Guaranteed salary provides consistent financial stability by offering a fixed income regardless of performance fluctuations, enabling employees to plan their expenses with confidence. Results-based pay can motivate higher productivity but introduces income variability, which may cause financial stress during periods of low performance. For those prioritizing financial security, a guaranteed salary offers a more dependable foundation compared to the unpredictability of performance-dependent earnings.

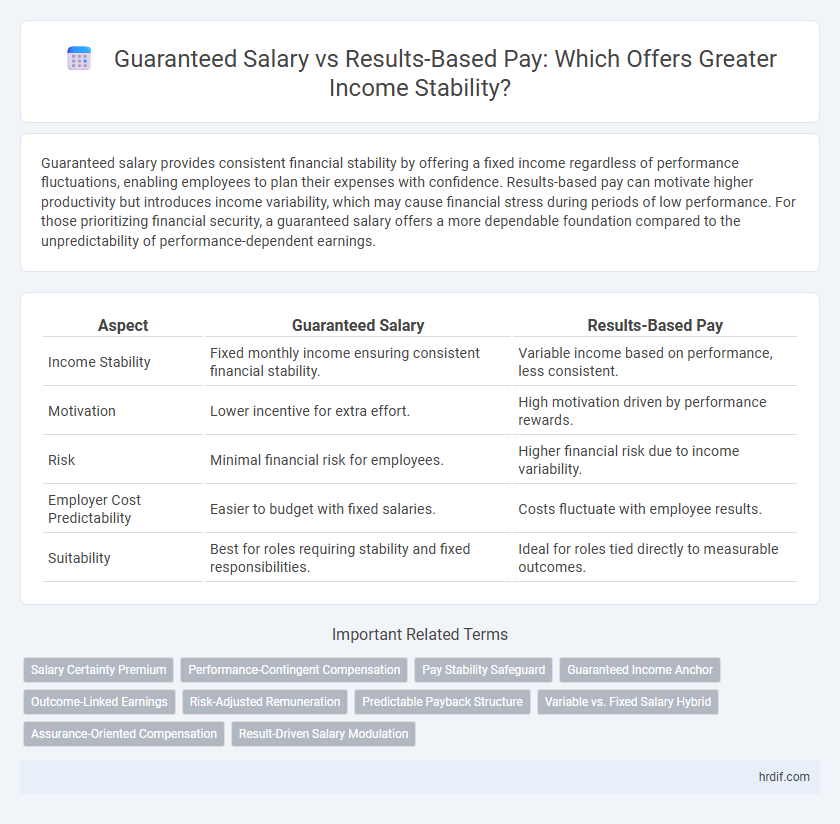

Table of Comparison

| Aspect | Guaranteed Salary | Results-Based Pay |

|---|---|---|

| Income Stability | Fixed monthly income ensuring consistent financial stability. | Variable income based on performance, less consistent. |

| Motivation | Lower incentive for extra effort. | High motivation driven by performance rewards. |

| Risk | Minimal financial risk for employees. | Higher financial risk due to income variability. |

| Employer Cost Predictability | Easier to budget with fixed salaries. | Costs fluctuate with employee results. |

| Suitability | Best for roles requiring stability and fixed responsibilities. | Ideal for roles tied directly to measurable outcomes. |

Understanding Guaranteed Salary and Results-Based Pay

Guaranteed salary provides employees with a fixed income regardless of performance, ensuring financial stability and predictable cash flow. Results-based pay ties compensation directly to individual or company performance, incentivizing productivity but introducing variability in earnings. Understanding the balance between these models helps businesses align employee motivation with financial security.

Key Differences Between Fixed Salaries and Performance Compensation

Fixed salaries offer predictable, consistent income regardless of individual or company performance, providing financial stability and easier budgeting for employees. Performance compensation ties earnings to measurable results, motivating higher productivity but introducing income variability and potential financial uncertainty. The primary distinction lies in risk allocation: fixed salaries shift risk to the employer, while results-based pay transfers income risk to the employee.

Financial Stability: How Guaranteed Salaries Provide Security

Guaranteed salaries offer employees consistent financial stability by ensuring a fixed income regardless of performance fluctuations. This predictability allows for easier budgeting and long-term financial planning, reducing stress related to income uncertainty. In contrast to results-based pay, guaranteed salaries minimize the risk of sudden income drops, fostering a secure economic environment for both employees and their families.

Income Fluctuations: Risks of Results-Based Pay

Guaranteed salary provides stable and predictable income, minimizing financial stress by eliminating income fluctuations common in results-based pay systems. Results-based pay exposes employees to income variability due to performance metrics, sales targets, or project outcomes, increasing financial risk during periods of underperformance. This instability can impact long-term financial planning, making guaranteed salary a preferred choice for those prioritizing consistent earnings and financial security.

Career Growth Opportunities in Both Models

Guaranteed salary provides consistent income stability, allowing professionals to focus on skill development and long-term career growth without financial stress. Results-based pay incentivizes high performance and can accelerate career advancement by rewarding exceptional achievements and productivity. Both models offer unique opportunities for career progression depending on individual work preferences and industry dynamics.

