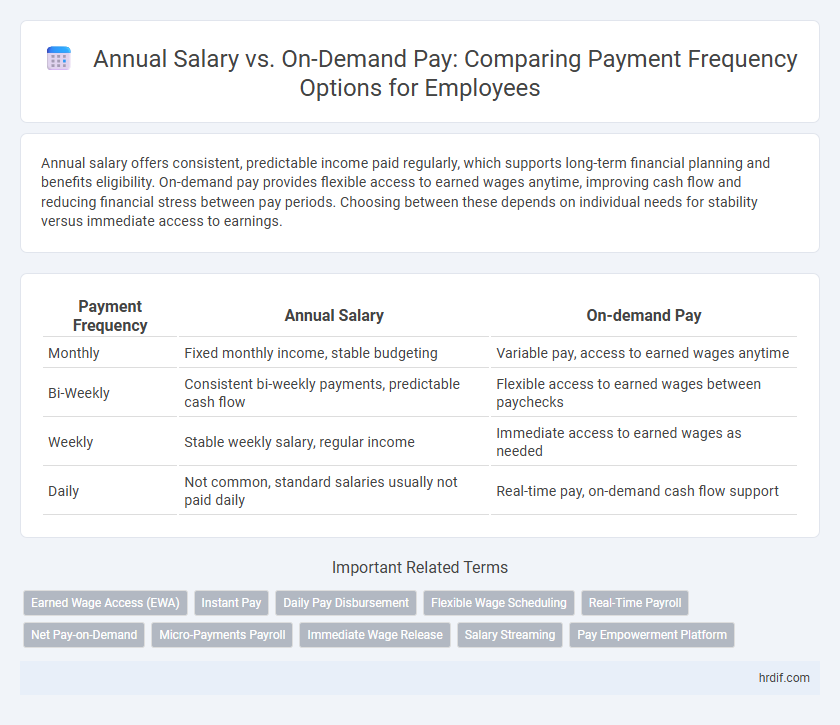

Annual salary offers consistent, predictable income paid regularly, which supports long-term financial planning and benefits eligibility. On-demand pay provides flexible access to earned wages anytime, improving cash flow and reducing financial stress between pay periods. Choosing between these depends on individual needs for stability versus immediate access to earnings.

Table of Comparison

| Payment Frequency | Annual Salary | On-demand Pay |

|---|---|---|

| Monthly | Fixed monthly income, stable budgeting | Variable pay, access to earned wages anytime |

| Bi-Weekly | Consistent bi-weekly payments, predictable cash flow | Flexible access to earned wages between paychecks |

| Weekly | Stable weekly salary, regular income | Immediate access to earned wages as needed |

| Daily | Not common, standard salaries usually not paid daily | Real-time pay, on-demand cash flow support |

Understanding Annual Salary and On-demand Pay

Annual salary represents a fixed amount paid over a year, providing financial stability and predictable budgeting for employees. On-demand pay allows workers to access earned wages anytime, enhancing cash flow flexibility and reducing financial stress. Understanding the balance between annual salary and on-demand pay options helps employees choose payment frequency aligned with their cash flow needs and lifestyle preferences.

Key Differences in Payment Frequency

Annual salary provides employees with a fixed total income distributed in regular intervals, typically monthly or biweekly, ensuring steady cash flow and financial predictability. On-demand pay allows workers to access earned wages immediately after completing work, enhancing liquidity and reducing financial stress without waiting for the traditional payroll cycle. Key differences in payment frequency lie in the stability and timing of income distribution, where annual salary emphasizes consistency, while on-demand pay prioritizes flexibility and immediacy.

Pros and Cons of Annual Salary

Annual salary provides consistent, predictable income that simplifies budgeting and financial planning for employees. It often includes benefits like paid leave and bonuses, enhancing total compensation but may limit flexibility in accessing earnings between pay periods. However, fixed annual pay can disadvantage workers during periods of fluctuating workloads, reducing the opportunity to earn more through overtime or on-demand pay structures.

Advantages and Disadvantages of On-demand Pay

On-demand pay offers employees immediate access to earned wages, enhancing financial flexibility and reducing reliance on high-interest loans. This payment frequency can improve employee satisfaction and reduce stress by aligning income with cash flow needs. However, it may lead to irregular budgeting habits and increased administrative costs for employers compared to traditional annual salary structures.

Impact on Financial Planning

Annual salary offers predictable income that simplifies budgeting and long-term financial planning by providing stability and clearer forecasting. On-demand pay delivers flexibility with immediate access to earned wages, which can help manage unexpected expenses but complicate consistent saving habits. Choosing between these payment frequencies directly affects cash flow management, savings strategies, and overall financial security.

Employee Motivation and Job Satisfaction

Annual salary provides employees with financial stability and a predictable income, which enhances job satisfaction by reducing financial stress. On-demand pay offers flexibility, allowing employees to access earnings when needed, which can boost motivation by improving cash flow management. Balancing stable annual salaries with on-demand pay options can lead to higher employee engagement and retention.

