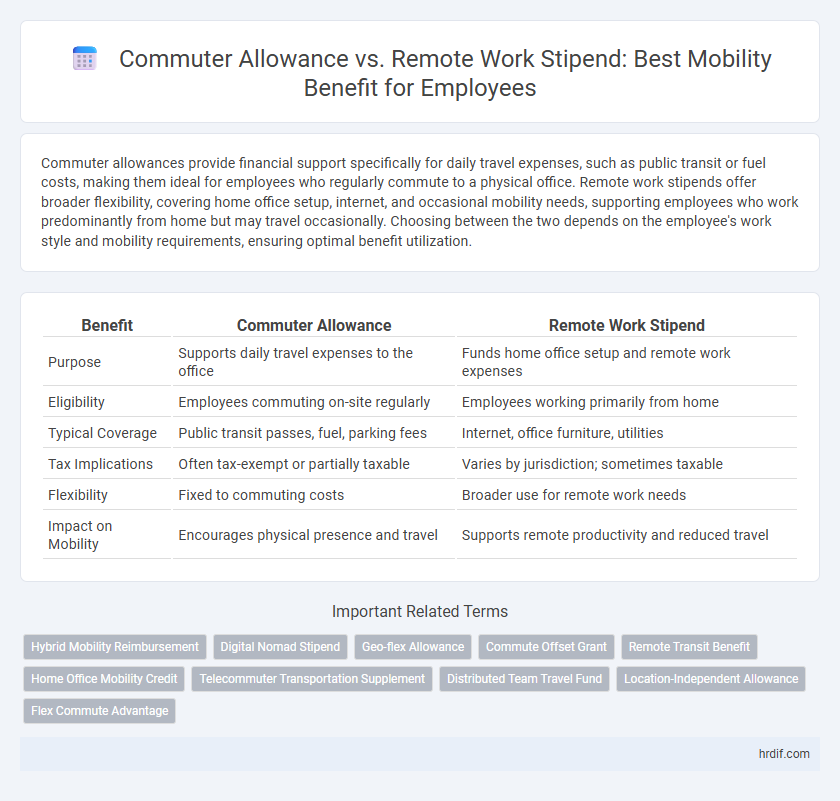

Commuter allowances provide financial support specifically for daily travel expenses, such as public transit or fuel costs, making them ideal for employees who regularly commute to a physical office. Remote work stipends offer broader flexibility, covering home office setup, internet, and occasional mobility needs, supporting employees who work predominantly from home but may travel occasionally. Choosing between the two depends on the employee's work style and mobility requirements, ensuring optimal benefit utilization.

Table of Comparison

| Benefit | Commuter Allowance | Remote Work Stipend |

|---|---|---|

| Purpose | Supports daily travel expenses to the office | Funds home office setup and remote work expenses |

| Eligibility | Employees commuting on-site regularly | Employees working primarily from home |

| Typical Coverage | Public transit passes, fuel, parking fees | Internet, office furniture, utilities |

| Tax Implications | Often tax-exempt or partially taxable | Varies by jurisdiction; sometimes taxable |

| Flexibility | Fixed to commuting costs | Broader use for remote work needs |

| Impact on Mobility | Encourages physical presence and travel | Supports remote productivity and reduced travel |

Understanding Mobility Benefits: Commuter Allowance vs Remote Work Stipend

Commuter allowance provides financial support specifically for daily travel expenses such as public transportation or fuel costs, directly reducing the cost burden of physical commuting. Remote work stipends offer flexibility by covering home office setup or utility costs, enabling employees to maintain productivity outside a traditional work environment. Choosing between these mobility benefits depends on the employee's work arrangement and mobility needs, optimizing cost-efficiency and employee satisfaction.

Key Differences Between Commuter Allowance and Remote Work Stipend

Commuter allowance primarily covers transportation expenses like bus, train, or fuel costs for employees traveling to the office, while remote work stipends focus on reimbursing home office necessities such as internet, utilities, or ergonomic equipment. The commuter allowance is typically a fixed monthly amount based on distance or transit costs, whereas remote work stipends vary depending on individual home office setup and usage. Both benefits aim to enhance employee mobility and productivity but address fundamentally different work environments and related expenses.

Evaluating Cost-Effectiveness: Which Benefit Saves More?

Commuter allowances typically incur consistent monthly costs tied to public transit or fuel expenses, while remote work stipends often involve one-time or periodic payments for home office setup and utility reimbursements. Evaluating cost-effectiveness depends on employee commuting frequency, with remote work stipends offering greater savings if employees work remotely most days, reducing transport expenses significantly. Companies benefit from analyzing data on employee work patterns and transportation usage to determine which mobility benefit maximizes savings and supports productivity.

Employee Experience: Impacts of Mobility Benefits on Job Satisfaction

Commuter Allowances enhance employee satisfaction by reducing the financial burden of travel, fostering punctuality, and improving overall work-life balance. Remote Work Stipends support home office setups, increasing comfort and productivity, which directly contributes to higher job satisfaction and employee retention. Both mobility benefits play crucial roles in shaping positive employee experiences by addressing diverse commuting needs and personal work environments.

Flexibility and Accessibility: Pros and Cons of Each Mobility Benefit

Commuter allowance provides financial support for daily travel expenses, enhancing accessibility for employees relying on public transportation or driving, but it limits flexibility to work from any location. Remote work stipends offer greater flexibility by covering home office setup and internet costs, enabling productivity beyond traditional office commutes, though they may not address mobility needs for employees who occasionally travel to a central workplace. Choosing between these benefits depends on balancing the need for consistent travel support versus the preference for flexible work environments that reduce dependency on physical commuting.

