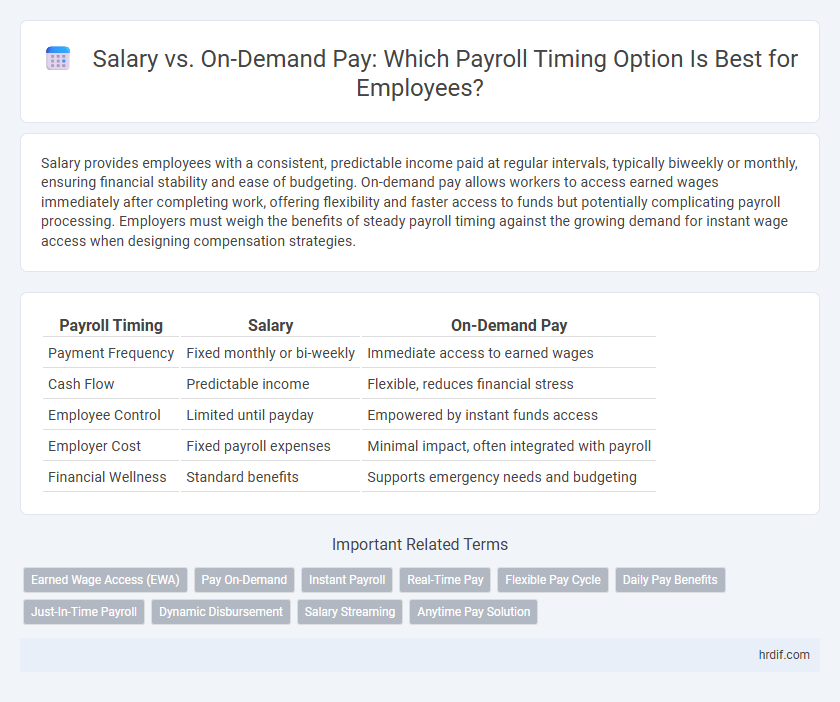

Salary provides employees with a consistent, predictable income paid at regular intervals, typically biweekly or monthly, ensuring financial stability and ease of budgeting. On-demand pay allows workers to access earned wages immediately after completing work, offering flexibility and faster access to funds but potentially complicating payroll processing. Employers must weigh the benefits of steady payroll timing against the growing demand for instant wage access when designing compensation strategies.

Table of Comparison

| Payroll Timing | Salary | On-Demand Pay |

|---|---|---|

| Payment Frequency | Fixed monthly or bi-weekly | Immediate access to earned wages |

| Cash Flow | Predictable income | Flexible, reduces financial stress |

| Employee Control | Limited until payday | Empowered by instant funds access |

| Employer Cost | Fixed payroll expenses | Minimal impact, often integrated with payroll |

| Financial Wellness | Standard benefits | Supports emergency needs and budgeting |

Introduction: Understanding Salary vs On-Demand Pay

Salary provides employees with consistent, predetermined earnings paid at regular intervals, offering financial stability and ease in budgeting. On-demand pay allows workers to access a portion of their earned wages before the traditional payday, enhancing cash flow flexibility and addressing immediate financial needs. Comparing payroll timing, salary schedules are fixed, while on-demand pay offers dynamic access to earned income anytime within the pay period.

Payroll Timing: Traditional Salary Payment Cycles

Traditional salary payment cycles typically follow a fixed schedule such as biweekly, semimonthly, or monthly, providing employees with consistent and predictable income. This structured payroll timing allows employers to manage cash flow and accounting processes effectively, aligning with regulatory requirements and tax reporting. While traditional salary payments offer stability, they can limit employees' flexibility to access earned wages before the scheduled payday.

The Rise of On-Demand Pay Solutions

On-demand pay solutions offer employees immediate access to earned wages, improving financial flexibility compared to traditional salary payment schedules. Companies integrating on-demand pay experience increased employee satisfaction and reduced turnover by addressing cash flow challenges faced between paychecks. This shift toward real-time payroll reflects growing demand for financial wellness tools in modern workforce management.

Key Differences Between Salary and On-Demand Pay

Salary provides employees with a fixed, predictable income paid at regular intervals, offering financial stability and simplifying budgeting. On-demand pay allows workers to access wages earned immediately before the standard payday, enhancing cash flow flexibility and reducing reliance on credit. Key differences include the timing of payout, with salary fixed in advance and on-demand pay tied directly to hours worked or earnings accumulated.

Employee Financial Well-being: Impact of Payment Timing

On-demand pay improves employee financial well-being by providing immediate access to earned wages, reducing reliance on costly short-term loans and enhancing cash flow management. Traditional salary schedules often force employees to wait weeks, which can lead to financial stress and decreased productivity. Access to timely payments supports better budgeting and overall financial stability, contributing to higher job satisfaction and retention.

