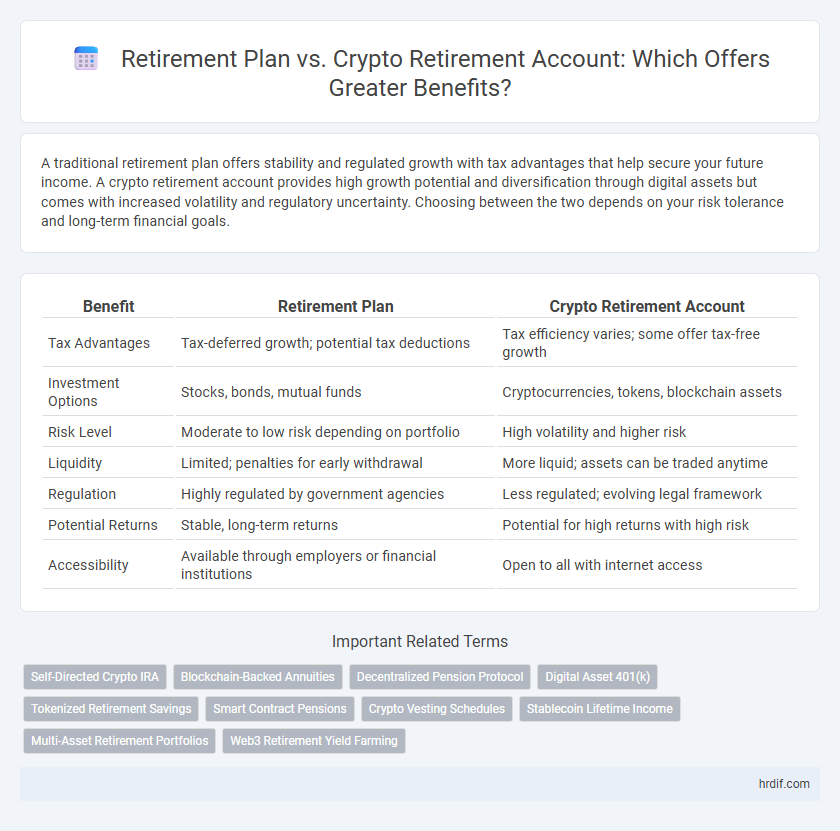

A traditional retirement plan offers stability and regulated growth with tax advantages that help secure your future income. A crypto retirement account provides high growth potential and diversification through digital assets but comes with increased volatility and regulatory uncertainty. Choosing between the two depends on your risk tolerance and long-term financial goals.

Table of Comparison

| Benefit | Retirement Plan | Crypto Retirement Account |

|---|---|---|

| Tax Advantages | Tax-deferred growth; potential tax deductions | Tax efficiency varies; some offer tax-free growth |

| Investment Options | Stocks, bonds, mutual funds | Cryptocurrencies, tokens, blockchain assets |

| Risk Level | Moderate to low risk depending on portfolio | High volatility and higher risk |

| Liquidity | Limited; penalties for early withdrawal | More liquid; assets can be traded anytime |

| Regulation | Highly regulated by government agencies | Less regulated; evolving legal framework |

| Potential Returns | Stable, long-term returns | Potential for high returns with high risk |

| Accessibility | Available through employers or financial institutions | Open to all with internet access |

Introduction to Retirement Plans and Crypto Retirement Accounts

Retirement plans such as 401(k)s and IRAs offer tax advantages and structured savings for long-term financial security. Crypto retirement accounts integrate digital assets like Bitcoin and Ethereum, providing potential for higher growth and portfolio diversification. Both options serve as essential tools for building a secure retirement but differ in risk profiles and regulatory frameworks.

Key Benefits of Traditional Retirement Plans

Traditional retirement plans offer tax-deferred growth, employer matching contributions, and a structured, regulated savings environment that promotes long-term financial security. These plans provide predictable, low-risk investment options and are protected by federal laws like ERISA, ensuring account stability and participant rights. Additionally, they typically include features such as automatic payroll deductions and professional management, simplifying retirement saving for participants.

Advantages of Crypto Retirement Accounts

Crypto retirement accounts offer enhanced portfolio diversification by incorporating digital assets such as Bitcoin and Ethereum, which traditionally show low correlation with conventional stocks and bonds. These accounts provide greater liquidity and faster transaction times compared to traditional retirement plans, enabling more flexible access to funds when needed. Tax advantages, including potential tax-deferred growth and unique IRS classifications of crypto assets, further position crypto retirement accounts as a compelling option for long-term wealth accumulation.

Risk Assessment: Conventional vs Crypto Accounts

Traditional retirement plans offer regulated risk profiles with insurance protections such as FDIC and SIPC, providing investors with predictable and lower volatility returns. Crypto retirement accounts carry higher risk due to market volatility, regulatory uncertainty, and the potential for security breaches, but they also present opportunities for significant gains through decentralized finance and digital asset appreciation. Risk assessment should consider an individual's tolerance, diversification strategies, and long-term financial goals when choosing between conventional and crypto retirement accounts.

Portfolio Diversification Opportunities

Retirement plans offer structured portfolio diversification through traditional assets like stocks, bonds, and mutual funds, providing stability and predictable growth. Crypto retirement accounts introduce access to digital assets such as Bitcoin and Ethereum, allowing exposure to high-growth potential and emerging blockchain technologies. Combining both options enhances portfolio diversification by balancing conventional securities with innovative, high-risk investments, optimizing long-term retirement benefits.

