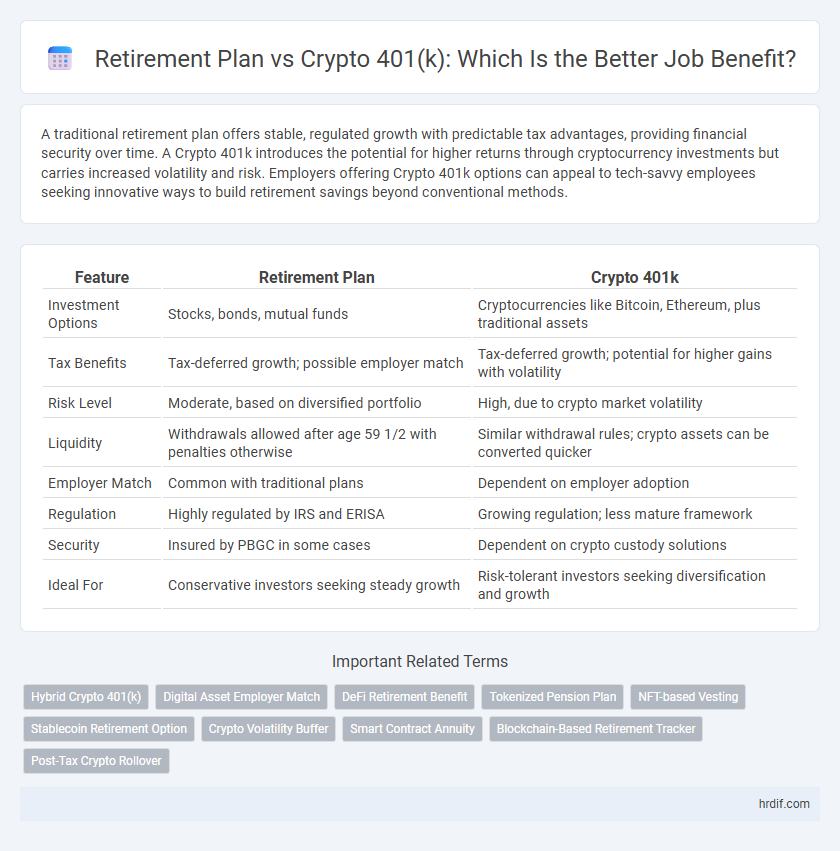

A traditional retirement plan offers stable, regulated growth with predictable tax advantages, providing financial security over time. A Crypto 401k introduces the potential for higher returns through cryptocurrency investments but carries increased volatility and risk. Employers offering Crypto 401k options can appeal to tech-savvy employees seeking innovative ways to build retirement savings beyond conventional methods.

Table of Comparison

| Feature | Retirement Plan | Crypto 401k |

|---|---|---|

| Investment Options | Stocks, bonds, mutual funds | Cryptocurrencies like Bitcoin, Ethereum, plus traditional assets |

| Tax Benefits | Tax-deferred growth; possible employer match | Tax-deferred growth; potential for higher gains with volatility |

| Risk Level | Moderate, based on diversified portfolio | High, due to crypto market volatility |

| Liquidity | Withdrawals allowed after age 59 1/2 with penalties otherwise | Similar withdrawal rules; crypto assets can be converted quicker |

| Employer Match | Common with traditional plans | Dependent on employer adoption |

| Regulation | Highly regulated by IRS and ERISA | Growing regulation; less mature framework |

| Security | Insured by PBGC in some cases | Dependent on crypto custody solutions |

| Ideal For | Conservative investors seeking steady growth | Risk-tolerant investors seeking diversification and growth |

Understanding Traditional Retirement Plans

Traditional retirement plans, such as 401(k)s and IRAs, offer tax advantages and employer matching contributions that help employees grow their retirement savings securely over time. These plans typically invest in diversified portfolios of stocks, bonds, and mutual funds, providing a balanced risk profile suitable for long-term financial planning. Understanding contribution limits, withdrawal rules, and tax implications is crucial for maximizing benefits within a conventional retirement strategy.

