Opting for a Sustainable Mobility Allowance over a traditional company car promotes environmental responsibility by encouraging eco-friendly transportation options such as public transit, cycling, or carpooling. This allowance provides employees with flexible choices tailored to their commuting needs while reducing overall carbon emissions and operational costs for the company. Offering sustainable mobility benefits enhances corporate social responsibility and aligns with growing demands for green workplace initiatives.

Table of Comparison

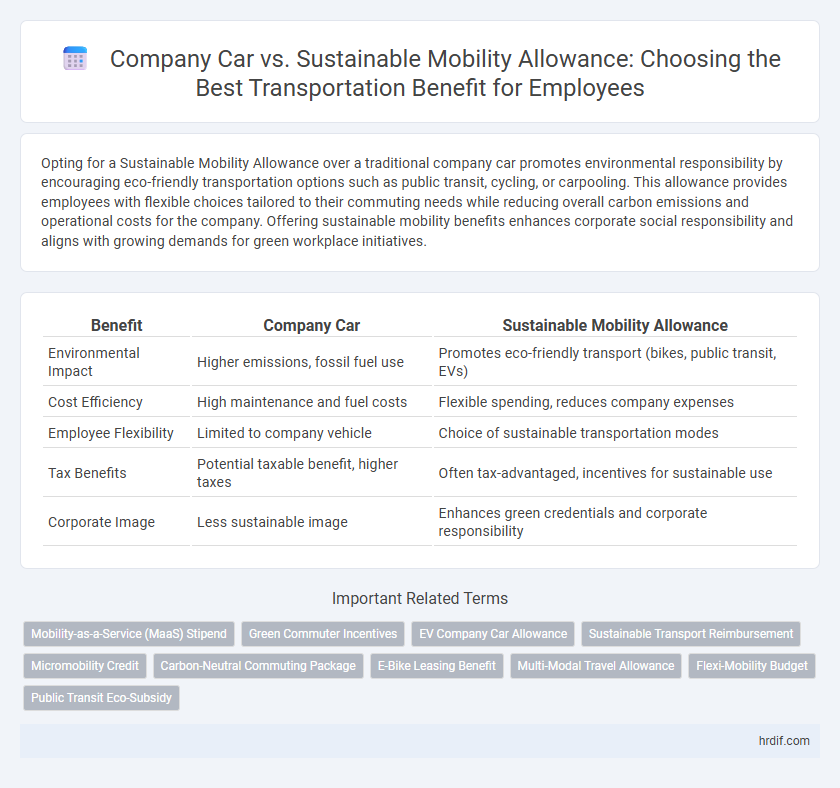

| Benefit | Company Car | Sustainable Mobility Allowance |

|---|---|---|

| Environmental Impact | Higher emissions, fossil fuel use | Promotes eco-friendly transport (bikes, public transit, EVs) |

| Cost Efficiency | High maintenance and fuel costs | Flexible spending, reduces company expenses |

| Employee Flexibility | Limited to company vehicle | Choice of sustainable transportation modes |

| Tax Benefits | Potential taxable benefit, higher taxes | Often tax-advantaged, incentives for sustainable use |

| Corporate Image | Less sustainable image | Enhances green credentials and corporate responsibility |

Introduction to Transportation Benefits: Company Car vs Sustainable Mobility Allowance

Transportation benefits play a crucial role in employee compensation, with Company Cars offering convenience, brand visibility, and tax advantages for businesses while supporting frequent travel needs. Sustainable Mobility Allowances promote eco-friendly commuting by providing financial incentives for public transit, cycling, or electric vehicle use, aligning with corporate social responsibility goals and reducing carbon footprints. Evaluating Company Cars versus Sustainable Mobility Allowances enables organizations to balance cost-efficiency, employee preferences, and environmental impact in their transportation benefit strategies.

