Health insurance provides essential coverage for medical expenses, offering financial protection against unexpected health issues and ensuring access to necessary treatments. A wellness stipend empowers employees to proactively invest in their personal health, encouraging preventive care and fostering healthier lifestyle choices. Combining both health insurance and wellness stipends creates a comprehensive benefits strategy that supports overall well-being and reduces long-term healthcare costs.

Table of Comparison

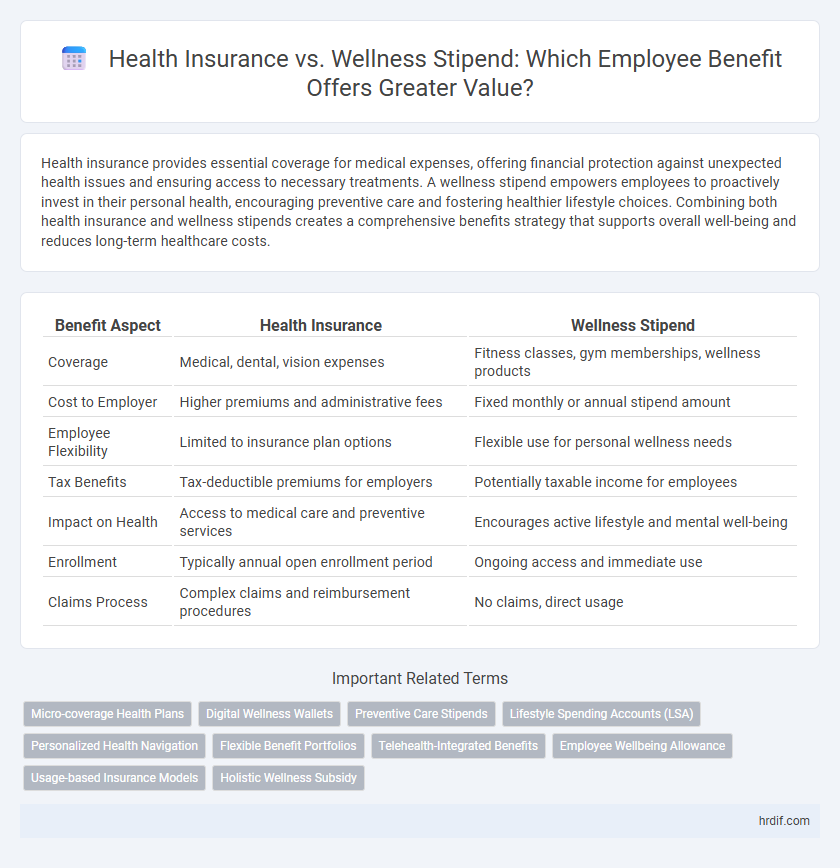

| Benefit Aspect | Health Insurance | Wellness Stipend |

|---|---|---|

| Coverage | Medical, dental, vision expenses | Fitness classes, gym memberships, wellness products |

| Cost to Employer | Higher premiums and administrative fees | Fixed monthly or annual stipend amount |

| Employee Flexibility | Limited to insurance plan options | Flexible use for personal wellness needs |

| Tax Benefits | Tax-deductible premiums for employers | Potentially taxable income for employees |

| Impact on Health | Access to medical care and preventive services | Encourages active lifestyle and mental well-being |

| Enrollment | Typically annual open enrollment period | Ongoing access and immediate use |

| Claims Process | Complex claims and reimbursement procedures | No claims, direct usage |

Understanding Health Insurance and Wellness Stipends

Health insurance provides comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs, ensuring financial protection against high healthcare costs. Wellness stipends offer employees a flexible allowance to spend on activities or products that promote healthy lifestyles, such as gym memberships, fitness classes, or wellness apps. Choosing between health insurance and wellness stipends depends on balancing essential medical coverage with incentives for personal health management.

Key Differences Between Health Insurance and Wellness Stipends

Health insurance provides comprehensive medical coverage, including hospitalization, prescriptions, and preventive care, protecting employees from high healthcare costs. Wellness stipends offer financial support for proactive health activities like gym memberships, fitness classes, or mental health resources, encouraging healthier lifestyle choices. The key difference lies in health insurance addressing medical needs and risks, while wellness stipends promote ongoing personal health and well-being.

Pros and Cons of Employer-Sponsored Health Insurance

Employer-sponsored health insurance offers comprehensive medical coverage, including hospitalization, prescription drugs, and preventive care, which helps reduce out-of-pocket expenses for employees and provides financial security during health emergencies. However, it often involves higher costs for employers due to premium contributions and less flexibility for employees to choose alternative plans or providers compared to wellness stipends. The administrative burden and potential for limited plan options can also impact employee satisfaction and employer resources.

Benefits and Limitations of Wellness Stipends

Wellness stipends offer employees flexible spending on health-related activities, promoting personalized well-being and increased morale. Limitations include lack of coverage for major medical expenses and varied utilization, potentially reducing overall impact compared to comprehensive health insurance. This approach enhances preventive care but should complement, not replace, traditional health insurance for balanced employee benefits.

Cost Comparison: Health Insurance vs Wellness Stipends for Employers

Health insurance typically involves higher fixed costs and administrative expenses for employers compared to wellness stipends, which offer more budget flexibility and lower overhead. Wellness stipends allow employers to allocate funds directly to employees for personalized health and fitness activities, reducing claims processing and insurance premiums. While health insurance provides comprehensive coverage, wellness stipends serve as a cost-effective supplement that can improve employee well-being with minimal financial risk for employers.

Employee Satisfaction: Health Insurance or Wellness Stipend?

