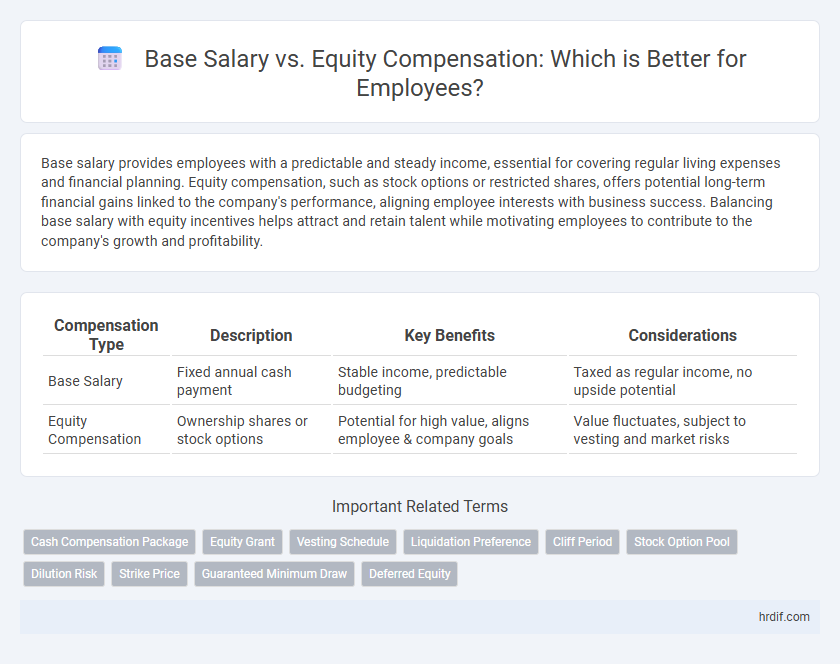

Base salary provides employees with a predictable and steady income, essential for covering regular living expenses and financial planning. Equity compensation, such as stock options or restricted shares, offers potential long-term financial gains linked to the company's performance, aligning employee interests with business success. Balancing base salary with equity incentives helps attract and retain talent while motivating employees to contribute to the company's growth and profitability.

Table of Comparison

| Compensation Type | Description | Key Benefits | Considerations |

|---|---|---|---|

| Base Salary | Fixed annual cash payment | Stable income, predictable budgeting | Taxed as regular income, no upside potential |

| Equity Compensation | Ownership shares or stock options | Potential for high value, aligns employee & company goals | Value fluctuates, subject to vesting and market risks |

Understanding Base Salary and Equity Compensation

Base salary provides employees with a fixed, predictable income that forms the foundation of their total earnings and financial stability. Equity compensation, such as stock options or restricted stock units, offers potential for significant long-term value by aligning employee interests with company performance and growth. Understanding the balance between these components is crucial for evaluating overall compensation packages and financial planning.

Key Differences Between Base Salary and Equity

Base salary provides employees with a fixed, predictable income paid regularly regardless of company performance, serving as immediate financial stability. Equity compensation, such as stock options or restricted shares, offers potential long-term financial gains tied directly to company growth and success but carries market risk and vesting schedules. The key difference lies in base salary's guaranteed cash flow versus equity's performance-based value appreciation, affecting tax treatment and financial planning for employees.

Pros and Cons of Base Salary

Base salary provides employees with stable and predictable income, ensuring financial security and easier personal budgeting. However, it lacks the potential for substantial wealth growth tied to company performance, unlike equity compensation which can fluctuate in value. Employees relying solely on base salary may miss out on long-term investment benefits linked to stock options or restricted stock units.

Advantages and Risks of Equity Compensation

Equity compensation offers employees potential for significant financial gain through stock ownership, aligning their interests with company growth and providing opportunities for long-term wealth accumulation. However, this form of pay carries risks such as market volatility, lack of liquidity, and the possibility of stock devaluation, which can undermine expected earnings. Unlike base salary, equity compensation depends heavily on company performance and stock market conditions, making it less predictable and more variable in total employee remuneration.

How Equity Compensation Works in Startups

Equity compensation in startups typically involves granting employees stock options or restricted stock units (RSUs) that vest over time, aligning incentives with company growth and success. Unlike base salary, which provides fixed, predictable income, equity offers potential upside tied to the startup's valuation and exit events such as acquisition or IPO. Employees benefit from this long-term incentive as equity can significantly increase overall compensation if the startup achieves substantial market value appreciation.

Evaluating Total Compensation Packages

Base salary provides a guaranteed income, influencing financial stability and immediate purchasing power. Equity compensation, often offered as stock options or restricted stock units, aligns employee interests with company performance and can lead to significant long-term wealth. Evaluating total compensation packages requires assessing both fixed salary and potential equity value to understand overall earning potential and risk tolerance.

