Gross pay represents the total earnings an employee receives before any deductions such as taxes, social security, and benefits. Transparent pay clearly outlines all components of the salary structure, including base pay, bonuses, and deductions, providing a full understanding of take-home pay. This transparency builds trust between employer and employee by eliminating confusion about earnings and ensuring fair compensation.

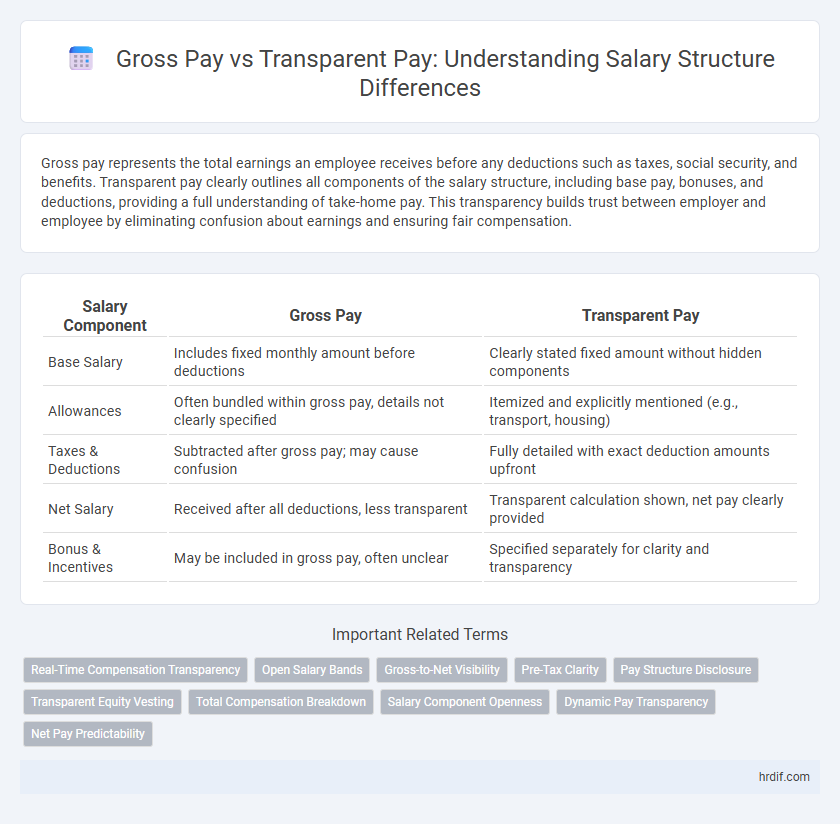

Table of Comparison

| Salary Component | Gross Pay | Transparent Pay |

|---|---|---|

| Base Salary | Includes fixed monthly amount before deductions | Clearly stated fixed amount without hidden components |

| Allowances | Often bundled within gross pay, details not clearly specified | Itemized and explicitly mentioned (e.g., transport, housing) |

| Taxes & Deductions | Subtracted after gross pay; may cause confusion | Fully detailed with exact deduction amounts upfront |

| Net Salary | Received after all deductions, less transparent | Transparent calculation shown, net pay clearly provided |

| Bonus & Incentives | May be included in gross pay, often unclear | Specified separately for clarity and transparency |

Understanding Gross Pay and Transparent Pay

Gross pay refers to the total earnings an employee receives before any deductions, including taxes, benefits, and contributions, are applied, providing a clear figure of overall compensation. Transparent pay emphasizes openly sharing detailed salary components and deductions with employees, fostering trust and clarity in the salary structure. Understanding both concepts helps employees accurately evaluate their take-home salary and the value of their compensation package.

Key Differences Between Gross Pay and Transparent Pay

Gross pay represents the total earnings before any deductions such as taxes, social security, and retirement contributions, providing a comprehensive figure of an employee's income. Transparent pay emphasizes clear communication of the entire salary structure, including base pay, bonuses, and deductions, fostering trust and clarity between employer and employee. Key differences lie in transparency and breakdown detail, with transparent pay promoting understanding of net income compared to the overarching total shown in gross pay.

The Pros and Cons of Gross Pay Structures

Gross pay structures provide employees with a clear understanding of their total earnings before deductions, promoting straightforward salary negotiations and financial planning. However, this model can create confusion regarding take-home pay due to variations in taxes and benefits, leading to potential dissatisfaction or misunderstandings. Employers benefit from simplified payroll management but may face challenges in achieving transparency and employee trust compared to more detailed transparent pay systems.

Advantages of Transparent Pay in the Workplace

Transparent pay structures enhance employee trust and motivation by openly sharing salary information, reducing pay disparities and fostering fairness. This approach improves talent retention and attracts diverse candidates by demonstrating organizational commitment to equity. Transparent pay also streamlines salary negotiations and helps employees understand clear pathways for career growth.

Impact on Employee Trust: Gross Pay vs Transparent Pay

Transparent pay fosters higher employee trust by clearly communicating salary components, reducing misunderstandings and perceived inequities. Gross pay often conceals deductions and bonuses, leading to confusion and potential mistrust among employees. Transparency in pay structure enhances satisfaction and loyalty by promoting fairness and accountability.

