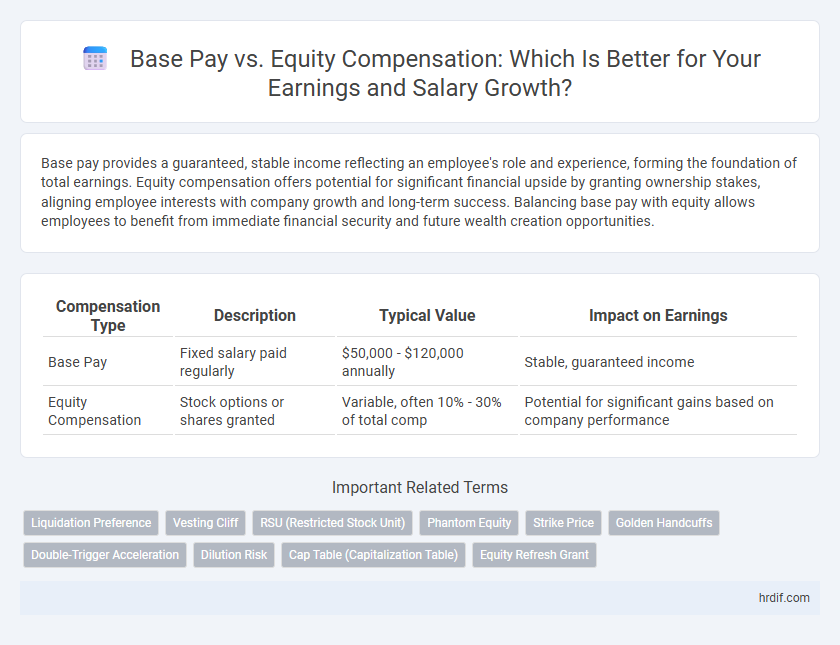

Base pay provides a guaranteed, stable income reflecting an employee's role and experience, forming the foundation of total earnings. Equity compensation offers potential for significant financial upside by granting ownership stakes, aligning employee interests with company growth and long-term success. Balancing base pay with equity allows employees to benefit from immediate financial security and future wealth creation opportunities.

Table of Comparison

| Compensation Type | Description | Typical Value | Impact on Earnings |

|---|---|---|---|

| Base Pay | Fixed salary paid regularly | $50,000 - $120,000 annually | Stable, guaranteed income |

| Equity Compensation | Stock options or shares granted | Variable, often 10% - 30% of total comp | Potential for significant gains based on company performance |

Understanding Base Pay and Equity Compensation

Base pay represents the fixed salary an employee receives regularly, providing financial stability and predictable income. Equity compensation, such as stock options or restricted stock units, offers ownership stakes that can increase in value over time, aligning employee interests with company performance. Understanding the balance between base pay and equity compensation helps employees evaluate total earnings potential and long-term wealth creation.

Key Differences Between Base Salary and Equity

Base salary provides a guaranteed, fixed income paid regularly regardless of company performance, ensuring financial stability for employees. Equity compensation grants ownership stakes such as stock options or restricted shares that can increase in value, aligning employee incentives with company success. The key difference lies in predictability and risk: base pay offers consistent earnings, while equity compensation offers potential for significant wealth tied directly to company valuation and growth.

Pros and Cons of Base Pay versus Equity

Base pay offers consistent, predictable income crucial for financial stability and budgeting, making it ideal for employees seeking guaranteed earnings without market volatility. Equity compensation provides potential for significant financial gain through company growth and stock appreciation, aligning employee incentives with long-term business success but carrying risks of market fluctuation and illiquidity. Balancing base pay and equity allows employees to secure steady income while benefiting from upside potential in startup or high-growth environments.

How Equity Compensation Works in Tech Jobs

Equity compensation in tech jobs typically involves stock options or restricted stock units (RSUs) that give employees ownership stakes in the company. Unlike base pay, which is a fixed salary, equity compensation fluctuates in value depending on the company's stock performance, aligning employee interests with long-term company growth. This form of compensation can significantly boost total earnings, especially in high-growth startups or established tech firms with rising stock prices.

Evaluating Your Earnings: Salary or Stock Options?

Evaluating your earnings requires understanding the trade-offs between base pay and equity compensation. Base pay offers guaranteed, predictable income essential for budgeting and financial stability, while equity compensation like stock options provides potential for significant long-term wealth if the company's value grows. Consider factors such as your risk tolerance, the company's growth prospects, and the vesting schedule when deciding the optimal balance between salary and equity compensation.

Tax Implications: Base Pay vs. Equity Awards

Base pay is subject to regular income tax and payroll taxes at the time of receipt, providing predictable tax obligations for employees. Equity compensation, such as stock options or restricted stock units (RSUs), often triggers tax events upon vesting or exercise, potentially resulting in capital gains tax benefits if shares are held long-term. Understanding the timing and nature of tax liabilities for base pay versus equity awards is crucial for optimizing overall compensation and tax efficiency.

