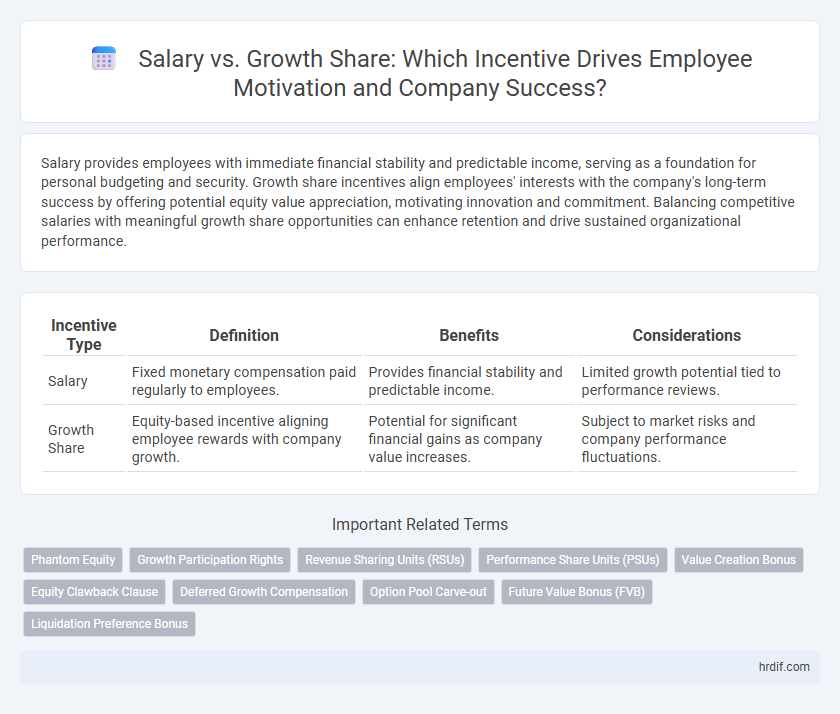

Salary provides employees with immediate financial stability and predictable income, serving as a foundation for personal budgeting and security. Growth share incentives align employees' interests with the company's long-term success by offering potential equity value appreciation, motivating innovation and commitment. Balancing competitive salaries with meaningful growth share opportunities can enhance retention and drive sustained organizational performance.

Table of Comparison

| Incentive Type | Definition | Benefits | Considerations |

|---|---|---|---|

| Salary | Fixed monetary compensation paid regularly to employees. | Provides financial stability and predictable income. | Limited growth potential tied to performance reviews. |

| Growth Share | Equity-based incentive aligning employee rewards with company growth. | Potential for significant financial gains as company value increases. | Subject to market risks and company performance fluctuations. |

Understanding Salary vs. Growth Share Incentives

Comparing salary and growth share incentives reveals distinct benefits: salary provides immediate, stable income, ensuring financial security, while growth share incentives (such as stock options or equity awards) offer potential for significant long-term wealth as the company's value increases. Employees motivated by growth shares often align their interests more closely with company success, fostering innovation and commitment. Employers balance these elements to attract talent and drive performance, leveraging competitive salaries alongside strategic equity incentives to optimize workforce engagement.

Comparing Fixed Salary to Equity-Based Compensation

Fixed salary offers predictable income and financial stability, making it ideal for employees valuing steady cash flow. Equity-based compensation, such as stock options or restricted stock units, aligns employee interests with company performance and provides potential for significant wealth accumulation if the company grows. Companies often balance salary and growth share incentives to attract talent while motivating long-term commitment and higher productivity.

Pros and Cons of Salary Packages

Salary packages provide employees with predictable, stable income that supports financial planning and security. However, fixed salaries may lack motivation for exceptional performance compared to growth share incentives, which align employee rewards with company success and long-term value creation. On the downside, salary packages can increase fixed costs for companies and may not directly encourage innovation or enhanced productivity, limiting their effectiveness as incentive tools.

The Advantages of Growth Share Plans

Growth share plans align employee interests with company performance by offering equity stakes that appreciate as the business grows, fostering long-term motivation. These plans can enhance retention by providing financial rewards linked directly to company success, unlike fixed salaries that remain constant regardless of growth. Employees benefit from potential capital gains, creating stronger incentives for innovation and productivity compared to traditional salary structures.

Impact on Employee Motivation and Retention

Competitive salary packages provide immediate financial security, serving as a primary motivator for employee performance and satisfaction. Growth shares, by offering equity stakes, align employees' interests with long-term company success, fostering deeper commitment and encouraging retention through potential future wealth. Combining salary and growth share incentives optimizes motivation by addressing both short-term needs and long-term aspirations, crucial for sustaining employee engagement and reducing turnover.

How Company Stage Influences Incentive Structures

Early-stage startups often prioritize growth shares over salary to conserve cash while aligning employee incentives with long-term company success. Mature companies typically offer higher base salaries and smaller equity portions, reflecting stable revenues and reduced growth risk. This shift in incentive structure corresponds directly to the company's development phase and funding status, influencing talent attraction and retention strategies.

