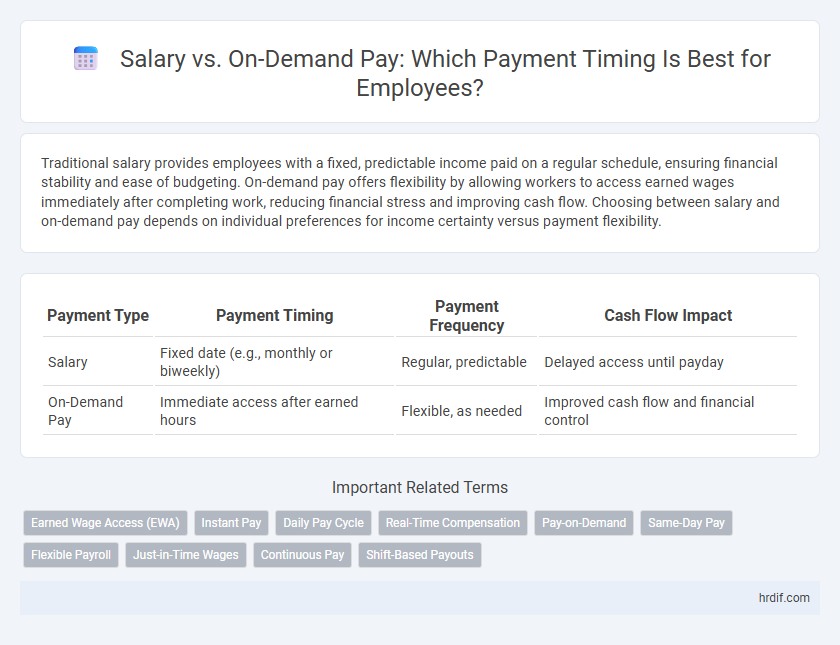

Traditional salary provides employees with a fixed, predictable income paid on a regular schedule, ensuring financial stability and ease of budgeting. On-demand pay offers flexibility by allowing workers to access earned wages immediately after completing work, reducing financial stress and improving cash flow. Choosing between salary and on-demand pay depends on individual preferences for income certainty versus payment flexibility.

Table of Comparison

| Payment Type | Payment Timing | Payment Frequency | Cash Flow Impact |

|---|---|---|---|

| Salary | Fixed date (e.g., monthly or biweekly) | Regular, predictable | Delayed access until payday |

| On-Demand Pay | Immediate access after earned hours | Flexible, as needed | Improved cash flow and financial control |

Understanding Salary: Traditional Payment Cycles

Traditional salary payments follow fixed cycles, typically monthly or biweekly, providing employees with predictable and consistent income. This structured timing supports financial planning and stability but may limit flexibility in accessing funds before payday. Understanding these cycles helps employees weigh the benefits of steady income against the immediacy offered by on-demand pay options.

What Is On-Demand Pay?

On-demand pay allows employees to access a portion of their earned wages before the traditional payday, providing greater financial flexibility compared to fixed salary schedules. This payment method helps reduce financial stress by enabling immediate access to earned income without waiting for the end of the pay cycle. On-demand pay services often integrate with payroll systems, ensuring accurate and timely disbursements while maintaining compliance with labor laws.

Salary vs On-Demand Pay: Key Differences

Salary offers fixed, predictable income paid on a regular schedule such as biweekly or monthly, ensuring financial stability and easier budgeting. On-demand pay provides immediate access to earned wages before the traditional payday, enhancing liquidity and flexibility for employees facing unexpected expenses. The primary difference lies in payment timing--salary is delayed and structured, while on-demand pay delivers earned funds instantly or within the same day.

Pros and Cons of Salary Payment Timing

Salary payment provides consistent income, allowing employees to plan their finances with predictability and stability, which enhances budgeting and financial security. However, the fixed payment schedule may cause cash flow challenges between pay periods, especially during emergencies or unexpected expenses. Unlike on-demand pay that offers flexibility, salary payments lack immediate access to earned wages but support long-term financial planning.

Advantages of On-Demand Pay for Employees

On-demand pay offers employees immediate access to earned wages, reducing financial stress and improving cash flow management compared to traditional salary schedules. This flexible payment option empowers workers to cover unexpected expenses without waiting for the next paycheck, enhancing overall financial well-being. Access to funds on demand also supports better budgeting and decreases reliance on high-interest loans or credit.

Financial Wellness: Impact of Payment Timing

Salary provides predictable, fixed income at regular intervals, enabling consistent budgeting and long-term financial planning. On-demand pay offers immediate access to earned wages, reducing financial stress and helping avoid high-interest debt during emergencies. Payment timing directly influences financial wellness by balancing stability with flexibility, critical for managing cash flow and improving overall financial health.

