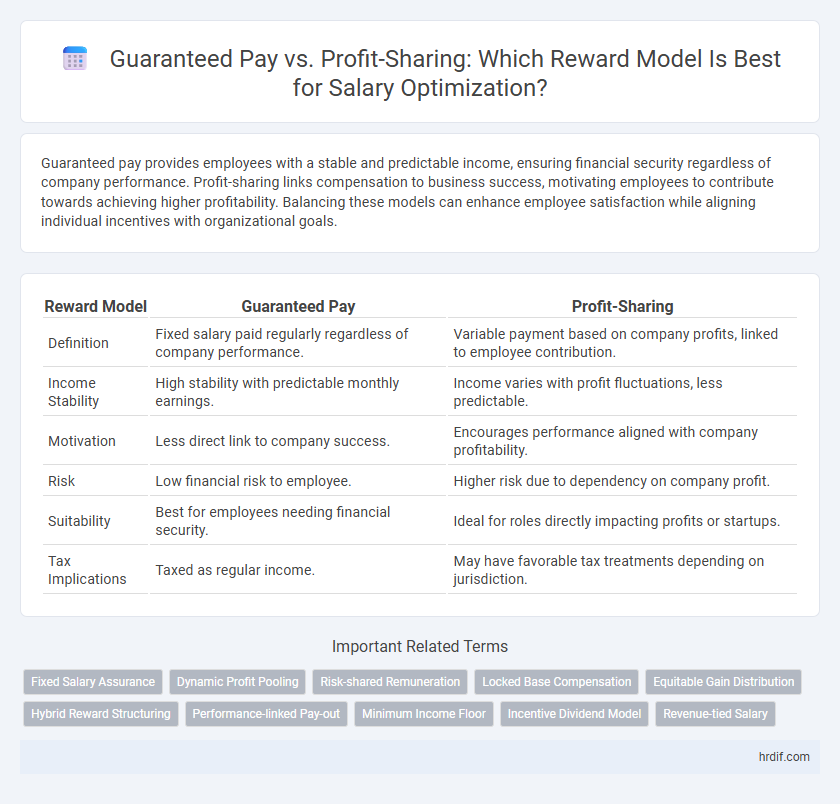

Guaranteed pay provides employees with a stable and predictable income, ensuring financial security regardless of company performance. Profit-sharing links compensation to business success, motivating employees to contribute towards achieving higher profitability. Balancing these models can enhance employee satisfaction while aligning individual incentives with organizational goals.

Table of Comparison

| Reward Model | Guaranteed Pay | Profit-Sharing |

|---|---|---|

| Definition | Fixed salary paid regularly regardless of company performance. | Variable payment based on company profits, linked to employee contribution. |

| Income Stability | High stability with predictable monthly earnings. | Income varies with profit fluctuations, less predictable. |

| Motivation | Less direct link to company success. | Encourages performance aligned with company profitability. |

| Risk | Low financial risk to employee. | Higher risk due to dependency on company profit. |

| Suitability | Best for employees needing financial security. | Ideal for roles directly impacting profits or startups. |

| Tax Implications | Taxed as regular income. | May have favorable tax treatments depending on jurisdiction. |

Introduction to Reward Models: Guaranteed Pay vs Profit-Sharing

Guaranteed pay ensures employees receive a fixed salary regardless of company performance, providing financial stability and predictable income. Profit-sharing ties compensation to business results, aligning employee rewards with company success and fostering motivation to improve performance. Each model offers distinct advantages: guaranteed pay supports consistent budgeting, while profit-sharing incentivizes long-term commitment and collaboration.

Defining Guaranteed Pay in the Workplace

Guaranteed pay in the workplace refers to a fixed salary or wage that employees receive regularly, irrespective of company performance or profits. This stable income model provides employees with financial security and predictability, ensuring consistent compensation for their work contributions. Unlike profit-sharing, guaranteed pay minimizes income variability by decoupling earnings from business outcomes.

Understanding Profit-Sharing Systems

Profit-sharing systems allocate a portion of company profits to employees, linking compensation directly to business performance and fostering a sense of ownership. Unlike guaranteed pay, which provides fixed, predictable income, profit-sharing varies based on the company's financial success, motivating employees to contribute to organizational growth. Understanding the mechanics of profit-sharing helps employees assess potential earnings fluctuations and the alignment of personal rewards with corporate profitability.

Key Differences Between Guaranteed Pay and Profit-Sharing

Guaranteed pay provides employees with a fixed salary amount that ensures consistent income regardless of company performance, offering financial security and predictability. Profit-sharing ties employee compensation to the company's financial success, distributing a portion of profits as bonuses, which can vary significantly based on business results. This key difference impacts risk tolerance, with guaranteed pay favoring stability while profit-sharing encourages alignment with company goals and performance-driven rewards.

Advantages of Guaranteed Pay for Employees

Guaranteed pay offers employees financial stability by providing a fixed income regardless of company performance, ensuring consistent budgeting for personal expenses. This reward model reduces income uncertainty and stress, promoting higher job satisfaction and focus on long-term productivity. Employees benefit from predictable compensation, which supports financial planning and secures basic living standards without fluctuations tied to profit variability.

