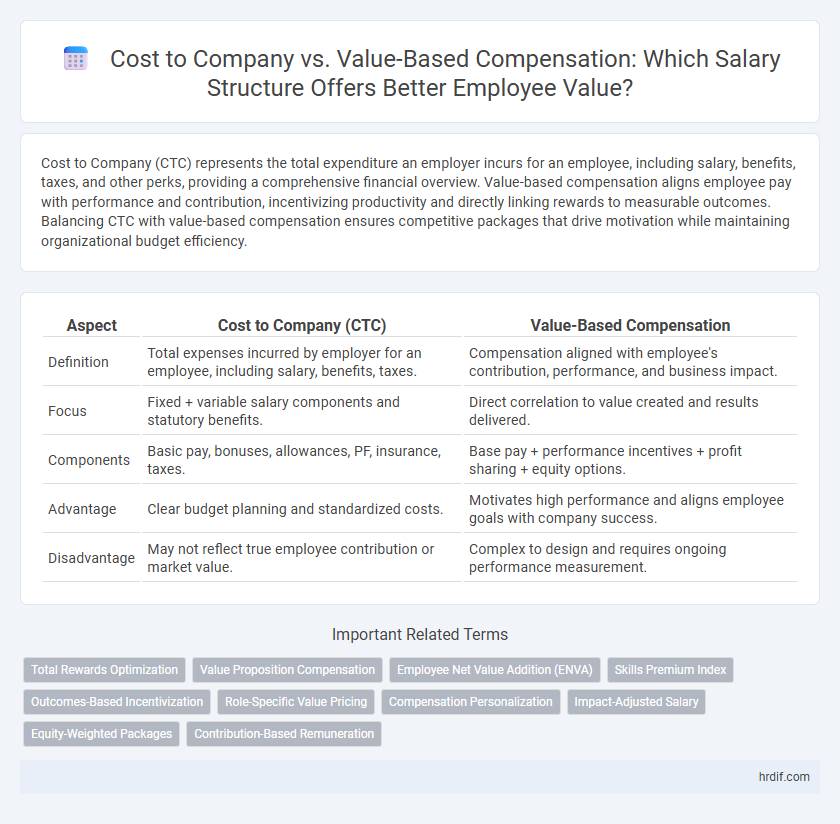

Cost to Company (CTC) represents the total expenditure an employer incurs for an employee, including salary, benefits, taxes, and other perks, providing a comprehensive financial overview. Value-based compensation aligns employee pay with performance and contribution, incentivizing productivity and directly linking rewards to measurable outcomes. Balancing CTC with value-based compensation ensures competitive packages that drive motivation while maintaining organizational budget efficiency.

Table of Comparison

| Aspect | Cost to Company (CTC) | Value-Based Compensation |

|---|---|---|

| Definition | Total expenses incurred by employer for an employee, including salary, benefits, taxes. | Compensation aligned with employee's contribution, performance, and business impact. |

| Focus | Fixed + variable salary components and statutory benefits. | Direct correlation to value created and results delivered. |

| Components | Basic pay, bonuses, allowances, PF, insurance, taxes. | Base pay + performance incentives + profit sharing + equity options. |

| Advantage | Clear budget planning and standardized costs. | Motivates high performance and aligns employee goals with company success. |

| Disadvantage | May not reflect true employee contribution or market value. | Complex to design and requires ongoing performance measurement. |

Understanding Cost to Company (CTC) in Employment Packages

Cost to Company (CTC) represents the total expense an employer incurs for hiring an employee, including salary, bonuses, benefits, taxes, and other perks. Unlike value-based compensation, which links pay to employee performance or value delivered, CTC provides a comprehensive figure reflecting the overall financial commitment by the company. Understanding CTC helps employees grasp the full monetary value of their employment package beyond just the take-home salary.

What is Value-Based Compensation?

Value-Based Compensation refers to a payment strategy where employee salaries and bonuses are tied to the measurable value they create for the company, rather than fixed costs or traditional salary bands. This model aligns compensation with individual performance, business outcomes, and market impact, promoting greater productivity and motivation. It contrasts with Cost to Company (CTC), which focuses on the total expenses incurred by the employer, including salary, benefits, and taxes, without directly linking pay to value contribution.

Comparing CTC and Value-Based Compensation Models

Cost to Company (CTC) represents the total monetary value an employer spends on an employee, including base salary, benefits, bonuses, and statutory contributions. Value-Based Compensation models link pay directly to employee performance and measurable contributions, promoting productivity and alignment with organizational goals. Comparing CTC and Value-Based Compensation reveals that while CTC provides a fixed, predictable expense for employers, value-based plans drive motivation and organizational value through performance incentives.

Key Components of a Cost to Company Package

Key components of a Cost to Company (CTC) package include the gross salary, employer contributions to provident fund, gratuity, health insurance, taxes, and any bonuses or incentives. This comprehensive figure represents the total expenditure an employer incurs on an employee annually, encompassing direct and indirect benefits. Understanding these elements helps employees evaluate the full financial value of their employment package beyond the base salary.

Benefits and Drawbacks of CTC-Based Packages

Cost to Company (CTC)-based packages offer a comprehensive view of total employee expenses, including salary, benefits, taxes, and other perks, providing transparency for both employers and employees. However, CTC may obscure the actual take-home pay due to variable deductions and can lead to misunderstandings about real compensation value. While beneficial for budgeting and tax purposes, CTC packages might lack flexibility in rewarding individual performance compared to value-based compensation models.

The Rise of Value-Based Compensation in Modern Workplaces

Value-based compensation has grown significantly in modern workplaces, prioritizing employee performance and impact over fixed salary structures. Cost to Company (CTC) frameworks emphasize total expenses incurred by employers, while value-based models align rewards with measurable contributions and organizational goals. This shift enhances talent motivation, retention, and drives a results-oriented culture essential for competitive industries.

