Overtime pay provides employees with additional income based on extra hours worked, ensuring direct financial compensation for their time. An unlimited PTO buyout offers flexibility by converting unused leave into a lump-sum payment, which can be advantageous for employees prioritizing immediate cash over time off. Both options impact salary structure differently, with overtime pay increasing hourly earnings and PTO buyouts reflecting accumulated benefits.

Table of Comparison

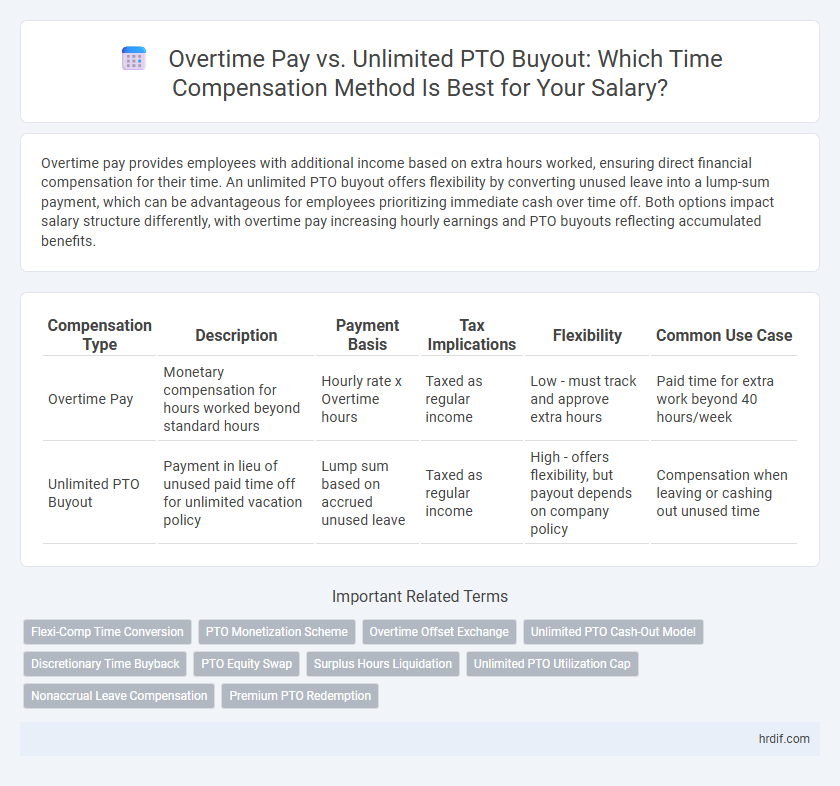

| Compensation Type | Description | Payment Basis | Tax Implications | Flexibility | Common Use Case |

|---|---|---|---|---|---|

| Overtime Pay | Monetary compensation for hours worked beyond standard hours | Hourly rate x Overtime hours | Taxed as regular income | Low - must track and approve extra hours | Paid time for extra work beyond 40 hours/week |

| Unlimited PTO Buyout | Payment in lieu of unused paid time off for unlimited vacation policy | Lump sum based on accrued unused leave | Taxed as regular income | High - offers flexibility, but payout depends on company policy | Compensation when leaving or cashing out unused time |

Understanding Overtime Pay: Pros and Cons

Overtime pay offers employees financial compensation for hours worked beyond the standard workweek, typically at a rate of 1.5 times the regular hourly wage, ensuring direct monetary reward for extra labor. This system incentivizes productivity and provides clear value for additional work but can lead to increased payroll costs for employers and potential employee burnout. Understanding the balance between guaranteed overtime pay and flexible alternatives like unlimited PTO buyout is crucial for optimizing time compensation strategies.

Unlimited PTO Buyout Explained

Unlimited PTO buyout provides employees with a cash compensation option for unused paid time off, ensuring they receive financial value for accrued leave. Unlike traditional overtime pay, which compensates for hours worked beyond regular schedules, unlimited PTO buyout focuses on rewarding unused vacation or personal days. This approach offers flexibility for both employers and employees, aligning compensation with individual time-off preferences and company policies.

Financial Impacts: Overtime Pay vs Unlimited PTO Buyout

Overtime pay provides immediate financial compensation based on actual hours worked beyond the standard schedule, often calculated at a premium rate, enhancing short-term earnings for employees. Unlimited PTO buyout offers a lump sum payment for unused paid time off, potentially leading to tax advantages and deferred income but may lack the consistent supplemental income overtime pay provides. Employers must consider cash flow implications and employee preferences, as overtime pay can increase payroll expenses immediately, whereas PTO buyouts may impact long-term liabilities and employee retention strategies.

Employee Satisfaction: Which Model Works Best?

Employee satisfaction often hinges on clear and fair compensation for extra hours worked, with overtime pay providing immediate financial recognition that appeals to those valuing direct monetary rewards. Unlimited PTO buyout offers flexibility and long-term work-life balance benefits, attracting employees who prioritize time over instant cash but may lead to ambiguity in pricing extra efforts. Studies indicate that combining structured overtime pay with transparent PTO policies generally enhances overall morale and trust in compensation fairness.

Legal Considerations and Compliance Factors

Overtime pay is governed by the Fair Labor Standards Act (FLSA), requiring non-exempt employees to receive at least 1.5 times their regular hourly rate for hours worked beyond 40 per week, ensuring legal compliance and avoiding wage disputes. Unlimited PTO buyouts, while offering flexibility, must carefully navigate state-specific labor laws and company policies to prevent violations related to wage replacement and accrual of earned time off. Employers must maintain meticulous records and consistently apply compensation practices to comply with Department of Labor regulations and minimize legal risks.

