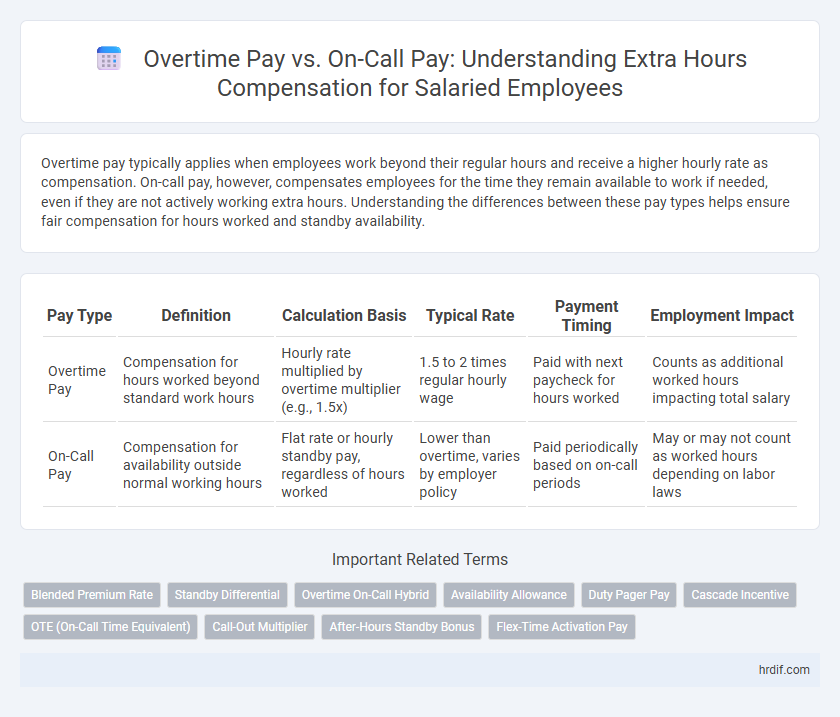

Overtime pay typically applies when employees work beyond their regular hours and receive a higher hourly rate as compensation. On-call pay, however, compensates employees for the time they remain available to work if needed, even if they are not actively working extra hours. Understanding the differences between these pay types helps ensure fair compensation for hours worked and standby availability.

Table of Comparison

| Pay Type | Definition | Calculation Basis | Typical Rate | Payment Timing | Employment Impact |

|---|---|---|---|---|---|

| Overtime Pay | Compensation for hours worked beyond standard work hours | Hourly rate multiplied by overtime multiplier (e.g., 1.5x) | 1.5 to 2 times regular hourly wage | Paid with next paycheck for hours worked | Counts as additional worked hours impacting total salary |

| On-Call Pay | Compensation for availability outside normal working hours | Flat rate or hourly standby pay, regardless of hours worked | Lower than overtime, varies by employer policy | Paid periodically based on on-call periods | May or may not count as worked hours depending on labor laws |

Understanding Overtime Pay: Key Definitions

Overtime pay refers to the additional compensation employees receive for hours worked beyond their standard work schedule, typically calculated at 1.5 times the regular hourly rate as mandated by labor laws such as the Fair Labor Standards Act (FLSA). Understanding key definitions includes recognizing exempt versus non-exempt employees, where only non-exempt workers are eligible for overtime pay, and knowing that on-call pay differs by compensating employees for being available to work, not necessarily for hours actively worked. Accurate classification and adherence to legal standards ensure proper calculation and fair distribution of both overtime and on-call payments.

What is On-Call Pay? An Overview

On-call pay compensates employees for being available to work outside regular hours, even if they're not actively performing tasks. Unlike overtime pay, which applies only when employees exceed standard working hours, on-call pay acknowledges the time commitment and potential disruption associated with readiness to respond. Employers typically offer a fixed amount or hourly rate for on-call periods, reflecting the value of employee availability rather than actual work performed.

Legal Rights: Overtime and On-Call Regulations

Overtime pay is legally mandated for hours worked beyond standard workweek thresholds, typically 40 hours, ensuring employees receive premium compensation for extra labor. On-call pay regulations vary by jurisdiction, often requiring payment if the employee's availability restricts their ability to use time freely, even without active work. Employers must comply with both overtime laws and on-call policies to avoid legal penalties and protect workers' rights.

Calculating Overtime Pay: Methods and Examples

Calculating overtime pay typically involves multiplying the employee's regular hourly rate by 1.5 for hours worked beyond the standard 40-hour workweek, known as time-and-a-half. For salaried employees, dividing the annual salary by 2,080 hours can determine an equivalent hourly rate for overtime calculations. Examples include an employee earning $20 per hour receiving $30 for each overtime hour, while a salaried worker with a $52,000 annual salary would get approximately $25 per overtime hour.

How On-Call Pay Works: Rates and Rules

On-call pay compensates employees for being available to work outside regular hours, typically at a lower rate than overtime pay but sometimes at a flat standby fee. Rates for on-call pay vary by industry and company policy, often calculated as a percentage of the regular hourly wage or a fixed amount per hour of standby time. Labor laws frequently mandate specific rules regarding on-call pay, such as requiring payment if the employee is called to work or limiting the maximum hours an employee can be on call.

Overtime Pay vs On-Call Pay: Core Differences

Overtime pay compensates employees for hours worked beyond their regular schedule, typically at a higher rate such as time-and-a-half or double time, ensuring fair remuneration for extended work hours. On-call pay provides compensation for employees who remain available to work outside scheduled hours but are not actively working, often paid as a fixed hourly rate or a percentage of their regular wage. The core difference lies in overtime pay covering actively worked extra hours, while on-call pay covers availability without guaranteed work.

