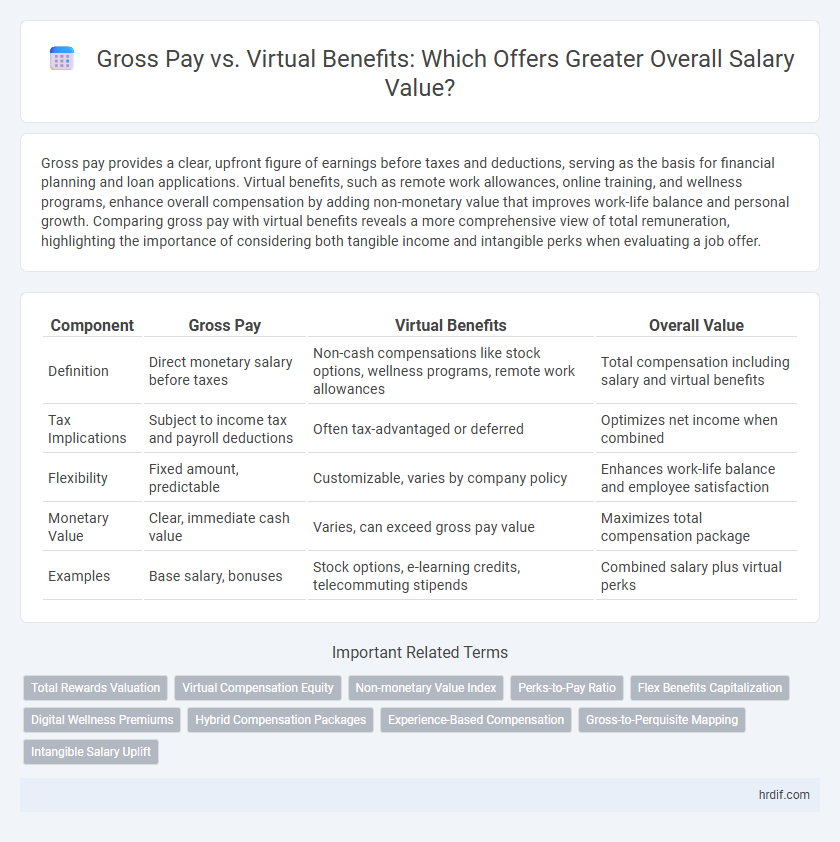

Gross pay provides a clear, upfront figure of earnings before taxes and deductions, serving as the basis for financial planning and loan applications. Virtual benefits, such as remote work allowances, online training, and wellness programs, enhance overall compensation by adding non-monetary value that improves work-life balance and personal growth. Comparing gross pay with virtual benefits reveals a more comprehensive view of total remuneration, highlighting the importance of considering both tangible income and intangible perks when evaluating a job offer.

Table of Comparison

| Component | Gross Pay | Virtual Benefits | Overall Value |

|---|---|---|---|

| Definition | Direct monetary salary before taxes | Non-cash compensations like stock options, wellness programs, remote work allowances | Total compensation including salary and virtual benefits |

| Tax Implications | Subject to income tax and payroll deductions | Often tax-advantaged or deferred | Optimizes net income when combined |

| Flexibility | Fixed amount, predictable | Customizable, varies by company policy | Enhances work-life balance and employee satisfaction |

| Monetary Value | Clear, immediate cash value | Varies, can exceed gross pay value | Maximizes total compensation package |

| Examples | Base salary, bonuses | Stock options, e-learning credits, telecommuting stipends | Combined salary plus virtual perks |

Understanding Gross Pay: The Foundation of Compensation

Gross pay represents the total earnings before deductions, forming the baseline for overall compensation analysis. Virtual benefits, such as stock options and flexible working arrangements, enhance the total value but are often less tangible than gross pay. Understanding gross pay is essential for evaluating salary offers and negotiating compensation packages effectively.

What Are Virtual Benefits? Definitions and Examples

Virtual benefits refer to non-cash perks provided by employers that enhance an employee's overall compensation package beyond gross pay, including remote work options, flexible schedules, and wellness programs. These benefits increase job satisfaction and work-life balance without increasing taxable income, offering significant value when evaluating total remuneration. Examples include telecommuting allowances, digital learning subscriptions, and virtual mental health support services.

Gross Pay vs Virtual Benefits: Key Differences

Gross pay represents the total income earned before deductions, providing a clear measure of direct financial compensation. Virtual benefits, including stock options, remote work allowances, and wellness programs, offer additional value that enhances overall employee compensation but do not increase immediate cash flow. Evaluating gross pay versus virtual benefits helps employees understand the true total rewards package and make informed decisions about job offers.

The Role of Gross Pay in Financial Planning

Gross pay represents the total earnings before deductions and serves as a crucial foundation in financial planning by providing a clear baseline to calculate taxes, retirement contributions, and loan eligibility. While virtual benefits like stock options and bonuses enhance overall compensation, gross pay remains the primary figure for budgeting essential expenses and long-term savings goals. Understanding gross pay ensures accurate forecasting of net income and supports effective management of both immediate and future financial obligations.

Virtual Benefits and Their Impact on Work-Life Balance

Virtual benefits such as remote work options, flexible schedules, and wellness programs significantly enhance overall compensation by improving work-life balance beyond monetary gross pay. These benefits reduce commuting time and stress, leading to higher job satisfaction and productivity, which traditional salaries alone cannot provide. Employers investing in comprehensive virtual benefits offerings create more appealing and sustainable work environments that support employee well-being and retention.

