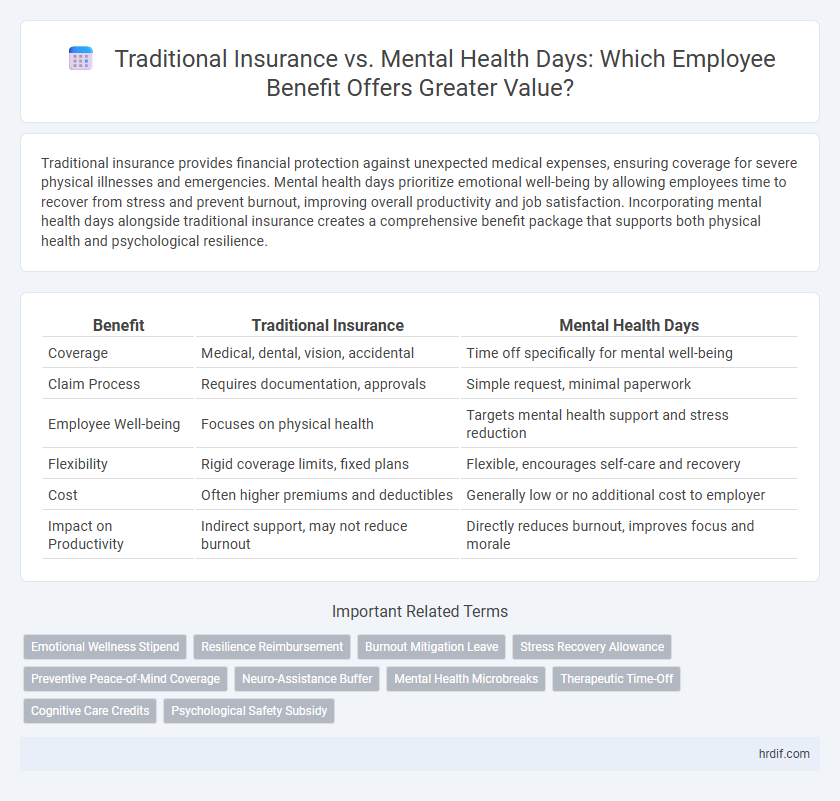

Traditional insurance provides financial protection against unexpected medical expenses, ensuring coverage for severe physical illnesses and emergencies. Mental health days prioritize emotional well-being by allowing employees time to recover from stress and prevent burnout, improving overall productivity and job satisfaction. Incorporating mental health days alongside traditional insurance creates a comprehensive benefit package that supports both physical health and psychological resilience.

Table of Comparison

| Benefit | Traditional Insurance | Mental Health Days |

|---|---|---|

| Coverage | Medical, dental, vision, accidental | Time off specifically for mental well-being |

| Claim Process | Requires documentation, approvals | Simple request, minimal paperwork |

| Employee Well-being | Focuses on physical health | Targets mental health support and stress reduction |

| Flexibility | Rigid coverage limits, fixed plans | Flexible, encourages self-care and recovery |

| Cost | Often higher premiums and deductibles | Generally low or no additional cost to employer |

| Impact on Productivity | Indirect support, may not reduce burnout | Directly reduces burnout, improves focus and morale |

Understanding Traditional Insurance Benefits

Traditional insurance benefits provide financial protection against unexpected medical expenses, covering hospital stays, surgeries, and prescription drugs. These plans typically offer structured reimbursements and networks of approved providers, ensuring predictable support for physical health concerns. Unlike mental health days, traditional insurance may have limited coverage for mental wellness services, making it essential to evaluate specific policy terms for comprehensive benefits.

The Rise of Mental Health Days in the Workplace

Mental health days have surged in workplace benefit plans, addressing employee well-being more effectively than traditional insurance alone. Companies increasingly recognize that dedicated mental health leave reduces burnout and enhances productivity, offering targeted support beyond standard medical coverage. This shift reflects a growing emphasis on holistic employee care, integrating mental health benefits into comprehensive wellness strategies.

Comparing Coverage: Physical vs. Mental Health

Traditional insurance predominantly covers physical health issues with extensive benefits for medical treatments, hospital stays, and surgeries, while mental health coverage often remains limited or requires separate plans. Mental health days, as a workplace benefit, provide direct support for psychological well-being through paid time off specifically designed to address stress, anxiety, and burnout, which traditional insurance may not fully accommodate. Employers integrating mental health days alongside comprehensive insurance create a more balanced approach to employee wellness, addressing both physical and mental health needs effectively.

Employee Satisfaction: Insurance vs. Mental Health Support

Traditional insurance benefits provide financial security against medical expenses, yet may not directly address employees' daily mental health needs. Mental health days offer immediate relief and promote emotional well-being, leading to higher employee satisfaction and reduced burnout. Combining comprehensive insurance with dedicated mental health support creates a balanced benefit package that enhances overall workforce productivity and morale.

Cost Efficiency: Insurance Premiums vs. Absenteeism Reduction

Traditional insurance often involves high premiums that can strain company budgets, while mental health days contribute directly to reducing absenteeism by promoting employee well-being. By prioritizing mental health support, organizations may experience lower overall costs due to decreased sick leave and increased productivity. Investing in mental health days proves to be a cost-efficient strategy when compared to the rising expenses of insurance premiums.

