401k matching boosts long-term retirement savings by offering employees extra contributions based on their input, creating a direct financial incentive for future security. Student loan repayment assistance alleviates immediate financial burdens by helping reduce outstanding debt, increasing disposable income and reducing stress. Both benefits foster employee retention, but 401k matching emphasizes future financial growth, while loan repayment targets current financial relief.

Table of Comparison

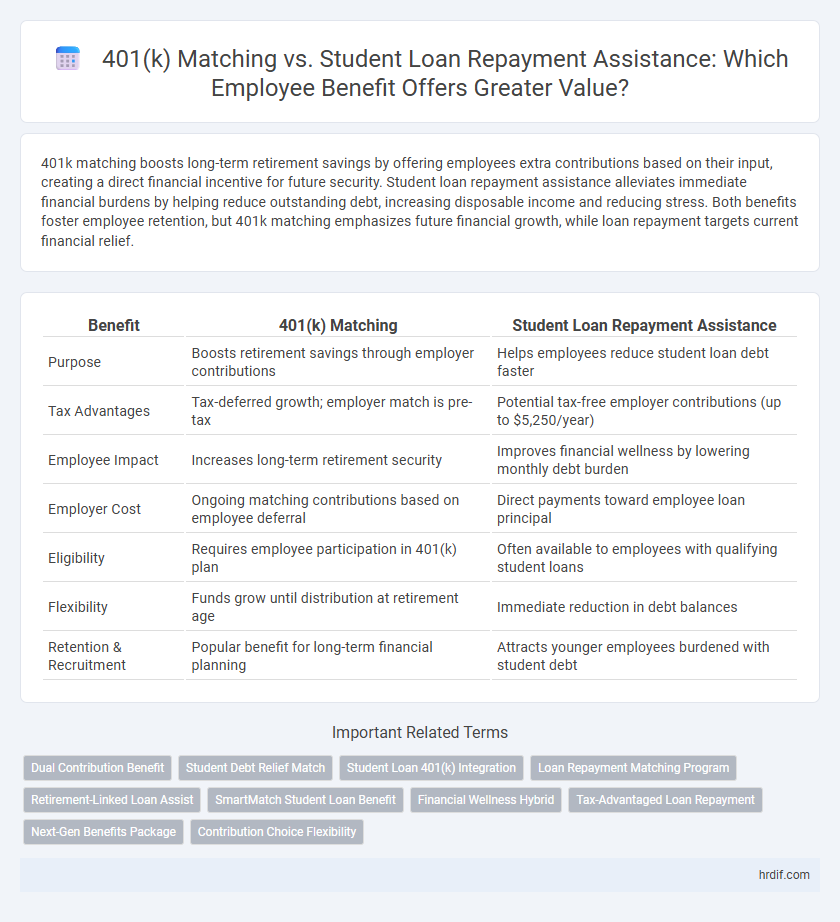

| Benefit | 401(k) Matching | Student Loan Repayment Assistance |

|---|---|---|

| Purpose | Boosts retirement savings through employer contributions | Helps employees reduce student loan debt faster |

| Tax Advantages | Tax-deferred growth; employer match is pre-tax | Potential tax-free employer contributions (up to $5,250/year) |

| Employee Impact | Increases long-term retirement security | Improves financial wellness by lowering monthly debt burden |

| Employer Cost | Ongoing matching contributions based on employee deferral | Direct payments toward employee loan principal |

| Eligibility | Requires employee participation in 401(k) plan | Often available to employees with qualifying student loans |

| Flexibility | Funds grow until distribution at retirement age | Immediate reduction in debt balances |

| Retention & Recruitment | Popular benefit for long-term financial planning | Attracts younger employees burdened with student debt |

Overview: 401k Matching vs Student Loan Repayment Assistance

401k matching benefits enhance retirement savings by allowing employees to receive employer contributions that increase their overall investment growth, typically matching a percentage of employee contributions up to a certain limit. Student loan repayment assistance provides financial relief by directly reducing employees' student loan debt, improving financial wellness and reducing stress. Both benefits serve distinct purposes: 401k matching builds long-term wealth, while student loan repayment aids in immediate debt management.

Understanding 401k Matching as an Employee Benefit

401k matching is a retirement savings benefit where employers contribute a percentage of an employee's salary to their 401k account, effectively boosting long-term financial security. This benefit incentivizes employees to save for retirement by directly increasing their contributions without extra cost to themselves. Compared to student loan repayment assistance, 401k matching targets future wealth accumulation, making it a crucial component of comprehensive employee benefit packages.

Exploring Student Loan Repayment Assistance Programs

Student loan repayment assistance programs offer a targeted benefit that helps employees reduce their debt faster compared to traditional 401(k) matching, which primarily aids long-term retirement savings. Companies providing student loan repayment support often see improved employee retention and financial wellness, addressing a younger workforce's immediate financial concerns. This benefit can complement retirement plans by relieving current financial stress, allowing employees to contribute more effectively to their 401(k) over time.

Financial Impact: Building Retirement Savings vs Paying Down Debt

401k matching maximizes long-term financial growth by leveraging employer contributions to build substantial retirement savings through compound interest. Student loan repayment assistance accelerates debt reduction, decreasing interest accrual and improving credit scores for immediate financial relief. Choosing between these benefits depends on prioritizing either wealth accumulation or debt elimination for optimal financial health.

Employee Demographics: Who Benefits Most?

