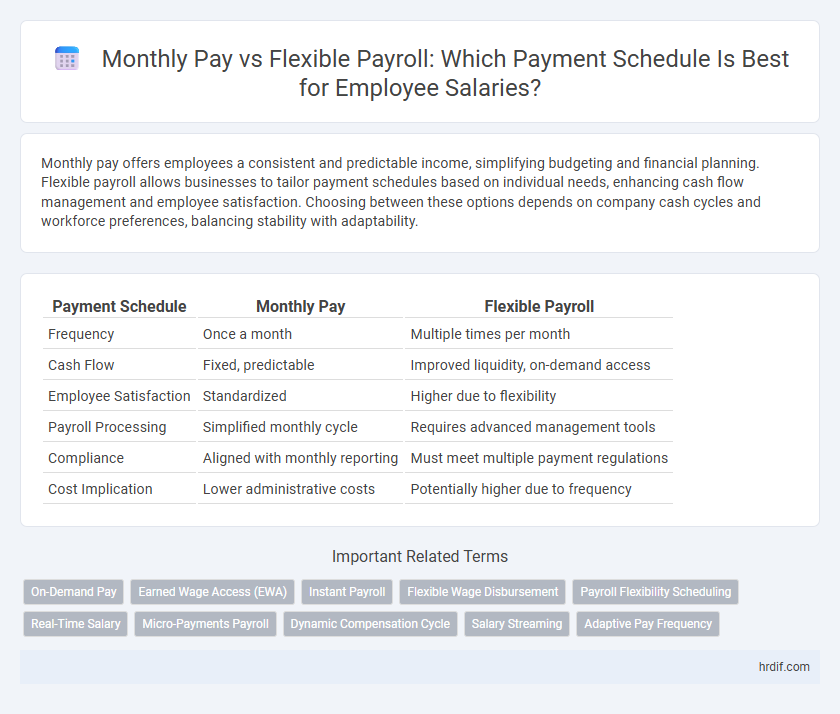

Monthly pay offers employees a consistent and predictable income, simplifying budgeting and financial planning. Flexible payroll allows businesses to tailor payment schedules based on individual needs, enhancing cash flow management and employee satisfaction. Choosing between these options depends on company cash cycles and workforce preferences, balancing stability with adaptability.

Table of Comparison

| Payment Schedule | Monthly Pay | Flexible Payroll |

|---|---|---|

| Frequency | Once a month | Multiple times per month |

| Cash Flow | Fixed, predictable | Improved liquidity, on-demand access |

| Employee Satisfaction | Standardized | Higher due to flexibility |

| Payroll Processing | Simplified monthly cycle | Requires advanced management tools |

| Compliance | Aligned with monthly reporting | Must meet multiple payment regulations |

| Cost Implication | Lower administrative costs | Potentially higher due to frequency |

Understanding Monthly Pay and Flexible Payroll

Monthly pay provides employees with a fixed, predictable income, typically disbursed once per month on a set date. Flexible payroll options allow for multiple payments within the month or variable pay dates tailored to employee preferences or company cash flow. Understanding the differences helps organizations balance consistent budgeting with employee financial needs and satisfaction.

Key Differences Between Monthly and Flexible Payment Schedules

Monthly pay offers a consistent, fixed salary disbursed once per month, providing predictability in budgeting and financial planning. Flexible payroll allows employees to receive payments multiple times within a pay period, enhancing cash flow and accommodating variable work hours or commission-based income. Key differences include payment frequency, financial stability, and adaptability to workforce needs, with monthly pay favoring steady income and flexible payroll supporting dynamic earning structures.

Pros and Cons of Monthly Salaries

Monthly salaries provide predictable income with consistent pay dates, aiding in long-term financial planning and budgeting for employees. However, the fixed payment schedule may limit flexibility in addressing urgent financial needs or irregular expenses compared to flexible payroll options. Employers benefit from simplified administrative processes but might face challenges in employee satisfaction if immediate access to earned wages is prioritized.

Advantages of Flexible Payroll for Employees

Flexible payroll offers employees the advantage of receiving wages more frequently, improving cash flow and reducing financial stress compared to traditional monthly pay schedules. This payment method enhances budgeting capabilities by aligning income with regular expenses, leading to better financial management. Moreover, flexible payroll supports employee retention and satisfaction by accommodating individual preferences and unexpected financial needs.

Financial Planning: Monthly Pay vs Flexible Payroll

Monthly pay provides consistent income that simplifies budgeting and long-term financial planning by ensuring predictable cash flow every pay period. Flexible payroll offers variable payment schedules, enabling employees to access earnings more frequently or as needed, which can enhance short-term financial agility and emergency fund management. Choosing between monthly pay and flexible payroll impacts personal money management strategies, influencing savings behavior and expense tracking efficiency.

Employer Perspectives on Payroll Scheduling

Employers favor monthly pay for its simplicity and ease of budgeting, providing consistent payroll processing and straightforward financial forecasting. Flexible payroll schedules allow employers to align payment timing with cash flow variations, improving liquidity management and employee satisfaction. Balancing fixed monthly payments with flexible options helps employers optimize operational efficiency while maintaining workforce motivation.

