Remote work stipends are designed to cover expenses like home office setup, internet, and utilities, providing targeted financial support beyond a base salary. While a higher salary offers overall compensation flexibility, stipends specifically enhance the remote work experience without impacting taxable income. Comparing salary versus remote work stipends helps employees evaluate total benefits and employers attract talent by addressing distinct financial needs.

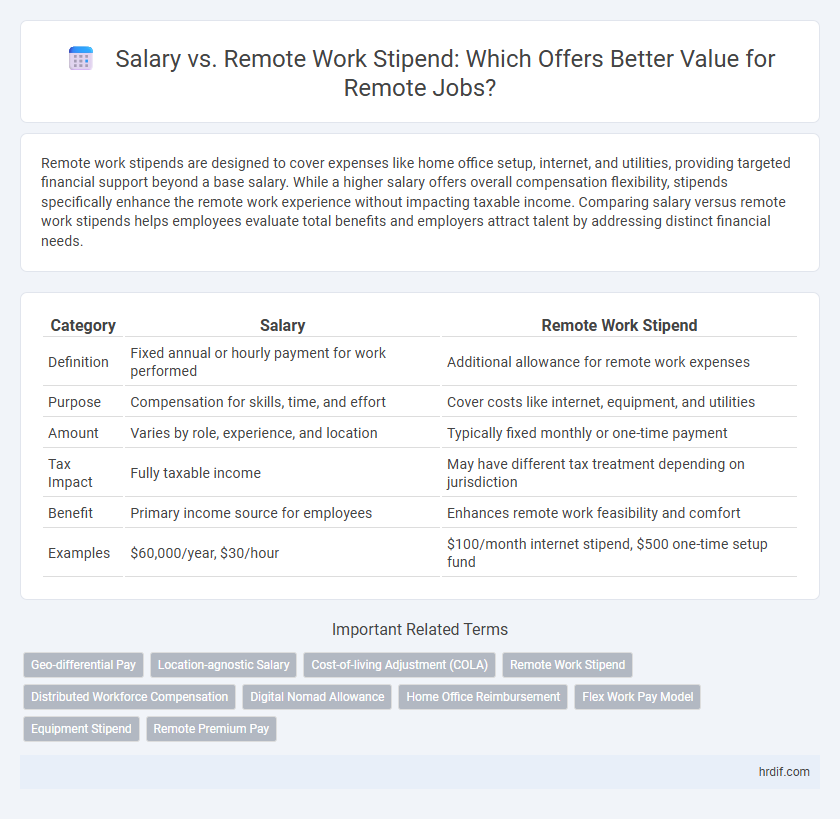

Table of Comparison

| Category | Salary | Remote Work Stipend |

|---|---|---|

| Definition | Fixed annual or hourly payment for work performed | Additional allowance for remote work expenses |

| Purpose | Compensation for skills, time, and effort | Cover costs like internet, equipment, and utilities |

| Amount | Varies by role, experience, and location | Typically fixed monthly or one-time payment |

| Tax Impact | Fully taxable income | May have different tax treatment depending on jurisdiction |

| Benefit | Primary income source for employees | Enhances remote work feasibility and comfort |

| Examples | $60,000/year, $30/hour | $100/month internet stipend, $500 one-time setup fund |

Understanding Salary and Remote Work Stipend Differences

Salary represents the fixed annual compensation an employee receives, while a remote work stipend is an additional allowance intended to cover home office expenses such as internet, utilities, and equipment. Unlike salary, which impacts tax and benefits, remote work stipends are often non-taxable reimbursements designed to offset work-from-home costs. Differentiating these components helps remote employees evaluate total compensation and negotiate benefits effectively.

Evaluating Total Compensation: Salary vs Stipend

Evaluating total compensation for remote jobs requires comparing base salary with remote work stipends that cover expenses like internet and home office setup. While salary provides predictable income, stipends offset remote-specific costs, effectively increasing net earnings. Understanding the balance between salary and stipends helps optimize overall financial benefit and job satisfaction.

How Remote Work Stipends Impact Take-Home Pay

Remote work stipends directly increase take-home pay by covering expenses such as home office setup, utilities, and internet costs, effectively supplementing the base salary without increasing taxable income. These stipends can reduce out-of-pocket expenses associated with remote work, enhancing overall employee compensation and financial well-being. Companies offering competitive remote work stipends often see improved employee retention and job satisfaction, making them a critical component in total compensation packages for remote jobs.

Tax Implications of Salary and Stipends in Remote Jobs

Salary and remote work stipends are subject to different tax implications that significantly affect employees in remote jobs. While salaries are generally taxed as regular income according to federal and state tax laws, remote work stipends may be considered taxable income unless specifically excluded by the IRS as reimbursements for business expenses. Understanding local tax regulations and consulting a tax professional is crucial for correctly reporting income and maximizing tax benefits associated with both salary and remote work stipends.

Negotiating Salary and Remote Work Stipend Packages

Negotiating salary and remote work stipend packages requires assessing the total compensation value, including base pay and allowances for home office setup, internet, and utilities. Research industry standards for both salary and remote work stipends to create a data-driven proposal that highlights the productivity and cost savings remote work offers. Emphasizing flexibility in combining salary with stipends can help secure a balanced package that meets financial needs and supports a productive remote work environment.

