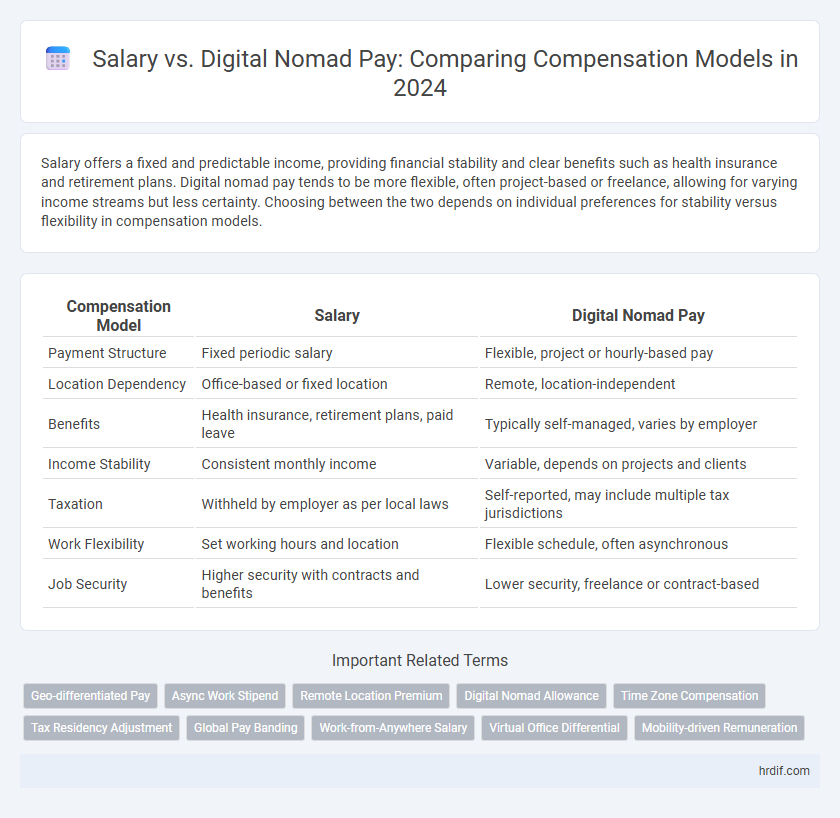

Salary offers a fixed and predictable income, providing financial stability and clear benefits such as health insurance and retirement plans. Digital nomad pay tends to be more flexible, often project-based or freelance, allowing for varying income streams but less certainty. Choosing between the two depends on individual preferences for stability versus flexibility in compensation models.

Table of Comparison

| Compensation Model | Salary | Digital Nomad Pay |

|---|---|---|

| Payment Structure | Fixed periodic salary | Flexible, project or hourly-based pay |

| Location Dependency | Office-based or fixed location | Remote, location-independent |

| Benefits | Health insurance, retirement plans, paid leave | Typically self-managed, varies by employer |

| Income Stability | Consistent monthly income | Variable, depends on projects and clients |

| Taxation | Withheld by employer as per local laws | Self-reported, may include multiple tax jurisdictions |

| Work Flexibility | Set working hours and location | Flexible schedule, often asynchronous |

| Job Security | Higher security with contracts and benefits | Lower security, freelance or contract-based |

Traditional Salary Compensation: An Overview

Traditional salary compensation provides employees with a fixed, predictable income typically paid monthly or biweekly, ensuring financial stability and clear tax obligations. Unlike digital nomad pay, which often varies based on project or location, salary models include benefits such as health insurance, retirement contributions, and paid leave, enhancing overall employee security. This compensation structure supports long-term career development within established organizations, aligning with conventional employment contracts and legal regulations worldwide.

The Rise of Digital Nomad Pay Structures

Digital nomad pay structures emphasize flexibility and location independence, offering compensation models that often include project-based fees, performance bonuses, and remote work stipends. Traditional salary systems focus on fixed monthly or annual payments tied to a specific location or office presence, limiting adaptability in global work environments. The rise of digital nomad pay reflects shifting workforce trends, enabling companies to attract diverse talent and optimize costs while employees benefit from personalized income models aligned with remote lifestyles.

Salary vs. Project-Based Payments: Key Differences

Salary compensation offers consistent, predictable income with fixed pay intervals, providing financial stability and benefits such as health insurance and retirement plans. Project-based payments, favored by digital nomads, vary according to project scope, deliverables, and deadlines, allowing greater flexibility but less income predictability. Understanding these models is crucial for optimizing compensation strategies aligned with career goals and lifestyle preferences.

Flexibility in Earnings: Remote Work vs. Fixed Pay

Flexible earnings in digital nomad pay models allow professionals to leverage multiple income streams through remote work, contrasting sharply with traditional fixed salary structures that provide steady but limited financial variation. Remote workers often benefit from the ability to adjust their workload and source diverse projects, optimizing compensation based on market demand and personal productivity. Fixed pay offers consistent income security but lacks the adaptability available in remote and freelance compensation models.

Performance-Based Compensation for Digital Nomads

Performance-based compensation for digital nomads leverages metrics such as project completion time, client feedback scores, and measurable output quality to align pay with productivity rather than fixed salaries. This model reduces overhead costs for companies and motivates nomads by rewarding efficiency and results, often incorporating flexible pay rates adjusted for varying workloads and project complexities. Data from remote work studies indicates a 20-30% increase in work output among digital nomads incentivized via performance-based pay structures compared to traditional salaried employees.