Tax Benefits Comparison

Retirement plans such as 401(k)s and IRAs offer significant tax advantages, including tax-deferred growth and potential tax deductions on contributions, which lower taxable income annually. Crypto retirement accounts provide tax-deferred growth similar to traditional plans but also allow investments in digital assets, offering potential for higher returns with corresponding tax benefits under certain IRS-approved structures like self-directed IRAs. Comparing tax benefits, traditional retirement plans may offer more stability and established tax treatment, while crypto accounts provide diversification and growth opportunities with complex tax implications that require careful management.

Security and Regulation Considerations

Retirement plans are typically backed by government regulations and insurance protections, offering a high level of security and legal oversight. Crypto retirement accounts provide innovative investment opportunities but face less regulatory clarity and greater exposure to cybersecurity risks. Investors should carefully evaluate the security protocols and regulatory frameworks before choosing between traditional retirement plans and crypto-based accounts.

Accessibility and Flexibility of Funds

Retirement plans typically offer stable growth with tax advantages but often restrict access to funds until a specified age, limiting liquidity and flexibility. Crypto retirement accounts provide enhanced accessibility by allowing users to manage digital assets globally with fewer withdrawal constraints, offering more control over fund utilization. This flexibility makes crypto accounts attractive for investors seeking diversified portfolios and immediate access to retirement savings without traditional penalties.

Long-Term Growth Potential

Retirement plans such as 401(k)s and IRAs generally offer stable, regulated investment options with tax advantages designed for long-term growth. Crypto retirement accounts present higher volatility but potential for significant appreciation due to exposure to emerging blockchain technologies and decentralized finance. Evaluating risk tolerance and diversification strategies is crucial for maximizing long-term growth potential in either retirement investment vehicle.

Which Retirement Option Offers Greater Benefits?

A traditional Retirement Plan typically offers stable growth with tax advantages, employer matching contributions, and federally insured protections, providing reliable benefits for long-term security. Crypto Retirement Accounts present higher potential returns through digital asset appreciation and decentralized finance opportunities but come with increased volatility and regulatory uncertainty. Evaluating which retirement option offers greater benefits depends on individual risk tolerance, investment horizon, and desire for diversification between conventional and innovative financial instruments.

Related Important Terms

Self-Directed Crypto IRA

A Self-Directed Crypto IRA offers greater diversification and potential tax advantages compared to traditional retirement plans, allowing investors to hold cryptocurrencies like Bitcoin and Ethereum within a tax-advantaged account. This approach provides enhanced control over asset allocation and the opportunity for higher returns in volatile markets, aligning with long-term retirement growth strategies.

Blockchain-Backed Annuities

Blockchain-backed annuities in crypto retirement accounts offer enhanced transparency and security over traditional retirement plans by leveraging decentralized ledger technology to authenticate transactions. These smart contract-enabled annuities provide real-time tracking and reduce intermediary costs, potentially increasing long-term benefit payouts for retirees.

Decentralized Pension Protocol

Decentralized Pension Protocols offer enhanced transparency and control over funds compared to traditional retirement plans, allowing users to benefit from blockchain security and reduced intermediaries. Crypto Retirement Accounts enable greater liquidity and global access, potentially increasing returns through decentralized finance mechanisms while mitigating regulatory constraints inherent in conventional pension systems.

Digital Asset 401(k)

Digital Asset 401(k) plans provide the unique benefit of integrating cryptocurrency investments within traditional retirement accounts, allowing for potential high-growth opportunities alongside tax advantages. These digital asset retirement accounts offer enhanced portfolio diversification and increased flexibility compared to conventional retirement plans focused on stocks and bonds.

Tokenized Retirement Savings

Tokenized retirement savings in crypto retirement accounts offer enhanced liquidity and diversification compared to traditional retirement plans, enabling investors to benefit from real-time asset transfers and fractional ownership of digital assets. These advantages provide greater control over investment portfolios and the potential for higher returns through exposure to emerging blockchain ecosystems.

Smart Contract Pensions

Smart contract pensions offer automated, transparent management of retirement funds, reducing administrative costs compared to traditional retirement plans. These blockchain-based accounts ensure secure, tamper-proof transactions and provide customizable payout options, enhancing benefits through increased efficiency and control over assets.

Crypto Vesting Schedules

Crypto retirement accounts offer customizable vesting schedules that can provide greater flexibility and tax optimization compared to traditional retirement plans. These schedules enable gradual, automated release of crypto assets, enhancing long-term benefit management and potential growth through exposure to digital assets.

Stablecoin Lifetime Income

A retirement plan offers traditional benefits like guaranteed income and tax advantages, while a crypto retirement account featuring stablecoin lifetime income provides inflation-resistant payouts with blockchain transparency and reduced volatility. Stablecoin-based income streams ensure consistent, secure, and globally accessible benefits, combining the reliability of fiat-pegged assets with the innovation of decentralized finance.

Multi-Asset Retirement Portfolios

Multi-asset retirement portfolios diversify investments across stocks, bonds, real estate, and cryptocurrencies, optimizing growth potential and risk management beyond traditional retirement plans. Crypto retirement accounts offer enhanced liquidity and access to digital assets, providing a complementary advantage in long-term wealth accumulation and tax efficiency.

Web3 Retirement Yield Farming

Web3 Retirement Yield Farming offers higher potential returns compared to traditional Retirement Plans by leveraging decentralized finance protocols and staking crypto assets for compounded yields. This innovative approach enhances retirement benefits through increased liquidity, transparency, and access to diverse crypto investment opportunities unavailable in conventional retirement accounts.

Retirement Plan vs Crypto Retirement Account for benefit. Infographic

hrdif.com

hrdif.com