Employee satisfaction tends to be higher when health insurance is provided, as it offers comprehensive medical coverage and financial security against health-related expenses. Wellness stipends promote proactive health management by enabling employees to invest in fitness activities or preventive care, which can improve overall well-being and reduce absenteeism. Employers who balance robust health insurance with wellness stipends often see increased morale and retention rates, reflecting a holistic approach to employee benefits.

Legal and Compliance Considerations in Employee Benefits

Health insurance plans must comply with the Affordable Care Act (ACA) and Employee Retirement Income Security Act (ERISA), ensuring coverage standards and non-discriminatory practices. Wellness stipends, often categorized as taxable benefits, require adherence to IRS guidelines and may trigger specific reporting obligations under the Fair Labor Standards Act (FLSA). Employers must carefully structure both to avoid violations of HIPAA privacy rules and maintain consistent employee eligibility criteria.

Impact on Employee Retention and Recruitment

Health insurance remains a critical factor in employee retention and recruitment due to its direct impact on financial security and access to medical care. Wellness stipends enhance employee satisfaction by promoting proactive health management, which can improve overall morale and productivity. Combining comprehensive health insurance with wellness stipends creates a competitive benefits package that attracts top talent and reduces turnover rates effectively.

Flexibility and Customization in Benefit Programs

Health insurance provides essential medical coverage, ensuring financial protection against healthcare expenses, while wellness stipends offer employees the flexibility to choose personalized health and wellness activities. Wellness stipends foster customization by allowing individuals to invest in fitness classes, mental health apps, or alternative therapies, aligning benefits with personal preferences. This combination of structured insurance and adaptable wellness spending enhances overall employee satisfaction and promotes a holistic approach to health management.

Choosing the Right Benefit: Health Insurance, Wellness Stipend, or Both?

Choosing the right employee benefit between health insurance and a wellness stipend depends on the organization's priorities and workforce needs, with health insurance providing comprehensive medical coverage essential for financial protection against illness or injury. Wellness stipends empower employees to invest in personalized fitness, nutrition, and mental health activities, promoting preventive care and overall well-being. Combining both benefits creates a balanced approach that addresses immediate healthcare expenses while encouraging long-term healthy lifestyle choices, enhancing employee satisfaction and productivity.

Related Important Terms

Micro-coverage Health Plans

Micro-coverage health plans offer targeted, affordable protection for specific health needs, making them a cost-effective alternative or complement to traditional health insurance in employee benefits. Wellness stipends promote preventive care and healthy behaviors, but micro-coverage ensures essential health expenses are covered, reducing out-of-pocket risks for employees.

Digital Wellness Wallets

Digital Wellness Wallets offer employees flexible access to health-related funds, enhancing traditional health insurance by covering a broader range of wellness services such as mental health apps, fitness subscriptions, and telehealth consultations. Integrating Digital Wellness Wallets with health insurance plans promotes comprehensive employee well-being, drives higher engagement, and supports personalized health management beyond standard medical coverage.

Preventive Care Stipends

Preventive care stipends within wellness programs offer employees targeted funding to cover screenings, vaccinations, and health assessments, fostering proactive health management. Health insurance typically covers a broader range of medical services but may have limitations on preventive care access or cost-sharing, making stipends a complementary benefit that enhances employee well-being through early intervention.

Lifestyle Spending Accounts (LSA)

Health insurance primarily covers medical expenses and emergencies, while Wellness stipends, often integrated into Lifestyle Spending Accounts (LSA), empower employees to invest in personalized health and lifestyle activities such as fitness classes, nutrition counseling, and mental health programs, enhancing overall well-being. LSAs offer flexible, tax-advantaged options that address broader wellness needs beyond traditional healthcare, driving higher employee satisfaction and productivity.

Personalized Health Navigation

Personalized Health Navigation enhances employee benefits by guiding individuals through complex health insurance options and care decisions, improving healthcare outcomes and cost efficiency. Wellness stipends complement this by promoting proactive health management but lack the tailored support and expert assistance found in personalized health navigation services.

Flexible Benefit Portfolios

Health insurance provides essential financial protection against medical expenses, while wellness stipends empower employees to invest in personalized health activities such as fitness classes or mental health programs. Combining both options within a flexible benefit portfolio enhances employee satisfaction by addressing comprehensive health needs and promoting proactive wellness.

Telehealth-Integrated Benefits

Health insurance plans with telehealth integration provide employees with comprehensive virtual medical consultations, ensuring immediate access to healthcare services and reducing out-of-pocket costs. Wellness stipends complement this by encouraging proactive health management through personalized wellness activities, fostering overall employee well-being alongside traditional medical coverage.

Employee Wellbeing Allowance

An Employee Wellbeing Allowance enhances overall health by providing funds for wellness activities beyond traditional health insurance coverage, promoting mental, physical, and financial wellbeing. Unlike health insurance, which primarily covers medical expenses, this allowance empowers employees to invest in personalized health solutions such as gym memberships, mindfulness courses, or nutritional programs.

Usage-based Insurance Models

Usage-based insurance models in health insurance leverage real-time data from devices and apps to tailor premiums based on actual employee health behaviors, promoting personalized cost savings and incentivizing healthier lifestyles. Wellness stipends, while allowing flexible spending on health-related activities, lack the dynamic risk-adjusted pricing seen in usage-based insurance, potentially limiting their impact on long-term health outcomes and cost management.

Holistic Wellness Subsidy

A Holistic Wellness Subsidy combines the comprehensive coverage of health insurance with the proactive support of wellness stipends, addressing physical, mental, and preventive care needs for employees. Integrating both benefits promotes improved employee health outcomes, reduces absenteeism, and enhances overall productivity by incentivizing holistic well-being investments beyond traditional medical expenses.

Health insurance vs Wellness stipend for employee benefits. Infographic

hrdif.com

hrdif.com