What is a Crypto 401k?

A Crypto 401k is a retirement plan option that allows employees to invest their 401k contributions in cryptocurrencies like Bitcoin and Ethereum. Unlike traditional retirement plans that focus on stocks and bonds, a Crypto 401k offers exposure to digital assets for potential high-growth returns. This innovative job benefit combines tax advantages of a 401k with the volatility and opportunity of the crypto market.

Key Differences Between Traditional and Crypto 401k

Traditional 401k plans offer tax-deferred growth with contributions made pre-tax, while crypto 401k plans provide the potential for higher returns through investments in cryptocurrencies but come with increased volatility and regulatory uncertainty. Traditional plans are widely accepted with stable returns and professional management, whereas crypto 401k options allow diversification into digital assets, appealing to risk-tolerant investors seeking innovative retirement savings. Understanding these key differences helps employees choose a plan that aligns with their risk tolerance, retirement goals, and interest in emerging financial technologies.

Security and Risk Management

Retirement plans traditionally offer robust security with government protections such as FDIC insurance and strict regulatory oversight, reducing the risk of loss. Crypto 401(k) plans introduce higher volatility and market risk but provide diversification benefits and potential for significant growth. Effective risk management in a retirement plan involves balancing stable investments with emerging assets like cryptocurrencies to optimize long-term financial security.

Tax Implications for Each Option

Traditional retirement plans offer tax-deferred growth, meaning contributions reduce taxable income now with taxes paid upon withdrawal, typically at retirement age, while crypto 401(k)s may offer similar tax advantages but with added volatility and regulatory uncertainty affecting tax treatment. Contributions to a crypto 401(k) can grow tax-free if structured as a Roth option, allowing tax-free withdrawals, yet the IRS scrutinizes cryptocurrency transactions, potentially complicating tax reporting. Understanding IRS rules on capital gains taxes and required minimum distributions is crucial for maximizing benefits and minimizing tax liabilities in both retirement plans.

Growth Potential and Investment Diversification

Retirement plans typically offer steady growth potential through diversified portfolios of stocks, bonds, and mutual funds, providing long-term financial security. Crypto 401(k) accounts introduce higher growth potential by allowing investment in digital assets like Bitcoin and Ethereum, though they carry increased volatility and risk. Combining traditional retirement plans with crypto options enhances investment diversification, balancing stability with opportunities for exponential returns.

Employer Contributions: Traditional vs Crypto 401k

Employer contributions in a traditional retirement plan typically include matching percentages based on employee deferrals, offering predictable growth and tax advantages. In contrast, a Crypto 401k allows employer contributions to be made in digital assets, potentially increasing portfolio diversification but introducing higher volatility and regulatory considerations. Understanding these differences helps employees evaluate the impact of employer contributions on long-term retirement savings.

Regulation and Legal Considerations

Retirement plans are governed by stringent regulatory frameworks such as ERISA and IRS rules, ensuring fiduciary protection and tax advantages for employees, while Crypto 401(k) plans operate in a rapidly evolving legal landscape with limited regulatory clarity and potential risks related to digital asset security and compliance. Employers must consider the legal implications of offering cryptocurrency investments within 401(k) plans, including adherence to Department of Labor guidelines and the fiduciary duty to act in participants' best interests. Regulatory uncertainties and the volatility of crypto assets may impact plan security and participant protections compared to traditional retirement plans.

Employee Participation and Accessibility

Employee participation in traditional retirement plans often benefits from automatic payroll deductions and employer matching contributions, fostering higher enrollment rates compared to Crypto 401k options. Crypto 401k plans offer enhanced accessibility through digital platforms and lower barriers for tech-savvy employees seeking diversified investment portfolios. Despite the innovative appeal of Crypto 401ks, conventional retirement plans typically maintain broader acceptance and regulatory clarity, influencing overall employee engagement and ease of access.

