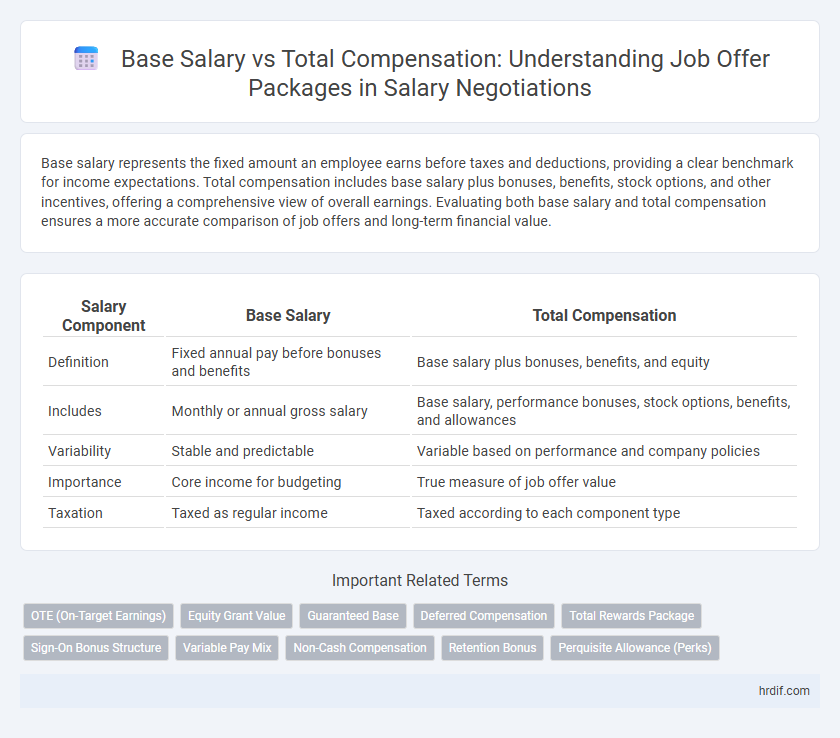

Base salary represents the fixed amount an employee earns before taxes and deductions, providing a clear benchmark for income expectations. Total compensation includes base salary plus bonuses, benefits, stock options, and other incentives, offering a comprehensive view of overall earnings. Evaluating both base salary and total compensation ensures a more accurate comparison of job offers and long-term financial value.

Table of Comparison

| Salary Component | Base Salary | Total Compensation |

|---|---|---|

| Definition | Fixed annual pay before bonuses and benefits | Base salary plus bonuses, benefits, and equity |

| Includes | Monthly or annual gross salary | Base salary, performance bonuses, stock options, benefits, and allowances |

| Variability | Stable and predictable | Variable based on performance and company policies |

| Importance | Core income for budgeting | True measure of job offer value |

| Taxation | Taxed as regular income | Taxed according to each component type |

Understanding Base Salary: What It Really Means

Base salary represents the fixed amount of money an employee earns before bonuses, benefits, or other incentives are added, serving as the foundation of total compensation. It reflects an employee's guaranteed earnings for performing job duties, excluding variable pay elements such as commissions and stock options. Understanding base salary is crucial for comparing job offers effectively, as it influences financial stability and sets the baseline for overall earning potential.

Defining Total Compensation Packages

Total compensation packages encompass more than just the base salary by including bonuses, stock options, health benefits, retirement contributions, and other financial incentives. Understanding total compensation provides a clearer picture of an employee's overall earnings and value beyond the initial salary figure. Employers use these comprehensive packages to attract and retain talent by balancing fixed income with variable rewards and benefits.

Key Differences Between Base Salary and Total Compensation

Base salary is the fixed amount an employee earns before bonuses, benefits, and other incentives are included, serving as the foundation of compensation. Total compensation encompasses base salary plus additional financial rewards like bonuses, stock options, health benefits, retirement contributions, and other perks that enhance overall earnings. Understanding these key differences is crucial for job seekers to accurately evaluate the full value of job offers and negotiate effectively.

The Components of Total Compensation Explained

Base salary refers to the fixed amount an employee earns before bonuses, benefits, or other incentives are added. Total compensation includes base salary plus bonuses, stock options, health benefits, retirement contributions, and other perks that contribute to overall employee earnings. Understanding all components of total compensation is crucial when evaluating job offers to compare the true value beyond just the base salary.

Evaluating Job Offers: Salary vs. Additional Benefits

Base salary represents the fixed annual income before taxes and deductions, while total compensation includes salary plus bonuses, stock options, health insurance, retirement plans, and other benefits. Evaluating job offers requires analyzing both base salary and additional benefits to understand the full financial value and long-term impact on personal wealth. Consider factors like performance bonuses, equity potential, and employer-provided perks to compare total compensation packages accurately.

Hidden Perks: Beyond the Base Salary

Hidden perks often elevate total compensation far beyond the base salary in job offers, including stock options, performance bonuses, and comprehensive health benefits. Employee perks such as retirement plan contributions, paid time off, and professional development stipends add significant value to overall compensation packages. Evaluating these elements provides a clearer picture of a job's true financial benefits beyond the initial salary figure.