Impact on Productivity: Health Coverage vs. Mental Wellness Days

Traditional insurance provides essential health coverage that reduces financial stress from medical expenses, indirectly supporting productivity by ensuring employees can access necessary treatments. Mental health days, specifically dedicated to psychological well-being, directly enhance focus, reduce burnout, and improve overall workplace engagement. Incorporating both health coverage and mental wellness days creates a balanced approach that maximizes employee productivity and sustains long-term organizational performance.

Legal Compliance: Insurance Mandates vs. Mental Health Policies

Traditional insurance benefits comply with federal and state insurance mandates ensuring coverage for physical health conditions, while mental health days are often governed by workplace mental health policies that may not be legally mandated but promote employee well-being. Insurance mandates require employers to provide mental health parity comparable to physical health coverage, aligning with the Mental Health Parity and Addiction Equity Act (MHPAEA). Mental health day policies supplement compliance by offering flexible time off specifically for psychological recovery, enhancing overall benefits beyond legal requirements.

Attracting Talent: Comprehensive Plans vs. Modern Benefits

Comprehensive traditional insurance plans appeal to talent seeking stability through coverage of medical, dental, and vision needs, reassuring employees of long-term security. Modern benefits like mental health days prioritize emotional well-being and work-life balance, increasingly attracting younger, wellness-focused candidates. Employers blending extensive insurance with innovative mental health support create competitive packages that enhance talent acquisition and retention.

Long-Term Outcomes: Insurance Payouts vs. Preventative Care

Traditional insurance provides financial payouts that support individuals during mental health crises, ensuring coverage for treatment costs and reducing immediate economic burdens. Mental health days emphasize preventative care by allowing employees to manage stress and maintain well-being, which can decrease the likelihood of severe mental health issues and reduce long-term claims. Prioritizing mental health days can lead to better long-term outcomes by minimizing insurance payouts through proactive wellness management.

Future Trends: Integrating Traditional Insurance with Mental Health Days

Future trends in employee benefits emphasize the integration of traditional insurance with dedicated mental health days, reflecting a holistic approach to wellness. Employers increasingly recognize mental health as a critical component of overall health, prompting insurance providers to offer plans that cover both physical and mental health services comprehensively. This integration aims to reduce absenteeism, enhance productivity, and foster long-term employee well-being through proactive mental health support.

Related Important Terms

Emotional Wellness Stipend

Offering an Emotional Wellness Stipend as a benefit enhances employee well-being by providing direct support for mental health expenses, improving emotional resilience beyond the limited scope of traditional insurance coverage. This proactive approach addresses stress and burnout more effectively, fostering a healthier, more productive workforce.

Resilience Reimbursement

Traditional insurance often excludes comprehensive coverage for mental health days, limiting resilience reimbursement options, whereas specialized mental health benefits provide targeted support that enhances employee well-being and reduces long-term costs. Companies investing in mental health days with resilience reimbursement see improved productivity and lower absenteeism due to proactive stress management.

Burnout Mitigation Leave

Burnout Mitigation Leave offers a targeted approach to reduce workplace stress and improve employee well-being, contrasting traditional insurance which primarily covers physical health risks. This specialized benefit directly addresses mental health by providing paid time off for recovery, enhancing productivity and reducing long-term healthcare costs.

Stress Recovery Allowance

Stress Recovery Allowance offers targeted financial support specifically for mental health days, enabling employees to recuperate without the bureaucratic delays common in traditional insurance claims. Unlike conventional insurance, which primarily covers physical health issues, this benefit directly addresses psychological well-being, promoting faster stress recovery and increased workplace productivity.

Preventive Peace-of-Mind Coverage

Traditional insurance provides financial protection against unexpected health expenses, while mental health days offer preventive peace-of-mind coverage by promoting emotional well-being and reducing stress before crises emerge. Integrating mental health days with insurance plans enhances overall benefit value through proactive care and long-term cost savings.

Neuro-Assistance Buffer

Traditional insurance primarily covers physical health crises and predictable medical expenses, often lacking provisions for mental well-being, whereas Mental Health Days integrated with a Neuro-Assistance Buffer provide proactive support for cognitive resilience, stress reduction, and emotional balance, directly enhancing employee productivity and reducing burnout-related absenteeism. This strategic approach to benefits leverages neuroscientific insights to create a preventive mental health safeguard, offering measurable improvements in workforce morale and long-term organizational health outcomes.

Mental Health Microbreaks

Mental Health Microbreaks offer employees crucial short periods of relaxation that enhance productivity and reduce stress more effectively than traditional insurance benefits, which often fail to address daily mental well-being. Integrating Mental Health Microbreaks into workplace benefits promotes sustained emotional resilience and supports overall mental health proactively.

Therapeutic Time-Off

Therapeutic time-off through mental health days provides employees with targeted respite to reduce stress and prevent burnout, enhancing overall productivity more effectively than traditional insurance benefits that primarily cover treatment post-illness. This proactive approach supports emotional well-being by prioritizing recovery and resilience before mental health issues escalate.

Cognitive Care Credits

Traditional insurance often excludes comprehensive coverage for mental health days, limiting employees' access to preventive cognitive care benefits. Cognitive Care Credits provide targeted support for mental wellness, enhancing productivity and reducing absenteeism by facilitating early intervention and personalized mental health services.

Psychological Safety Subsidy

Traditional insurance typically covers a range of medical expenses but often excludes specific support for mental health days, limiting access to psychological safety resources. A dedicated Psychological Safety Subsidy enhances employee well-being by directly funding mental health days, promoting a supportive work environment and reducing stress-related absenteeism.

Traditional insurance vs Mental health days for benefit. Infographic

hrdif.com

hrdif.com