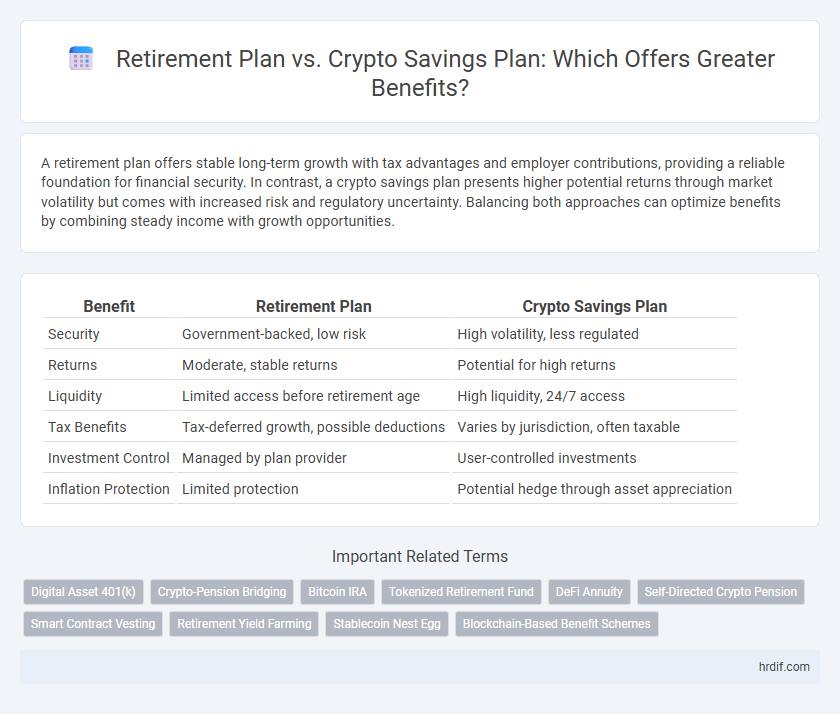

A retirement plan offers stable long-term growth with tax advantages and employer contributions, providing a reliable foundation for financial security. In contrast, a crypto savings plan presents higher potential returns through market volatility but comes with increased risk and regulatory uncertainty. Balancing both approaches can optimize benefits by combining steady income with growth opportunities.

Table of Comparison

| Benefit | Retirement Plan | Crypto Savings Plan |

|---|---|---|

| Security | Government-backed, low risk | High volatility, less regulated |

| Returns | Moderate, stable returns | Potential for high returns |

| Liquidity | Limited access before retirement age | High liquidity, 24/7 access |

| Tax Benefits | Tax-deferred growth, possible deductions | Varies by jurisdiction, often taxable |

| Investment Control | Managed by plan provider | User-controlled investments |

| Inflation Protection | Limited protection | Potential hedge through asset appreciation |

Comparative Overview: Retirement Plans vs Crypto Savings Plans

Retirement plans offer structured, tax-advantaged growth with employer matching and regulatory protections, providing predictable long-term benefits and income security. Crypto savings plans present high volatility and potential for substantial gains, leveraging blockchain technology for decentralization and accessibility, yet lack the same level of regulation and consistent returns. Comparing both, retirement plans prioritize stability and risk management, while crypto savings plans emphasize growth opportunity combined with higher risk exposure.

Security and Reliability: Traditional vs Digital Assets

Retirement plans offer established security with government-backed protections and insured accounts, ensuring reliable, long-term growth through regulated financial institutions. Crypto savings plans provide potential high returns but face volatility and regulatory uncertainties, posing risks to asset stability and security. Traditional retirement plans prioritize reliability and predictability, while digital asset plans demand careful risk management due to their evolving security frameworks.

Growth Potential: Long-Term Gains in Retirement and Crypto

Retirement plans offer steady growth potential through diversified, regulated investments that benefit from compound interest and tax advantages over long periods. Crypto savings plans provide higher volatility but the possibility of exponential long-term gains due to blockchain innovation and market adoption. Balancing the stability of retirement funds with the high-growth prospects of crypto can optimize overall wealth accumulation.

Accessibility and Ease of Use

Retirement plans typically offer structured accessibility with regulated withdrawal ages and streamlined processes for managing contributions, ensuring long-term financial security. Crypto savings plans provide greater accessibility with 24/7 account access and instant transactions, appealing to users seeking flexibility and control. Ease of use in retirement plans is enhanced by professional management services, while crypto savings plans rely on intuitive digital platforms that may require some technical familiarity.

Tax Advantages and Implications

Retirement plans offer significant tax advantages such as tax-deferred growth and potential tax-deductible contributions, which can reduce taxable income during working years. Crypto savings plans, while increasingly popular, often face complex tax implications including capital gains taxes on asset appreciation and less regulatory clarity. Evaluating these plans requires careful consideration of long-term tax treatment, potential penalties, and the evolving legal framework surrounding cryptocurrencies.

Risk Factors: Stability vs Volatility

Retirement plans offer long-term financial security with relatively stable returns through diversified investments and regulatory protections, minimizing exposure to market volatility. Crypto savings plans present high earning potential but come with significant risks due to market instability, price fluctuations, and lack of regulatory oversight. Choosing between these options depends on individual risk tolerance and the desire for either predictable growth or high-reward opportunities.

