traditional salary slip cycle that typically pays on a biweekly or monthly schedule. This on-demand pay model improves cash flow management, reduces financial stress, and enhances overall employee satisfaction by providing real-time access to earned income.

Payroll on Demand

Salary slips provide detailed monthly breakdowns of earnings and deductions, while Payroll on Demand offers instant access to earned wages anytime, enhancing cash flow flexibility for employees. On-demand pay solutions reduce paycheck waiting periods and improve financial well-being compared to traditional salary slip-based payment frequencies.

Dynamic Pay Frequency

Dynamic pay frequency enables employees to access their earned wages anytime, contrasting traditional salary slips that restrict payments to fixed intervals, enhancing financial flexibility and cash flow management. This approach reduces reliance on monthly payroll cycles by allowing on-demand pay disbursements aligned with real-time earnings data.

Micro-Payments Salary

Micro-payments salary systems enable workers to access earned wages instantly through on-demand pay platforms, bypassing traditional salary slip cycles that typically require waiting until the end of a pay period. This shift in payment frequency enhances financial flexibility for employees, reducing reliance on fixed pay dates and allowing for better cash flow management.

Salary Transparency API

Salary Slip provides a detailed breakdown of earnings, deductions, and benefits per pay period, while On-Demand Pay enables employees to access earned wages before the standard payday. Integrating a Salary Transparency API enhances payment frequency options by offering real-time visibility into earnings, promoting financial wellness and empowering employees with instant access to accurate salary data.

Salary Slip vs On-Demand Pay for payment frequency. Infographic

hrdif.com

hrdif.com