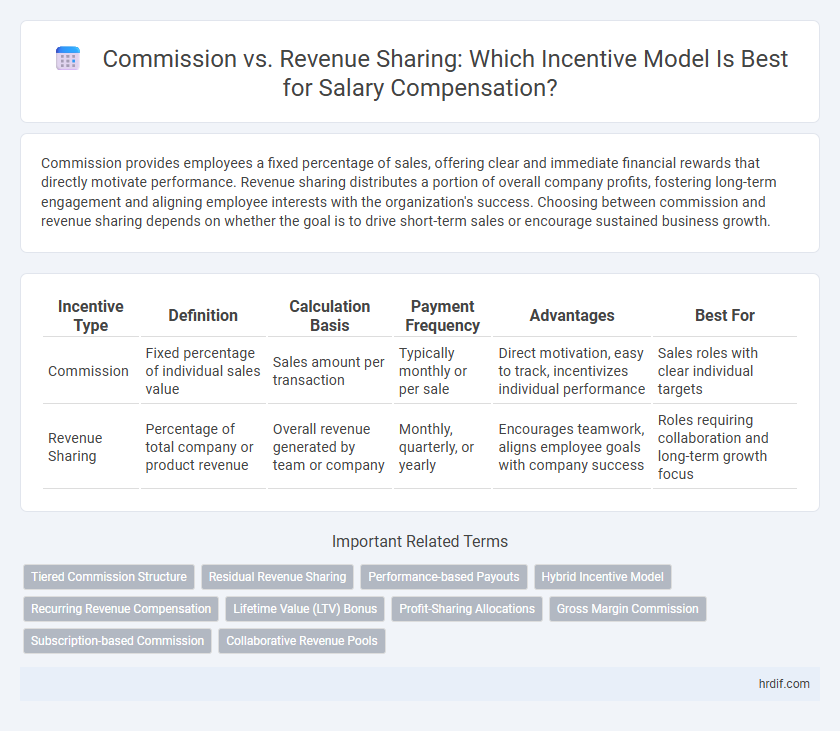

Commission provides employees a fixed percentage of sales, offering clear and immediate financial rewards that directly motivate performance. Revenue sharing distributes a portion of overall company profits, fostering long-term engagement and aligning employee interests with the organization's success. Choosing between commission and revenue sharing depends on whether the goal is to drive short-term sales or encourage sustained business growth.

Table of Comparison

| Incentive Type | Definition | Calculation Basis | Payment Frequency | Advantages | Best For |

|---|---|---|---|---|---|

| Commission | Fixed percentage of individual sales value | Sales amount per transaction | Typically monthly or per sale | Direct motivation, easy to track, incentivizes individual performance | Sales roles with clear individual targets |

| Revenue Sharing | Percentage of total company or product revenue | Overall revenue generated by team or company | Monthly, quarterly, or yearly | Encourages teamwork, aligns employee goals with company success | Roles requiring collaboration and long-term growth focus |

Understanding Commission-Based Incentives

Commission-based incentives directly link employee earnings to individual sales performance, typically calculated as a fixed percentage of each sale. This method motivates employees by providing immediate financial rewards proportional to their efforts, ensuring clarity and predictability in compensation. Unlike revenue sharing, commissions emphasize personal accountability and measurable outcomes, fostering a performance-driven sales culture.

What is Revenue Sharing in Compensation?

Revenue sharing in compensation involves distributing a percentage of a company's earnings to employees based on the overall sales or profits generated. This model aligns employee incentives with long-term business success by linking rewards to the company's total revenue performance rather than individual sales targets. Revenue sharing fosters teamwork and collective accountability, motivating employees to contribute to broader company growth.

Key Differences: Commission vs Revenue Sharing

Commission provides a fixed percentage of sales directly to the individual, creating a clear, performance-based reward tied to personal effort. Revenue sharing allocates a portion of overall company earnings to employees or partners, fostering collective investment and alignment with long-term business success. The key difference lies in commission rewarding direct sales impact, while revenue sharing emphasizes shared growth across the organization.

Benefits of Commission Structures for Employees

Commission structures provide employees with direct financial rewards tied to their individual sales performance, motivating higher productivity and goal achievement. These incentives often lead to increased earning potential compared to fixed salaries, fostering a performance-driven culture. Clear and immediate compensation feedback enhances employee satisfaction and retention in competitive sales environments.

Advantages of Revenue Sharing for Teams

Revenue sharing fosters collaboration by aligning individual goals with overall team performance, leading to increased collective motivation and productivity. It encourages long-term commitment and accountability as team members benefit directly from the company's sustained revenue growth. This approach minimizes internal competition, promoting a supportive environment that drives innovation and shared success.

Drawbacks of Commission-Based Incentives

Commission-based incentives often result in unpredictable income, creating financial instability for employees and reducing motivation during slow sales periods. This model can encourage aggressive selling tactics, potentially damaging customer relationships and long-term brand loyalty. Furthermore, commissions may overlook team collaboration, leading to internal competition rather than unified company growth.