Transparency and Salary Negotiation Power

Gross pay reflects the total earnings before deductions, often lacking clarity on actual take-home amounts, which can obscure true compensation during salary negotiations. Transparent pay structures provide a clear breakdown of wages, benefits, and deductions, enhancing employee trust and empowering candidates with precise information to negotiate effectively. Access to transparent pay data strengthens bargaining positions by revealing fair market standards and internal pay equity.

Legal Implications of Transparent Pay Structures

Transparent pay structures promote fairness and compliance by clearly outlining salary components, reducing risks of wage disputes and discrimination claims. Legal frameworks in many regions mandate transparency to ensure equal pay for equal work and prevent hidden deductions from gross pay. Organizations adopting transparent pay systems benefit from enhanced legal protection and improved employee trust through accountability.

Gross Pay, Transparent Pay, and Pay Equity

Gross Pay represents the total salary before deductions, while Transparent Pay promotes clarity by openly sharing salary components and ranges. Implementing Transparent Pay enhances Pay Equity by reducing wage gaps and fostering fairness across roles and demographics. Organizations adopting Transparent Pay benefit from increased trust and alignment with equitable compensation practices.

Implementing Transparent Salary Structures: Best Practices

Implementing transparent salary structures enhances employee trust and promotes fairness by clearly outlining gross pay components, including base salary, bonuses, and deductions. Best practices involve regularly updating salary bands, providing accessible explanations of pay calculations, and encouraging open communication between management and staff to ensure clarity. Transparent pay systems reduce wage gaps and improve retention by aligning compensation with performance and market standards.

Future Trends in Salary Transparency and Compensation

Future trends in salary transparency emphasize a shift from traditional gross pay disclosure to comprehensive transparent pay models that include bonuses, benefits, and tax withholdings. Companies adopting transparent pay structures foster trust, reduce wage gaps, and enhance employee satisfaction by providing clear, detailed compensation insights. Regulatory movements and technology platforms increasingly support transparent pay frameworks, promoting fairness and accountability in salary practices.

Related Important Terms

Real-Time Compensation Transparency

Gross pay represents the total salary before deductions, providing a static figure often lacking clear insight into actual take-home benefits. Transparent pay systems enhance real-time compensation transparency by displaying detailed breakdowns of earnings, taxes, and benefits, empowering employees to understand and manage their true net income effectively.

Open Salary Bands

Open salary bands promote transparency by clearly defining gross pay ranges, enhancing employee trust and enabling competitive compensation benchmarking. Transparent pay structures reduce wage disparities and improve salary negotiations by providing visible criteria tied to roles and experience.

Gross-to-Net Visibility

Gross pay represents the total salary before deductions, while transparent pay provides clear insight into how each deduction affects the net income, enhancing gross-to-net visibility. This clarity helps employees better understand their actual take-home pay and fosters trust in the salary structure.

Pre-Tax Clarity

Gross pay represents the total earnings before any deductions, while transparent pay provides a clear breakdown of pre-tax components, helping employees understand their take-home salary more accurately. Pre-tax clarity in transparent pay structures enhances financial planning and compliance by detailing taxable earnings, deductions, and allowances upfront.

Pay Structure Disclosure

Transparent pay structures enhance employee trust by clearly disclosing gross pay components, including base salary, bonuses, and deductions, which helps reduce wage disparities and fosters equitable compensation practices. Companies adopting transparent pay disclosure improve workforce satisfaction and attract talent by promoting fairness and clarity in salary distribution.

Transparent Equity Vesting

Transparent equity vesting provides employees with clear, detailed schedules outlining the timing and amount of stock options or shares they earn as part of their compensation, fostering trust and alignment with company growth. Unlike gross pay, which only reflects total earnings before deductions, transparent pay structures reveal the true long-term value of equity, enhancing employee motivation and retention.

Total Compensation Breakdown

Gross Pay includes the total earnings before deductions such as taxes, insurance, and retirement contributions, representing the full amount agreed upon in the employment contract. Transparent Pay goes beyond Gross Pay by providing a detailed breakdown of Total Compensation, encompassing base salary, bonuses, benefits, and employer contributions, enabling employees to clearly understand the full value of their remuneration package.

Salary Component Openness

Transparent pay structures enhance employee trust by clearly breaking down gross pay into base salary, bonuses, taxes, and deductions, promoting financial transparency and informed decision-making. Unlike traditional gross pay presentations, open salary components reduce ambiguity and support fair compensation practices across organizations.

Dynamic Pay Transparency

Dynamic pay transparency enhances employee trust by providing clear visibility into gross pay components, including base salary, bonuses, and deductions. This approach reduces salary disputes and promotes fairness by allowing real-time adjustments and comparisons within transparent pay structures.

Net Pay Predictability

Gross pay includes total earnings before deductions, making net pay unpredictable due to taxes and benefits variances. Transparent pay structures clarify deductions upfront, ensuring more accurate net pay predictability for employees.

Gross Pay vs Transparent Pay for salary structure. Infographic

hrdif.com

hrdif.com