Benefits of Profit-Sharing for Workplace Motivation

Profit-sharing enhances workplace motivation by directly linking employee rewards to company success, fostering a sense of ownership and commitment. Unlike guaranteed pay, profit-sharing incentivizes higher performance and collaboration, as employees are motivated to contribute to the company's profitability. This reward model also promotes long-term engagement and aligns individual goals with organizational objectives, driving overall productivity.

Potential Drawbacks of Guaranteed Pay Models

Guaranteed pay models may lead to higher fixed labor costs, reducing financial flexibility during downturns and limiting incentives for performance improvement. This structure can result in complacency among employees, as compensation remains stable regardless of individual or company achievements. Consequently, guaranteed pay systems might hinder motivation and fail to effectively align employees' efforts with organizational profitability.

Risks and Challenges of Profit-Sharing Schemes

Profit-sharing schemes pose risks such as income unpredictability and lack of immediate financial security compared to guaranteed pay, leading to potential employee dissatisfaction. These models may also create challenges in aligning individual performance with company profits, resulting in perceived unfairness or decreased motivation. Furthermore, profit-sharing depends on overall business performance, which can be volatile due to market fluctuations, affecting employees' total compensation unpredictably.

Choosing the Right Reward Model for Your Business

Guaranteed pay provides employees with a fixed salary that ensures financial stability regardless of company performance, making it ideal for roles requiring consistent income and risk aversion. Profit-sharing ties compensation to business success, motivating employees through variable rewards linked to profitability, which can drive engagement and align interests with company goals. Selecting the right reward model depends on your business's financial predictability, employee preferences, and the need to balance risk with incentives to maximize productivity and retention.

Future Trends in Employee Compensation Strategies

Future trends in employee compensation strategies emphasize a shift towards integrating guaranteed pay with profit-sharing models to enhance employee motivation and retention. Companies increasingly adopt hybrid reward systems that balance fixed salaries with variable profit-sharing components, aligning employee interests with organizational performance. Data indicates that this approach not only attracts top talent but also fosters a culture of shared success and long-term commitment.

Related Important Terms

Fixed Salary Assurance

Guaranteed pay provides employees with a fixed salary assurance, ensuring financial stability regardless of company performance, while profit-sharing rewards fluctuate based on profitability, introducing income variability. Fixed salary assurance supports consistent budgeting and reduces income uncertainty, making it preferred in roles demanding reliable compensation.

Dynamic Profit Pooling

Dynamic Profit Pooling enhances reward models by tying employee compensation directly to real-time company performance, creating a flexible profit-sharing system that adjusts payouts based on quarterly or monthly results. This approach contrasts with guaranteed pay, which offers fixed salaries regardless of business outcomes, limiting incentives for employees to contribute to profit growth.

Risk-shared Remuneration

Guaranteed pay ensures fixed income stability regardless of company performance, providing employees with predictable financial security, while profit-sharing aligns rewards with business success, distributing variable income based on profitability and fostering risk-shared remuneration. This model balances employee motivation and organizational risk by combining steady salary with performance-linked incentives.

Locked Base Compensation

Locked base compensation provides employees with a stable, guaranteed pay regardless of company performance, ensuring financial security and predictability. In contrast, profit-sharing links rewards directly to the company's profitability, potentially increasing earnings but introducing variability and risk to total compensation.

Equitable Gain Distribution

Guaranteed pay ensures employees receive a fixed income regardless of company performance, providing financial stability and predictability. Profit-sharing aligns employee rewards with business success, promoting equitable gain distribution by directly linking compensation to company profits and incentivizing collective performance.

Hybrid Reward Structuring

Hybrid reward structuring combines guaranteed pay's stability with profit-sharing's performance incentives, aligning employee motivation with company success while ensuring financial security. This balanced approach enhances retention by providing a fixed income alongside variable rewards linked to profitability, optimizing workforce engagement and productivity.

Performance-linked Pay-out

Guaranteed pay ensures a fixed income regardless of company performance, providing financial stability, while profit-sharing aligns employee rewards directly with business profitability, incentivizing higher performance and fostering a culture of ownership. Performance-linked payouts through profit-sharing enhance motivation by tying compensation to measurable company success, driving employees to contribute more effectively to organizational goals.

Minimum Income Floor

Guaranteed pay ensures a minimum income floor, providing financial stability regardless of company performance, while profit-sharing ties rewards to business outcomes, potentially offering higher earnings but with income variability. Minimum income floors in guaranteed pay models protect employees from volatile market conditions, promoting consistent cash flow and reducing financial stress.

Incentive Dividend Model

The Incentive Dividend Model blends Guaranteed Pay with Profit-sharing by ensuring a base salary while distributing dividends based on company performance, aligning employee rewards directly with organizational success. This hybrid approach motivates sustained productivity and loyalty by combining financial stability with performance-driven incentives.

Revenue-tied Salary

Revenue-tied salary models link guaranteed pay with profit-sharing elements to align employee incentives with company financial performance and boost motivation. This hybrid approach ensures a stable income while directly rewarding contributions to revenue growth, enhancing overall productivity and retention.

Guaranteed Pay vs Profit-sharing for reward model. Infographic

hrdif.com

hrdif.com