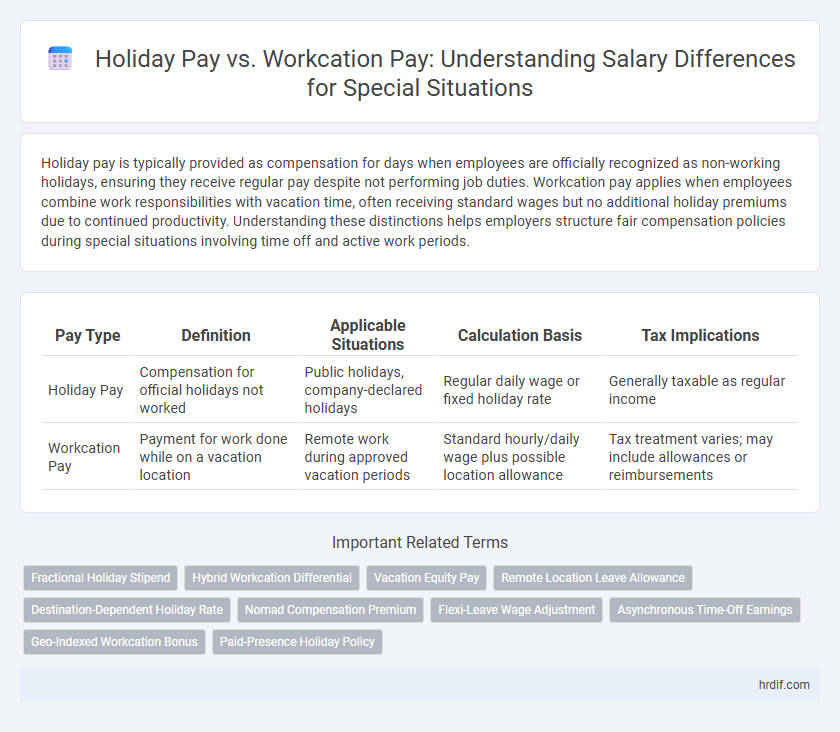

Holiday pay is typically provided as compensation for days when employees are officially recognized as non-working holidays, ensuring they receive regular pay despite not performing job duties. Workcation pay applies when employees combine work responsibilities with vacation time, often receiving standard wages but no additional holiday premiums due to continued productivity. Understanding these distinctions helps employers structure fair compensation policies during special situations involving time off and active work periods.

Table of Comparison

| Pay Type | Definition | Applicable Situations | Calculation Basis | Tax Implications |

|---|---|---|---|---|

| Holiday Pay | Compensation for official holidays not worked | Public holidays, company-declared holidays | Regular daily wage or fixed holiday rate | Generally taxable as regular income |

| Workcation Pay | Payment for work done while on a vacation location | Remote work during approved vacation periods | Standard hourly/daily wage plus possible location allowance | Tax treatment varies; may include allowances or reimbursements |

Understanding Holiday Pay and Workcation Pay

Holiday pay refers to the compensation employees receive for officially recognized holidays when they are not working, typically calculated as a percentage of regular wages or a fixed rate per day. Workcation pay applies when employees combine work with vacation, requiring separate agreements to compensate for hours worked during typically non-working days or holidays. Understanding the distinctions ensures accurate payroll handling and compliance with labor regulations, particularly in special situations where work and leave overlap.

Key Differences Between Holiday Pay and Workcation Pay

Holiday pay compensates employees for scheduled time off during recognized public holidays, often calculated based on standard daily wages or contractual agreements. Workcation pay applies when employees perform work duties while on a vacation or remote location, typically involving overtime rates or special allowances for non-standard work environments. Key differences include eligibility criteria, pay calculation methods, and the nature of time off--holiday pay rewards abstaining from work, whereas workcation pay compensates for working during leisure periods.

Eligibility Criteria for Holiday and Workcation Pay

Holiday pay eligibility primarily requires an employee to be on an official company-recognized holiday or meet criteria set by labor laws, such as minimum hours worked in a predetermined period. Workcation pay eligibility depends on specific company policies allowing remuneration for work performed during an approved workcation period, often tied to meeting productivity targets or prior approval. Both require clear documentation and adherence to contract terms to qualify for the respective pay types.

How Special Situations Affect Pay Entitlements

Special situations such as holidays or workcations can significantly alter pay entitlements by introducing specific compensation rules for time off or remote work. Holiday pay ensures employees receive standard or premium wages for official non-working days, while workcation pay may involve standard salary continuation with ambiguous overtime or bonus eligibility depending on company policy. Understanding these distinctions is crucial for accurately calculating total remuneration during atypical work arrangements or mandated breaks.

Legal Considerations: Labor Laws on Holiday and Workcation Pay

Labor laws often mandate specific compensation rates for holiday pay, typically requiring employers to pay employees at least 1.5 times their regular hourly wage for work performed on statutory holidays. Workcation pay, where employees combine work with vacation time, lacks uniform legal guidelines but may be governed by standard overtime and holiday compensation rules depending on jurisdiction. Employers must carefully review local labor statutes to ensure compliance with regulations regarding holiday and workcation pay to avoid legal disputes and penalties.

Calculating Holiday Pay vs Workcation Pay

Calculating Holiday Pay involves multiplying the employee's regular daily wage by the number of holiday hours worked, ensuring compliance with labor laws that mandate premium rates for holidays. Workcation Pay, however, requires assessing the employee's productivity and hours spent working remotely during a vacation period, often integrating standard pay rates with any overtime or special allowances based on company policy. Accurate payroll systems must differentiate these pay types to maintain transparency and adherence to compensation regulations in special work situations.