Cost of Living Adjustments: Salary or Stipend?

Cost of living adjustments (COLA) typically favor salary increases over remote work stipends, as salaries provide more comprehensive financial flexibility to accommodate varying expenses across regions. Remote work stipends are often fixed and may not adequately reflect fluctuating local costs such as housing, utilities, and taxes. Employers aiming to equitably support remote employees in diverse locations generally prefer adjusting base salaries to ensure consistent purchasing power and long-term financial stability.

Employer Perspectives: Why Offer Stipends Over Salary?

Employers often offer remote work stipends instead of increasing salaries to manage budget flexibility and directly cover specific remote-related expenses like internet, equipment, or utilities. Stipends provide a transparent, tax-efficient method for supporting remote employees without committing to permanent salary hikes, helping companies control labor costs while enhancing employee satisfaction. This approach allows organizations to adapt quickly to changing remote work needs and maintain competitive compensation packages without inflating overall payroll expenses.

Employee Satisfaction: Salary Versus Remote Stipends

Employees often prioritize competitive salaries over remote work stipends when evaluating job satisfaction, as base pay directly impacts financial stability and career growth. Remote work stipends provide valuable support for home office expenses but are generally seen as supplementary benefits rather than primary compensation drivers. Companies balancing attractive salaries with reasonable stipends tend to achieve higher employee satisfaction and retention in remote job markets.

Industry Trends: Remote Job Compensation Structures

Remote job compensation structures increasingly differentiate between base salary and remote work stipends, with 65% of companies offering stipends to cover home office expenses such as internet, equipment, and utilities. Industry trends reveal technology and finance sectors lead in providing remote stipends averaging $500 to $1,000 annually, enhancing overall employee satisfaction and retention. Salary packages now often incorporate these stipends as integral components to balance cost-of-living variations and support remote workforce productivity.

Maximizing Benefits: Combining Salary and Remote Work Stipends

Maximizing benefits in remote jobs involves strategically combining a competitive salary with a remote work stipend to cover home office expenses, technology upgrades, and coworking space fees. Employers offering both salary and stipends enhance employee satisfaction and productivity by addressing financial needs related to remote work. This dual approach helps professionals optimize their total compensation package while minimizing out-of-pocket costs associated with working remotely.

Related Important Terms

Geo-differential Pay

Geo-differential pay adjusts salaries based on an employee's location, balancing cost of living variations to maintain equitable compensation. Remote work stipends provide fixed allowances for home office expenses but do not replace the broader salary adjustments required for geographic pay disparities.

Location-agnostic Salary

Location-agnostic salary structures offer consistent compensation regardless of the employee's geographic location, eliminating variations typically influenced by local cost of living. Remote work stipends serve as supplementary benefits to offset home office expenses, but they do not replace the need for equitable, standardized salary models that attract top talent globally.

Cost-of-living Adjustment (COLA)

Remote work stipends often complement base salaries by covering home office expenses and internet costs, but Cost-of-Living Adjustments (COLA) directly impact the overall compensation by aligning pay with geographic living expenses. Employers increasingly incorporate COLA to ensure equitable salaries across remote locations, making it a critical factor in total remuneration beyond standard remote work stipends.

Remote Work Stipend

Remote work stipends provide employees with designated funds to cover home office expenses such as internet, utilities, and equipment, often supplementing rather than replacing salary. These stipends enhance job satisfaction and productivity by offsetting the costs associated with remote work environments.

Distributed Workforce Compensation

Remote work stipends supplement salaries by covering home office expenses such as internet, equipment, and utilities, enhancing total compensation in distributed workforce models. Employers balancing salary structures with remote stipends ensure fair and competitive pay while addressing the unique costs of remote work environments.

Digital Nomad Allowance

Digital nomad allowances often supplement base salary by covering remote work expenses such as coworking spaces, high-speed internet, and travel costs, enhancing overall compensation for remote employees. Companies offering these stipends recognize the need to support digital nomads in maintaining productivity and comfort while working from diverse locations worldwide.

Home Office Reimbursement

Home office reimbursement increasingly offsets the lack of salary increases in remote jobs by covering expenses for equipment, internet, and utilities, enhancing employee satisfaction and productivity. Employers providing transparent remote work stipends directly support efficient home office setups, reducing financial strain and promoting a balanced work environment.

Flex Work Pay Model

The Flex Work Pay Model balances salary and remote work stipends by integrating a base salary with variable allowances to cover home office expenses, promoting fair compensation tailored to remote employees' needs. This approach enhances employee satisfaction and productivity by recognizing the distinct costs associated with remote work compared to traditional in-office roles.

Equipment Stipend

An equipment stipend for remote jobs often supplements the base salary by covering the costs of essential tools like laptops, monitors, and ergonomic office furniture, helping employees maintain productivity from home. Unlike general salary increases, this targeted financial support ensures workers have the proper technology and workspace setup without directly impacting their taxable income.

Remote Premium Pay

Remote premium pay often exceeds standard remote work stipends by directly increasing base salary to compensate for the flexibility and reduced commuting costs associated with remote jobs. Companies offering remote premium pay attract top talent by integrating this allowance into overall compensation, enhancing employee satisfaction and retention compared to separate, limited stipends.

Salary vs Remote Work Stipend for remote jobs Infographic

hrdif.com

hrdif.com