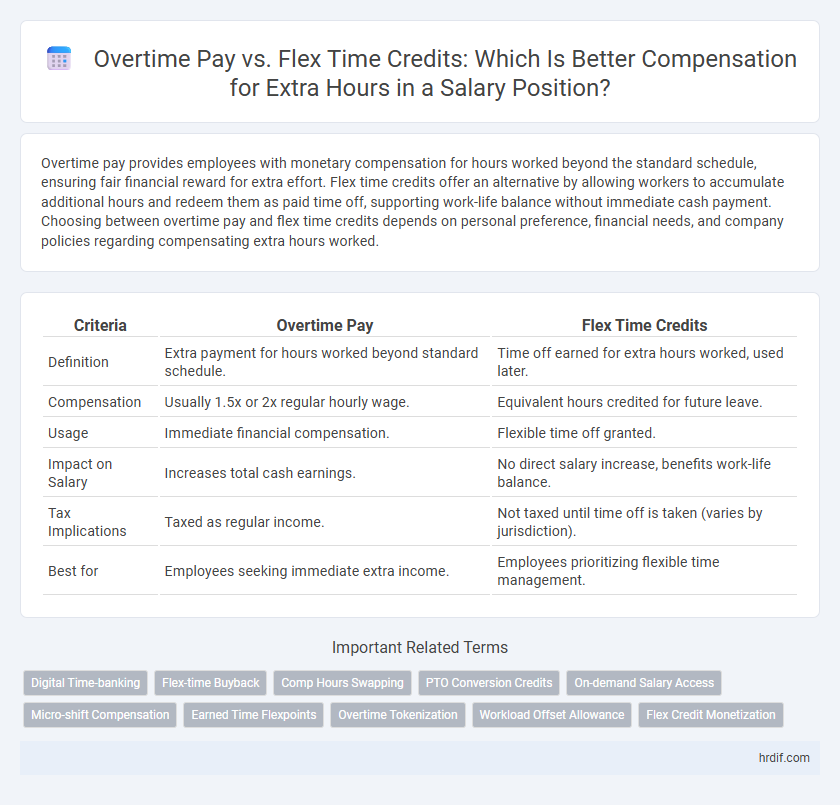

Overtime pay provides employees with monetary compensation for hours worked beyond the standard schedule, ensuring fair financial reward for extra effort. Flex time credits offer an alternative by allowing workers to accumulate additional hours and redeem them as paid time off, supporting work-life balance without immediate cash payment. Choosing between overtime pay and flex time credits depends on personal preference, financial needs, and company policies regarding compensating extra hours worked.

Table of Comparison

| Criteria | Overtime Pay | Flex Time Credits |

|---|---|---|

| Definition | Extra payment for hours worked beyond standard schedule. | Time off earned for extra hours worked, used later. |

| Compensation | Usually 1.5x or 2x regular hourly wage. | Equivalent hours credited for future leave. |

| Usage | Immediate financial compensation. | Flexible time off granted. |

| Impact on Salary | Increases total cash earnings. | No direct salary increase, benefits work-life balance. |

| Tax Implications | Taxed as regular income. | Not taxed until time off is taken (varies by jurisdiction). |

| Best for | Employees seeking immediate extra income. | Employees prioritizing flexible time management. |

Understanding Overtime Pay: Key Concepts

Overtime pay compensates employees at a higher rate, typically 1.5 times their regular hourly wage, for hours worked beyond the standard 40-hour workweek, ensuring fair compensation for extended labor. Flex time credits allow employees to earn time off instead of immediate extra pay, providing flexibility in work schedules while balancing productivity and personal time management. Understanding the legal requirements and company policies governing both overtime pay and flex time credits is essential for maximizing benefits and ensuring compliance.

What Are Flex Time Credits?

Flex time credits are a system where employees earn compensatory time off for extra hours worked instead of receiving immediate overtime pay. These credits accumulate and can be used to take paid time off at a later date, promoting work-life balance and flexible scheduling. Unlike overtime pay, which is monetary compensation typically calculated at 1.5 times the hourly rate, flex time credits provide time flexibility rather than direct financial gain.

Legal Framework: Overtime vs Flex Time

Overtime pay is mandated by labor laws such as the Fair Labor Standards Act (FLSA), requiring employers to compensate eligible employees at a rate of 1.5 times their regular pay for hours worked beyond 40 in a workweek. Flex time credits, however, are governed by employer-specific policies and may not be covered under federal overtime regulations, as they offer compensatory time off instead of monetary payment. Legal frameworks vary by jurisdiction, but overtime pay remains the predominant legal requirement for extra hours, whereas flex time credits depend largely on collective bargaining agreements or company discretion.

Financial Impact: Overtime Pay vs Flex Time Credits

Overtime pay directly increases an employee's immediate earnings by compensating extra hours at a higher rate, often 1.5 times the regular hourly wage, resulting in a clear financial gain. Flex time credits offer employees time-off alternatives instead of cash, which can provide long-term value in work-life balance but lack the immediate monetary benefit of overtime pay. Employers and employees must weigh the immediate financial boost of overtime pay against the potential savings in paid time-off and reduced burnout that flex time credits can offer.

Employee Preferences: Cash or Time Off?

Employees often prefer overtime pay for immediate financial reward, valuing the cash boost that directly supplements their income. Conversely, some prioritize flex time credits, appreciating the opportunity to trade extra hours worked for additional time off to improve work-life balance. Understanding these preferences helps employers tailor compensation strategies to enhance employee satisfaction and retention.