Tax Implications: Salary vs. Equity

Base salary is subject to federal and state income taxes, Social Security, and Medicare withholding, resulting in immediate tax obligations. Equity compensation, such as stock options or restricted stock units, often benefits from favorable tax treatment, with taxes typically deferred until shares are vested or sold, potentially reducing annual tax burdens. Employees should carefully assess the timing and nature of equity taxation to optimize overall tax efficiency and maximize their total compensation value.

Factors to Consider When Choosing

Evaluating base salary against equity compensation involves assessing job security, immediate cash flow needs, and long-term financial growth potential. Employees should consider company stability, stock volatility, and vesting schedules to gauge equity's true value. Tax implications and personal risk tolerance also play crucial roles in determining the optimal compensation balance.

Negotiation Strategies for Salary and Equity

Negotiation strategies for salary and equity compensation require a clear understanding of the total compensation package, including base salary benchmarks and equity valuation terms. Employees should leverage market data from sources like Payscale and Glassdoor to negotiate competitive base salaries while carefully evaluating stock options, RSUs, or performance shares based on company stage and growth projections. Combining transparent communication about financial needs with a strategic approach to equity vesting schedules and strike prices enhances long-term wealth potential beyond the immediate cash salary.

Long-term Impact on Wealth and Career

Base salary provides immediate financial stability and predictable income, essential for covering living expenses and short-term goals. Equity compensation, often in the form of stock options or shares, offers potential for substantial long-term wealth accumulation aligned with company growth and success. Understanding the balance between stable base pay and equity enables employees to strategically optimize career growth and maximize long-term financial rewards.

Related Important Terms

Cash Compensation Package

Base salary provides a consistent and predictable cash compensation package essential for meeting daily expenses, while equity compensation offers potential long-term financial gains linked to company performance but lacks immediate liquidity. Combining a competitive base salary with equity incentives creates a balanced cash compensation package that supports both short-term financial stability and long-term wealth accumulation for employees.

Equity Grant

Equity grants provide employees with ownership stakes through stock options or restricted stock units, aligning their interests with the company's long-term growth and potentially offering significant financial upside beyond base salary. Unlike fixed base salary, equity compensation fluctuates in value based on company performance, incentivizing employees to contribute to shareholder value.

Vesting Schedule

Base salary provides guaranteed income, while equity compensation offers potential long-term value through stock options or shares that typically vest over a predetermined schedule, incentivizing employee retention. Vesting schedules commonly span four years with a one-year cliff, ensuring employees earn equity gradually and align their interests with company growth.

Liquidation Preference

Base salary provides consistent cash flow, while equity compensation offers potential upside linked to company valuation, with liquidation preference clauses ensuring preferred shareholders receive payouts before common stockholders during liquidity events, thereby impacting the true value of equity in employee earnings. Understanding liquidation preference is crucial for employees to assess the actual financial benefit of equity compensation versus guaranteed base salary.

Cliff Period

Base salary provides consistent cash flow, while equity compensation offers potential long-term financial gains subject to stock performance and vesting schedules. The cliff period, typically one year, delays any equity payout until the employee remains with the company for that timeframe, ensuring commitment before ownership rights are granted.

Stock Option Pool

Base salary provides consistent income and financial stability, while equity compensation through the Stock Option Pool offers potential long-term wealth aligned with company growth. Employees leveraging stock options can benefit significantly from company valuation increases, complementing their fixed earnings with performance-based rewards.

Dilution Risk

Base salary provides stable, predictable income, essential for consistent financial planning, while equity compensation offers potential upside but carries dilution risk as company shares increase, possibly reducing the value of an employee's ownership stake over time. Understanding dilution risk is crucial for employees to evaluate the true worth of equity awards compared to guaranteed base salary earnings.

Strike Price

The strike price in equity compensation represents the predetermined cost at which employees can purchase company stock, often set below current market value to provide potential financial gain. Unlike base salary, which is fixed cash income, equity compensation's value depends on stock performance and the difference between the strike price and market price at exercise.

Guaranteed Minimum Draw

Guaranteed Minimum Draw ensures employees receive a stable base salary regardless of performance-based equity fluctuations, providing financial security and predictable cash flow. This fixed compensation contrasts with equity compensation, which varies in value and depends on company stock performance, aligning employee incentives with long-term business growth.

Deferred Equity

Deferred equity compensation allows employees to receive shares as part of their total remuneration, aligning their interests with company growth while potentially offering tax advantages over immediate cash payments. This approach can balance a lower base salary by providing long-term financial incentives tied to stock performance and company valuation increases.

base salary vs equity compensation for employee earning Infographic

hrdif.com

hrdif.com