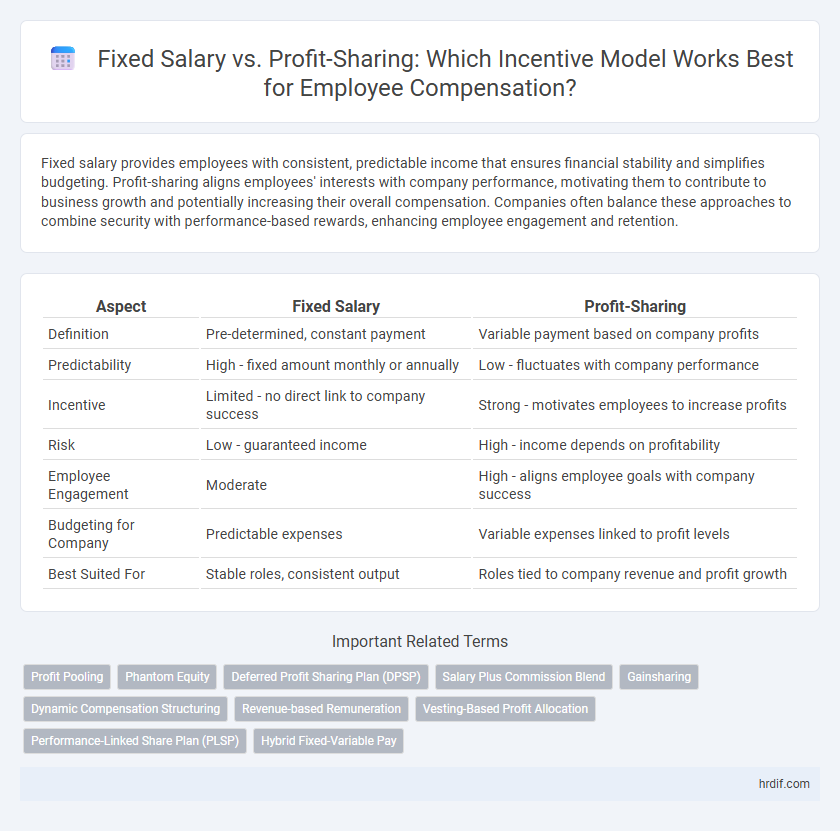

Fixed salary provides employees with consistent, predictable income that ensures financial stability and simplifies budgeting. Profit-sharing aligns employees' interests with company performance, motivating them to contribute to business growth and potentially increasing their overall compensation. Companies often balance these approaches to combine security with performance-based rewards, enhancing employee engagement and retention.

Table of Comparison

| Aspect | Fixed Salary | Profit-Sharing |

|---|---|---|

| Definition | Pre-determined, constant payment | Variable payment based on company profits |

| Predictability | High - fixed amount monthly or annually | Low - fluctuates with company performance |

| Incentive | Limited - no direct link to company success | Strong - motivates employees to increase profits |

| Risk | Low - guaranteed income | High - income depends on profitability |

| Employee Engagement | Moderate | High - aligns employee goals with company success |

| Budgeting for Company | Predictable expenses | Variable expenses linked to profit levels |

| Best Suited For | Stable roles, consistent output | Roles tied to company revenue and profit growth |

Introduction to Company Incentive Structures

Company incentive structures typically include fixed salary and profit-sharing plans to motivate employees and align their goals with business performance. Fixed salary provides consistent, predictable income, ensuring financial stability, while profit-sharing directly links compensation to company profitability, encouraging a sense of ownership and increased productivity. Balancing these incentives helps firms attract talent, maintain motivation, and drive long-term growth.

Fixed Salary: Definition and Key Features

Fixed salary refers to a predetermined and consistent amount of compensation paid to employees regardless of company performance or profits, ensuring financial stability and predictability for workers. Key features include regular pay intervals, contractual obligation, and exclusion of variable components such as bonuses or profit-sharing incentives. This structure supports budgeting and aligns with roles where performance metrics are less directly tied to company revenue fluctuations.

Profit-Sharing: How It Works in Modern Companies

Profit-sharing in modern companies allocates a portion of net profits to employees, aligning their interests with overall business success and boosting motivation and retention. This incentive model often uses clear formulas based on individual or team performance metrics tied to company profitability, ensuring transparency and fairness. By distributing varying shares according to contribution, profit-sharing fosters a collaborative culture that drives innovation and sustainable growth.

Motivation and Productivity: Comparing Incentive Impacts

Fixed salary provides employees with financial stability and predictable income, which can reduce stress and support consistent performance. Profit-sharing aligns employees' interests with company success, fostering motivation and encouraging higher productivity through direct rewards linked to business outcomes. Studies indicate that combining both strategies often results in optimal employee engagement and improved organizational performance.

Financial Stability: Fixed Salary vs Profit-Sharing

Fixed salary provides employees with consistent financial stability by guaranteeing regular income regardless of company performance, which supports predictable budgeting and reduces personal financial stress. Profit-sharing aligns employee incentives with company success, potentially increasing earnings during profitable periods but introduces income variability and uncertainty. Companies often balance these models to maintain employee motivation while ensuring dependable financial security.

