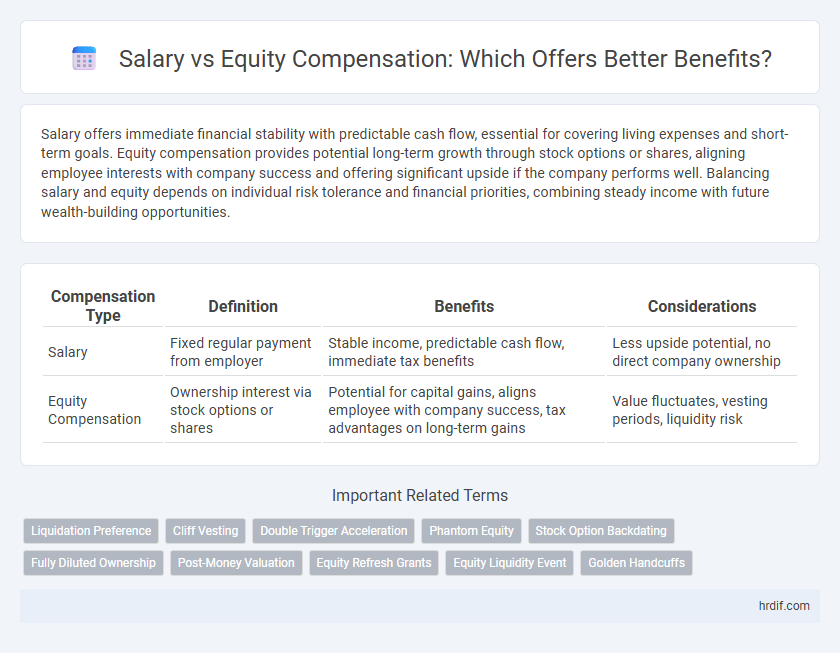

Salary offers immediate financial stability with predictable cash flow, essential for covering living expenses and short-term goals. Equity compensation provides potential long-term growth through stock options or shares, aligning employee interests with company success and offering significant upside if the company performs well. Balancing salary and equity depends on individual risk tolerance and financial priorities, combining steady income with future wealth-building opportunities.

Table of Comparison

| Compensation Type | Definition | Benefits | Considerations |

|---|---|---|---|

| Salary | Fixed regular payment from employer | Stable income, predictable cash flow, immediate tax benefits | Less upside potential, no direct company ownership |

| Equity Compensation | Ownership interest via stock options or shares | Potential for capital gains, aligns employee with company success, tax advantages on long-term gains | Value fluctuates, vesting periods, liquidity risk |

Understanding Salary Compensation Benefits

Salary compensation provides employees with a predictable and stable income, essential for budgeting and financial planning. It often includes additional benefits such as health insurance, retirement contributions, and paid time off, directly enhancing overall financial security. Understanding the trade-offs between salary and equity compensation helps employees evaluate immediate cash flow versus potential long-term wealth accumulation.

What is Equity Compensation?

Equity compensation refers to non-cash pay that represents ownership in a company, often granted through stock options, restricted stock units (RSUs), or employee stock purchase plans (ESPPs). This form of compensation aligns employee interests with company performance by offering potential financial gains tied to stock value appreciation. Unlike salary, equity compensation can provide substantial benefits if the company's market valuation increases over time, creating long-term wealth opportunities.

Comparing Salary and Equity: Key Differences

Salary provides consistent, predictable income with immediate cash flow and fixed tax obligations, whereas equity compensation offers potential for long-term financial gains through stock value appreciation tied to company performance. Salary benefits include stability and straightforward tax treatment, while equity can align employee incentives with company success but involves valuation risk and potential liquidity constraints. Understanding these key differences helps individuals balance immediate needs against future growth opportunities in total compensation packages.

Financial Stability: Salary vs. Equity

A fixed salary provides immediate financial stability through predictable income and consistent cash flow, essential for managing daily expenses and long-term financial planning. Equity compensation, while potentially lucrative, carries inherent market risks and lacks guaranteed value, often subjecting employees to stock price volatility and liquidity constraints. Balancing salary with equity allows individuals to secure stable earnings while participating in a company's growth and capital appreciation.

Long-Term Value: Evaluating Equity Benefits

Equity compensation provides long-term value by aligning employee interests with company growth, often yielding significant financial returns if the company performs well. Unlike salary, which offers immediate and predictable income, equity offers potential upside through stock appreciation and dividends over time. Employees must weigh the risk and reward of equity benefits against the stability of a fixed salary when evaluating total compensation packages.