How to Evaluate True Compensation Beyond Salary

Evaluating true compensation requires analyzing both Cost to Company (CTC) and value-based components such as bonuses, stock options, benefits, and professional development opportunities to gauge the overall employment package. Cost to Company includes direct salary, employer contributions to taxes, insurance, and retirement funds, providing a comprehensive financial picture of employee costs. Value-based compensation adds long-term growth potential and intangible benefits that often exceed base salary, making total remuneration a critical factor in employment decisions.

Impact on Employee Motivation: CTC vs Value-Based Pay

Cost to Company (CTC) offers a fixed, transparent salary structure that simplifies financial planning but may limit motivation by emphasizing total expense over individual contribution. Value-Based Compensation aligns pay with employee performance and business impact, fostering higher motivation through recognition and reward for tangible results. This performance-linked approach encourages continuous improvement and drives engagement more effectively than a static CTC model.

Negotiating Your Employment Package: Key Considerations

When negotiating your employment package, understanding the distinction between Cost to Company (CTC) and Value-Based Compensation is essential for maximizing financial benefits. CTC represents the total expense an employer incurs, including salary, bonuses, and benefits, while Value-Based Compensation aligns pay with individual performance and contribution to company goals. Emphasizing Value-Based Compensation can lead to more personalized and potentially higher earnings, making it crucial to quantify your impact and negotiate beyond fixed salary figures.

Future Trends in Employee Compensation Strategies

Future trends in employee compensation strategies emphasize a shift from traditional Cost to Company (CTC) models to value-based compensation systems that prioritize employee performance and contribution over fixed salary components. Companies increasingly adopt data-driven approaches to tailor compensation packages, integrating incentives aligned with business outcomes and employee growth potential. This evolution aims to enhance talent retention and motivation by linking rewards directly to the demonstrable value employees bring to the organization.

Related Important Terms

Total Rewards Optimization

Cost to Company (CTC) encapsulates the total monetary expense an employer incurs for an employee, including salary, benefits, taxes, and bonuses, while Value-Based Compensation aligns pay with employee performance and contribution to organizational goals. Optimizing Total Rewards involves balancing CTC transparency with value-driven incentives to enhance motivation, retention, and overall workforce effectiveness.

Value Proposition Compensation

Value-Based Compensation structures emphasize aligning employee rewards with individual and company performance metrics, driving motivation and productivity beyond fixed salary costs. This approach enhances the value proposition of employment packages by linking compensation directly to measurable outcomes and long-term organizational success.

Employee Net Value Addition (ENVA)

Cost to Company (CTC) quantifies the total expenses incurred by the employer, including salary, benefits, and taxes, while Value-Based Compensation aligns rewards with Employee Net Value Addition (ENVA), emphasizing the measurable impact an employee creates in driving organizational growth and profitability. Prioritizing ENVA in compensation models incentivizes performance, fosters accountability, and promotes a results-driven culture that directly correlates employee contributions with business value.

Skills Premium Index

Cost to Company (CTC) often reflects fixed salary components and standard benefits, while Value-Based Compensation aligns pay with employee output and strategic impact, measured effectively through the Skills Premium Index that quantifies wage differentials based on specialized skills demand. Employers leveraging the Skills Premium Index can optimize compensation packages to attract and retain high-value talent, ensuring pay structures are directly correlated with market-driven skill scarcity and organizational value creation.

Outcomes-Based Incentivization

Cost to Company (CTC) represents the total expenses an employer incurs for an employee, including salary, benefits, and taxes, while value-based compensation aligns pay with individual or team performance outcomes, driving productivity and goal attainment. Outcomes-based incentivization enhances employee motivation by directly linking rewards to measurable business results, fostering a performance-driven culture that optimizes overall organizational value.

Role-Specific Value Pricing

Role-specific value pricing in employment packages aligns compensation with the unique impact and contributions of an employee, enhancing Cost to Company (CTC) efficiency by directly correlating pay with job performance metrics and business outcomes. This approach prioritizes measurable value creation over traditional fixed salaries, driving motivation and optimizing talent investment.

Compensation Personalization

Cost to Company (CTC) represents the total expenditure an employer incurs for an employee, including salary, benefits, and taxes, while Value-Based Compensation aligns pay with employee performance and contribution to business outcomes. Personalizing compensation packages by integrating value-based metrics fosters employee motivation and retention, ensuring remuneration reflects individual impact rather than fixed costs.

Impact-Adjusted Salary

Impact-Adjusted Salary integrates performance metrics with traditional Cost to Company, reflecting both fixed costs and the employee's contribution to business outcomes. This value-based compensation model incentivizes productivity and aligns remuneration with measurable impact, enhancing overall organizational effectiveness.

Equity-Weighted Packages

Cost to Company (CTC) represents the total expenditure an employer incurs on an employee, including salary, benefits, and taxes, while Value-Based Compensation focuses on aligning remuneration with the employee's contribution and impact on company growth. Equity-weighted packages emphasize stock options or shares, enabling employees to benefit directly from the company's market valuation, thereby fostering long-term commitment and performance-driven rewards.

Contribution-Based Remuneration

Contribution-Based Remuneration emphasizes aligning employee compensation with individual and team performance outcomes rather than fixed Cost to Company figures, driving motivation and productivity. This performance-focused approach ensures salaries reflect real value added, fostering a meritocratic workplace where rewards correlate directly with measurable contributions.

Cost to Company vs Value-Based Compensation for employment packages. Infographic

hrdif.com

hrdif.com