Monthly salary provides consistent income and financial stability, making it ideal for employees who value predictable earnings and benefits. Gig pay offers flexibility by allowing workers to choose projects and work hours, appealing to those prioritizing autonomy and varied income sources. Evaluating personal financial needs and lifestyle preferences helps determine whether a steady paycheck or variable gig pay suits your work arrangement best.

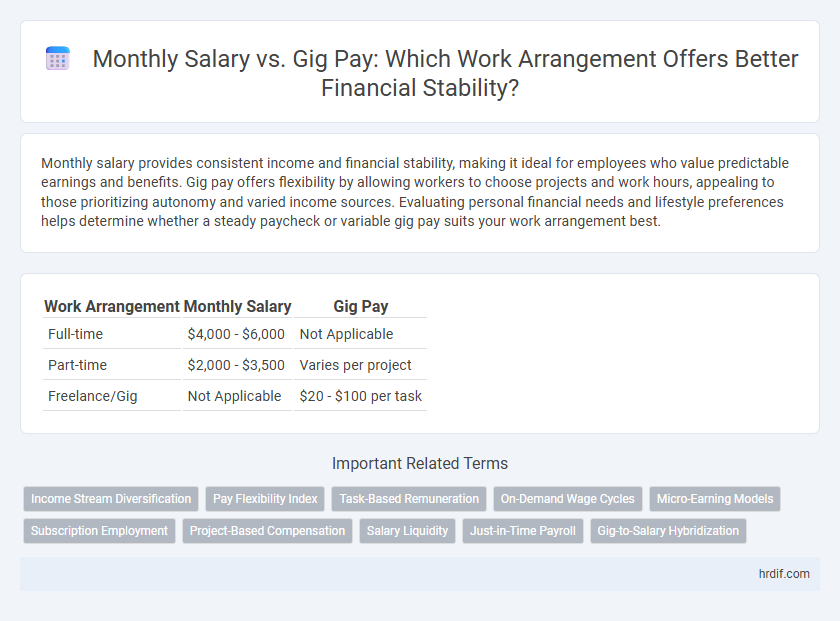

Table of Comparison

| Work Arrangement | Monthly Salary | Gig Pay |

|---|---|---|

| Full-time | $4,000 - $6,000 | Not Applicable |

| Part-time | $2,000 - $3,500 | Varies per project |

| Freelance/Gig | Not Applicable | $20 - $100 per task |

Understanding Monthly Salary and Gig Pay Structures

Monthly salary offers stable, predictable income with fixed payments and benefits, ideal for long-term financial planning and job security. Gig pay structures vary per project or task, providing flexibility but often lacking consistent earnings and employee benefits. Choosing between monthly salary and gig pay depends on individual preference for income stability versus work schedule autonomy.

Key Differences Between Monthly and Gig Payment Models

Monthly salary offers consistent income through a fixed payment schedule, providing financial stability and predictable budgeting for employees. In contrast, gig pay varies by project or task completion, offering greater flexibility but income unpredictability tied directly to workload and market demand. Key differences include income regularity, benefits eligibility, and control over work hours, with monthly salaries often including employer benefits and gig pay lacking such guarantees.

Financial Stability: Salary vs. Gig Income

Monthly salary provides consistent financial stability with predictable income and benefits such as health insurance and retirement contributions. Gig pay often fluctuates based on workload and demand, creating variable income that can challenge budgeting and financial planning. Prioritizing a steady monthly salary supports long-term financial security compared to the irregular earnings from gig work.

Flexibility and Work-Life Balance Comparison

Monthly salary offers consistent income and financial stability, supporting predictable budgeting for employees. Gig pay provides greater flexibility, allowing workers to choose tasks and hours that fit their personal schedules and enhance work-life balance. This flexibility often benefits those seeking to manage family commitments or pursue multiple interests simultaneously.

Benefits and Perks: Full-Time vs. Gig Workers

Full-time employees often receive comprehensive benefits and perks, including health insurance, retirement plans, paid leave, and job security, which supplement their monthly salary and contribute to overall financial stability. Gig workers, paid per project or task, typically lack access to traditional benefits but enjoy flexible work schedules and the potential for multiple income streams through diverse gigs. Companies and workers must weigh these trade-offs when choosing between consistent monthly salaries and the variable, gig-based compensation models.

Income Growth Potential: Which Pays More Over Time?

Monthly salary offers consistent income with steady raises and benefits, providing predictable financial growth over time. Gig pay varies widely based on project volume and market demand, which can lead to higher short-term earnings but lacks guaranteed long-term stability. Over an extended period, salaried positions generally deliver more reliable income growth and security compared to fluctuating gig earnings.

