Salary provides employees with predictable, stable income essential for daily expenses and financial security. Equity compensation offers potential long-term financial gains by aligning employee interests with company performance and growth. Balancing salary and equity rewards can motivate employees while managing cash flow effectively for businesses.

Table of Comparison

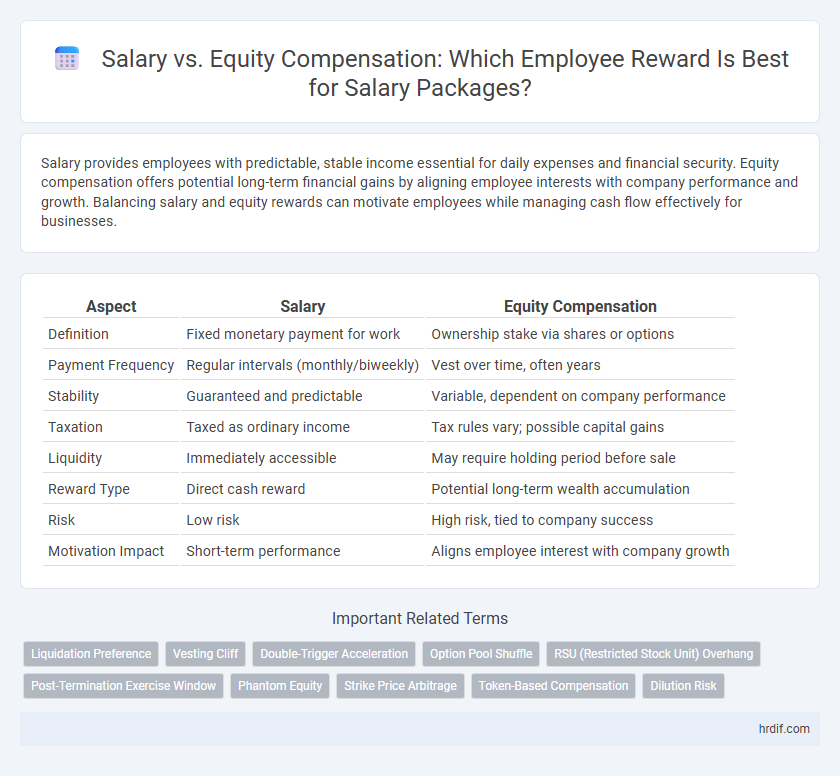

| Aspect | Salary | Equity Compensation |

|---|---|---|

| Definition | Fixed monetary payment for work | Ownership stake via shares or options |

| Payment Frequency | Regular intervals (monthly/biweekly) | Vest over time, often years |

| Stability | Guaranteed and predictable | Variable, dependent on company performance |

| Taxation | Taxed as ordinary income | Tax rules vary; possible capital gains |

| Liquidity | Immediately accessible | May require holding period before sale |

| Reward Type | Direct cash reward | Potential long-term wealth accumulation |

| Risk | Low risk | High risk, tied to company success |

| Motivation Impact | Short-term performance | Aligns employee interest with company growth |

Understanding Salary and Equity Compensation

Salary provides employees with a fixed and predictable income based on their role and experience, ensuring financial stability and covering regular expenses. Equity compensation involves granting shares or stock options, aligning employees' interests with company performance and offering potential long-term financial gains. Understanding the balance between salary and equity compensation is crucial for employees to evaluate total rewards and make informed career decisions.

Key Differences Between Salary and Equity

Salary provides employees with fixed, predictable income based on work performed, often paid regularly as wages or hourly rates. Equity compensation grants ownership stakes, such as stock options or shares, aligning employee interests with company performance and long-term growth potential. While salary ensures immediate financial stability, equity offers potential for significant future value tied to company success.

Pros and Cons of Salary Compensation

Salary compensation provides employees with predictable, stable income that supports financial planning and reduces stress associated with income variability. Guaranteed cash flow makes salary an attractive option for risk-averse employees who prioritize immediate financial security over potential long-term gains. However, salary lacks the wealth-building potential of equity compensation and may limit employee motivation tied to company performance and growth.

Pros and Cons of Equity Compensation

Equity compensation offers employees potential for significant financial gains through stock appreciation, aligning their interests with company performance and fostering long-term commitment. However, it carries risks such as market volatility, lack of liquidity, and potential dilution of shares, which can diminish the perceived value compared to guaranteed salary. Employers must balance these factors to create attractive compensation packages that motivate employees while managing financial and operational stability.

How Equity Compensation Works

Equity compensation grants employees ownership shares or stock options, aligning their interests with company performance and long-term value creation. Unlike fixed salary payments, equity rewards fluctuate in value based on the company's market capitalization and financial success. Vesting schedules typically govern equity, requiring employees to remain with the company for a certain period before gaining full ownership of the shares.

Impact on Employee Motivation and Retention

Salary provides employees with immediate financial security, enhancing motivation through predictable income, while equity compensation aligns employees' interests with company performance, fostering long-term commitment and retention. Equity incentives often increase loyalty and drive innovation, as employees benefit directly from company growth, which can outweigh short-term salary gains in boosting engagement. Combining salary and equity creates a balanced reward system that maximizes motivation and minimizes turnover by addressing both immediate needs and future aspirations.

