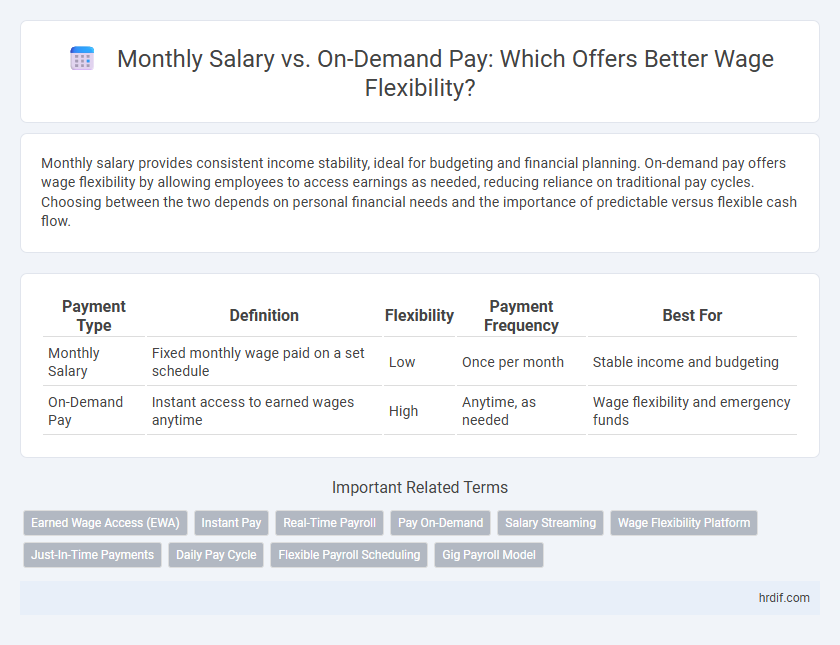

Monthly salary provides consistent income stability, ideal for budgeting and financial planning. On-demand pay offers wage flexibility by allowing employees to access earnings as needed, reducing reliance on traditional pay cycles. Choosing between the two depends on personal financial needs and the importance of predictable versus flexible cash flow.

Table of Comparison

| Payment Type | Definition | Flexibility | Payment Frequency | Best For |

|---|---|---|---|---|

| Monthly Salary | Fixed monthly wage paid on a set schedule | Low | Once per month | Stable income and budgeting |

| On-Demand Pay | Instant access to earned wages anytime | High | Anytime, as needed | Wage flexibility and emergency funds |

Overview: Monthly Salary Versus On-Demand Pay

Monthly salary provides stable, predictable income that supports long-term financial planning and consistent budget management. On-demand pay offers wage flexibility by allowing employees to access earned wages before the traditional payday, reducing financial stress and improving cash flow. Choosing between monthly salary and on-demand pay depends on individual cash flow needs and preference for income stability versus immediate access to earnings.

Comparing Wage Flexibility: Traditional vs. Modern Payment Models

Monthly salary provides workers with predictable income and financial stability, supporting long-term budgeting and expense management. On-demand pay offers immediate access to earned wages, enhancing wage flexibility by allowing employees to address urgent financial needs without waiting for a traditional payday. Modern payment models improve cash flow control and reduce reliance on credit, contrasting with the fixed structure of traditional monthly salaries.

Financial Security: Monthly Paychecks and Their Stability

Monthly salary provides consistent income, allowing employees to plan budgets and meet recurring expenses with financial predictability. This stability fosters long-term financial security by reducing income volatility and enabling steady savings growth. On-demand pay offers flexibility but may lack the reliable foundation necessary for managing essential bills and financial obligations.

Instant Access: The Rise of On-Demand Pay Solutions

On-demand pay solutions empower employees with instant access to earned wages, enhancing financial flexibility and reducing reliance on traditional pay cycles. This immediate availability helps workers manage unexpected expenses and avoid high-interest loans, promoting better financial stability. Employers adopting on-demand pay report increased employee satisfaction and retention, highlighting its growing significance in the modern workforce.

Budgeting Challenges: Fixed Salary vs. Pay-As-You-Go

Monthly salary provides predictable income streams that simplify budgeting by ensuring consistent cash flow, allowing individuals to plan expenses and savings accurately. In contrast, on-demand pay introduces variability that can complicate financial planning, as income fluctuates based on hours worked or tasks completed, making it harder to forecast monthly expenses. Balancing these payment structures requires strategic management of resources to accommodate periods of high or low earnings.

Employee Preferences: Which Payment Model Do Workers Favor?