Pros and Cons of Overtime Compensation

Overtime pay provides employees with higher wages for hours worked beyond the standard schedule, incentivizing productivity and compensating increased effort, but it can lead to higher labor costs for employers and potential employee burnout. On-call pay offers compensation for availability without guaranteed work, which helps balance employer needs and employee flexibility, yet might result in lower overall earnings compared to actual overtime hours worked. Choosing between overtime pay and on-call pay depends on workforce demands, cost management strategies, and employee preferences for predictable income versus flexibility.

Pros and Cons of On-Call Compensation

On-call pay provides financial compensation for employees who must remain available outside regular working hours, ensuring readiness without active work but often at a lower rate than overtime pay. It offers flexibility for employers and security for workers but can lead to unpredictable income and potential work-life imbalance due to restricted personal time. Unlike overtime pay, which remunerates actual extra hours worked at a premium rate, on-call pay may not fully reflect effort, creating possible dissatisfaction among employees.

Best Practices: Negotiating Your Extra Hours

When negotiating extra hours, clearly distinguish between overtime pay, typically calculated at 1.5 times the regular rate, and on-call pay, which compensates availability rather than active work. Emphasize establishing specific terms in your contract regarding eligibility, rates, and maximum overtime hours to avoid ambiguities. Prioritize transparent communication and documentation to ensure fair compensation aligned with labor laws and company policies.

Choosing the Right Extra Pay: What Employees Should Know

Employees must understand the distinctions between overtime pay and on-call pay to accurately assess their compensation for extra hours worked. Overtime pay typically applies when hours exceed regular work limits, calculated at a higher rate, while on-call pay compensates availability without necessarily requiring active work. Choosing the right extra pay depends on job duties, company policies, and labor laws governing eligibility and calculation methods for each pay type.

Related Important Terms

Blended Premium Rate

Blended premium rate for overtime pay and on-call pay combines regular hourly wages with additional premiums to ensure fair compensation for extra hours worked beyond standard schedules. This rate balances base salary with variable premiums, reflecting the true cost of extended labor while maintaining compliance with labor laws and company policies.

Standby Differential

Standby differential is a form of on-call pay that compensates employees for being available to work during designated off-hours without actively working, differing from overtime pay which applies when actual work exceeds standard hours. This pay structure ensures fair remuneration for employees on standby, reflecting their restricted availability and readiness to respond.

Overtime On-Call Hybrid

Overtime On-Call Hybrid compensation combines hourly overtime rates with on-call pay premiums, ensuring employees receive fair remuneration for both active work hours and availability outside regular shifts. This hybrid model optimizes workforce flexibility by balancing guaranteed minimum on-call fees with variable overtime earnings based on actual hours worked.

Availability Allowance

Overtime pay compensates employees for hours worked beyond their regular schedule at a higher rate, while on-call pay, often referred to as availability allowance, provides compensation for being available to work if needed, regardless of actual hours worked. Availability allowance ensures employees receive remuneration for restricted personal time during on-call periods, reflecting the balance between readiness and actual labor.

Duty Pager Pay

Duty pager pay supplements regular salary by compensating employees for time spent available to respond during on-call hours, ensuring they receive fair remuneration even without active work. Overtime pay applies only when employees actively work beyond scheduled hours, while duty pager pay covers standby periods, highlighting the importance of differentiating compensation types for extra hours.

Cascade Incentive

Cascade Incentive structures prioritize overtime pay over on-call pay by compensating employees at a higher hourly rate for extra hours worked, ensuring fair remuneration for extended labor. This approach contrasts with on-call pay, which typically offers a fixed, lower rate regardless of actual hours worked, making overtime pay more financially rewarding for employees working beyond standard shifts.

OTE (On-Call Time Equivalent)

Overtime pay compensates employees for hours worked beyond their standard schedule, typically at a higher rate, while on-call pay provides remuneration for availability during off-hours without guaranteed work. Calculating On-Call Time Equivalent (OTE) helps accurately quantify and compare the effective compensation value of on-call shifts against overtime hours by standardizing on-call availability into payable work time units.

Call-Out Multiplier

Overtime pay typically compensates employees at 1.5 times their regular hourly rate for hours worked beyond the standard schedule, while on-call pay often involves a lower base rate plus a call-out multiplier when an employee must actively respond during off-hours. The call-out multiplier can significantly increase total earnings by applying a higher pay rate for emergency or unscheduled work, ensuring fair compensation for the disruption and immediacy required.

After-Hours Standby Bonus

After-hours standby bonuses provide compensation for employees required to be available outside regular working hours without actively working, differing from overtime pay, which applies to hours actively worked beyond the standard schedule. Overtime pay rates are typically higher due to direct labor, while standby bonuses offer fixed or hourly amounts recognizing readiness but not active engagement during extra hours.

Flex-Time Activation Pay

Flex-time activation pay compensates employees for hours worked beyond their regular schedule without requiring full overtime rates, offering a cost-effective alternative to traditional overtime pay for extra hours. This pay structure differs from on-call pay, which remunerates employees for being available rather than actively working, emphasizing flexible scheduling while managing labor costs efficiently.

Overtime Pay vs On-Call Pay for extra hours. Infographic

hrdif.com

hrdif.com