Tax Implications of Salary vs Equity

Salary income is subject to immediate federal, state, and payroll taxes at ordinary income tax rates, resulting in predictable after-tax earnings for employees. Equity compensation, such as stock options or restricted stock units, often defers taxation until vesting or sale, potentially benefiting from capital gains tax treatment, which is typically lower than ordinary income tax rates. Understanding the timing and type of taxation on equity awards is essential for employees to optimize their overall compensation and tax liabilities.

Salary and Equity Trends in Startups vs Corporates

Startups increasingly emphasize equity compensation to attract and retain talent, offering employees stock options as a potential high-value reward aligned with company growth, while corporates tend to prioritize higher base salaries with limited equity due to established market stability. Salary trends in corporates show steady increments based on experience and role, whereas startup salaries often lag behind industry averages but compensate with significant equity upside potential. Employee rewards in startups reflect a strategic balance between immediate cash needs and long-term wealth creation through equity, contrasting with corporates' preference for predictable, cash-based compensation packages.

Choosing the Right Compensation Package

Selecting the right compensation package involves balancing immediate salary needs with long-term equity potential, crucial for aligning employee motivation with company growth. Salary provides financial stability and predictable income, while equity compensation offers a stake in the company's success, potentially leading to significant financial rewards over time. Evaluating factors such as risk tolerance, career goals, and market conditions helps employees and employers design a tailored compensation strategy that maximizes overall value.

Negotiating Salary and Equity Offers

Negotiating salary and equity offers requires balancing immediate financial needs with long-term investment potential, where salary provides predictable income and equity offers ownership stakes in company growth. Thoroughly evaluating the company's valuation, growth potential, and equity vesting schedule can maximize compensation value while mitigating risks. Clear communication about your market value and aligning compensation structures with personal financial goals ensures more favorable and customized reward packages.

Related Important Terms

Liquidation Preference

Liquidation preference in equity compensation ensures employees receive a prioritized payout during company liquidation events, providing a safety net that salary alone cannot offer. While salary guarantees fixed income, equity with liquidation preference aligns employee incentives with company success and potential high-value exit scenarios.

Vesting Cliff

Vesting cliffs in equity compensation create a specified period before employees earn ownership, aligning long-term incentives with company performance and retention goals. Unlike salary, which provides immediate financial reward, equity with vesting cliffs delays full benefits, fostering sustained commitment and reducing early turnover risk.

Double-Trigger Acceleration

Double-trigger acceleration in equity compensation enables employees to vest their stock options faster upon a change of control combined with termination, safeguarding their financial interests beyond regular salary payouts. This mechanism enhances total reward packages by providing significant equity upside alongside stable salary, aligning employee retention with corporate acquisition events.

Option Pool Shuffle

Option pool shuffle reallocates equity shares among founders and investors, impacting the size of equity compensation available to employees and potentially reducing their ownership percentage. Salary remains a fixed cash reward unaffected by these shifts, influencing employee motivation and retention when equity dilution occurs.

RSU (Restricted Stock Unit) Overhang

RSU overhang represents the percentage of a company's shares reserved for employee stock compensation relative to its total outstanding shares, impacting shareholder dilution and employee motivation. Balancing salary with equity compensation like RSUs requires careful consideration of overhang levels to attract talent while maintaining shareholder value.

Post-Termination Exercise Window

Equity compensation often includes a post-termination exercise window, typically ranging from 30 to 90 days, allowing employees to purchase vested stock options after leaving the company. Salary-based rewards provide immediate financial benefits without exercise deadlines, making equity's post-termination requirements a critical consideration in total compensation planning.

Phantom Equity

Phantom equity offers employees a form of equity compensation that simulates stock ownership without actual shares, providing potential financial rewards tied to company performance without dilution. This compensation method aligns employee incentives with long-term business growth while maintaining cash salary stability and minimizing immediate tax impact.

Strike Price Arbitrage

Strike price arbitrage in equity compensation allows employees to capitalize on the difference between the grant price and the current market value, potentially yielding substantial financial gains compared to fixed salary increments. This strategy leverages stock options' inherent volatility and timing to maximize rewards beyond traditional salary structures, aligning employee incentives with company performance and shareholder value.

Token-Based Compensation

Token-based compensation offers employees a unique value proposition by providing equity in the form of digital tokens that can appreciate alongside company growth, aligning incentives beyond fixed salary structures. This approach enhances long-term wealth potential through market-driven token valuation while maintaining liquidity options often absent in traditional stock equity plans.

Dilution Risk

Equity compensation offers potential for significant financial gain through company growth but carries dilution risk as issuing new shares can decrease an employee's ownership percentage. Salary provides stable, predictable income without dilution concerns, making it a lower-risk reward compared to equity-based incentives.

Salary vs Equity Compensation for employee rewards. Infographic

hrdif.com

hrdif.com