Which Retirement Benefit is Right for You?

Choosing the right retirement benefit depends on your risk tolerance and investment goals; a traditional retirement plan offers stable growth with tax advantages, while a Crypto 401k provides exposure to digital assets with potential high returns but increased volatility. Evaluate factors such as employer matching, liquidity, and long-term diversification to maximize your benefits. Understanding the tax implications and market risks associated with each option is crucial for making an informed decision tailored to your financial future.

Related Important Terms

Hybrid Crypto 401(k)

A Hybrid Crypto 401(k) combines the tax advantages and employer matching of a traditional retirement plan with diversified crypto asset exposure, offering potential for higher returns and portfolio growth. This approach balances long-term retirement security with innovative investment opportunities, leveraging blockchain assets while maintaining regulatory compliance.

Digital Asset Employer Match

A Retirement Plan with a Digital Asset Employer Match allows employees to grow their savings through traditional investment options while benefiting from employer contributions in cryptocurrencies, enhancing portfolio diversification and potential returns. Crypto 401k plans specifically integrate digital assets, offering tax-advantaged growth and aligning with emerging financial technology trends favored by forward-thinking employers.

DeFi Retirement Benefit

DeFi retirement benefits in a Crypto 401k offer enhanced transparency, lower fees, and increased liquidity compared to traditional retirement plans, enabling users to access decentralized finance protocols for potentially higher yields. This innovation provides job benefits with flexible investment options and real-time portfolio management, promoting greater financial autonomy and retirement security.

Tokenized Pension Plan

Tokenized Pension Plans leverage blockchain technology to offer increased transparency, security, and liquidity compared to traditional Retirement Plans or Crypto 401(k)s, enabling employees to access real-time asset valuation and potentially fractional pension distributions. These decentralized benefits reduce administrative costs and enhance flexibility, making them a forward-thinking alternative for modern workforce retirement strategies.

NFT-based Vesting

NFT-based vesting in a Crypto 401k offers enhanced transparency and immutability compared to traditional retirement plans, allowing employees to track and prove ownership of their vested benefits securely. This innovative approach leverages blockchain technology to automate vesting schedules and reduce administrative overhead while providing potential for increased asset liquidity through tokenization.

Stablecoin Retirement Option

Stablecoin retirement options within a Crypto 401k offer enhanced liquidity and reduced volatility compared to traditional retirement plans, providing employees with a more stable and accessible digital asset for long-term savings. Integrating stablecoins into retirement portfolios leverages blockchain transparency and low transaction costs, optimizing benefits for tech-savvy participants seeking diversification beyond conventional assets.

Crypto Volatility Buffer

A traditional retirement plan offers stable growth and predictable returns, which help employees mitigate financial risk over time. In contrast, a Crypto 401k provides access to high-growth potential assets but requires a crypto volatility buffer to manage the inherent price fluctuations and protect long-term retirement savings.

Smart Contract Annuity

A Retirement Plan with a Smart Contract Annuity automates payout schedules through blockchain technology, ensuring transparent and tamper-proof distributions compared to a traditional Crypto 401k, which may lack such programmable contract features. This integration enhances security and predictability for retirement income, reducing administrative overhead and the risks associated with manual processing.

Blockchain-Based Retirement Tracker

A Blockchain-Based Retirement Tracker enhances transparency and security by recording all transactions and contributions immutably, offering a significant advantage over traditional retirement plans. Crypto 401k benefits include faster fund accessibility and lower fees, while blockchain integration ensures accurate, real-time tracking of retirement assets and compliance.

Post-Tax Crypto Rollover

A Post-Tax Crypto Rollover in a Crypto 401k allows employees to leverage the tax advantages of digital assets while securing retirement savings beyond traditional plans. Unlike conventional Retirement Plans, this option offers potential for tax-deferred growth and diversification through blockchain investments, optimizing long-term financial benefits.

Retirement Plan vs Crypto 401k for job benefit Infographic

hrdif.com

hrdif.com