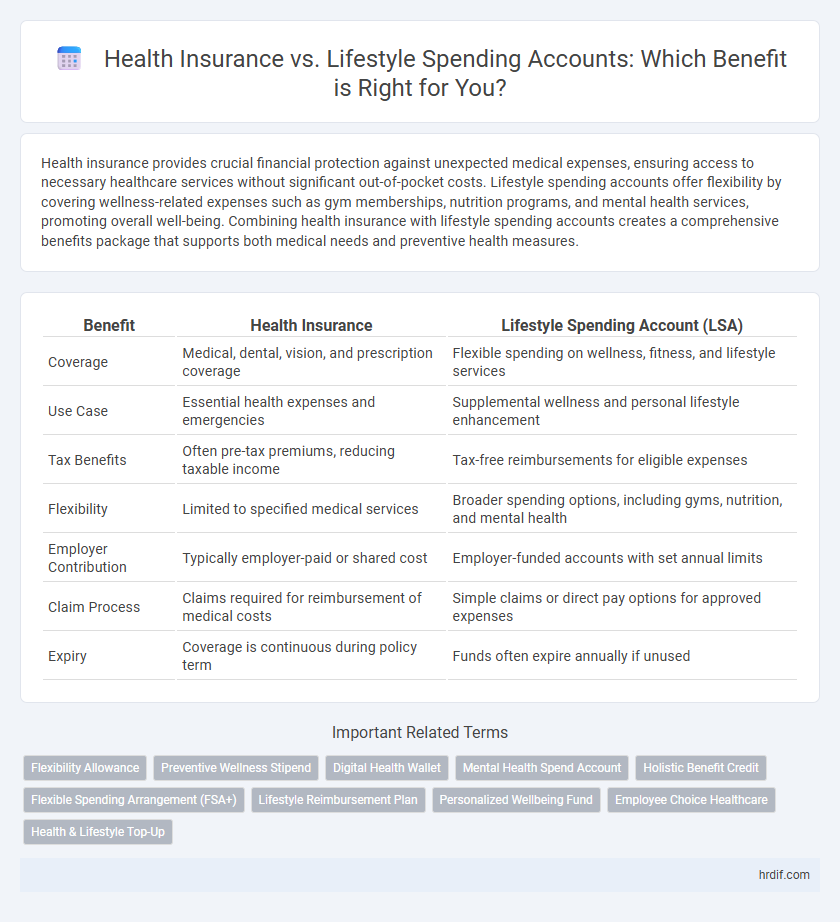

Health insurance provides crucial financial protection against unexpected medical expenses, ensuring access to necessary healthcare services without significant out-of-pocket costs. Lifestyle spending accounts offer flexibility by covering wellness-related expenses such as gym memberships, nutrition programs, and mental health services, promoting overall well-being. Combining health insurance with lifestyle spending accounts creates a comprehensive benefits package that supports both medical needs and preventive health measures.

Table of Comparison

| Benefit | Health Insurance | Lifestyle Spending Account (LSA) |

|---|---|---|

| Coverage | Medical, dental, vision, and prescription coverage | Flexible spending on wellness, fitness, and lifestyle services |

| Use Case | Essential health expenses and emergencies | Supplemental wellness and personal lifestyle enhancement |

| Tax Benefits | Often pre-tax premiums, reducing taxable income | Tax-free reimbursements for eligible expenses |

| Flexibility | Limited to specified medical services | Broader spending options, including gyms, nutrition, and mental health |

| Employer Contribution | Typically employer-paid or shared cost | Employer-funded accounts with set annual limits |

| Claim Process | Claims required for reimbursement of medical costs | Simple claims or direct pay options for approved expenses |

| Expiry | Coverage is continuous during policy term | Funds often expire annually if unused |

Understanding Health Insurance: Key Features and Coverage

Health insurance provides essential coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care, reducing out-of-pocket costs and financial risks associated with illness. Key features often include network providers, copayments, deductibles, and coverage limits, all designed to offer comprehensive protection against unexpected health issues. Unlike lifestyle spending accounts, which fund wellness-related expenses like gym memberships or nutrition programs without covering medical emergencies, health insurance focuses on safeguarding overall health through structured medical benefits.