Calculating Total Compensation: Beyond the Paycheck

Calculating total compensation involves assessing both gross pay and virtual benefits to understand the overall value of an employment package. Gross pay provides the base salary before taxes and deductions, while virtual benefits--such as stock options, health insurance, and retirement contributions--add significant financial value beyond direct wages. Incorporating these elements offers a comprehensive view of an employee's total earnings, essential for accurate salary comparisons and informed career decisions.

Employer Perspectives: Why Virtual Benefits Matter

Employers prioritize virtual benefits alongside gross pay to enhance overall compensation value, recognizing that flexible perks improve employee satisfaction and retention. Virtual benefits such as remote work options, wellness programs, and professional development opportunities reduce turnover costs and elevate productivity. Integrating these benefits helps employers attract top talent while maintaining a competitive labor market position.

Employee Preferences: Salary or Virtual Benefits?

Employee preferences often vary between gross pay and virtual benefits, with many valuing direct salary for immediate financial security while others prioritize virtual benefits like health insurance, flexible work options, or wellness programs for long-term value. Studies indicate that younger employees tend to favor virtual benefits that enhance work-life balance, whereas experienced professionals often prefer higher gross pay to support savings and expenses. Employers should tailor compensation packages to align with these preferences, optimizing overall employee satisfaction and retention.

Negotiating Your Package: Balancing Gross Pay and Benefits

Negotiating your package requires a strategic balance between gross pay and virtual benefits like remote work stipends, wellness programs, and professional development credits that significantly enhance overall compensation value. While gross pay provides immediate financial security, virtual benefits contribute to long-term career growth and quality of life, often resulting in substantial hidden value. Emphasizing both components during negotiations can lead to a more comprehensive and satisfactory compensation package.

Future Trends: Evolving Compensation Structures

Future compensation structures increasingly integrate gross pay with virtual benefits such as stock options, flexible work arrangements, and digital wellness programs, enhancing overall employee value. Companies leverage data analytics and AI-driven platforms to personalize benefits, aligning with individual preferences and long-term financial security. This evolution reflects a shift towards holistic reward systems prioritizing both immediate income and virtual assets for sustained employee engagement.

Related Important Terms

Total Rewards Valuation

Gross pay represents the base monetary compensation before taxes and deductions, while virtual benefits, such as stock options, wellness programs, and flexible work arrangements, enhance Total Rewards Valuation by adding significant non-cash value to an employee's overall compensation package. Employers leveraging virtual benefits create a more comprehensive Total Rewards strategy that boosts retention and job satisfaction beyond what gross pay alone can achieve.

Virtual Compensation Equity

Gross pay provides a clear baseline for employee earnings, but virtual compensation equity enhances overall value by including stock options, RSUs, and other equity-based incentives that align employee interests with company performance. Evaluating total rewards through virtual benefits offers a comprehensive view of compensation, often exceeding immediate cash value by fostering long-term financial growth and company loyalty.

Non-monetary Value Index

Gross pay quantifies direct earnings while the Non-monetary Value Index captures critical virtual benefits such as health insurance, flexible work arrangements, and professional development opportunities that enhance overall compensation. Evaluating total remuneration requires integrating gross salary with these intangible perks to accurately assess employee value and satisfaction.

Perks-to-Pay Ratio

Gross pay represents direct monetary compensation, while virtual benefits include non-cash perks such as health insurance, remote work options, and retirement plans, significantly enhancing the overall compensation package. The Perks-to-Pay Ratio quantifies the value of these virtual benefits relative to salary, serving as a crucial metric for evaluating total employee remuneration and job offer attractiveness.

Flex Benefits Capitalization

Gross pay provides a clear monetary base, but virtual benefits like Flex Benefits Capitalization enhance overall compensation by allowing employees to allocate funds toward personalized perks, maximizing their total rewards value. These flexible benefits increase financial efficiency and employee satisfaction by offering tax advantages and tailored options beyond base salary, ultimately elevating overall remuneration impact.

Digital Wellness Premiums

Gross pay represents the total monetary compensation before taxes, while virtual benefits such as Digital Wellness Premiums enhance overall value by providing employees with access to mental health apps, online fitness classes, and stress management tools. These digital perks contribute to improved employee well-being and productivity, often offsetting lower gross salaries through increased job satisfaction and reduced healthcare costs.

Hybrid Compensation Packages

Hybrid compensation packages blend gross pay with virtual benefits such as stock options, remote work stipends, and wellness programs to enhance overall employee value beyond traditional salary figures. This combination allows companies to offer competitive total rewards tailored to individual preferences while optimizing tax efficiency and retention strategies.

Experience-Based Compensation

Experience-based compensation enhances total employee value by combining gross pay with virtual benefits such as stock options, performance bonuses, and professional development credits. This holistic approach ensures that seasoned professionals receive a comprehensive rewards package reflecting their expertise and long-term contributions.

Gross-to-Perquisite Mapping

Gross pay offers a clear monetary figure, but virtual benefits such as stock options, health plans, and wellness programs significantly enhance the total compensation through Gross-to-Perquisite Mapping, effectively increasing an employee's overall value beyond base salary. This approach quantifies both tangible and intangible assets, enabling precise comparisons of compensation packages and maximizing perceived financial worth.

Intangible Salary Uplift

Gross pay represents the tangible monetary compensation received by an employee, whereas virtual benefits contribute to the overall compensation package by enhancing job satisfaction and work-life balance, creating an intangible salary uplift that can significantly increase perceived value. This intangible salary uplift includes perks like flexible working hours, employee wellness programs, and professional development opportunities, which collectively boost retention and productivity beyond the direct financial earnings.

gross pay vs virtual benefits for overall value Infographic

hrdif.com

hrdif.com