Annual pay provides a consistent and predictable income stream, enabling employees to plan their finances with confidence throughout the year. On-demand pay offers flexibility by allowing workers to access earned wages before the traditional payday, reducing financial stress and improving cash flow management. Choosing between annual pay and on-demand pay depends on individual needs for stability versus immediate access to funds.

Table of Comparison

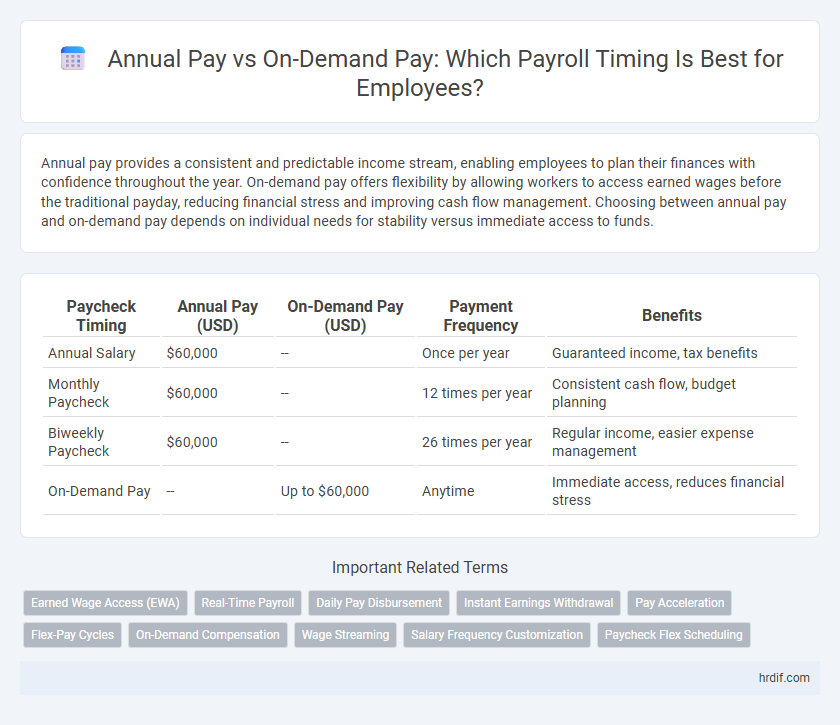

| Paycheck Timing | Annual Pay (USD) | On-Demand Pay (USD) | Payment Frequency | Benefits |

|---|---|---|---|---|

| Annual Salary | $60,000 | -- | Once per year | Guaranteed income, tax benefits |

| Monthly Paycheck | $60,000 | -- | 12 times per year | Consistent cash flow, budget planning |

| Biweekly Paycheck | $60,000 | -- | 26 times per year | Regular income, easier expense management |

| On-Demand Pay | -- | Up to $60,000 | Anytime | Immediate access, reduces financial stress |

Understanding Annual Pay: Pros and Cons

Annual pay provides consistent income stability and simplifies budgeting by distributing a fixed salary over a year. However, it lacks flexibility for employees who may benefit from on-demand pay options to address unexpected expenses. Understanding these pros and cons helps workers choose the best paycheck timing to suit their financial needs.

On-Demand Pay: The New Salary Revolution

On-demand pay offers employees immediate access to earned wages, eliminating the traditional wait for monthly or biweekly paychecks. This innovative salary model improves financial flexibility and reduces reliance on high-interest loans by allowing workers to withdraw funds as needed. Companies adopting on-demand pay report higher employee satisfaction and retention, signaling a shift towards more dynamic payroll solutions.

Financial Stability: Annual vs On-Demand Pay

Annual pay offers consistent paycheck timing, enabling employees to budget effectively and maintain financial stability throughout the year. On-demand pay provides immediate access to earned wages, reducing reliance on credit but may lead to unpredictable cash flow. Choosing between annual and on-demand pay hinges on balancing steady income with flexible access to funds for optimal financial management.

Employee Satisfaction: Which Model Wins?

Annual pay provides employees with financial stability and predictable income, contributing to higher overall job satisfaction. On-demand pay offers flexibility and immediate access to earned wages, reducing financial stress and improving employee morale. Studies show companies adopting on-demand pay models report increased retention rates and positive employee feedback compared to traditional annual pay structures.

Cash Flow Management for Workers

Annual pay provides a predictable income stream, allowing workers to budget effectively over 12 months and plan long-term expenses with confidence. On-demand pay offers flexibility by enabling employees to access earned wages immediately, improving day-to-day cash flow management and reducing reliance on high-interest loans or overdrafts. Balancing annual pay with on-demand access empowers workers to stabilize finances while addressing unexpected expenses promptly.

Impact on Employer-Employee Relationships

Annual pay structures foster predictability and financial stability, enhancing trust and long-term commitment between employers and employees. On-demand pay offers flexibility and immediate access to earnings, which can improve employee satisfaction and reduce financial stress. Balancing these payment methods influences retention rates, productivity, and the overall dynamics of workplace relationships.

