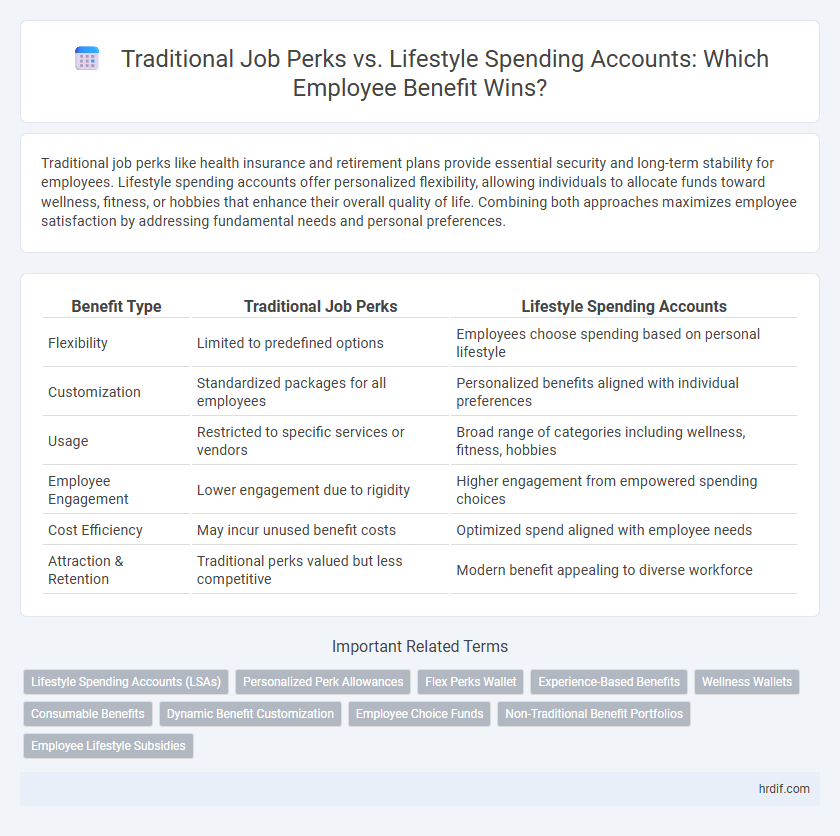

Traditional job perks like health insurance and retirement plans provide essential security and long-term stability for employees. Lifestyle spending accounts offer personalized flexibility, allowing individuals to allocate funds toward wellness, fitness, or hobbies that enhance their overall quality of life. Combining both approaches maximizes employee satisfaction by addressing fundamental needs and personal preferences.

Table of Comparison

| Benefit Type | Traditional Job Perks | Lifestyle Spending Accounts |

|---|---|---|

| Flexibility | Limited to predefined options | Employees choose spending based on personal lifestyle |

| Customization | Standardized packages for all employees | Personalized benefits aligned with individual preferences |

| Usage | Restricted to specific services or vendors | Broad range of categories including wellness, fitness, hobbies |

| Employee Engagement | Lower engagement due to rigidity | Higher engagement from empowered spending choices |

| Cost Efficiency | May incur unused benefit costs | Optimized spend aligned with employee needs |

| Attraction & Retention | Traditional perks valued but less competitive | Modern benefit appealing to diverse workforce |

Understanding Traditional Job Benefits

Traditional job benefits typically include health insurance, retirement plans, paid time off, and employee wellness programs, offering employees financial security and support. These benefits provide tangible, long-term value by addressing essential needs such as healthcare and retirement savings. Understanding these core benefits helps employees evaluate the stability and overall compensation package offered by employers.

What Are Lifestyle Spending Accounts?

Lifestyle Spending Accounts (LSAs) provide employees with flexible, tax-advantaged funds to spend on wellness, fitness, personal development, and other lifestyle expenses that traditional job perks typically exclude. Unlike fixed, pre-set traditional benefits such as health insurance or retirement contributions, LSAs empower individuals to customize spending based on personal priorities, improving overall job satisfaction and well-being. Companies adopting LSAs see increased employee engagement by addressing diverse lifestyle needs beyond conventional workplace benefit structures.

Comparing Health Insurance Coverage

Traditional job perks often include comprehensive health insurance coverage that ensures access to a wide range of medical services, prescription drugs, and preventive care. Lifestyle spending accounts typically provide flexible funds for alternative wellness expenses, but they may lack the extensive network and protection offered by standard health insurance plans. Comparing these options highlights the trade-off between guaranteed medical coverage and personalized health and wellness spending freedom.

Flexibility: LSAs vs. Standard Perks

Lifestyle Spending Accounts (LSAs) offer unmatched flexibility compared to traditional job perks by allowing employees to allocate funds toward personalized wellness, hobbies, and family needs rather than fixed benefits. Unlike standard perks such as gym memberships or catered lunches, LSAs adapt to individual lifestyles, enhancing employee satisfaction and engagement. This customization supports diverse workforce priorities, driving productivity and retention through tailored benefit experiences.

Impact on Employee Satisfaction

Traditional job perks such as health insurance and retirement plans provide foundational security that contributes to baseline employee satisfaction, but lifestyle spending accounts offer personalized flexibility that significantly enhances overall well-being and engagement. Employees value the autonomy to tailor benefits like gym memberships, wellness programs, or dining experiences, which directly correlates with increased motivation and retention rates. Companies incorporating lifestyle spending accounts into their benefits package report higher employee satisfaction scores and lower turnover, demonstrating a measurable impact on workplace culture and productivity.

