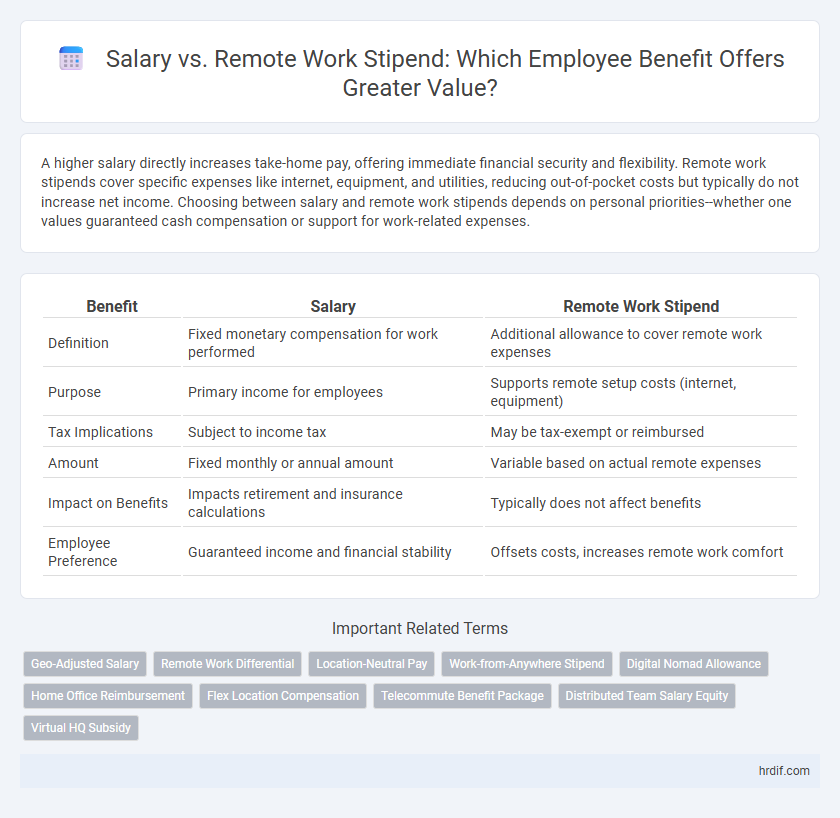

A higher salary directly increases take-home pay, offering immediate financial security and flexibility. Remote work stipends cover specific expenses like internet, equipment, and utilities, reducing out-of-pocket costs but typically do not increase net income. Choosing between salary and remote work stipends depends on personal priorities--whether one values guaranteed cash compensation or support for work-related expenses.

Table of Comparison

| Benefit | Salary | Remote Work Stipend |

|---|---|---|

| Definition | Fixed monetary compensation for work performed | Additional allowance to cover remote work expenses |

| Purpose | Primary income for employees | Supports remote setup costs (internet, equipment) |

| Tax Implications | Subject to income tax | May be tax-exempt or reimbursed |

| Amount | Fixed monthly or annual amount | Variable based on actual remote expenses |

| Impact on Benefits | Impacts retirement and insurance calculations | Typically does not affect benefits |

| Employee Preference | Guaranteed income and financial stability | Offsets costs, increases remote work comfort |

Understanding Salary and Remote Work Stipend

Salary represents the fixed annual or monthly compensation an employee receives, forming the primary component of total earnings. A remote work stipend supplements salary by covering expenses related to home office setup, internet, and utilities, enhancing employee productivity without increasing base pay. Understanding both helps employers balance direct salary costs with remote work benefits to attract and retain talent effectively.

Key Differences Between Salary and Remote Work Stipend

Salary represents a fixed, regular payment typically provided as compensation for full-time employment, encompassing base pay and possible bonuses. A remote work stipend is a specific allowance designed to cover expenses related to working from home, such as internet costs, office equipment, and utilities, separate from the main salary. Key differences include salary's role as total income versus stipends as targeted reimbursements and the regularity and tax implications of each type of compensation.

Financial Impact: Salary vs Remote Work Stipend

Employees often weigh the financial impact when comparing a direct salary increase to a remote work stipend, which typically covers specific expenses like home office setup and internet costs. While a salary boost provides flexible, unrestricted income that can improve overall financial security and long-term savings, a remote work stipend targets out-of-pocket work-related expenses, potentially reducing taxable income in some cases. Employers balance these benefits by considering cost-effectiveness, with stipends offering controlled budget allocation versus the broader financial commitment of salary raises.

Tax Implications: Salary or Remote Work Stipend

Tax implications for salary and remote work stipends differ significantly; salary is typically subject to standard income tax withholding, Social Security, and Medicare taxes. Remote work stipends, when provided as reimbursements for business-related expenses, may be non-taxable if properly documented, but fixed monthly stipends often count as taxable income. Employers and employees must carefully structure stipends to minimize tax burdens and comply with IRS regulations.

Employee Satisfaction: Salary Against Remote Work Stipends

Employee satisfaction often hinges more on competitive salary offerings than on remote work stipends, as consistent income directly impacts financial stability and long-term planning. While remote work stipends provide short-term relief for home office expenses, they rarely match the perceived value of a substantial base salary. Data from workplace surveys reveal employees prioritize salary increases over stipends when evaluating overall job satisfaction and benefits packages.