What Is a Lifestyle Spending Account? An Overview

A Lifestyle Spending Account (LSA) is a flexible employee benefit designed to cover a variety of personal wellness and lifestyle expenses not typically included in traditional health insurance plans. LSAs enable employees to allocate a set budget toward activities such as fitness classes, mental health services, or nutrition programs, promoting overall well-being. Unlike health insurance, which primarily covers medical expenses, LSAs focus on preventative and holistic lifestyle choices that contribute to long-term health.

Health Insurance Benefits: Pros and Cons

Health insurance benefits provide comprehensive financial protection against medical expenses, covering hospitalization, prescription drugs, and preventive care, which can reduce out-of-pocket costs significantly. However, health insurance often involves premiums, deductibles, and co-pays, which may limit immediate cash flow and flexibility compared to a lifestyle spending account. While lifestyle spending accounts offer more freedom for wellness-related expenses, health insurance remains essential for managing high-cost or unexpected health events effectively.

Lifestyle Spending Accounts: Advantages and Limitations

Lifestyle Spending Accounts (LSAs) offer employees flexible benefits by allowing personalized spending on wellness, fitness, and mental health services not typically covered by traditional health insurance. LSAs enhance overall well-being and increase employee satisfaction through customizable options but may have limitations such as capped budgets and exclusion of essential medical expenses covered by health insurance. Employers need to balance LSAs with robust health insurance plans to maximize employee health benefits and financial protection.

Comparing Covered Services: Health Insurance vs Lifestyle Spending Account

Health insurance primarily covers essential medical services such as doctor visits, hospital stays, prescription medications, and preventive care, ensuring protection against high healthcare costs. Lifestyle Spending Accounts (LSAs) offer flexible benefits for wellness-related expenses like gym memberships, fitness classes, mental health programs, and holistic treatments not typically covered by traditional health insurance. Comparing covered services reveals that health insurance addresses critical health needs, while LSAs enhance overall well-being through customizable lifestyle choices.

Cost Considerations: Premiums, Contributions, and Flexibility

Health insurance involves regular premium payments that provide coverage for medical expenses, offering financial protection against unexpected healthcare costs. Lifestyle spending accounts feature flexible contributions allowing employees to allocate pre-tax dollars toward wellness activities, often resulting in lower upfront costs compared to traditional insurance premiums. Evaluating cost considerations requires comparing the predictable expenses of health insurance premiums with the adaptable funding and potential tax advantages of lifestyle spending accounts.

Employee Wellness Impact: Traditional vs Flexible Benefits

Health insurance provides essential coverage that directly reduces medical expenses and supports long-term employee wellness by ensuring access to necessary healthcare services. Lifestyle spending accounts offer flexibility, empowering employees to invest in wellness activities like fitness, mental health resources, and nutrition, which can enhance overall well-being and productivity. Combining traditional health insurance with flexible lifestyle benefits creates a comprehensive approach that addresses both immediate medical needs and holistic lifestyle choices, improving employee satisfaction and reducing absenteeism.

Employer Perspective: Cost and Administration Differences

Health insurance typically involves predictable monthly premiums and regulatory compliance, which streamline budgeting but require ongoing administrative management for claims processing and plan updates. Lifestyle spending accounts offer employers flexible benefit options with potentially lower fixed costs, although they demand robust tracking systems to monitor account usage and prevent misuse. Employers must weigh the trade-offs between the stability of health insurance premiums and the dynamic administration needs of lifestyle spending accounts to optimize overall benefit cost efficiency.

Legal and Tax Implications of Each Benefit

Health insurance offers tax advantages such as premium payments typically being tax-deductible or paid with pre-tax dollars, reducing taxable income, while lifestyle spending accounts often provide tax-exempt reimbursements for eligible wellness expenses under IRS Section 213(d). Legal regulations require health insurance plans to comply with the Affordable Care Act and Employee Retirement Income Security Act, ensuring minimum essential coverage and consumer protections, whereas lifestyle spending accounts must adhere to Internal Revenue Service guidelines to maintain tax-advantaged status and avoid penalties. Employers must carefully structure lifestyle spending accounts to avoid classification as taxable income or unauthorized benefits under the Internal Revenue Code, contrasting with the more standardized compliance framework governing health insurance benefits.

