Choosing between salary and equity as job benefits impacts both immediate financial stability and long-term wealth potential. A competitive salary ensures consistent income, essential for daily expenses and financial security, while equity offers the possibility of significant future gains if the company thrives. Balancing these options depends on personal financial goals, risk tolerance, and confidence in the company's growth trajectory.

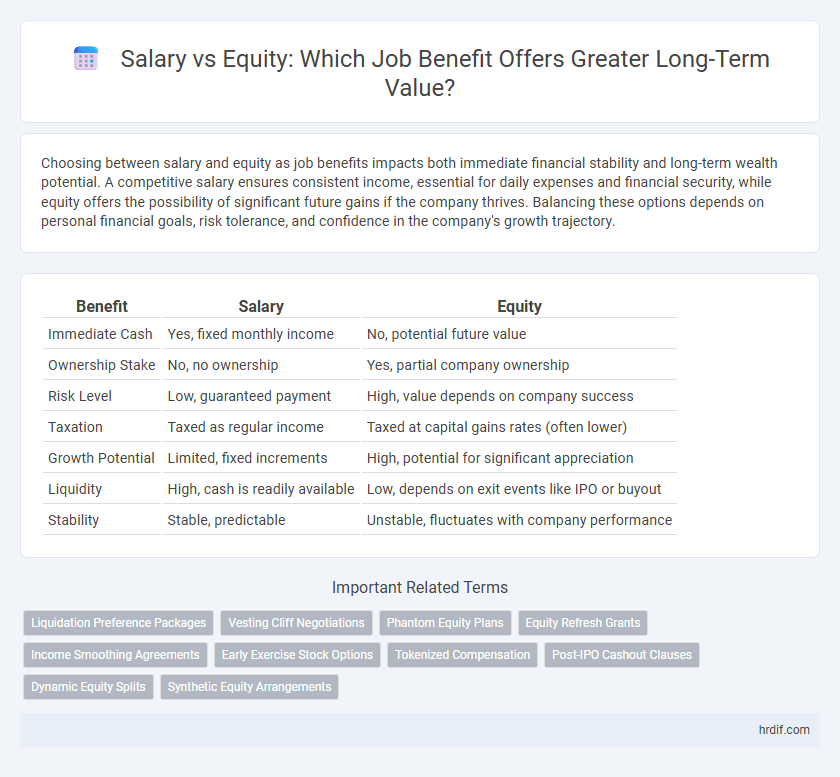

Table of Comparison

| Benefit | Salary | Equity |

|---|---|---|

| Immediate Cash | Yes, fixed monthly income | No, potential future value |

| Ownership Stake | No, no ownership | Yes, partial company ownership |

| Risk Level | Low, guaranteed payment | High, value depends on company success |

| Taxation | Taxed as regular income | Taxed at capital gains rates (often lower) |

| Growth Potential | Limited, fixed increments | High, potential for significant appreciation |

| Liquidity | High, cash is readily available | Low, depends on exit events like IPO or buyout |

| Stability | Stable, predictable | Unstable, fluctuates with company performance |

Understanding Salary vs Equity: Key Differences

Salary provides fixed, predictable income paid regularly, ensuring financial stability and immediate liquidity. Equity offers potential long-term wealth through ownership stakes, aligning employee interests with company growth but carrying market and company performance risks. Understanding these key differences helps employees balance immediate earnings with future financial upside when evaluating job benefits.

The Pros and Cons of Salary Packages

Salary packages provide immediate financial stability and predictable income, essential for daily expenses and long-term planning. However, they lack the potential for significant financial growth tied to company performance, unlike equity options. Fixed salaries offer security but may limit wealth accumulation compared to equity-based compensation.

Equity Compensation: What You Need to Know

Equity compensation offers employees ownership stakes, aligning their interests with company growth and potential high returns beyond base salary. Unlike fixed salary, equity can significantly increase in value over time, especially in startups or high-growth companies, providing long-term wealth building opportunities. Understanding vesting schedules, stock options, and tax implications is crucial to maximizing the benefits of equity compensation.

Long-Term Value: Equity’s Upside Potential

Equity offers significant long-term value by aligning employee incentives with company growth, potentially yielding substantial financial gains beyond a fixed salary. While salary provides immediate and guaranteed income, equity can exponentially increase in worth if the company succeeds, often surpassing cumulative salary benefits over time. This upside potential makes equity a powerful component of compensation packages, especially in high-growth industries and startups.

Immediate Rewards: Salary Advantages

Salary provides immediate financial benefits through consistent paychecks, enabling employees to cover daily expenses and financial commitments without delay. Unlike equity, which may take years to vest or realize value, salary offers guaranteed income that enhances financial stability and purchasing power from the start. This immediate reward can be crucial for those prioritizing short-term financial needs over potential long-term gains.