Employer Perspectives: Payroll Management Challenges

Employers face significant payroll management challenges when balancing traditional salary payments versus on-demand pay systems, including increased administrative complexity and the need for real-time fund availability. On-demand pay requires advanced payroll technology integration and careful compliance with labor laws, impacting employer cash flow and accounting processes. Efficient payroll timing strategies are essential to minimize operational disruptions and maintain employee satisfaction while controlling costs.

Legal and Compliance Considerations for Payroll Timing

Salary payment schedules must comply with federal and state labor laws, ensuring timely and full wage disbursement to avoid legal penalties. On-demand pay models require rigorous adherence to wage and hour regulations, including accurate record-keeping and clear communication of pay timelines to maintain compliance. Failure to meet established payroll timing rules can result in costly fines and wage claim disputes.

Technology’s Role in On-Demand Pay Adoption

Technology accelerates the adoption of on-demand pay by enabling real-time wage access through secure digital platforms and mobile apps. Advanced payroll software integrates seamlessly with employer systems, allowing instantaneous calculation and disbursement of earned wages. This technological innovation reduces financial stress for employees and enhances workforce satisfaction compared to traditional fixed salary schedules.

Cost Implications: Salary vs On-Demand Pay

Salary payments provide predictable cost management with fixed expenses each pay period, enabling accurate budgeting and financial forecasting. On-demand pay introduces variable payroll costs that can increase administrative expenses and complicate cash flow management due to frequent, irregular payouts. Employers must weigh the higher operational costs and potential liquidity challenges of on-demand pay against the stability and simplicity of traditional salary structures.

Future Trends in Payroll Timing and Employee Compensation

Salary remains the standard for consistent payroll timing, providing employees with predictable income and financial stability. On-demand pay is gaining traction as a flexible compensation alternative, enabling employees to access earned wages instantly and enhance financial wellness. Future trends indicate a shift toward hybrid payroll systems that combine fixed salaries with on-demand pay options to increase employee satisfaction and retention.

Related Important Terms

Earned Wage Access (EWA)

Earned Wage Access (EWA) enables employees to access a portion of their earned salary before the traditional payday, providing improved cash flow and reducing reliance on high-interest loans. Unlike fixed salary payments, EWA offers on-demand payroll timing that aligns more closely with workers' financial needs and enhances overall employee satisfaction.

Pay On-Demand

Pay On-Demand offers employees flexible access to earned wages before the traditional payroll date, reducing financial stress and enhancing cash flow management. This system improves employee satisfaction and retention by providing immediate liquidity without waiting for the standard pay cycle.

Instant Payroll

Instant Payroll offers employees immediate access to earned wages, contrasting traditional salary payments that follow fixed pay cycles. This on-demand pay model enhances financial flexibility by reducing the waiting time between work performed and compensation received, supporting improved cash flow management.

Real-Time Pay

Real-time pay offers employees immediate access to earned wages, eliminating the traditional wait for scheduled salary disbursements and enhancing financial flexibility. This on-demand pay model improves cash flow management while reducing reliance on high-interest loans, contrasting with fixed payroll timing in salaried compensation.

Flexible Pay Cycle

Flexible pay cycles offer employees the advantage of accessing earned wages on-demand rather than waiting for traditional salary payment dates, improving financial agility and reducing cash flow stress. On-demand pay solutions integrate seamlessly with payroll systems, enabling real-time payment processing that enhances worker satisfaction and retention compared to fixed salary schedules.

Daily Pay Benefits

On-demand pay offers daily access to earned wages, reducing financial stress and improving cash flow compared to traditional salary paid biweekly or monthly. This flexibility supports employees in managing unexpected expenses and enhances overall financial wellness.

Just-In-Time Payroll

Just-In-Time Payroll offers employees immediate access to earned wages, enhancing financial flexibility compared to traditional Salary disbursements that occur on fixed pay cycles. This on-demand pay solution reduces cash flow gaps and improves liquidity, aligning payroll timing with actual work hours rather than predetermined dates.

Dynamic Disbursement

Dynamic disbursement in payroll timing allows employees to access earned wages instantly, contrasting with traditional salary payouts that occur on fixed schedules like biweekly or monthly. On-demand pay enhances financial flexibility and reduces reliance on payday loans by providing timely access to earned income as it accrues.

Salary Streaming

Salary streaming offers employees real-time access to earned wages before the traditional payroll date, improving financial flexibility compared to fixed salary payments. This on-demand pay model reduces reliance on payday loans by enabling instant access to earned income, promoting better cash flow management and employee satisfaction.

Anytime Pay Solution

On-Demand Pay solutions enable employees to access earned wages instantly, improving cash flow and financial flexibility compared to traditional salary payrolls that disburse funds on fixed dates. This real-time wage access reduces reliance on payday loans and enhances worker satisfaction by aligning payroll timing with individual needs.

Salary vs On-Demand Pay for payroll timing. Infographic

hrdif.com

hrdif.com