Pros and Cons of Overtime Pay

Overtime pay offers clear financial benefits by compensating employees at a higher hourly rate, typically 1.5 times their regular wage, which can significantly boost income for extra hours worked. However, it can lead to increased labor costs for employers and may reduce scheduling flexibility for employees compared to flex time credits. The potential for burnout and work-life imbalance is a notable drawback, as overtime often requires working beyond standard hours without the compensatory flexibility that flex time provides.

Pros and Cons of Flex Time Credits

Flex time credits offer employees greater control over their work-life balance by allowing flexibility in managing extra hours without immediate financial compensation. Unlike overtime pay, which provides direct monetary rewards for additional work, flex time credits may lead to reduced immediate income but enhance long-term time off opportunities. Employers benefit from flex time by promoting employee satisfaction and reducing burnout, though tracking and redeeming credits can be administratively complex.

Employer Considerations: Cost and Compliance

Employers must balance the financial impact of overtime pay, which legally mandates higher hourly rates for extra hours, against the use of flex time credits that offer scheduling flexibility without immediate cash expenses. Compliance with labor laws such as the Fair Labor Standards Act (FLSA) requires precise tracking of hours to avoid costly violations and penalties. Strategic implementation of flex time can reduce payroll costs but demands rigorous record-keeping to ensure that accrued hours do not inadvertently trigger overtime pay obligations.

Best Practices for Managing Extra Hours

Overtime pay ensures employees receive fair compensation for hours worked beyond their standard schedule, aligned with labor laws and company policies. Flex time credits offer an alternative by allowing workers to accumulate extra hours for future time off, promoting work-life balance without immediate payroll impact. Effective management of extra hours requires clear communication, accurate tracking systems, and adherence to legal standards to optimize employee satisfaction and operational efficiency.

Choosing the Right Approach for Your Career

When managing extra hours, choosing between overtime pay and flex time credits depends on your career goals and financial needs. Overtime pay offers immediate monetary compensation for additional hours worked, which benefits those prioritizing income growth. Flex time credits allow accumulated hours to be used as paid time off, appealing to professionals valuing work-life balance and flexible scheduling.

Related Important Terms

Digital Time-banking

Overtime pay typically provides monetary compensation for extra hours worked above the standard schedule, while flex time credits allow employees to accumulate digital time-banking hours redeemable for future leave. Digital time-banking systems optimize workforce management by tracking accrued flex hours with precision, offering greater flexibility and cash flow advantages compared to traditional overtime compensation.

Flex-time Buyback

Flex-time buyback allows employees to convert accrued flex hours into direct monetary compensation, providing a flexible alternative to traditional overtime pay and enhancing cash flow without extending work hours. Companies implementing flex-time buyback often see improved workforce satisfaction and financial efficiency by offering employees control over extra hours' compensation.

Comp Hours Swapping

Overtime pay compensates employees with additional wages for hours worked beyond standard shifts, while flex time credits allow workers to accrue compensatory time off for extra hours through comp hours swapping. Comp hours swapping enables employees to exchange overtime for flexible leave, optimizing work-life balance without immediate monetary compensation.

PTO Conversion Credits

Overtime pay compensates employees with extra wages for hours worked beyond the standard schedule, while flex time credits allow earned extra hours to be converted into paid time off (PTO), providing greater work-life balance flexibility. PTO conversion credits enable staff to bank accrued overtime as paid leave, helping businesses manage labor costs and enhance employee satisfaction without immediate payroll increases.

On-demand Salary Access

Overtime pay provides immediate financial compensation for extra hours worked, whereas flex time credits allow employees to accumulate hours for future time off, optimizing work-life balance. On-demand salary access enhances this by enabling workers to access earned wages before the traditional payday, improving cash flow without waiting for overtime or flex time accruals.

Micro-shift Compensation

Micro-shift compensation often balances overtime pay and flex time credits by awarding employees additional pay for extra hours worked beyond their standard shift or allowing flexible time off as compensation. Employers leveraging micro-shifts in workforce scheduling optimize labor costs while ensuring compliance with labor laws governing overtime pay rates and flex time accrual policies.

Earned Time Flexpoints

Earned Time Flexpoints provide employees with flexible compensation for extra hours worked, allowing them to accrue time off instead of receiving immediate overtime pay. This system enhances work-life balance by converting overtime hours into valuable leave credits rather than direct cash payments.

Overtime Tokenization

Overtime tokenization transforms extra work hours into digital tokens that employees can redeem for pay or flex time credits, maximizing compensation flexibility. This innovative system enhances transparency by accurately tracking and converting overtime hours, ensuring fair labor compensation aligned with company policies and labor laws.

Workload Offset Allowance

Workload Offset Allowance provides employees with flexible compensation options for extra hours worked, allowing them to choose between overtime pay or accumulating flex time credits. This system enhances workforce productivity by offering a balanced approach to managing additional workload while maintaining employee satisfaction.

Flex Credit Monetization

Flex time credits accumulate as paid time off but can also be monetized in many companies, allowing employees to convert unused flex hours into direct salary payments or bonuses. This option provides a flexible compensation alternative to traditional overtime pay, enhancing employee financial benefits while optimizing company payroll expenses.

Overtime Pay vs Flex Time Credits for extra hours. Infographic

hrdif.com

hrdif.com