Tax Implications for Both Compensation Models

Overtime pay is considered taxable income subject to federal, state, and local taxes, increasing the employee's taxable wage base and potentially affecting tax bracket placement. Unlimited PTO buyouts, often treated as supplemental wages, may be taxed differently depending on jurisdiction but generally undergo federal withholding at a flat supplemental rate, impacting net compensation differently than regular overtime. Each compensation model's tax treatment influences overall take-home pay and employer payroll tax liabilities, necessitating careful analysis for optimized payroll and tax strategy.

Flexibility and Work-Life Balance Comparison

Overtime pay offers clear monetary compensation for extra hours worked, providing immediate financial benefits but often requiring strict adherence to logged hours, which can limit flexibility. Unlimited PTO buyout allows employees to convert unused leave into cash while promoting greater control over work schedules and enhancing work-life balance by encouraging time off without the pressure of accrual limits. Organizations balancing both options can attract talent seeking either direct compensation for overtime or the freedom to manage personal time more effectively.

Cost Analysis for Employers: Overtime vs PTO Buyout

Employers face significant cost implications when choosing between overtime pay and unlimited PTO buyout for time compensation, with overtime typically incurring direct wage premiums of 1.5 to 2 times the regular hourly rate. Unlimited PTO buyouts may appear less costly upfront by avoiding premium wages but can accumulate hidden liabilities and affect workforce utilization. A detailed cost analysis should consider hourly wage rates, employee overtime eligibility, accrued PTO balances, and potential impacts on productivity and employee satisfaction to optimize financial outcomes.

Case Studies: Real-Life Company Practices

Case studies reveal that companies with overtime pay policies often see higher employee satisfaction in hourly roles, as compensation directly correlates with hours worked, fostering transparency and fairness. In contrast, organizations offering unlimited PTO buyout for unused leave highlight flexibility and work-life balance, though some employees report undervaluation of their extra work hours without immediate financial reward. Data from industry leaders like Netflix and Starbucks demonstrate the distinct impacts of each approach on retention, productivity, and employee morale within diverse workforces.

Choosing the Right Compensation Strategy for Your Career

Selecting the right compensation strategy between overtime pay and unlimited PTO buyout depends on your career goals and work-life balance preferences. Overtime pay provides immediate financial rewards for extra hours worked, making it ideal for those seeking higher short-term income. Unlimited PTO buyouts offer flexibility and long-term wellness benefits, appealing to professionals prioritizing time off and personal well-being over direct monetary gains.

Related Important Terms

Flexi-Comp Time Conversion

Flexi-comp time conversion allows employees to exchange overtime hours for flexible paid time off, offering an alternative to traditional overtime pay or unlimited PTO buyout options. This method enhances work-life balance by providing tailored time compensation aligned with individual preferences and organizational policies.

PTO Monetization Scheme

Overtime pay provides employees with direct financial compensation for extra hours worked, calculated based on hourly wage rates, whereas unlimited PTO buyout schemes allow employees to monetize unused paid time off, often at a predetermined rate, converting leave balances into taxable income. PTO monetization policies require clear documentation and compliance with labor laws to ensure equitable compensation while optimizing employer cash flow management.

Overtime Offset Exchange

Overtime offset exchange allows employees to convert accrued overtime hours into an unlimited PTO buyout, providing flexible time compensation without additional payroll costs. This strategy optimizes workforce productivity while offering a tax-efficient alternative to traditional overtime pay.

Unlimited PTO Cash-Out Model

The Unlimited PTO Cash-Out Model offers employees the flexibility to convert unused paid time off into direct financial compensation, aligning with modern workforce preferences and improving overall job satisfaction. Unlike traditional overtime pay, this model incentivizes work-life balance by providing monetary value for accrued time off without the constraints of hourly tracking.

Discretionary Time Buyback

Discretionary time buyback offers employees a flexible option to monetize unused PTO by converting it into direct financial compensation, often favored over traditional overtime pay which compensates extra hours worked beyond regular schedules. This approach aligns with salary optimization strategies by providing predictable income boosts and incentivizing efficient time management without the constraints of hourly tracking.

PTO Equity Swap

Overtime pay provides direct financial compensation for extra hours worked, ensuring immediate monetary reward based on labor laws and hourly rates. PTO equity swap offers employees the option to convert unused paid time off into equity shares, aligning time compensation with long-term investment growth and company valuation.

Surplus Hours Liquidation

Overtime pay provides direct monetary compensation for surplus hours worked, ensuring employees receive a fixed premium rate for each hour beyond standard work time. Unlimited PTO buyout offers flexibility by converting unused leave into cash, allowing surplus hours liquidation without immediate overtime wage expense but potentially impacting long-term employee satisfaction and retention.

Unlimited PTO Utilization Cap

Unlimited PTO utilization cap limits the maximum amount of paid time off employees can redeem, often restricting financial compensation for unused days. In contrast, overtime pay ensures direct monetary reimbursement for extra hours worked, providing clear quantifiable benefits absent in many unlimited PTO buyout policies.

Nonaccrual Leave Compensation

Nonaccrual leave compensation involves repaying employees for unused overtime hours rather than unused paid time off, aligning with labor laws that distinguish between earned wages and discretionary time off. Overtime pay ensures direct monetary compensation for additional work hours, while unlimited PTO buyouts often lack clear policies, making nonaccrual leave compensation a more transparent and legally compliant method for time compensation.

Premium PTO Redemption

Premium PTO redemption offers employees a financial benefit by converting unused paid time off into overtime pay rates, maximizing compensation for extra hours worked. Choosing overtime pay over unlimited PTO buyout ensures higher earnings for actual work performed rather than forfeiting time off balances.

Overtime Pay vs Unlimited PTO Buyout for time compensation. Infographic

hrdif.com

hrdif.com