Tax Implications: Commuter Allowance vs Remote Work Stipend

Commuter allowances often qualify as tax-exempt benefits up to specific limits defined by tax authorities, reducing employees' taxable income for daily travel expenses. Remote work stipends, however, may be treated as taxable income since they reimburse home office-related costs without strict regulatory guidelines. Understanding these tax implications helps employers optimize employee compensation while complying with local tax laws.

Company Culture: Shaping Workplace Values Through Mobility Benefits

Commuter allowance and remote work stipends are strategic mobility benefits that shape company culture by promoting flexibility and inclusivity in the workplace. Offering commuter allowances supports employees who travel to physical offices, fostering a culture of punctuality and environmental awareness, while remote work stipends empower a culture of autonomy and work-life balance by facilitating productive home office setups. Both benefits reflect a company's commitment to adapting workplace values to evolving employee needs and mobility trends.

Environmental Impact: Comparing Commuter and Remote Mobility Perks

Commuter allowances often contribute to increased carbon emissions due to reliance on vehicles, whereas remote work stipends support reduced commuting and lower environmental footprints by enabling work from home. Remote work stipends encourage digital connectivity infrastructure, minimizing traffic congestion and air pollution in urban areas. Choosing remote mobility perks aligns with corporate sustainability goals by substantially decreasing greenhouse gas emissions linked to employee travel.

Attracting Talent: Which Mobility Benefit Appeals to Job Seekers?

Commuter allowances and remote work stipends both enhance employee appeal by addressing distinct mobility needs; commuter allowances attract candidates who prefer or rely on public transit or carpooling, offering direct cost relief for daily travel expenses. Remote work stipends appeal to talent seeking flexibility and home office support, covering expenses like internet fees and ergonomic equipment. Data shows that job seekers prioritize benefits that align with their lifestyle and commuting patterns, making personalized mobility benefits a key factor in competitive talent acquisition.

Future Trends: The Evolving Landscape of Employee Mobility Benefits

Commuter allowances are increasingly being supplemented or replaced by remote work stipends as companies adapt to hybrid work models and rising demand for flexible mobility benefits. Future employee mobility strategies focus on personalized financial support that accommodates both daily commuting costs and home office expenses, promoting workforce satisfaction and retention. Data-driven policies leveraging mobility benefit trends emphasize cost efficiency and enhanced employee well-being in the evolving workplace landscape.

Related Important Terms

Hybrid Mobility Reimbursement

Hybrid mobility reimbursement offers a flexible approach by combining commuter allowance and remote work stipend to support employees' transportation costs both on-site and off-site. This integrated benefit maximizes mobility efficiency, reduces commuting expenses, and encourages balanced work arrangements in hybrid environments.

Digital Nomad Stipend

Digital Nomad Stipends offer flexible mobility benefits by covering expenses such as coworking spaces, international internet costs, and short-term accommodation, contrasting with traditional Commuter Allowances that primarily reimburse daily local travel. These stipends enhance productivity and employee satisfaction for remote workers by supporting work-from-anywhere lifestyles beyond standard commuting needs.

Geo-flex Allowance

Geo-flex Allowance offers a versatile mobility benefit that adapts to both Commuter Allowance and Remote Work Stipend needs, empowering employees with location-based financial support. This flexible solution optimizes transportation and home office expenses, enhancing employee satisfaction and reducing overall corporate mobility costs.

Commute Offset Grant

The Commute Offset Grant provides financial relief by covering transportation expenses for employees who commute daily, distinguishing it from a Remote Work Stipend which typically supports home office setup and internet costs. This mobility benefit directly offsets transit fares, encouraging sustainable commuting options and reducing the overall burden of travel expenses.

Remote Transit Benefit

Remote Transit Benefit offers flexible financial support for transportation costs associated with hybrid or fully remote work, addressing diverse commuting needs beyond traditional commuter allowances. This mobility benefit enhances employee satisfaction by covering expenses like rideshares, bike-sharing services, and public transit subscriptions tailored to remote work schedules.

Home Office Mobility Credit

The Home Office Mobility Credit offers employees a flexible benefit to cover expenses related to remote work setups and home office equipment, promoting productivity outside traditional commuting constraints. Unlike traditional Commuter Allowances that reimburse travel costs, this stipend directly supports home-based work environments, reducing the need for daily transit and encouraging sustainable mobility choices.

Telecommuter Transportation Supplement

Telecommuter Transportation Supplement provides a flexible alternative to traditional commuter allowances by covering expenses related to remote work mobility, such as internet upgrades and home office equipment necessary for efficient telecommuting. This benefit enhances employee productivity and satisfaction by directly supporting the infrastructure needed for effective remote work rather than just commuting costs.

Distributed Team Travel Fund

A Distributed Team Travel Fund offers flexible mobility benefits by combining commuter allowance with remote work stipends, enabling employees to cover expenses for both daily transit and occasional travel to central offices. This hybrid approach maximizes employee convenience and supports collaboration by facilitating seamless movement across distributed locations.

Location-Independent Allowance

Location-independent allowances, such as remote work stipends, offer flexible financial support that covers home office setup, internet costs, and other mobility-related expenses without tying employees to a specific commute route or zone. Unlike traditional commuter allowances limited to travel costs between home and office, remote work stipends adapt to diverse working environments, enhancing employee satisfaction and productivity by accommodating various locations.

Flex Commute Advantage

Flex Commute Advantage offers a superior mobility benefit by providing employees with a commuter allowance that covers diverse transportation options, promoting convenience and cost savings compared to a remote work stipend, which primarily offsets home office expenses without addressing daily travel needs. Employers leveraging Flex Commute Advantage enhance workforce flexibility and reduce carbon footprints by incentivizing sustainable commuting alternatives like public transit, biking, or carpooling.

Commuter Allowance vs Remote Work Stipend for mobility benefit. Infographic

hrdif.com

hrdif.com