Potential Pitfalls of Revenue Sharing Models

Revenue sharing models can create challenges such as unpredictable income streams due to fluctuating company performance, which may demotivate employees relying on consistent incentives. They also risk diluting individual accountability, as earnings depend on overall revenue rather than personal sales achievements. Complex calculations and delays in payments often lead to confusion and dissatisfaction among staff compared to straightforward commission structures.

Choosing the Right Incentive Program for Your Business

Choosing the right incentive program depends on your business goals: commission structures provide direct rewards based on individual sales, motivating personal performance and quick results, while revenue sharing fosters long-term collaboration by distributing profits among team members or partners, encouraging collective success. Analyzing sales cycles, team dynamics, and profit margins helps determine whether immediate sales growth or sustained partnership alignment drives better financial outcomes. Tailoring incentives to match business scale and employee motivation ensures optimal engagement and maximized revenue impact.

Industry Examples: Commission vs Revenue Sharing

Sales roles in the real estate industry often favor commission structures, enabling agents to earn a percentage of each property sold, directly aligning incentives with individual performance. In contrast, tech startups frequently implement revenue sharing models, distributing a portion of overall company income among employees to foster collective ownership and long-term growth. E-commerce businesses may combine both approaches, offering commissions on sales targets alongside profit-sharing plans to balance immediate rewards with sustained company success.

Future Trends in Employee Incentive Compensation

Commission-based incentives remain prevalent for sales roles, but future trends indicate a shift towards revenue sharing models to foster long-term employee engagement and company growth. Revenue sharing aligns employee interests with overall business performance, promoting sustainable motivation beyond individual sales targets. Emerging analytics tools enable personalized incentive plans that blend commission and revenue sharing, optimizing employee retention and productivity strategies.

Related Important Terms

Tiered Commission Structure

A tiered commission structure incentivizes sales performance by increasing commission rates as revenue targets are met, aligning employee motivation with company growth objectives. This approach contrasts with flat revenue sharing by rewarding higher achievement levels with progressively greater financial benefits, optimizing both employee engagement and overall sales output.

Residual Revenue Sharing

Commission structures typically offer one-time payments based on individual sales, while residual revenue sharing provides ongoing income proportional to the continued revenue generated by a client or product. Residual revenue sharing incentivizes long-term performance and aligns employee interests with sustained company growth, making it a preferred model for roles involving client retention and recurring services.

Performance-based Payouts

Commission offers direct performance-based payouts tied to individual sales volume, ensuring clear incentives for sales representatives. Revenue sharing distributes a percentage of overall company or team earnings, aligning incentives with long-term business growth and collaborative success.

Hybrid Incentive Model

The hybrid incentive model combines commission and revenue sharing to align employee performance with company profitability, offering fixed commission rates on individual sales alongside a percentage of overall revenue to encourage team collaboration. This approach enhances motivation by balancing immediate rewards with long-term business growth incentives, optimizing both personal productivity and collective success.

Recurring Revenue Compensation

Commission structures typically reward sales personnel based on individual transactions, while revenue sharing emphasizes ongoing participation in recurring revenue streams, encouraging long-term client relationships. Recurring revenue compensation models align incentives with subscription renewals and customer retention, driving sustained business growth.

Lifetime Value (LTV) Bonus

Commission structures directly reward sales performance based on individual deals, while revenue sharing allocates a percentage of ongoing income generated, fostering long-term engagement. Lifetime Value (LTV) Bonus programs align incentives with customer retention and lifetime profitability, encouraging sustained revenue growth beyond initial sales.

Profit-Sharing Allocations

Commission structures offer fixed percentages of sales revenue as direct incentives, while revenue sharing involves distributing a portion of overall profits, aligning employee motivation with company profitability. Profit-sharing allocations enhance financial transparency and foster long-term commitment by linking compensation to net earnings rather than gross sales.

Gross Margin Commission

Gross margin commission incentivizes employees by directly aligning their earnings with the profitability of sales, rewarding them proportionally to the difference between sales revenue and the cost of goods sold. This approach motivates a focus on cost-efficient sales strategies, contrasting with revenue sharing, which distributes a fixed percentage of total sales revenue without accounting for associated costs.

Subscription-based Commission

Subscription-based commission structures provide consistent, predictable income aligned with ongoing customer revenue, enhancing salesperson motivation and retention. Unlike revenue sharing, which distributes a percentage of overall profits, subscription commissions reward sustained sales performance tied directly to subscription renewals and client retention.

Collaborative Revenue Pools

Collaborative revenue pools integrate commission and revenue sharing models by distributing incentives based on collective team performance, promoting alignment with overall business goals. This approach enhances motivation across departments, balancing individual commissions with shared revenue benefits to drive sustainable growth.

Commission vs Revenue Sharing for incentive. Infographic

hrdif.com

hrdif.com