Flexibility and Perks: Comparing Benefits

Salary provides a fixed financial value that directly impacts an employee's earnings, while a remote work stipend offers flexible support for home office expenses and connectivity, enhancing remote work comfort. Evaluating benefits requires analyzing how salary guarantees consistent income, whereas stipends contribute to productivity and work-life balance by covering costs like internet or ergonomic equipment. Companies increasingly combine competitive salaries with targeted remote work stipends to attract talent seeking both financial stability and adaptable work environments.

Employer Perspective: Cost Analysis of Salary vs Stipend

Employers face distinct cost implications when comparing direct salary increases to remote work stipends as employee benefits. Salary raises result in long-term financial commitments including taxes, benefits, and potential raises, while stipends offer a fixed, controllable expense specifically allocated for remote work-related costs. Analyzing employer budgets, stipends provide flexibility and cost predictability, enabling companies to support remote workers without the escalating overhead tied to permanent salary adjustments.

Career Growth and Compensation Structure

Salary remains the primary driver of career growth by directly influencing compensation structure and long-term earning potential. Remote work stipends offer targeted financial support for home office expenses but typically do not contribute to base salary increases or performance-based bonuses. Companies balancing salary and remote work benefits must ensure clear differentiation to maintain motivation and transparency in career progression pathways.

Negotiating Your Offer: Salary vs Remote Stipend

When negotiating your job offer, carefully evaluate the trade-offs between a higher salary and a remote work stipend, considering your personal financial needs and work-from-home expenses. Employers may offer a remote stipend for equipment, internet, and utilities, which can reduce out-of-pocket costs but might not increase overall take-home pay like a salary boost. Prioritize total compensation value, factoring in tax implications and benefit structures to secure the most advantageous package.

Long-Term Prospects: Salary or Remote Work Stipend

Long-term financial stability often favors a competitive salary over a remote work stipend, as salaries contribute to benefits like retirement plans and promotions. Remote work stipends typically cover short-term expenses such as home office supplies but lack impact on overall compensation growth. Employees prioritizing career advancement and consistent income tend to value salary enhancements more than periodic stipends.

Related Important Terms

Geo-Adjusted Salary

Geo-adjusted salary aligns compensation with local cost of living, ensuring equitable pay regardless of an employee's location, while remote work stipends provide targeted support for home office expenses. This approach optimizes total benefits by balancing fair base pay with specific allowances, enhancing employee satisfaction and retention.

Remote Work Differential

Remote work differential provides employees with a stipend that compensates for increased home-office expenses, often enhancing overall benefits compared to a fixed salary increase. This allowance offsets costs such as utilities, internet, and ergonomic equipment, making remote work financially sustainable without impacting base salary.

Location-Neutral Pay

Location-neutral pay ensures employees receive consistent salaries regardless of their geographic location, eliminating disparities caused by local cost-of-living adjustments. Remote work stipends provide targeted financial support for home office expenses but do not replace the equitable compensation achieved through location-neutral salary structures.

Work-from-Anywhere Stipend

Work-from-Anywhere stipends offer employees flexible financial support to cover remote work expenses, enhancing job satisfaction beyond base salary alone. Companies providing these stipends often see improved retention rates and increased productivity compared to traditional salary-only compensation models.

Digital Nomad Allowance

Digital nomad allowance often surpasses traditional remote work stipends by covering a broader range of expenses including coworking spaces, international health insurance, and travel costs, directly enhancing flexibility and productivity. Salary structures integrating these allowances demonstrate a higher appeal in talent acquisition, as they address the comprehensive financial needs of remote professionals beyond mere monthly stipends.

Home Office Reimbursement

Home office reimbursement offers employees a targeted benefit that directly offsets costs associated with remote work, such as internet, equipment, and utilities, enhancing overall compensation without increasing base salary. This stipend can improve job satisfaction and productivity by reducing out-of-pocket expenses, making it a strategic alternative or complement to traditional salary adjustments in remote work arrangements.

Flex Location Compensation

Flex Location Compensation offers a tailored approach by integrating salary adjustments with remote work stipends to reflect employees' diverse location needs and cost-of-living differences. This hybrid benefit enhances total remuneration packages, balancing base salary competitiveness with targeted remote work support to attract and retain top talent.

Telecommute Benefit Package

A competitive telecommute benefit package often balances a fair salary with a remote work stipend to cover home office expenses, enhancing employee satisfaction and productivity. Offering both a base salary aligned with market rates and a dedicated remote work allowance supports work-life balance and reduces financial barriers associated with telecommuting.

Distributed Team Salary Equity

Distributed team salary equity ensures fair compensation by balancing core salary with remote work stipends, reflecting regional cost-of-living differences and the value of flexible work environments. Companies adopting this model optimize talent retention and satisfaction by transparently integrating remote allowances into total remuneration structures.

Virtual HQ Subsidy

A Virtual HQ subsidy offers a dedicated remote work stipend that enhances employee productivity and engagement by covering home office expenses, often surpassing traditional salary increases in perceived value. Companies adopting this benefit see improved retention and job satisfaction as workers gain financial support tailored specifically to their remote work environment.

Salary vs Remote Work Stipend for benefits. Infographic

hrdif.com

hrdif.com