Company Stage: When Equity Beats Base Pay

Early-stage startups often offer lower base pay but compensate with significant equity stakes, making equity compensation potentially more valuable as the company grows. Employees at seed or Series A companies may benefit from equity that outpaces their base salary if the startup successfully scales or exits. In contrast, later-stage companies tend to balance higher base pay with reduced equity upside, shifting earnings emphasis toward immediate cash compensation.

Negotiating Your Compensation Package

When negotiating your compensation package, it's essential to balance base pay and equity compensation to maximize overall earnings and financial security. Base pay offers stable, predictable income, while equity compensation, such as stock options or RSUs, provides potential for long-term wealth through company growth. Evaluating the risk and reward of equity alongside immediate salary needs ensures a strategic approach to total compensation negotiation.

Long-Term Value: Equity Upside Potential

Base pay offers consistent, predictable income, while equity compensation provides the potential for substantial long-term financial growth through stock price appreciation. Equity upside potential aligns employee incentives with company performance, often resulting in significant wealth creation if the company succeeds. This long-term value makes equity a critical component of total compensation in startups and high-growth organizations.

Making the Right Choice for Your Career

Evaluating base pay versus equity compensation requires understanding their impact on total earnings and financial stability. Base pay offers consistent income essential for daily expenses, while equity compensation provides potential long-term wealth linked to company performance. Prioritizing your career goals and risk tolerance helps determine the optimal balance between guaranteed salary and growth opportunities through stock options or shares.

Related Important Terms

Liquidation Preference

Base pay represents guaranteed cash earnings, while equity compensation offers potential financial upside tied to company valuation but depends heavily on liquidation preference terms, which dictate the order and amount shareholders receive during a liquidity event. Understanding liquidation preference is crucial, as it can significantly impact the actual value realized from equity compensation compared to fixed base salary.

Vesting Cliff

Base pay provides a consistent salary amount, while equity compensation, often granted through stock options or restricted stock units (RSUs), typically involves a vesting cliff that requires employees to remain with the company for a specified period--commonly one year--before any equity is owned. This vesting cliff is designed to incentivize employee retention by delaying equity ownership until the initial employment milestone is reached.

RSU (Restricted Stock Unit)

Base pay provides a predictable cash salary, while equity compensation through RSUs (Restricted Stock Units) offers potential for wealth accumulation by granting company shares that vest over time, aligning employee incentives with company performance. RSUs can significantly increase total earnings, especially in high-growth companies, but their value fluctuates with stock price, contrasting the stability of base pay.

Phantom Equity

Base pay provides consistent, guaranteed income, while Phantom Equity offers potential value tied to company performance without immediate cash payout. Phantom Equity aligns employee incentives with long-term company growth by granting the right to receive future cash or stock equivalent, enhancing total compensation beyond salary.

Strike Price

Base pay provides stable, guaranteed earnings, while equity compensation offers potential upside tied to company performance, heavily influenced by the strike price--the preset cost at which stock options can be purchased. A lower strike price increases the likelihood of profit upon exercising options, directly impacting the real value of equity compensation in total earnings.

Golden Handcuffs

Base pay provides consistent, guaranteed earnings, while equity compensation offers potential long-term gains tied to company performance. Golden handcuffs leverage equity grants like stock options or restricted shares to incentivize employee retention by aligning compensation with company success and vesting schedules.

Double-Trigger Acceleration

Double-trigger acceleration in equity compensation activates when an employee experiences both a change in control and involuntary termination, allowing accelerated vesting of stock options or shares. This mechanism protects equity value beyond base pay by ensuring employees receive earned equity promptly during corporate transitions, enhancing total compensation stability.

Dilution Risk

Base pay provides a guaranteed income unaffected by market fluctuations, while equity compensation offers potential for significant upside but carries dilution risk as additional shares may decrease the value of existing equity. Understanding dilution risk is essential for evaluating the true worth of equity awards compared to stable base salary earnings.

Cap Table (Capitalization Table)

Base pay provides a fixed salary component, while equity compensation derives value from ownership stakes reflected in the cap table, impacting long-term wealth based on company valuation and dilution events. Understanding the cap table is crucial for evaluating equity's potential payoff relative to the guaranteed earnings of base pay.

Equity Refresh Grant

Equity refresh grants provide ongoing ownership opportunities that complement base pay, aligning employee incentives with long-term company performance. These grants typically vest over multiple years, enhancing total compensation by offering potential financial upside beyond fixed salary components.

Base Pay vs Equity Comp for earnings. Infographic

hrdif.com

hrdif.com