Geographic Pay Adjustments: Local Salary vs. Global Remote Rates

Geographic pay adjustments differentiate traditional local salary structures from digital nomad pay models by aligning compensation with regional economic conditions and living costs. Local salary models typically base wages on the company's headquarters or employee's physical location, whereas global remote rates consider market rates across multiple geographies, offering flexibility to attract talent worldwide. This shift enables companies to optimize payroll expenses while maintaining competitive and fair compensation for remote employees regardless of their location.

Benefits and Perks: Employer Packages vs. Nomadic Benefits

Employer salary packages often include comprehensive benefits such as health insurance, retirement plans, paid leave, and professional development opportunities, providing long-term financial security and structured support. Digital nomad pay models typically emphasize flexibility and freedom, offering stipends for coworking spaces, travel allowances, and technology reimbursements that cater to a mobile lifestyle. While traditional salary benefits focus on stability and future planning, nomadic benefits prioritize adaptability and immediate quality-of-life enhancements for remote work environments.

Tax Implications in Salary and Digital Nomad Compensation

Salary compensation typically involves fixed tax withholdings based on the employee's country of residence, leading to predictable tax liabilities and potential benefits such as social security contributions. Digital nomad pay, often characterized by freelance or contract income, introduces complex tax implications depending on the nomad's location, local tax treaties, and potential double taxation risks. Understanding these differences is crucial for accurate tax planning and compliance in global compensation models.

Security and Stability: Traditional vs. Nomadic Income Streams

Traditional salary models offer consistent monthly income with predictable tax withholdings, providing financial security and stability essential for long-term planning and creditworthiness. In contrast, digital nomad pay often varies due to fluctuating contract terms and currency exchange rates, introducing income volatility that requires rigorous budgeting and emergency savings. Employers providing traditional salaries generally offer benefits like health insurance and retirement plans, whereas nomadic income streams often lack such safety nets, demanding greater personal financial management.

Which Compensation Model Suits Your Career Goals?

Choosing between a traditional salary and digital nomad pay depends on your career goals, lifestyle preferences, and earning flexibility. Salaries offer stability, predictable income, and benefits such as health insurance and retirement plans, ideal for professionals seeking financial security. Digital nomad pay provides location independence and potentially higher income through diverse gigs or remote contracts, suitable for those prioritizing freedom and varied work experiences.

Related Important Terms

Geo-differentiated Pay

Geo-differentiated pay models adjust digital nomad compensation based on the employee's location, reflecting local living costs and market standards rather than a fixed salary. This approach promotes fairness and efficiency by aligning pay with regional economic conditions, contrasting traditional salary structures that typically offer uniform compensation regardless of geographic differences.

Async Work Stipend

Salary models provide fixed, predictable income streams, while digital nomad pay often incorporates asynchronous work stipends to support flexible, location-independent lifestyles. Async work stipends cover expenses such as coworking spaces, internet, and time zone flexibility allowances, making them a critical component in modern compensation strategies for remote professionals.

Remote Location Premium

Remote location premium significantly influences compensation models by increasing salaries for digital nomads working from high-cost or underserved areas compared to traditional fixed-location salaries. This adjustment recognizes the cost-of-living variations and lifestyle benefits, ensuring equitable pay that reflects geographic flexibility and market demand.

Digital Nomad Allowance

Digital nomad allowance offers flexible compensation by covering expenses such as coworking spaces, travel, and accommodation, enhancing the appeal beyond traditional salary models. This targeted allowance supports remote work lifestyles, making it a strategic component in attracting and retaining global talent.

Time Zone Compensation

Salary models often neglect time zone differences, leading to inequities in compensation for digital nomads who work across multiple regions. Digital nomad pay structures incorporate time zone compensation, ensuring fair remuneration by adjusting wages based on the cost of living and market rates in the employee's location.

Tax Residency Adjustment

Salary compensation models typically involve fixed income structures with tax residency obligations based on the employee's physical location. Digital nomad pay frameworks often require dynamic tax residency adjustments to optimize tax liabilities across multiple jurisdictions.

Global Pay Banding

Global pay banding standardizes salary ranges across diverse regions, ensuring equitable compensation for digital nomads regardless of location. This model addresses disparities by aligning pay with roles and experience rather than geographic cost of living, promoting fairness and talent retention in remote work environments.

Work-from-Anywhere Salary

Work-from-anywhere salary models offer greater flexibility by aligning compensation with regional cost-of-living variations, unlike traditional fixed salaries that do not account for location differences. Digital nomad pay structures often incorporate dynamic adjustments based on remote work locations, enhancing financial efficiency and employee satisfaction in global talent management.

Virtual Office Differential

Digital nomad pay structures often incorporate a Virtual Office Differential reflecting cost-of-living adjustments and location-based productivity metrics, contrasting with traditional fixed salary models that remain static regardless of geographic factors. This adjustment enables companies to optimize compensation costs while attracting global talent by aligning pay with regional economic conditions and remote work efficiencies.

Mobility-driven Remuneration

Mobility-driven remuneration models prioritize digital nomad pay by incorporating location-independent compensation strategies that adjust salaries based on cost of living and regional economic factors. This approach contrasts traditional fixed salary structures by offering flexible, mobility-based pay scales that enhance global workforce agility and employee satisfaction.

Salary vs Digital Nomad Pay for compensation models. Infographic

hrdif.com

hrdif.com