Employer Contributions and Incentives

Employer contributions in retirement plans often include matching a percentage of employee contributions, providing a guaranteed growth vehicle with tax advantages. Crypto savings plans may offer incentive structures like bonus tokens or staking rewards but lack consistent employer match guarantees. The stability and predictability of employer contributions in retirement plans generally surpass the variable incentives found in crypto savings options.

Flexibility and Withdrawal Options

Retirement plans typically offer structured withdrawal schedules with penalties for early access, ensuring long-term financial security but limited flexibility. Crypto savings plans provide greater flexibility, allowing users to withdraw funds at any time without traditional restrictions, benefiting those seeking more control over their assets. This ease of access makes crypto savings appealing for individuals prioritizing liquidity and adaptable investment strategies.

Inflation Protection and Purchasing Power

A retirement plan offers structured inflation protection through diversified investments in bonds and equities, aiming to preserve purchasing power over decades. Crypto savings plans provide potential high returns that can outpace inflation, though they carry significant volatility and regulatory risks. Combining both strategies can balance long-term stability with growth opportunities to better maintain purchasing power against inflation.

Future Trends: Evolving Benefits in Retirement and Crypto Choices

Retirement plans traditionally offer stable, tax-advantaged growth with predictable income streams, appealing to long-term security and regulatory protections. Crypto savings plans provide higher volatility but potential for significant capital appreciation, attracting investors seeking diversification and innovation in digital assets. Future trends indicate increasing hybrid models combining retirement benefits with crypto exposure, reflecting evolving personal finance strategies and technology-driven asset management.

Related Important Terms

Digital Asset 401(k)

A Digital Asset 401(k) offers a unique retirement plan benefit by combining traditional tax advantages with the growth potential of cryptocurrency investments, enhancing portfolio diversification and long-term wealth accumulation. Unlike conventional retirement plans, Digital Asset 401(k)s provide access to digital assets like Bitcoin and Ethereum, enabling participants to capitalize on the rapidly expanding blockchain economy while maintaining regulatory compliance.

Crypto-Pension Bridging

A Crypto-Pension Bridging strategy leverages blockchain technology to enhance retirement plans by providing increased liquidity, transparency, and potential for higher returns compared to traditional retirement savings accounts. Integrating a crypto savings plan can diversify pension portfolios, reduce reliance on conventional financial markets, and offer more flexible access to funds during retirement.

Bitcoin IRA

A Bitcoin IRA offers tax advantages and diversification by allowing investors to hold Bitcoin within a retirement account, potentially benefiting from long-term capital gains treatment. Compared to traditional retirement plans, a crypto savings plan in a Bitcoin IRA provides exposure to digital assets' growth while maintaining regulatory protections and retirement-specific benefits.

Tokenized Retirement Fund

A Tokenized Retirement Fund offers enhanced liquidity and transparency compared to traditional Retirement Plans by enabling fractional ownership and real-time asset tracking via blockchain technology. Crypto savings plans provide higher growth potential through diversified digital assets while reducing reliance on centralized financial institutions.

DeFi Annuity

A Retirement plan offers regulated, long-term financial security with predictable returns, whereas a Crypto savings plan leveraging DeFi annuities provides innovative, blockchain-based passive income opportunities with potentially higher yields and liquidity. DeFi annuities utilize decentralized finance protocols to automate interest payments, reduce counterparty risks, and enable transparent asset management for diversified retirement benefits.

Self-Directed Crypto Pension

A Self-Directed Crypto Pension offers greater flexibility and potential for higher returns compared to traditional retirement plans by allowing individuals to directly manage and invest their retirement funds in cryptocurrencies. This approach leverages blockchain technology's transparency and security while providing tax advantages and diversification beyond conventional assets.

Smart Contract Vesting

A Retirement plan offers structured, regulated benefit accumulation with predictable tax advantages and employer matching, while a Crypto savings plan with Smart Contract Vesting provides automated, transparent fund release schedules and potential high returns through blockchain technology. Smart Contract Vesting enhances benefit security and minimizes administrative overhead by enforcing conditions programmatically, ensuring timely access to vested assets without intermediaries.

Retirement Yield Farming

Retirement yield farming in a crypto savings plan offers potential for higher returns compared to traditional retirement plans by leveraging decentralized finance protocols and liquidity pools. While traditional retirement plans provide stable growth through stocks and bonds, crypto yield farming can amplify benefits with compounded interest and token rewards, though it carries higher risk volatility.

Stablecoin Nest Egg

Stablecoin Nest Egg offers a highly stable and liquid alternative to traditional retirement plans by minimizing volatility and providing consistent value preservation, which is crucial for long-term financial security. Unlike conventional retirement funds subject to market fluctuations, Stablecoin Nest Egg leverages blockchain technology to deliver transparent, low-fee savings with faster access to funds and potential for passive income through staking.

Blockchain-Based Benefit Schemes

Blockchain-based retirement plans offer enhanced transparency, reduced administrative costs, and real-time tracking of contributions and benefits, ensuring greater security and trust for participants. In contrast, crypto savings plans provide high liquidity and potential for significant returns but carry increased volatility and regulatory uncertainties that may affect long-term benefit stability.

Retirement plan vs Crypto savings plan for benefit. Infographic

hrdif.com

hrdif.com