Employee Satisfaction: Fixed vs Flexible Payments

Monthly pay provides employees with consistent, predictable income, enhancing financial stability and satisfaction. Flexible payroll options accommodate varying cash flow needs, increasing employee autonomy and morale. Employers who offer flexible payments often see improved retention and engagement due to personalized compensation schedules.

Impact on Cash Flow Management

Monthly pay provides predictable cash flow management by delivering consistent income on set dates, enabling more straightforward budgeting and expense planning. Flexible payroll options, such as bi-weekly or on-demand payments, improve liquidity by allowing employees to access funds closer to when expenses occur, reducing reliance on credit. Companies adopting flexible payroll can balance operational cash flow more effectively, minimizing the risk of cash shortages while enhancing employee financial wellness.

Industry Trends in Salary Payment Schedules

Industry trends in salary payment schedules reveal a growing shift from traditional monthly pay to flexible payroll systems that accommodate varied employee needs and improve cash flow management. Flexible payroll options, such as bi-weekly or semi-monthly payments, enhance employee satisfaction by providing more frequent access to earnings and better financial planning. Companies adopting these models often experience increased retention rates and competitiveness in talent acquisition across sectors.

Choosing the Best Payment Schedule for Your Career

Selecting the ideal payment schedule depends on your financial needs and career goals, with monthly pay providing consistent income ideal for budgeting fixed expenses. Flexible payroll schedules offer adaptability, allowing employees to access earnings more frequently, which can improve cash flow management and reduce financial stress. Evaluating personal spending habits and job stability helps determine whether a steady monthly salary or flexible payment intervals best support your long-term career and financial wellbeing.

Related Important Terms

On-Demand Pay

On-Demand Pay offers employees immediate access to earned wages before the traditional monthly pay cycle, enhancing financial flexibility and reducing reliance on costly loans. This flexible payroll solution improves cash flow management and employee satisfaction by aligning payment schedules with individual needs rather than fixed monthly dates.

Earned Wage Access (EWA)

Earned Wage Access (EWA) allows employees to access a portion of their earned wages before the traditional monthly pay date, enhancing financial flexibility and reducing reliance on payday loans. Flexible payroll schedules supported by EWA improve cash flow management for workers while maintaining employer payroll efficiency and compliance.

Instant Payroll

Instant Payroll offers employees immediate access to earned wages, enhancing financial flexibility compared to traditional monthly pay schedules that provide fixed payments once a month; this real-time payment method reduces financial stress and improves cash flow management. Organizations adopting Instant Payroll see increased employee satisfaction and retention, as workers can better align income with expenses without waiting for the standard monthly payday.

Flexible Wage Disbursement

Flexible wage disbursement allows employees to access earned wages in real-time, reducing financial stress and improving cash flow management compared to traditional monthly pay cycles. This payment schedule enhances workforce satisfaction by offering greater control over earnings and addressing urgent financial needs promptly.

Payroll Flexibility Scheduling

Monthly pay provides a fixed, consistent income stream, ideal for predictable budgeting, while flexible payroll scheduling allows employees to choose payment intervals, enhancing cash flow control and addressing individual financial needs. Payroll flexibility scheduling improves employee satisfaction and retention by accommodating varying lifestyle demands and reducing financial stress.

Real-Time Salary

Real-time salary payments through flexible payroll enable employees to access earned wages immediately, enhancing financial stability compared to traditional monthly pay cycles that delay income until the end of the billing period. This shift toward on-demand payroll reduces financial stress and supports better cash flow management by aligning pay schedules with actual work hours or milestones rather than fixed monthly dates.

Micro-Payments Payroll

Micro-payments payroll offers greater flexibility by distributing monthly pay into smaller, more frequent installments, enhancing employee cash flow management and reducing financial stress. This payment schedule aligns with modern workforce demands by enabling real-time access to earned wages, improving overall payroll efficiency and satisfaction.

Dynamic Compensation Cycle

A dynamic compensation cycle offers employees the flexibility to choose between monthly pay and flexible payroll schedules, optimizing cash flow management and aligning with individual financial needs. This approach enhances employee satisfaction by providing tailored payment frequencies that accommodate varying income volatility and budgeting preferences.

Salary Streaming

Monthly pay provides employees with a fixed salary at the end of each month, ensuring predictable income, while flexible payroll systems, including salary streaming, allow workers to access earned wages in real-time or on-demand, improving financial flexibility and reducing cash flow stress. Salary streaming platforms integrate with payroll data to enable seamless, instant access to accrued earnings, enhancing employee satisfaction and retention by addressing immediate financial needs without waiting for traditional pay cycles.

Adaptive Pay Frequency

Adaptive pay frequency enhances monthly pay by allowing employees to select payment schedules that align with their financial needs, improving cash flow management and job satisfaction. Flexible payroll systems reduce financial stress and increase retention by delivering wages on demand rather than fixed monthly dates.

Monthly Pay vs Flexible Payroll for payment schedule. Infographic

hrdif.com

hrdif.com