Employee Rights and Employer Obligations

Holiday pay entitles employees to compensation during designated days off, reflecting their contractual rights and statutory protections under labor laws. Workcation pay, a newer concept, compensates employees who work remotely while on vacation, requiring clear employer policies to delineate hours, tasks, and remuneration. Employers must ensure transparent communication and compliance with labor standards to honor employee rights and avoid disputes in these special compensation scenarios.

Tax Implications of Holiday and Workcation Pay

Holiday pay is typically subject to standard income tax and social security contributions based on statutory regulations and employer payroll policies. Workcation pay may involve complex tax considerations, potentially qualifying as regular salary or a taxable benefit depending on jurisdiction and employer arrangements. Employers and employees must evaluate local tax laws to determine applicable withholding, reporting requirements, and possible deductions related to holiday or workcation compensations.

Best Practices for Employers Handling Special Situations

Employers should establish clear policies distinguishing holiday pay and workcation pay to ensure fair compensation during special situations. Holiday pay typically compensates employees for non-working holidays, while workcation pay may apply when employees work remotely during vacation periods. Transparent communication and consistent application of these policies help maintain employee satisfaction and legal compliance.

Future Trends: The Evolving Landscape of Workcation Pay

Holiday pay remains a standard benefit for employees taking traditional time off, but workcation pay is emerging as a competitive perk that blends vacation with remote work flexibility. Future trends show companies increasingly adopting hybrid compensation models that account for remote work locations and productivity during workcations, adjusting pay structures to reflect these new work dynamics. Data indicates a rise in tailored holiday and workcation pay policies, driven by employee demand for wellness and work-life balance enhancements in an evolving labor market.

Related Important Terms

Fractional Holiday Stipend

Holiday pay typically compensates employees for non-working days based on their regular salary, while workcation pay involves remuneration for working remotely during vacation, often requiring special arrangements such as a fractional holiday stipend to balance pay accurately. The fractional holiday stipend ensures proportional payment reflecting partial leave and work-time, optimizing salary fairness in unique scenarios involving overlapping work and holiday periods.

Hybrid Workcation Differential

Holiday pay typically ensures employees receive compensation during non-working holidays, while workcation pay for hybrid workcation differentials compensates employees who blend remote work with vacation periods, reflecting the unique productivity and availability challenges. Hybrid workcation differentials adjust salary based on the location-specific cost of living and time zone differences, ensuring equitable pay during special workcation arrangements.

Vacation Equity Pay

Holiday pay compensates employees for working on designated holidays, typically calculated as time-and-a-half or double pay, while workcation pay addresses compensation during extended work-related vacations combining leisure with business tasks. Vacation equity pay ensures fair remuneration by allocating pay based on accrued vacation time and earned benefits, safeguarding employee rights during unique scenarios where holiday and workcation overlaps occur.

Remote Location Leave Allowance

Holiday pay typically covers regular leave entitlements, while workcation pay includes additional Remote Location Leave Allowance to compensate employees working from a non-standard location. This allowance ensures fair remuneration for the extra expenses and time zone challenges faced during remote work assignments.

Destination-Dependent Holiday Rate

Holiday pay is calculated based on a destination-dependent holiday rate reflecting local wage standards and living costs, ensuring fair compensation aligned with regional economic conditions. Workcation pay typically excludes this rate, as employees remain productive while traveling, necessitating distinct payroll policies to address mixed work and leisure scenarios.

Nomad Compensation Premium

Holiday pay typically compensates employees for non-working days during official breaks, while workcation pay addresses remuneration when employees work remotely from vacation-like settings, integrating flexibility with productivity. The Nomad Compensation Premium offers an enhanced salary adjustment reflecting additional expenses and lifestyle changes for remote workers combining work and travel, ensuring fair compensation beyond standard holiday or regular workcation pay.

Flexi-Leave Wage Adjustment

Holiday pay ensures employees receive fixed compensation for designated non-working days, while workcation pay adjusts wages based on hours worked during combined work and vacation periods. Flexi-leave wage adjustment recalculates salary by prorating holiday pay according to actual work hours, optimizing pay fairness in special scheduling situations.

Asynchronous Time-Off Earnings

Holiday pay typically compensates employees at a standard or enhanced rate for recognized public holidays, ensuring income stability during non-working days, while workcation pay addresses earnings during work-related travel combined with leisure. Asynchronous time-off earnings enable flexible compensation models that track and remunerate employees for irregular, non-concurrent work hours, optimizing pay structures in dynamic work environments.

Geo-Indexed Workcation Bonus

Holiday pay ensures employees receive compensation during approved time off, maintaining income consistency, while workcation pay, particularly with a geo-indexed workcation bonus, adjusts salary based on employees working remotely from locations with different living costs. This geo-indexed bonus incentivizes work-life flexibility and cost-effective remote work arrangements by aligning compensation with local economic conditions, benefiting both employers and employees in special working situations.

Paid-Presence Holiday Policy

Holiday pay under a Paid-Presence Holiday Policy ensures employees receive full compensation during official holidays without work obligations, whereas workcation pay applies when employees work remotely from a holiday destination, blending vacation time with active job duties. Clear differentiation in payroll systems is essential to accurately calculate entitlements and avoid discrepancies in special situations involving remote holiday work.

Holiday Pay vs Workcation Pay for special situations. Infographic

hrdif.com

hrdif.com