Employer Perspectives: Managing Salary and On-Demand Pay

Employers balance fixed salary schedules with on-demand pay to improve workforce satisfaction and reduce financial stress, recognizing that immediate access to earned wages can enhance productivity and retention. Integrating on-demand pay systems requires careful management of cash flow and payroll processes to ensure compliance and avoid administrative burden. Strategic use of both payment methods supports agile compensation practices aligning with evolving employee expectations and organizational financial planning.

Technology’s Role in Payment Flexibility

Technology enhances payment flexibility by enabling real-time salary access through on-demand pay platforms, reducing financial stress for employees. Integration with payroll systems allows seamless and instant transactions, improving cash flow management compared to traditional fixed salary schedules. Advanced mobile apps and AI-driven solutions optimize payroll timing, offering personalized payment options that adapt to individual financial needs.

Employee Preference: Salary or On-Demand Pay?

Employees increasingly prefer on-demand pay over traditional salary structures due to immediate access to earned wages, which enhances financial flexibility and reduces stress. Surveys indicate that 70% of workers favor on-demand pay options, highlighting a shift in payment timing preferences. Employers offering on-demand pay report higher employee satisfaction and retention rates compared to those relying solely on fixed salary schedules.

Future Trends in Payroll Timing

Emerging payroll trends indicate a shift towards on-demand pay, allowing employees to access earned wages instantly rather than waiting for traditional salary cycles. This flexibility enhances financial wellness by reducing reliance on high-interest loans and improving cash flow management. Future payroll systems will likely integrate real-time payment technologies, fostering a more adaptive and employee-centric compensation landscape.

Related Important Terms

Earned Wage Access (EWA)

Earned Wage Access (EWA) allows employees to access a portion of their earned wages before the traditional payday, offering greater financial flexibility compared to fixed salary schedules. This on-demand pay solution reduces reliance on high-interest loans by providing timely access to earned income, improving cash flow management and employee satisfaction.

Instant Pay

Instant Pay provides employees with immediate access to earned wages, bypassing traditional salary payment schedules that typically occur biweekly or monthly. This on-demand pay solution enhances financial flexibility by allowing workers to withdraw funds as soon as they complete their shifts, reducing the wait time associated with conventional payroll cycles.

Daily Pay Cycle

The daily pay cycle in on-demand pay systems offers employees immediate access to earned wages, enhancing cash flow flexibility compared to traditional monthly or biweekly salary payments. This real-time payment timing supports better financial management and reduces reliance on short-term credit solutions.

Real-Time Compensation

Real-time compensation through on-demand pay allows employees to access earned wages immediately, contrasting with traditional salary payment cycles that delay income until scheduled payday. This instant access to funds enhances financial flexibility and reduces reliance on costly short-term credit options.

Pay-on-Demand

Pay-on-demand offers employees immediate access to earned wages before the traditional payday, enhancing cash flow flexibility and reducing financial stress. Unlike salaried payments fixed to a set schedule, pay-on-demand empowers workers with timely access to funds, improving financial wellness and overall job satisfaction.

Same-Day Pay

Same-day pay offers employees immediate access to earned wages, enhancing financial flexibility compared to traditional salary schedules that typically process payments biweekly or monthly. On-demand pay platforms reduce wait times for income, allowing workers to manage expenses more efficiently without relying on delayed salary disbursements.

Flexible Payroll

Flexible payroll solutions offer employees the advantage of accessing earned wages on-demand, reducing financial stress compared to traditional fixed salary schedules. By enabling immediate payment for hours worked, these systems enhance cash flow management and increase employee satisfaction without compromising employer budget stability.

Just-in-Time Wages

Just-in-time wages provide workers with immediate access to earned income, reducing financial stress by aligning payment timing closely with labor output, unlike traditional salary structures that disburse fixed payments on predetermined schedules. This on-demand pay model enhances cash flow flexibility, improving employee satisfaction and retention by allowing real-time earnings access without waiting for standard payroll cycles.

Continuous Pay

Continuous Pay offers flexible payment timing by enabling employees to access earned wages instantly, contrasting with traditional salary schedules that distribute fixed payments monthly or biweekly. This on-demand pay model improves cash flow management and reduces financial stress by eliminating waiting periods for earned income.

Shift-Based Payouts

Shift-based payouts in on-demand pay systems allow employees to access earnings immediately after completing each shift, providing greater financial flexibility compared to traditional salary models, which disburse payments on fixed dates. This real-time compensation approach enhances cash flow management for hourly workers and reduces reliance on costly short-term loans or advances.

Salary vs On-Demand Pay for payment timing. Infographic

hrdif.com

hrdif.com