Understanding Company Car Programs

Company car programs offer structured transportation benefits by providing employees with access to vehicles owned or leased by the company, facilitating convenient commuting and business travel while managing tax implications and maintenance costs. Sustainable mobility allowances encourage the use of eco-friendly transportation options such as public transit, cycling, or car-sharing services by allocating funds that employees can use flexibly, promoting environmental responsibility and reducing carbon footprints. Understanding the balance between company car programs and sustainable mobility allowances helps organizations optimize transportation benefits, align with sustainability goals, and enhance employee satisfaction through personalized mobility solutions.

Exploring Sustainable Mobility Allowance Options

Exploring Sustainable Mobility Allowance options offers employees flexibility by providing financial support for eco-friendly transportation methods such as public transit, cycling, or electric vehicles, reducing reliance on traditional company cars. This approach aligns with corporate sustainability goals while promoting cost-effective and health-conscious commuting alternatives. Implementing sustainable mobility allowances can lower environmental impact and drive innovation in employee transportation benefits.

Environmental Impact: Company Car vs Sustainable Mobility

Sustainable mobility allowances promote significant environmental benefits by encouraging employees to choose eco-friendly transportation options such as public transit, cycling, or electric vehicles, reducing carbon emissions compared to traditional company cars. Company cars, especially those powered by internal combustion engines, tend to have higher greenhouse gas emissions and contribute more to air pollution. Transitioning to sustainable mobility allowances supports corporate sustainability goals and helps decrease the overall carbon footprint associated with employee commuting.

Cost Comparison: Company Car vs Mobility Allowance

A company car often incurs higher total costs, including acquisition, maintenance, insurance, and fuel, compared to a sustainable mobility allowance that covers public transport, bike-sharing, or ride-hailing expenses. Sustainable mobility allowances provide cost flexibility and reduce the employer's financial burden while encouraging eco-friendly transportation alternatives. Employers can optimize budgets by choosing allowances that align with employee commuting patterns, potentially lowering overall transportation benefit expenses.

Employee Flexibility and Choice in Transportation Benefits

Offering a Sustainable Mobility Allowance instead of a traditional Company Car significantly enhances employee flexibility and choice by allowing individuals to select transportation methods that best fit their lifestyle and environmental values. This approach supports diverse commuting options such as public transit, cycling, car-sharing, and electric vehicle use, promoting sustainability and personal preference. Empowering employees with customizable transportation benefits increases satisfaction, reduces the company's carbon footprint, and aligns with modern mobility trends.

Tax Implications of Company Cars and Mobility Allowances

Company cars are often considered a taxable fringe benefit, with tax liabilities based on the vehicle's value, CO2 emissions, and personal use, leading to higher taxable income for employees. Sustainable mobility allowances, designed to support eco-friendly transport options such as public transit, cycling, or car-sharing, typically offer more favorable tax treatment or exemptions, reducing the taxable burden. Companies promoting sustainable mobility benefits can leverage tax incentives while encouraging environmentally responsible transportation choices among employees.

Attracting Talent: Which Benefit Appeals More?

Company cars remain a highly attractive benefit for talent seeking convenience and status, providing immediate access to reliable transportation without personal financial burden. Sustainable Mobility Allowances appeal to environmentally conscious candidates, offering flexibility to choose eco-friendly options like public transit, biking, or car-sharing, aligning with modern corporate social responsibility values. Employers prioritizing talent attraction may find a tailored balance between these benefits enhances employer branding and meets diverse employee preferences.

Long-term Considerations for Employers

Employers should evaluate the long-term financial impact of company cars versus sustainable mobility allowances, considering fuel, maintenance, and tax incentives associated with eco-friendly transportation options. Offering sustainable mobility allowances encourages adoption of public transit, cycling, and car-sharing, reducing carbon footprints and supporting corporate social responsibility goals. Investing in flexible transportation benefits enhances employee satisfaction and aligns with evolving regulatory frameworks promoting environmental sustainability.