Tax Implications: Salary Versus Equity

Salary is subject to regular income tax and payroll taxes at the time of payment, providing predictable tax obligations, whereas equity compensation such as stock options or restricted stock units can defer tax liability until the shares are sold or vested. Capital gains tax rates often apply to equity compensation upon sale, which may be lower than ordinary income tax rates, offering potential tax advantages. Understanding the timing and type of equity awards is essential for optimizing tax outcomes between salary and equity compensation.

Risk Factors in Equity Compensation

Equity compensation carries significant risk factors, including market volatility that can drastically affect the value of stock options or shares granted. Unlike fixed salary, equity is subject to company performance and liquidity constraints, which may result in uncertain or delayed financial benefits. Employees must carefully assess potential dilution, vesting schedules, and tax implications before relying on equity as a major component of their compensation.

Salary and Equity: Choosing the Right Mix

Balancing salary and equity compensation requires evaluating immediate financial needs against long-term growth potential. Salary offers guaranteed income and stability, while equity provides ownership stakes that may appreciate significantly over time. Optimizing benefits involves aligning salary security with equity's upside to suit both risk tolerance and career goals.

Impact on Career Growth and Retention

Salary provides immediate financial stability essential for meeting day-to-day expenses and is a key factor in employee retention, especially for those prioritizing consistent income. Equity compensation, such as stock options or restricted stock units, aligns employee interests with company performance and can significantly enhance long-term wealth, fostering deeper engagement and loyalty. Combining competitive salary packages with meaningful equity offers a balanced approach that supports both career growth and sustained employee commitment.

Negotiation Strategies: Maximizing Total Compensation

Negotiation strategies for maximizing total compensation should balance salary and equity by clearly understanding market salary benchmarks and the potential value of equity grants. Emphasizing the growth prospects and vesting schedules of stock options or RSUs can enhance leverage in discussions. Prioritizing a mix that aligns with personal financial goals and risk tolerance ensures optimal benefits beyond base pay.

Related Important Terms

Liquidation Preference

Liquidation preference in equity compensation ensures investors recoup their investment before common shareholders during a sale, offering protection not present in salary-based benefits. Unlike guaranteed cash salary, equity with liquidation preference can provide significant upside in exit events but carries higher risk due to variability in liquidity timing and amount.

Cliff Vesting

Cliff vesting in equity compensation ensures employees earn full ownership of stock options only after a specified period, reducing the risk compared to immediate salary payouts. This structure aligns long-term incentives with company performance, offering potential financial benefits beyond fixed salary but with delayed access to rewards.

Double Trigger Acceleration

Double Trigger Acceleration in equity compensation unlocks stock options upon a change of control combined with termination, enhancing employee financial security beyond salary alone. This mechanism ensures employees receive both their salary and accelerated equity benefits during mergers or acquisitions, aligning long-term incentives with immediate financial protection.

Phantom Equity

Phantom equity offers employees potential financial upside akin to stock ownership without actual shares, providing long-term incentive benefits alongside a steady salary. This form of equity compensation aligns employee interests with company performance while preserving cash flow, unlike traditional salary increases that impact immediate payroll expenses.

Stock Option Backdating

Stock option backdating manipulates the grant date to a lower stock price, artificially increasing the value of equity compensation compared to a transparent salary package. This practice can distort the perceived benefits of equity versus salary, impacting tax liabilities and investor trust.

Fully Diluted Ownership

Salary provides immediate, guaranteed income, while equity compensation offers potential long-term gains through fully diluted ownership, which accounts for all outstanding shares including options and convertible securities. Evaluating benefits requires understanding the impact of stock dilution on equity value and the stability of consistent salary payments.

Post-Money Valuation

Salary offers immediate, guaranteed income, while equity compensation aligns employee incentives with the company's growth, potentially yielding significant returns based on post-money valuation. A high post-money valuation can substantially increase the value of equity grants, making them an attractive benefit for long-term wealth creation compared to fixed salary.

Equity Refresh Grants

Equity refresh grants provide ongoing ownership incentives by awarding additional stock options or restricted stock units to employees, aligning their interests with long-term company performance beyond the initial compensation package. These grants often supplement base salary, enhancing total compensation value and retaining key talent through sustained equity participation.

Equity Liquidity Event

Equity compensation offers significant upside potential through a liquidity event such as an IPO or acquisition, often resulting in substantial financial gains beyond a fixed salary. While salary provides steady cash flow and immediate benefits, equity aligns employee incentives with company growth and long-term wealth creation during the liquidity event.

Golden Handcuffs

Equity compensation often creates "golden handcuffs" by incentivizing employees to remain with a company longer due to vested stock options or restricted shares, potentially outweighing the appeal of immediate salary increases. While salary provides consistent cash flow, equity benefits can lead to substantial financial gains over time, aligning employee interests with company performance and retention strategies.

Salary vs Equity Compensation for benefits. Infographic

hrdif.com

hrdif.com