Tax Implications for Salaried and Gig Workers

Monthly salary earners face tax withholding directly from their paychecks, ensuring consistent tax payments and simplified filing, while gig workers must manage estimated tax payments quarterly due to the lack of automatic withholding. Gig income is subject to self-employment tax, which includes both the employer and employee portions of Social Security and Medicare, often resulting in higher tax liabilities compared to salaried employees. Understanding these tax implications helps workers optimize deductions and avoid penalties during annual tax filing.

Job Security: Traditional Roles vs. Gig Opportunities

Monthly salary jobs typically provide greater job security through steady income, benefits, and legal protections, which are often absent in gig work. Gig pay offers flexibility but lacks the stability of guaranteed monthly earnings, leading to income volatility and limited worker protections. Traditional employment remains preferred for individuals valuing consistent financial stability and long-term career development.

Suitability by Career Stage and Industry

Monthly salary offers stability and benefits suitable for early-career professionals in traditional industries like finance and healthcare, promoting consistent income and career growth. Gig pay appeals to experienced specialists and freelancers in creative and tech sectors, providing flexibility and project-based earnings aligned with fluctuating workloads. Choosing between monthly salary and gig pay depends on career stage priorities and industry demands for financial predictability or work autonomy.

Making the Right Choice: Evaluating Personal and Financial Goals

Evaluating personal and financial goals is essential when choosing between a steady monthly salary and gig pay, as stability often suits those prioritizing consistent income and long-term financial planning. Gig pay offers flexibility and potential for higher earnings per project, appealing to individuals valuing autonomy and diverse work experiences. Careful consideration of cash flow needs, benefits, and career growth opportunities ensures alignment with one's unique priorities and lifestyle.

Related Important Terms

Income Stream Diversification

Monthly salary provides stable, predictable income streams with consistent financial security, while gig pay offers flexible opportunities to diversify earnings through multiple short-term projects. Balancing fixed monthly wages and varied gig payments enhances financial resilience and income stream diversification in changing job markets.

Pay Flexibility Index

Monthly salary offers stability with fixed income and benefits, while gig pay provides variable earnings based on completed tasks, enhancing flexibility for diverse work preferences. The Pay Flexibility Index quantifies this adaptability, indicating higher scores for gig pay due to its customizable schedule and income potential.

Task-Based Remuneration

Task-based remuneration prioritizes payment for completed assignments over a fixed monthly salary, offering flexibility and performance-driven income for gig workers. This arrangement allows individuals to maximize earnings based on task volume and complexity rather than time spent, aligning compensation directly with productivity.

On-Demand Wage Cycles

On-demand wage cycles provide workers the flexibility to access earnings immediately after completing gigs, contrasting with traditional monthly salary payments that offer fixed, periodic income. This shift caters to gig economy participants seeking timely compensation to manage fluctuating expenses without waiting for standard payroll schedules.

Micro-Earning Models

Monthly salary provides consistent income stability and benefits, while gig pay in micro-earning models offers flexible, task-based compensation allowing workers to monetize short-term projects or individual tasks. Micro-earning platforms enable individuals to diversify income streams by completing small gigs, optimizing earnings through volume and skill specialization.

Subscription Employment

Subscription employment offers a fixed monthly salary that ensures consistent income stability compared to gig pay, which varies based on task completion and fluctuating work availability. This model benefits workers seeking predictable earnings and employer-backed benefits, contrasting with the variable and often unpredictable nature of gig-based compensation.

Project-Based Compensation

Project-based compensation allows workers to earn pay tied directly to the completion and value of specific gigs, offering flexibility compared to a fixed monthly salary. This model often benefits freelancers and contractors by aligning earnings with project scope and delivery timelines rather than standardized time-based wages.

Salary Liquidity

Monthly salary provides consistent income with predictable cash flow, enhancing financial stability and ease of budgeting, while gig pay offers irregular payments that can lead to fluctuating salary liquidity and potential cash flow gaps. Workers relying on gig pay must manage income variability carefully to maintain sufficient liquidity for ongoing expenses.

Just-in-Time Payroll

Monthly salary provides a fixed, predictable income stream beneficial for budgeting, while gig pay offers flexibility aligned with task completion in just-in-time payroll systems, ensuring workers receive compensation immediately after service delivery. Just-in-time payroll enhances cash flow management for employers and reduces financial uncertainty for gig workers by synchronizing payments with actual work performed.

Gig-to-Salary Hybridization

Gig-to-salary hybridization blends the stability of monthly salaries with the flexibility of gig pay, allowing workers to balance consistent income and variable project-based earnings. This arrangement enhances financial security while accommodating diverse work schedules, appealing to professionals in dynamic industries seeking hybrid compensation models.

Monthly Salary vs Gig Pay for work arrangements. Infographic

hrdif.com

hrdif.com