Employee Retention and Engagement Factors

Fixed salary provides employees with financial stability and predictable income, enhancing job satisfaction and reducing turnover rates. Profit-sharing aligns employee interests with company performance, fostering higher engagement, motivation, and a sense of ownership. Combining fixed salary with profit-sharing incentives optimizes retention by balancing security and performance-driven rewards.

Addressing Risk Tolerance in Compensation Plans

Fixed salary provides predictable income that reduces financial risk for employees, appealing to those with low risk tolerance. Profit-sharing aligns employee incentives with company performance but introduces variable compensation, suitable for individuals willing to accept income fluctuations. Designing compensation plans that balance stable base pay with performance-based rewards can effectively address diverse risk preferences among staff.

Industry Trends: Popularity of Fixed Salary vs Profit-Sharing

Industry trends reveal a steady preference for fixed salary structures in established sectors such as finance and healthcare, providing employees with predictable income and stability. Conversely, tech startups and sales-driven companies increasingly adopt profit-sharing models to align employee incentives with company performance, enhancing motivation and retention. Hybrid compensation approaches also gain traction, combining fixed salary guarantees with profit-sharing bonuses to balance security and reward.

Selecting the Right Incentive Model for Your Organization

Selecting the right incentive model depends on your organization's goals, culture, and financial stability. Fixed salary provides predictable costs and steady income for employees, fostering security and consistent performance. Profit-sharing aligns employee interests with company success, motivating innovation and productivity but introduces variable expenses tied to profit fluctuations.

Future Outlook: Evolving Incentive Practices in the Workplace

Future workplace incentive practices are shifting towards hybrid models that combine fixed salaries with profit-sharing schemes to enhance employee engagement and retention. Data from recent studies indicates companies adopting profit-sharing report up to 25% higher productivity and stronger alignment with corporate goals. As transparency and performance metrics evolve, flexible compensation structures are expected to become standard for motivating diverse workforce generations.

Related Important Terms

Profit Pooling

Profit pooling aligns employee incentives with company performance by distributing a portion of net profits among staff, fostering a culture of ownership and motivation. This approach often leads to increased productivity and retention compared to fixed salaries, which provide stable but uninspired compensation unrelated to business outcomes.

Phantom Equity

Phantom Equity offers an alternative to fixed salary by providing employees with profit-sharing incentives tied to company performance without actual equity dilution, aligning individual goals with long-term business growth. This form of incentive enhances retention and motivation by simulating ownership benefits while maintaining cash flow stability for the company.

Deferred Profit Sharing Plan (DPSP)

A Deferred Profit Sharing Plan (DPSP) allows companies to share profits with employees by contributing a portion of their earnings into a retirement savings account, enhancing long-term financial security beyond fixed salary structures. This incentive aligns employee interests with company performance, encouraging productivity while deferring tax liabilities until withdrawal.

Salary Plus Commission Blend

A Salary Plus Commission blend combines the stability of a fixed salary with the performance-driven benefits of profit-sharing, aligning employee motivation with company profitability. This compensation structure enhances employee retention by providing a guaranteed income while incentivizing higher sales or performance through commission-based bonuses.

Gainsharing

Gainsharing aligns employee incentives with company performance by distributing financial rewards based on measurable improvements, promoting a culture of collaboration and productivity beyond fixed salary structures. Unlike traditional profit-sharing, Gainsharing provides more frequent, transparent payouts tied directly to operational metrics, enhancing motivation and engagement.

Dynamic Compensation Structuring

Fixed salary ensures predictable income by providing employees with a stable base pay, fostering financial security and consistent motivation. Profit-sharing aligns employee incentives with company performance, driving engagement and productivity through dynamic compensation that adapts to business success.

Revenue-based Remuneration

Revenue-based remuneration aligns employee incentives with company performance by linking compensation directly to generated sales, motivating increased productivity and growth. Fixed salary provides predictability and financial stability, but may lack the dynamic motivation that profit-sharing models driven by revenue generation offer.

Vesting-Based Profit Allocation

Vesting-based profit allocation ties employee earnings to company performance over a specified period, motivating sustained contribution and loyalty by granting profit-sharing rights incrementally. This system contrasts with fixed salary models by aligning compensation directly with business success, fostering long-term commitment and reducing turnover.

Performance-Linked Share Plan (PLSP)

Performance-Linked Share Plans (PLSP) align employee incentives with company success by offering equity-based rewards tied directly to performance metrics, contrasting with fixed salaries that provide consistent but static compensation. By integrating PLSP, companies foster long-term commitment and drive higher productivity through shared ownership, enhancing motivation beyond traditional fixed salary structures.

Hybrid Fixed-Variable Pay

Hybrid fixed-variable pay combines a stable fixed salary with performance-based profit-sharing, aligning employee incentives with company profitability while ensuring financial security. This approach optimizes motivation and retention by balancing guaranteed income and rewards tied to business success.

Fixed Salary vs Profit-Sharing for company incentives. Infographic

hrdif.com

hrdif.com