Financial Security vs. Long-Term Wealth Building

A competitive salary provides employees with immediate financial security, ensuring steady income to cover living expenses and reduce stress. Growth shares, often tied to company performance, offer the potential for substantial long-term wealth building but carry higher risk and delayed benefits. Balancing fixed salary and equity incentives aligns employee motivation with company success while addressing both short-term needs and future financial goals.

Tax Implications of Salary and Growth Share

Salary income is subject to regular income tax rates, often resulting in immediate tax liabilities throughout the fiscal year. Growth shares, typically classified as capital assets, may benefit from favorable capital gains tax treatment, allowing tax deferral until shares are sold. Companies leveraging growth shares for incentives can optimize employee compensation by balancing immediate taxable salary with the potential tax-efficient appreciation of equity awards.

Choosing the Right Incentive Mix for Talent

Balancing salary and growth share is essential for crafting effective company incentives that attract and retain top talent. Offering competitive salaries ensures immediate financial stability, while growth shares align employee interests with the company's long-term success, fostering motivation and loyalty. Tailoring the right mix depends on industry standards, company stage, and individual employee priorities to maximize engagement and performance.

Real-World Examples: Salary vs. Growth Share Outcomes

Employees at tech giants like Amazon often receive moderate base salaries paired with significant stock options, incentivizing long-term company growth and personal wealth accumulation. In contrast, startups may offer higher immediate salaries but smaller equity stakes, providing short-term financial stability with limited upside from company growth. Data from public companies shows that employees who opt for growth shares tend to see substantial value appreciation over five to ten years, outperforming peers with fixed salaries in wealth creation.

Related Important Terms

Phantom Equity

Phantom Equity offers employees a growth share incentive that aligns their potential earnings with the company's long-term value appreciation without immediate salary increases. This approach balances fixed salary stability with the opportunity for significant future financial rewards linked to company performance.

Growth Participation Rights

Growth Participation Rights offer employees a direct stake in the company's future success, aligning incentives with long-term value creation rather than fixed salary compensation. This approach motivates talent by linking rewards to measurable company growth, fostering retention and driving performance beyond base salary limitations.

Revenue Sharing Units (RSUs)

Revenue Sharing Units (RSUs) align employee incentives with company performance by granting shares that increase in value as revenue grows, offering potential long-term financial benefits beyond fixed salary. Unlike traditional salary structures, RSUs encourage sustained commitment and can significantly enhance overall compensation through equity participation.

Performance Share Units (PSUs)

Performance Share Units (PSUs) align employee incentives with long-term company growth by granting equity tied to specific performance metrics, often resulting in greater value than fixed salary components. Unlike base salary, PSUs motivate sustained performance improvements and shareholder value creation, making them a strategic tool in executive compensation packages.

Value Creation Bonus

Value Creation Bonus aligns employee incentives with long-term company performance by rewarding measurable increases in enterprise value, outperforming fixed Salary structures that lack direct linkage to growth metrics. This approach fosters a culture of ownership and drives strategic decision-making, enhancing both individual motivation and sustainable shareholder value.

Equity Clawback Clause

Equity clawback clauses in salary versus growth share incentives protect companies by reclaiming equity granted if performance targets are not met or employees leave prematurely, ensuring alignment between compensation and long-term growth objectives. This mechanism balances immediate salary payouts with growth share benefits, incentivizing sustained contributions while mitigating risk associated with equity dilution.

Deferred Growth Compensation

Deferred Growth Compensation aligns employee incentives with long-term company performance by linking pay to future equity appreciation rather than immediate salary increases. This strategy fosters sustained value creation while optimizing cash flow, attracting talent motivated by growth potential instead of short-term earnings.

Option Pool Carve-out

Option pool carve-out directly impacts the balance between salary and growth share incentives by allocating a specific percentage of equity to new hires and key employees, which can reduce immediate cash salary expenses while aligning employee interests with long-term company valuation increases. Structuring compensation with a defined option pool carve-out enhances retention and motivation by offering growth share potential, effectively supplementing or partially replacing higher fixed salaries.

Future Value Bonus (FVB)

Future Value Bonus (FVB) incentivizes employees by aligning compensation with long-term company growth rather than immediate salary increases, maximizing potential future earnings. This strategic approach enhances retention and drives performance by linking rewards to the company's future market value and overall success.

Liquidation Preference Bonus

Liquidation preference bonuses play a critical role in balancing salary with growth share incentives by ensuring investors and key employees receive prioritized payouts during exit events, thus aligning compensation with company performance and risk. This mechanism enhances motivation while protecting stakeholders' capital, making it a strategic element of equity compensation plans.

Salary vs Growth Share for company incentives. Infographic

hrdif.com

hrdif.com