Choosing the Right Option: Decision Factors for Employers and Employees

Employers and employees must evaluate health insurance and lifestyle spending accounts by considering coverage scope, tax advantages, and flexibility of use. Health insurance primarily offers essential medical expense protection, while lifestyle spending accounts provide discretionary spending for wellness and personal activities. Decision factors include cost efficiency, employee preferences, regulatory compliance, and anticipated utilization rates to align benefits with organizational goals and employee well-being.

Related Important Terms

Flexibility Allowance

Health insurance provides comprehensive medical coverage essential for financial protection against health-related expenses, while a Lifestyle Spending Account (LSA) offers flexibility by allowing employees to allocate a set allowance toward wellness activities, fitness programs, or personal health-related purchases. Choosing a Flexibility Allowance that integrates both options enhances benefit customization, empowering employees to address diverse health needs and personal lifestyle preferences effectively.

Preventive Wellness Stipend

Health insurance primarily covers medical expenses, while a Lifestyle Spending Account enhances employee well-being through a Preventive Wellness Stipend that funds activities like fitness classes, mental health programs, and nutritional counseling to proactively maintain health. Investing in a Preventive Wellness Stipend reduces long-term healthcare costs by promoting healthier lifestyles and preventing chronic illnesses.

Digital Health Wallet

Health insurance offers comprehensive coverage for medical expenses, while a Lifestyle Spending Account (LSA) provides flexible funds for wellness-related purchases such as gym memberships and mental health apps. Integrating a Digital Health Wallet enhances both benefits by securely managing claims, tracking spending limits, and enabling seamless access to healthcare and lifestyle services in one platform.

Mental Health Spend Account

Health insurance typically covers essential mental health treatments such as therapy and medication, while a Lifestyle Spending Account (LSA) offers flexible funds for a broader range of mental wellness activities, including meditation apps, fitness classes, and stress management workshops. Allocating benefits to a Mental Health Spend Account within an LSA empowers employees to tailor mental health support to their individual needs, promoting overall well-being beyond traditional clinical care.

Holistic Benefit Credit

Holistic Benefit Credit integrates health insurance with lifestyle spending accounts to offer comprehensive coverage that supports both medical needs and personal wellbeing. This approach maximizes employee satisfaction by combining preventive healthcare access with flexible spending on wellness activities and lifestyle enhancements.

Flexible Spending Arrangement (FSA+)

Flexible Spending Arrangement (FSA+) offers a tax-advantaged benefit that complements traditional health insurance by covering out-of-pocket medical expenses, enhancing overall financial flexibility for healthcare costs. Unlike lifestyle spending accounts, FSA+ specifically targets eligible medical expenses, promoting cost savings and reducing the burden of unexpected healthcare charges.

Lifestyle Reimbursement Plan

A Lifestyle Reimbursement Plan offers tax-efficient flexibility by allowing employees to allocate funds toward wellness, fitness, and personal development expenses beyond traditional health insurance coverage. This plan supports holistic well-being, promoting healthier lifestyle choices that can reduce long-term healthcare costs and improve overall employee productivity.

Personalized Wellbeing Fund

The Personalized Wellbeing Fund integrates health insurance with lifestyle spending accounts, offering employees tailored benefits that cover medical expenses, fitness programs, mental health services, and wellness activities. This flexible approach maximizes individualized support, promoting holistic health by combining preventive care and lifestyle enhancements under one comprehensive benefit solution.

Employee Choice Healthcare

Employee Choice Healthcare empowers employees to tailor their benefits by allocating funds between health insurance and a Lifestyle Spending Account, optimizing both medical coverage and wellness-related expenses. This flexible approach enhances overall satisfaction by addressing diverse healthcare needs while supporting personal lifestyle choices.

Health & Lifestyle Top-Up

Health insurance provides essential coverage for medical expenses, ensuring financial protection against unexpected health issues, while a Lifestyle Top-Up spending account offers flexible funds for wellness activities and preventive care that enhance overall well-being. Combining health insurance with a Lifestyle Top-Up maximizes employee benefits by addressing both medical needs and promoting a healthier, more balanced lifestyle.

Health insurance vs Lifestyle spending account for benefit. Infographic

hrdif.com

hrdif.com