Employees increasingly favor on-demand pay over traditional monthly salary due to the flexibility it offers in managing cash flow and unexpected expenses. Studies show that 65% of workers prefer access to earned wages before the standard payday, improving financial well-being and reducing reliance on high-interest loans. Organizations adopting on-demand pay report higher employee satisfaction and retention, indicating a strong shift in worker preference toward wage flexibility.

Impact on Workforce Retention and Productivity

Monthly salary provides employees with financial stability and predictability, which enhances overall job satisfaction and loyalty, leading to higher workforce retention. On-demand pay offers wage flexibility that addresses immediate financial needs, reducing stress and absenteeism, thus boosting productivity. Combining both compensation methods can create a balanced approach that supports employee well-being and sustained organizational performance.

Employer Considerations: Costs and Compliance

Employers must evaluate the cost implications of monthly salary versus on-demand pay, considering administrative expenses and cash flow management. Compliance with labor laws requires adherence to minimum wage regulations, timely wage payments, and accurate record-keeping regardless of the pay structure. Implementing flexible wage options demands robust payroll systems to mitigate risks of wage disputes and ensure regulatory compliance.

Industry Trends Shaping Salary and Wage Flexibility

Industry trends reveal a growing shift towards on-demand pay as companies seek to enhance wage flexibility and employee satisfaction. Monthly salary structures are increasingly complemented by on-demand payment options to address fluctuating financial needs and improve cash flow for workers. This hybrid approach aligns with evolving workforce demands and promotes competitive compensation strategies in dynamic labor markets.

Choosing the Right Pay Structure for Your Organization

Selecting the optimal pay structure depends on balancing employee preferences with operational cash flow needs. Monthly salary offers financial stability and predictable budgeting, while on-demand pay provides wage flexibility that can boost employee satisfaction and reduce turnover. Organizations should analyze workforce demographics and cash flow patterns to determine the most effective compensation model.

Related Important Terms

Earned Wage Access (EWA)

Earned Wage Access (EWA) offers employees immediate access to their earned income before the traditional monthly salary payout, enhancing wage flexibility and reducing financial stress. This on-demand pay model allows workers to manage unexpected expenses without waiting for the monthly paycheck, promoting better financial well-being and retention.

Instant Pay

Instant Pay offers wage flexibility by allowing employees to access earned wages before the traditional monthly salary date, reducing financial stress and improving cash flow management. Unlike fixed monthly salaries, on-demand pay systems provide real-time access to earned income, supporting better budgeting and urgent expense coverage.

Real-Time Payroll

Real-time payroll enables employees to access earned wages instantly, enhancing financial flexibility beyond traditional monthly salary schedules. On-demand pay reduces reliance on fixed pay cycles, empowering workers to manage cash flow and meet unexpected expenses efficiently.

Pay On-Demand

On-demand pay offers employees immediate access to earned wages, enhancing financial flexibility and reducing the need for high-interest loans. Unlike fixed monthly salaries, pay on-demand adapts to individual cash flow needs, improving overall financial wellness and job satisfaction.

Salary Streaming

Salary streaming offers workers wage flexibility by allowing them to access earned income on-demand rather than waiting for a fixed monthly salary. This system enhances financial stability and reduces reliance on high-cost loans by providing real-time access to earned wages.

Wage Flexibility Platform

Wage flexibility platforms enable employees to access on-demand pay, allowing greater control over cash flow compared to traditional monthly salary schedules. This system reduces financial stress by offering real-time access to earned wages, enhancing overall employee satisfaction and retention.

Just-In-Time Payments

Just-in-time payments offer workers greater wage flexibility by providing access to earned income immediately, unlike traditional monthly salary structures that impose fixed pay schedules. This on-demand pay model enhances financial well-being by allowing employees to manage cash flow effectively and respond promptly to unexpected expenses.

Daily Pay Cycle

A daily pay cycle provides unmatched wage flexibility by allowing employees to access earnings immediately after work, contrasting with the fixed monthly salary model that delays income availability. This approach enhances cash flow management, reducing financial stress and supporting workers in meeting urgent expenses without waiting for traditional pay periods.

Flexible Payroll Scheduling

Flexible payroll scheduling enhances wage flexibility by allowing employees to choose between traditional monthly salary payments and on-demand pay options, improving financial control and reducing stress. Companies implementing on-demand pay solutions report increased employee satisfaction and retention, as workers access earned wages instantly without waiting for the monthly payroll cycle.

Gig Payroll Model

The gig payroll model enhances wage flexibility by allowing workers to choose between a predictable monthly salary and on-demand pay, which provides immediate access to earned income for better cash flow management. This approach caters to the diverse financial needs of gig economy workers, balancing stability with real-time earning access.

Monthly Salary vs On-Demand Pay for wage flexibility. Infographic

hrdif.com

hrdif.com