Tax Implications of Each Option

Traditional job perks like health insurance and retirement plans often provide tax advantages by deducting contributions pre-tax, reducing taxable income for employees. Lifestyle spending accounts, while flexible for non-traditional expenses such as fitness or wellness, typically do not offer the same tax benefits, as funds may be considered taxable income. Employers and employees must weigh these tax implications when choosing benefit options to maximize financial efficiency.

Customization of Benefits Packages

Lifestyle spending accounts offer greater customization of benefits packages by allowing employees to allocate funds toward personalized wellness, childcare, or fitness expenses, unlike traditional job perks that typically provide fixed, one-size-fits-all options. This flexibility enhances employee satisfaction and engagement by aligning benefits with individual needs and preferences. Employers leveraging lifestyle spending accounts see improved retention rates and a competitive advantage in attracting diverse talent.

Cost Efficiency for Employers

Traditional job perks often entail fixed, non-flexible costs that can lead to unnecessary expenditures for employers, especially when employees do not fully utilize these benefits. Lifestyle spending accounts offer a cost-efficient alternative by allowing employers to allocate a set budget that employees can customize according to personal preferences, reducing waste and maximizing perceived value. This approach enhances budget management and aligns spending directly with employee satisfaction, ultimately optimizing the return on investment for employer-sponsored benefits.

Trends in Modern Employee Benefits

Traditional job perks like health insurance and retirement plans remain valuable, yet lifestyle spending accounts are rapidly gaining traction as a preferred benefit among modern employees. These flexible accounts enable spending on wellness, fitness, mental health, and personalized lifestyle needs, reflecting a shift towards holistic employee well-being. Employers adopting lifestyle spending accounts report higher engagement and retention rates, aligning benefits with evolving workforce priorities.

Selecting the Right Mix for Your Workforce

Traditional job perks such as health insurance, retirement plans, and paid time off provide foundational security valued by many employees. Lifestyle spending accounts offer greater flexibility by allowing workers to allocate funds toward wellness, fitness, and personal development, catering to individual preferences. Balancing these benefits ensures a customized compensation package that enhances employee satisfaction and retention across diverse workforce demographics.

Related Important Terms

Lifestyle Spending Accounts (LSAs)

Lifestyle Spending Accounts (LSAs) offer employees flexible benefits tailored to personal wellness, fitness, and family needs, surpassing traditional job perks like fixed bonuses or standard health insurance. Employers adopting LSAs see increased employee satisfaction and retention by allowing customizable spending on mental health, childcare, and holistic wellness programs.

Personalized Perk Allowances

Traditional job perks such as health insurance and retirement plans provide standardized benefits, while lifestyle spending accounts offer personalized perk allowances that empower employees to choose benefits tailored to their unique preferences and needs. Personalized perk allowances enhance employee satisfaction and engagement by allowing customization of wellness, fitness, education, and family care expenses.

Flex Perks Wallet

Traditional job perks often provide fixed benefits like health insurance and retirement plans, while Lifestyle Spending Accounts (LSAs) through Flex Perks Wallet offer personalized spending flexibility on wellness, entertainment, and professional development. Flex Perks Wallet empowers employees to allocate funds according to individual preferences, enhancing satisfaction and promoting work-life balance beyond standard corporate benefits.

Experience-Based Benefits

Experience-based benefits like lifestyle spending accounts provide employees with personalized opportunities to enhance well-being and work-life balance, surpassing traditional job perks such as fixed bonuses and standard health plans. These accounts empower individuals to allocate funds toward unique experiences, from wellness activities to creative pursuits, fostering greater engagement and satisfaction.

Wellness Wallets

Wellness Wallets offer a flexible alternative to traditional job perks by allowing employees to allocate funds toward personalized health and lifestyle expenses, promoting overall well-being and satisfaction. This modern approach to benefits integrates seamlessly with lifestyle spending accounts, empowering employees to invest in mental health services, fitness programs, and nutrition plans that align with their unique wellness goals.

Consumable Benefits

Traditional job perks often include fixed benefits like health insurance and retirement plans, while lifestyle spending accounts offer flexible, consumable benefits tailored to employee preferences such as gym memberships, wellness programs, and meal delivery services. This flexibility in lifestyle spending accounts enhances employee satisfaction by allowing personalized choices that directly impact daily well-being and work-life balance.

Dynamic Benefit Customization

Traditional job perks such as health insurance and retirement plans provide foundational security, while lifestyle spending accounts offer dynamic benefit customization by allowing employees to allocate funds toward personalized wellness, fitness, and leisure activities. This flexibility enhances employee satisfaction and retention by addressing diverse individual needs beyond conventional compensation structures.

Employee Choice Funds

Employee Choice Funds offer greater flexibility than traditional job perks by allowing employees to allocate benefit dollars toward personalized lifestyle expenses such as wellness, caregiving, or education. This customized spending adapts to individual needs, enhancing overall job satisfaction and promoting employee well-being beyond standard perks like gym memberships or commuter subsidies.

Non-Traditional Benefit Portfolios

Non-traditional benefit portfolios shift focus from traditional job perks such as health insurance and retirement plans to lifestyle spending accounts that offer employees flexible funds for wellness, fitness, and personal development expenses. This approach enhances employee satisfaction and retention by aligning benefits with individual lifestyle needs and preferences.

Employee Lifestyle Subsidies

Employee lifestyle subsidies enhance job satisfaction by providing funds for wellness, fitness, and personal development, surpassing traditional perks like fixed bonuses or limited healthcare benefits. Lifestyle spending accounts offer flexible, customizable options that align with individual employee needs, promoting well-being and work-life balance more effectively.

Traditional job perks vs Lifestyle spending accounts for benefit. Infographic

hrdif.com

hrdif.com