Productivity Trends: Pay Timing Analysis

Annual pay structures provide employees with consistent, predictable income, which can reduce financial stress and increase long-term productivity by ensuring stability. On-demand pay enables immediate access to earned wages, promoting higher engagement and motivation by aligning compensation timing with workers' needs, leading to improved short-term productivity. Studies indicate that flexible paycheck timing, such as on-demand pay, correlates with decreased absenteeism and enhanced employee performance in dynamic work environments.

Attracting Talent: Is Flexibility the Key?

Annual pay provides employees with predictable income, fostering financial stability and long-term commitment. On-demand pay offers immediate access to earned wages, appealing to talent seeking greater financial flexibility and control over their cash flow. Employers combining both pay structures can enhance their attractiveness by meeting diverse employee preferences, potentially boosting talent acquisition and retention rates.

Financial Wellness and Paycheck Timing

Annual pay provides predictable income but may create financial stress due to long gaps between paychecks, impacting financial wellness negatively. On-demand pay offers greater flexibility by allowing employees to access earned wages anytime, improving cash flow management and reducing reliance on high-interest loans. This timely access to funds supports better budgeting, enhances financial stability, and promotes overall employee well-being.

Future Trends in Payroll Systems

Future trends in payroll systems emphasize the shift from traditional annual pay structures to flexible on-demand pay options, enhancing employee financial wellness. Real-time payment platforms and apps enable workers to access earned wages instantly, reducing reliance on fixed pay cycles. Integration of AI and blockchain technology streamlines accuracy and security in paycheck timing, promoting transparency and trust in payroll management.

Related Important Terms

Earned Wage Access (EWA)

Earned Wage Access (EWA) enables employees to access a portion of their earned wages before the traditional annual or biweekly paycheck, improving financial flexibility and reducing reliance on high-interest loans. This on-demand pay model enhances cash flow management by allowing workers to withdraw earned income anytime, aligning payroll timing with individual needs rather than fixed pay cycles.

Real-Time Payroll

Real-time payroll enables employees to access earned wages instantly, contrasting traditional annual pay which consolidates income into a single yearly lump sum. This on-demand pay model improves financial flexibility and cash flow management, allowing workers to better align paycheck timing with their immediate expenses.

Daily Pay Disbursement

Daily pay disbursement offers employees immediate access to earnings, enhancing financial flexibility compared to traditional annual salary structures that provide income only once a year. On-demand pay systems reduce cash-flow stress by allowing workers to receive wages earned up to any point in the pay cycle, promoting timely financial management and wellbeing.

Instant Earnings Withdrawal

Instant earnings withdrawal offers employees the advantage of accessing a portion of their earned wages immediately, contrasting traditional annual pay which consolidates income into a lump sum once per year. This on-demand pay system improves financial flexibility and reduces reliance on high-interest loans by aligning paycheck timing with actual work performed.

Pay Acceleration

Pay acceleration enables employees to access a portion of their earned wages before the traditional annual or monthly payday, improving cash flow and financial flexibility. On-demand pay reduces reliance on fixed paycheck schedules, allowing for timely access to funds and minimizing the effects of delayed salary payments.

Flex-Pay Cycles

Flex-Pay Cycles offer employees the option to receive annual pay distributed through more frequent, customizable installments rather than traditional lump-sum payments, enhancing financial flexibility and cash flow management. This on-demand pay structure alleviates stress related to paycheck timing by aligning income with individual budgeting needs, reducing dependence on credit or loans.

On-Demand Compensation

On-demand compensation offers immediate access to earned wages, providing greater financial flexibility compared to traditional annual pay schedules that distribute salary once or twice a year. This pay model improves cash flow and reduces the need for high-interest loans by allowing employees to withdraw earnings as needed before the standard paycheck date.

Wage Streaming

Wage streaming offers employees access to earned wages on-demand, improving cash flow compared to traditional annual pay which distributes income in fixed intervals. This flexible paycheck timing enhances financial stability by allowing workers to withdraw earnings immediately after each shift rather than waiting for a monthly or biweekly paycheck.

Salary Frequency Customization

Annual pay provides a fixed yearly income that can be divided into consistent paycheck intervals, while on-demand pay allows employees to access earned wages instantly, improving cash flow flexibility. Salary frequency customization enables businesses to tailor paycheck timing to employee preferences, enhancing satisfaction and financial well-being.

Paycheck Flex Scheduling

Paycheck Flex Scheduling offers employees the advantage of on-demand pay, allowing access to earned wages before the traditional annual pay date, improving cash flow and financial flexibility. This system reduces dependence on fixed annual salary disbursements, aligning paycheck timing with individual needs and enhancing overall financial well-being.

annual pay vs on-demand pay for paycheck timing Infographic

hrdif.com

hrdif.com