How Bonuses and Incentives Impact Total Compensation

Bonuses and incentives significantly enhance total compensation beyond the base salary by providing performance-based financial rewards that motivate employees to exceed targets. These variable pay elements can include annual bonuses, stock options, and profit-sharing plans, often accounting for 10% to 30% or more of overall earnings depending on the industry and role. Evaluating job offers requires considering both base salary and potential bonuses to understand the complete financial package and long-term earning potential.

Negotiating Your Total Compensation Package

Negotiating your total compensation package involves understanding the difference between base salary and additional benefits like bonuses, stock options, and health insurance. Employers often allocate significant value to perks beyond the base salary that can substantially increase your overall earnings. Effective negotiation requires evaluating the full compensation offer to maximize financial and non-financial benefits aligned with your career goals.

Comparing Offers: Base Salary and Total Rewards

When comparing job offers, it is essential to evaluate both base salary and total compensation to understand the full value of the package. Total compensation includes base salary, bonuses, stock options, health benefits, retirement plans, and other perks that contribute significantly to overall earnings. Focusing solely on base salary may overlook substantial financial benefits embedded in total rewards, impacting long-term wealth and job satisfaction.

Making Informed Decisions: Which Matters More?

Understanding the difference between base salary and total compensation is crucial when evaluating job offers, as total compensation includes bonuses, stock options, benefits, and other perks beyond the fixed base pay. Analyzing total compensation provides a clearer picture of the overall financial value and long-term benefits of the offer, helping candidates make more informed decisions about their career moves. Prioritizing total compensation over base salary alone ensures alignment with personal financial goals and lifestyle needs.

Related Important Terms

OTE (On-Target Earnings)

Base salary provides a fixed income guaranteed regardless of performance, while total compensation includes base salary plus variable elements like bonuses, commissions, and benefits; On-Target Earnings (OTE) represent the expected total compensation when performance targets are met, offering a clearer picture of potential earnings than base salary alone. Understanding OTE is crucial for evaluating job offers in sales or commission-based roles, as it reflects achievable income rather than just the guaranteed base pay.

Equity Grant Value

Equity grant value significantly impacts total compensation by providing potential long-term financial growth beyond the base salary, often including stock options or restricted shares that align employee incentives with company performance. Evaluating job offers requires analyzing both base salary and equity value to understand the complete remuneration package and potential future earnings.

Guaranteed Base

Guaranteed base salary represents the fixed annual amount an employee receives regardless of company performance or bonuses, forming the foundation of total compensation. Total compensation includes the guaranteed base salary plus variable elements such as bonuses, stock options, and benefits, reflecting the complete financial value of a job offer.

Deferred Compensation

Deferred compensation is a critical component that distinguishes total compensation from base salary by encompassing earnings set aside to be paid at a later date, often tied to retirement plans or stock options. Evaluating job offers requires understanding how deferred compensation impacts overall financial benefits beyond the immediate base salary, influencing long-term wealth accumulation and tax strategies.

Total Rewards Package

Understanding the distinction between base salary and total compensation is essential for evaluating job offers, as the total rewards package includes base pay, bonuses, stock options, health benefits, retirement plans, and other perks. Employers often emphasize total compensation to reflect the full value of employment beyond the fixed salary, impacting long-term financial and career satisfaction.

Sign-On Bonus Structure

Sign-on bonuses significantly enhance total compensation, often compensating for lower base salaries in job offers. Understanding the structure and tax implications of sign-on bonuses is crucial for accurately comparing overall financial benefits between employment opportunities.

Variable Pay Mix

Base salary represents the fixed annual income guaranteed to employees, while total compensation includes variable pay elements such as bonuses, commissions, and stock options that fluctuate based on performance or company profitability. Understanding the variable pay mix is essential for evaluating job offers, as a higher proportion of variable pay can significantly impact overall earnings and financial stability.

Non-Cash Compensation

Base salary represents the fixed annual amount paid by an employer, while total compensation includes non-cash benefits such as stock options, bonuses, health insurance, retirement contributions, and other perks that add significant value beyond the paycheck. Evaluating job offers requires analyzing both base salary and the full scope of total compensation to fully understand the financial and non-monetary rewards offered.

Retention Bonus

Retention bonuses significantly enhance total compensation by providing targeted financial incentives beyond the base salary, encouraging employee loyalty during critical periods. Employers strategically use retention bonuses to reduce turnover costs, often making the total offer more attractive despite a moderate base salary.

Perquisite Allowance (Perks)

Base salary represents the fixed annual income without additional benefits, while total compensation includes perquisite allowances such as health insurance, company cars, and stock options that significantly enhance the overall value of a job offer. Evaluating perquisite allowances alongside base salary provides a comprehensive understanding of the financial and non-cash benefits impacting employee satisfaction and retention.

Base Salary vs Total Compensation for job offers. Infographic

hrdif.com

hrdif.com