Future Trends in Transportation Benefits for Employees

Future trends in transportation benefits for employees emphasize sustainable mobility allowances over traditional company cars, driven by increasing environmental regulations and corporate social responsibility goals. Sustainable mobility allowances offer flexibility by supporting diverse transportation options such as public transit, bike-sharing, and electric scooters, aligning with urbanization and reduced carbon footprints. Data shows companies implementing these allowances report higher employee satisfaction and cost savings compared to maintaining company car fleets.

Related Important Terms

Mobility-as-a-Service (MaaS) Stipend

A Mobility-as-a-Service (MaaS) stipend offers employees flexible, multimodal transportation options tailored to their individual needs, promoting sustainable mobility while reducing reliance on traditional company cars. This allowance empowers users to access public transit, bike-sharing, and ride-hailing services, aligning corporate benefits with eco-friendly, cost-effective commuting solutions.

Green Commuter Incentives

Company car programs often increase carbon emissions due to vehicle usage, whereas sustainable mobility allowances promote green commuter incentives by encouraging employees to choose eco-friendly transportation modes such as cycling, public transit, or electric vehicles. Implementing sustainable mobility allowances aligns with corporate sustainability goals, reduces overall environmental impact, and offers flexibility that supports diverse commuting needs while fostering employee engagement in green initiatives.

EV Company Car Allowance

An EV company car allowance offers employees a tax-efficient benefit promoting eco-friendly transportation and reducing carbon emissions compared to traditional company cars. Sustainable mobility allowances provide flexibility for various transportation modes but may lack the direct environmental impact and status benefits associated with electric vehicle incentives.

Sustainable Transport Reimbursement

Sustainable Transport Reimbursement offers employees financial support for eco-friendly commuting options such as public transit, cycling, or electric vehicle charging, reducing carbon emissions and promoting greener mobility. Compared to a traditional company car, this allowance provides greater flexibility and aligns with corporate sustainability goals by encouraging the use of low-impact transportation methods.

Micromobility Credit

Micromobility Credits maximize employee flexibility by offering cost-effective transportation options like e-scooters and bike-sharing, which reduce carbon emissions compared to traditional company cars. Incorporating Micromobility Credits into Sustainable Mobility Allowances aligns corporate benefits with environmental sustainability goals while optimizing urban mobility efficiency.

Carbon-Neutral Commuting Package

A Carbon-Neutral Commuting Package combining a Sustainable Mobility Allowance with company car options significantly reduces corporate carbon footprints by incentivizing electric vehicle use and public transit integration. This hybrid approach maximizes employee flexibility while promoting zero-emission transportation solutions aligned with environmental sustainability goals.

E-Bike Leasing Benefit

E-bike leasing benefits provide employees with a sustainable mobility allowance that reduces carbon emissions and promotes eco-friendly commuting options compared to traditional company cars. This benefit supports corporate social responsibility goals while offering cost savings on fuel and maintenance expenses commonly associated with company car programs.

Multi-Modal Travel Allowance

Multi-Modal Travel Allowance encourages sustainable transportation choices by providing flexible benefits that cover public transit, car-sharing, cycling, and walking expenses, reducing reliance on company cars and lowering corporate carbon footprints. This approach aligns with environmental goals while enhancing employee mobility options and cost efficiency in transportation benefits.

Flexi-Mobility Budget

Flexi-Mobility Budget offers employees a customizable transportation benefit alternative to traditional company cars, integrating sustainable mobility options such as public transit, bike-sharing, and electric vehicle leasing. This approach enhances environmental impact reduction while promoting cost efficiency and flexibility in commuting choices.

Public Transit Eco-Subsidy

A sustainable mobility allowance with a public transit eco-subsidy encourages employees to reduce their carbon footprint by subsidizing environmentally friendly transportation options, enhancing corporate social responsibility efforts. Unlike traditional company cars, this approach supports urban congestion reduction and aligns with global sustainability goals by promoting the use of buses, trains, and other low-emission public transit systems.

Company Car vs Sustainable Mobility Allowance for transportation benefits. Infographic

hrdif.com

hrdif.com