Employer Perspectives: Managing Payroll

Employers managing payroll often prefer annual salary structures for their predictability and streamlined budgeting, which simplifies cash flow management and ensures consistent tax withholding. On-demand pay, while appealing for employee flexibility, introduces complexity in payroll processing and can increase administrative costs due to frequent calculations and disbursements. Balancing these payment frequencies requires employers to consider operational efficiency, compliance risks, and workforce satisfaction when designing compensation plans.

Legal Considerations for Payment Schedules

Legal considerations for payment schedules require employers to comply with state and federal wage laws when choosing between annual salary and on-demand pay structures. Annual salary payments must meet minimum wage and overtime requirements while ensuring timely disbursements as mandated by the Fair Labor Standards Act (FLSA). On-demand pay options must also adhere to regulations preventing wage theft, with clear documentation and transparency to avoid legal disputes.

Industry Trends in Salary Structures

Annual salary remains the dominant payment frequency in traditional industries such as finance and healthcare, offering employees predictable income and benefits. On-demand pay is rapidly gaining traction in gig economy sectors and technology startups, driven by workforce demand for greater financial flexibility and immediate access to earnings. Recent industry data indicates a growing hybrid model, where companies integrate both salary and on-demand pay options to attract diverse talent pools and improve employee retention.

Choosing the Right Payment Model for Your Career

Choosing the right payment model depends on your financial goals and cash flow preferences; annual salary provides stability and predictable income, ideal for long-term budgeting. On-demand pay offers flexibility by allowing access to earned wages before payday, which suits freelance or gig workers needing immediate funds. Evaluate your career path and lifestyle to determine if consistent monthly income or variable pay fits best with your financial management strategy.

Related Important Terms

Earned Wage Access (EWA)

Earned Wage Access (EWA) offers employees immediate access to a portion of their earned salary before the traditional pay cycle, enhancing financial flexibility compared to fixed annual salary payments. This on-demand pay model reduces reliance on high-interest loans and improves cash flow management, making it a valuable alternative to standard annual salary structures.

Instant Pay

Instant Pay offers employees immediate access to earned wages, enhancing financial flexibility compared to traditional annual salary structures that distribute income in fixed intervals. This payment frequency reduces reliance on credit and improves cash flow management, aligning compensation more closely with real-time work performance.

Daily Pay Disbursement

Daily pay disbursement offers employees greater financial flexibility by providing immediate access to earned wages, reducing reliance on traditional monthly or annual salary cycles. This payment frequency supports improved cash flow management and enhances job satisfaction, especially for those with fluctuating work hours or urgent financial needs.

Flexible Wage Scheduling

Flexible wage scheduling offers employees the advantage of choosing between annual salary and on-demand pay, allowing income to better match personal financial needs and cash flow variability. This adaptability can enhance employee satisfaction and retention by providing timely access to earned wages without waiting for traditional pay cycles.

Real-Time Payroll

Real-time payroll systems enable on-demand pay by providing employees instant access to earned wages, contrasting with traditional annual salary payments that distribute income at fixed intervals. This shift toward flexible payment frequency improves cash flow management and enhances financial well-being for workers by aligning pay distribution with actual work hours.

Net Pay-on-Demand

Net Pay-on-Demand offers employees immediate access to earned wages, reducing financial stress compared to traditional annual salary disbursements that provide a lump sum once per year. This payment frequency enhances cash flow flexibility and supports better budgeting, appealing to workers seeking timely compensation over fixed annual income.

Micro-Payments Payroll

Micro-payments payroll offers flexible on-demand pay options that enable employees to access earned wages instantly, contrasting with traditional annual salary structures that distribute compensation in fixed periodic increments; this shift enhances financial agility and reduces dependence on monthly pay cycles. By leveraging technology for real-time earnings tracking, micro-payments payroll systems improve cash flow management and employee satisfaction through immediate financial access.

Immediate Wage Release

Immediate wage release through on-demand pay offers employees faster access to earned income compared to traditional annual salary disbursements, enhancing financial flexibility and reducing the need for short-term loans. This payment frequency model supports improved cash flow management by allowing workers to access wages as they are earned rather than waiting for monthly or yearly paycheck cycles.

Salary Streaming

Salary streaming provides employees with continuous access to earned wages throughout the pay period, contrasting with traditional annual salary models that deliver lump-sum payments monthly or biweekly. This on-demand pay approach enhances financial flexibility, reduces reliance on high-interest loans, and supports improved cash flow management for workers.

Pay Empowerment Platform

Pay Empowerment Platform offers flexible compensation options by integrating annual salary structures with on-demand pay features, enabling employees to access earned wages instantly while maintaining stable income predictions. This hybrid payment system enhances financial wellness and employee satisfaction by providing the security of a fixed salary alongside the liquidity benefits of real-time pay access.

Annual Salary vs On-demand Pay for payment frequency. Infographic

hrdif.com

hrdif.com