Risk Factors in Choosing Equity Over Salary

Choosing equity over salary introduces significant risk factors due to market volatility and company performance uncertainty, which can lead to fluctuating or potentially worthless compensation. Equity compensation often lacks liquidity and guarantees, making it less reliable than consistent salary payments for meeting immediate financial needs. Evaluating the stability of the employer, the vesting schedule, and potential dilution is essential to balance growth opportunities against financial security.

Tax Implications: Salary vs Equity

Tax implications differ significantly between salary and equity compensation, influencing overall employee benefit value. Salary is subject to standard income tax rates and payroll taxes immediately upon payment, providing predictable tax treatment. Equity compensation, such as stock options or restricted stock units, often benefits from deferred taxation until shares vest or are sold, potentially allowing for access to lower capital gains tax rates and strategic tax planning.

Negotiating Your Compensation: Salary or Equity?

Negotiating your compensation requires understanding the trade-offs between salary and equity, as salary offers immediate financial stability while equity provides potential long-term wealth growth through company shares. Assess factors like company valuation, growth prospects, and your personal financial needs to determine the right balance between fixed income and ownership stakes. Prioritize clear communication with your employer about your compensation goals to maximize the overall benefit package tailored to your career and financial objectives.

How Company Stage Impacts Salary and Equity Offers

Early-stage startups typically offer lower base salaries but compensate with higher equity stakes to attract talent willing to assume greater risk for potential significant returns. Established companies, conversely, provide competitive salaries paired with modest equity packages, reflecting their stable market position and lower growth volatility. The company's stage significantly influences the balance between immediate financial compensation and long-term ownership incentives.

Making the Right Choice: Salary vs Equity Decision-Making

Evaluating salary versus equity requires understanding your financial goals, risk tolerance, and company growth potential to make an informed decision. Salary provides immediate, stable income crucial for covering living expenses, while equity offers long-term wealth through company share appreciation, aligning rewards with company success. Prioritizing your personal financial stability and career outlook ensures you choose the option that maximizes overall benefit and aligns with your long-term financial strategy.

Related Important Terms

Liquidation Preference Packages

Liquidation preference packages in equity compensation protect investors by ensuring they receive their investment back before common shareholders during a liquidation event, providing a safety net that salary alone cannot offer. Employees should weigh the guaranteed income of a salary against the potential upside and risk mitigation offered by liquidation preferences in equity grants.

Vesting Cliff Negotiations

Negotiating vesting cliffs in salary versus equity compensation can significantly impact long-term financial benefits by determining when employees gain ownership of their stock options. Understanding typical vesting schedules, such as a one-year cliff followed by quarterly vesting, allows candidates to secure favorable terms that align with career growth and reduce the risk of forfeiting equity if leaving the company early.

Phantom Equity Plans

Phantom Equity Plans offer employees the benefits of equity ownership without actual stock issuance, providing financial upside tied to company valuation increases. Unlike direct salary increments, phantom equity aligns employee incentives with long-term company performance, potentially resulting in substantial rewards upon liquidity events without immediate tax implications.

Equity Refresh Grants

Equity refresh grants provide employees with ongoing ownership stakes, aligning long-term incentives with company growth and potentially exceeding the immediate gains of salary increments. These grants enhance retention by offering renewed opportunities for wealth accumulation tied to stock price appreciation and company performance milestones.

Income Smoothing Agreements

Income Smoothing Agreements (ISAs) provide a strategic approach to balancing salary and equity, ensuring consistent cash flow while offering long-term financial upside through equity participation. By converting variable equity gains into stable monthly payments, ISAs help employees manage income volatility and enhance financial planning stability.

Early Exercise Stock Options

Early exercise stock options offer employees the benefit of purchasing shares at a lower strike price, potentially maximizing long-term financial gain compared to immediate salary increases. This option not only aligns employee incentives with company growth but also allows for favorable tax treatment through long-term capital gains when shares are held after exercise.

Tokenized Compensation

Tokenized compensation transforms traditional salary and equity models by enabling employees to receive part of their compensation in digital tokens, offering increased liquidity and potential for value appreciation. This innovative approach aligns employee incentives with company performance while providing flexibility and transparency unmatched by conventional stock options or fixed salaries.

Post-IPO Cashout Clauses

Post-IPO cashout clauses enable employees to convert equity into liquid assets, often providing significant financial upside beyond fixed salary compensation. Evaluating salary versus equity should prioritize the timing and terms of these cashout provisions to maximize overall job benefit.

Dynamic Equity Splits

Dynamic equity splits align employee compensation with company performance by adjusting ownership stakes based on individual contributions, fostering motivation and long-term commitment. Comparing salary versus equity benefits highlights how dynamic splits offer personalized financial growth opportunities beyond fixed wages, enhancing overall job satisfaction and retention.

Synthetic Equity Arrangements

Synthetic equity arrangements offer employees benefits similar to stock ownership, such as value tied to company performance, without granting actual shares, providing potential financial upside without dilution risks. These arrangements can be more flexible than traditional salaries, aligning employee incentives with company growth while preserving cash flow and ownership structure.

Salary vs Equity for job benefit Infographic

hrdif.com

hrdif.com