401k matching primarily benefits employees who are further along in their careers and have disposable income to contribute toward retirement savings, typically ages 30 and above. Student loan repayment assistance is most valuable to younger employees, especially recent graduates burdened with significant debt. Companies targeting millennial and Gen Z workers often find student loan repayment enhances recruitment and retention more effectively than traditional retirement benefits.

Talent Attraction: Which Benefit Appeals to Job Seekers?

401k matching programs are highly valued by job seekers prioritizing long-term financial security and retirement planning, making them a strong draw for talent focused on future stability. Student loan repayment assistance appeals particularly to younger professionals burdened by debt, enhancing employer attractiveness by addressing immediate financial concerns. Employers aiming to attract diverse talent pools often find offering both benefits maximizes appeal across different career stages and financial needs.

Retention Rates: Long-Term Effects on Employee Loyalty

401k matching programs significantly enhance retention rates by fostering long-term financial security and demonstrating employer investment in employees' futures. Student loan repayment assistance increases loyalty primarily among younger workers burdened by debt but may have less impact on long-term retention across all age groups. Companies offering robust 401k matching often see higher employee commitment over time compared to those focusing solely on student loan support, indicating stronger overall retention benefits.

Tax Implications for Employees and Employers

401k matching contributions are tax-deferred for employees, reducing taxable income until withdrawal, while employers can deduct these contributions as a business expense. Student loan repayment assistance is considered taxable income for employees, increasing their tax burden, but employers can also deduct these payments as a business expense. Navigating these tax implications is crucial for both parties to maximize financial benefits and compliance.

Industry Trends: Adoption Rates of Both Benefits

Employer adoption rates for 401k matching programs remain high, with approximately 85% of large companies offering this benefit to attract and retain talent. Student loan repayment assistance is gaining momentum, with adoption increasing by over 40% in the past five years, especially among tech and financial services sectors. Despite slower uptake, student loan benefits provide a competitive edge in recruitment, targeting younger demographics burdened by education debt.

Choosing the Right Benefit for Your Workforce

Selecting between 401k matching and student loan repayment assistance depends on employees' financial priorities and organizational goals. 401k matching appeals to those focused on long-term retirement savings, while student loan repayment assistance targets younger workers burdened by education debt. Understanding workforce demographics and preferences allows companies to tailor benefits that enhance recruitment, retention, and overall employee satisfaction.

Related Important Terms

Dual Contribution Benefit

Dual contribution benefits combining 401(k) matching and student loan repayment assistance enhance employee financial wellness by simultaneously boosting retirement savings while alleviating debt burden. This integrated approach attracts talent seeking comprehensive support, increases job satisfaction, and fosters long-term financial security.

Student Debt Relief Match

Student Debt Relief Match programs provide employees with targeted financial support by contributing funds directly to their student loan balances, reducing long-term debt faster than traditional 401k matching plans. These benefits address the growing concern over student loan burdens, enhancing employee retention and financial wellness more effectively than retirement-focused 401k contributions.

Student Loan 401(k) Integration

Student loan repayment assistance combined with 401(k) matching creates a powerful benefit strategy that enhances employee financial wellness by simultaneously reducing debt and building retirement savings. Integrating student loan payments into 401(k) contributions helps employers attract talent while fostering long-term financial security and boosting overall workforce productivity.

Loan Repayment Matching Program

Loan repayment assistance programs provide a direct financial boost by reducing employee debt, enhancing financial wellness and retention more effectively than traditional 401k matching, which primarily benefits long-term retirement savings. Employers offering loan repayment matching see increased employee satisfaction and reduced turnover, especially among younger workers burdened by student debt.

Retirement-Linked Loan Assist

Retirement-linked loan assistance integrates 401k matching with student loan repayment by allowing employees to contribute part of their student loan payments toward their 401k savings, effectively boosting retirement funds while reducing debt. This benefit enhances long-term financial security by simultaneously addressing retirement planning and student loan obligations.

SmartMatch Student Loan Benefit

SmartMatch Student Loan Benefit offers employers a strategic advantage by providing targeted assistance to employees burdened with student debt, enhancing retention and engagement more effectively than traditional 401(k) matching programs. This benefit directly addresses financial stress associated with student loans, making it a competitive and highly valued alternative that supports long-term employee financial wellness.

Financial Wellness Hybrid

401k matching enhances long-term retirement savings by maximizing employee contributions with employer funds, promoting sustained financial security. Student loan repayment assistance directly reduces educational debt burdens, improving immediate cash flow; integrating both in a Financial Wellness Hybrid offers a balanced approach to addressing short-term financial relief and future retirement readiness.

Tax-Advantaged Loan Repayment

Tax-advantaged student loan repayment assistance offers employees a unique benefit by directly reducing their debt while leveraging tax-free employer contributions, potentially providing greater immediate financial relief compared to traditional 401(k) matching. This strategy enhances workforce retention and financial wellness without delaying retirement savings growth, making it a compelling option for employers aiming to support employees burdened by student loans.

Next-Gen Benefits Package

401k matching boosts retirement savings by leveraging employer contributions, while student loan repayment assistance directly reduces employees' financial burdens, enhancing overall financial wellness. Next-Gen Benefits Packages integrate both options to attract and retain talent, appealing to diverse workforce needs and promoting long-term financial security.

Contribution Choice Flexibility

401k matching offers employees flexible contribution options with potential employer matches, enhancing long-term retirement savings growth. Student loan repayment assistance provides targeted financial support but lacks the same adaptability in contribution levels and timing.

401k matching vs Student loan repayment assistance for benefit. Infographic

hrdif.com

hrdif.com