Employee Motivation: Security vs. Performance Pressure

Guaranteed salary provides employees with financial security, fostering motivation through stability and reduced stress about meeting targets. Results-based pay drives performance by directly linking compensation to achievements, increasing pressure but encouraging goal-oriented behavior. Balancing these models can optimize employee motivation by combining security with incentives for high performance.

Industry Trends: Which Sectors Prefer Each Model?

The technology and finance sectors predominantly favor results-based pay models to incentivize innovation and performance, while healthcare and education industries prioritize guaranteed salaries to ensure workforce stability and predictability. Manufacturing and public sector jobs often strike a balance, offering base salaries with performance bonuses to align stability with motivation. Emerging trends indicate a shift towards hybrid compensation models, blending guaranteed salaries and results-based incentives to attract diverse talent in competitive markets.

Employer Perspective: Predictability and Cost Control

Employers favor guaranteed salary for its predictability in budgeting fixed labor costs and simplifying financial forecasting. This approach minimizes fluctuations in payroll expenses, enabling more accurate cost control and resource allocation. Results-based pay introduces variability that can complicate financial planning and increase the risk of overpayment during peak performance periods.

Employee Satisfaction and Retention Rates

Guaranteed salary provides employees with financial stability, fostering higher satisfaction and reducing turnover rates by ensuring predictable income. Results-based pay can motivate performance but often leads to income uncertainty, which may decrease job satisfaction and increase employee attrition. Companies prioritizing retention benefit from guaranteed salaries that create a secure work environment, enhancing overall workforce loyalty.

Choosing the Right Pay Structure for Your Career Stability

Guaranteed salary offers consistent income that ensures financial stability regardless of performance fluctuations, making it ideal for professionals seeking predictability in their career. Results-based pay ties compensation directly to individual or company performance, which can motivate higher achievement but introduces income variability and potential financial uncertainty. Evaluating your risk tolerance, career goals, and industry norms is crucial when choosing between guaranteed salary and results-based pay to maintain long-term stability.

Related Important Terms

Salary Certainty Premium

Guaranteed salary offers employees a predictable income stream, enhancing financial stability and peace of mind compared to results-based pay, which fluctuates with performance outcomes. The Salary Certainty Premium reflects the added value workers place on consistent earnings, often outweighing potential variable bonuses tied to results.

Performance-Contingent Compensation

Performance-contingent compensation aligns employee earnings with individual or company outcomes, promoting motivation and productivity by directly linking pay to measurable results. While guaranteed salary offers financial stability, performance-based pay incentivizes higher performance, driving business growth and rewarding exceptional contributions.

Pay Stability Safeguard

Guaranteed salary provides a consistent income stream that ensures financial stability regardless of performance fluctuations, serving as a crucial pay stability safeguard. Results-based pay, while potentially more lucrative, can lead to income variability that may undermine long-term financial security.

Guaranteed Income Anchor

Guaranteed salary provides a stable income anchor that ensures predictable financial security regardless of performance fluctuations, making it ideal for maintaining consistent living standards and long-term financial planning. Results-based pay, while potentially more lucrative, introduces income variability that can undermine financial stability and increase stress during periods of inconsistent outcomes.

Outcome-Linked Earnings

Guaranteed salary provides financial stability through fixed monthly income regardless of performance, while results-based pay ties earnings directly to measurable outcomes, incentivizing higher productivity but introducing income variability. Outcome-linked earnings schemes balance risk and reward by aligning compensation with specific performance metrics, fostering motivation without sacrificing essential financial security.

Risk-Adjusted Remuneration

Guaranteed salary provides consistent income with minimal financial risk, ensuring stable cash flow regardless of performance fluctuations, while results-based pay aligns compensation with individual or company outcomes, introducing higher variability but potentially greater rewards. Risk-adjusted remuneration balances these approaches by factoring both stable baseline earnings and performance incentives, optimizing employee motivation while managing income volatility.

Predictable Payback Structure

Guaranteed salary ensures a predictable payback structure by providing consistent income regardless of performance fluctuations, enhancing financial stability and planning. Results-based pay introduces variability tied to individual or company performance, creating potential income instability but incentivizing higher productivity and achievement.

Variable vs. Fixed Salary Hybrid

A hybrid compensation model combines a fixed guaranteed salary with variable results-based pay to balance financial stability and performance incentives. This approach ensures consistent income while motivating employees through performance-linked bonuses, optimizing both security and productivity.

Assurance-Oriented Compensation

Assurance-oriented compensation prioritizes guaranteed salary structures to provide employees with financial stability and predictable income, reducing stress and fostering long-term commitment. Results-based pay, while incentivizing performance, can introduce income variability that challenges financial security for many workers.

Result-Driven Salary Modulation

Result-driven salary modulation aligns compensation with measurable performance metrics, enhancing employee motivation by directly linking pay to outcomes. This approach balances financial stability with incentives for productivity, fostering a dynamic work environment that prioritizes results over fixed guaranteed salaries.

Guaranteed Salary vs Results-Based Pay for stability. Infographic

hrdif.com

hrdif.com